Realty Revenue (NYSE:O) has repeatedly confirmed that it stays a top-tier REIT, even because the macroeconomic setting stays difficult for the sector. Final week, the corporate raised its dividend as soon as once more, persevering with its spectacular legacy of tons of of dividend hikes up to now 26 years. Regardless of excessive rates of interest impacting progress and bottom-line prospects, Realty Revenue has managed to excel. In actual fact, its FFO per share is about to achieve new document ranges this 12 months. Subsequently, I stay bullish on Realty Revenue inventory.

Sturdy Outcomes Regardless of Elevated Curiosity Charges

The present macroeconomic setting presents important challenges for REITs. Most firms within the area make the most of important quantities of debt to fund their growth targets. Subsequently, elevated rates of interest can adversely influence their backside strains. That is significantly problematic when a considerable portion of that debt is tied to variable charges moderately than mounted charges.

Nonetheless, Realty Revenue is in a extra favorable place in comparison with its friends. The corporate has constructed a strong stability sheet, supported by a long time of operational excellence, with most of its debt tied to mounted charges. As of the tip of March, Realty Revenue had $22.65 billion in fixed-rate debt and solely $1.52 billion in variable-rate debt. Whereas future refinancing could enhance its weighted common rates of interest, the present debt construction makes monetary administration simpler.

Mixed with its high-quality property portfolio attracting sturdy leasing outcomes, Realty Revenue stays well-positioned to maintain bettering its profitability. This 12 months, in actual fact, its FFO per share is predicted to hit a brand new document. Let’s take a deeper take a look at the corporate’s most up-to-date Q1 outcomes, which spotlight this trajectory.

For the primary quarter, Realty Revenue posted rental revenues of $1.21 billion, almost 40% increased in comparison with final 12 months. The numerous income enhance was because of the firm’s acquisition of Spirit Realty, which closed in January. Realty Revenue’s current property portfolio additionally contributed to its top-line progress, with same-property revenues advancing by about 1% throughout this era.

However extra importantly, regardless of strain from increased rates of interest and a considerably increased share depend stemming from the merger with Spirit Realty, Realty Revenue’s profitability nonetheless managed to enhance. Its FFO per share for the quarter got here in at $1.05, up one cent from final 12 months.

Sure, this can be a tiny enhance. But, it highlights each the wholesome attributes of the corporate’s stability sheet, as I simply famous, and the truth that the Spirit acquisition ended up being accretive on a per-share foundation. This, in flip, exhibits the prudent and well-thought-out nature of administration’s capital allocation.

Based mostly on the first-quarter outcomes and general momentum all through the remainder of Fiscal 2024, administration sees normalized FFO per share touchdown between $4.17 and $4.29. This midpoint of $4.23 implies a good 3.4% enhance in comparison with final 12 months and a brand new document FFO per share end result for the retail property large.

Dividend Will increase Strengthen Investor Confidence

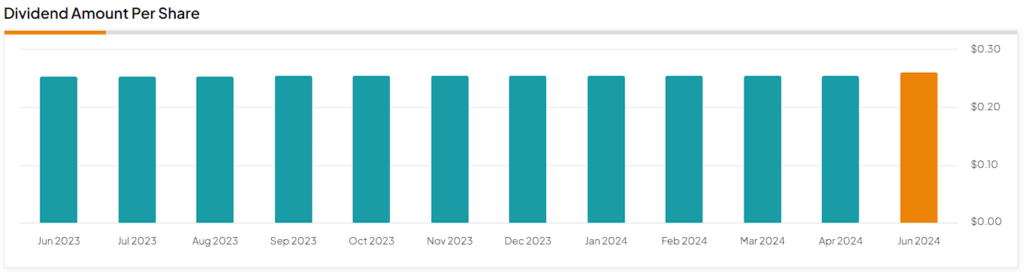

Final week, Realty Revenue introduced one other dividend enhance, strengthening investor confidence within the inventory. Specifically, the corporate raised its dividend by 2.1% to a month-to-month fee of $0.2625. Nonetheless, that is certainly one of a number of intra-year hikes that in the end end in a extra important yearly dividend progress fee. For context, this marked the one hundred and twenty fifth dividend hike since Realty Revenue’s itemizing on the NYSE in 1994, feeding its 26-year dividend progress observe document.

There is no such thing as a cause to imagine that this development won’t proceed within the coming quarters and years. On the midpoint of administration’s steerage, the present annualized dividend fee of $3.15 implies a payout ratio of about 74%. I believe this can be a wholesome fee, particularly because it ought to lower if charges ultimately normalize to decrease ranges. Lastly, the 5.6% dividend yield, whereas not extraordinary within the face of rates of interest that hover above 5%, ought to nonetheless promise nice earnings prospects for buyers over the long run.

Is Realty Revenue Inventory a Purchase, In keeping with Analysts?

Wall Avenue stays comparatively bullish on Realty Revenue. The inventory now includes a Reasonable Purchase consensus ranking primarily based on three Buys and 5 Holds assigned up to now three months. At $58.63, the common Realty Revenue inventory forecast suggests 12.1% upside potential.

The Takeaway

Summing up, Realty Revenue’s spectacular efficiency throughout the difficult macroeconomic circumstances affecting the sector is really commendable. With a strong stability sheet, together with primarily fixed-rate debt, and the acquisition of Spirit Realty proving accretive on a per-share foundation, Realty Revenue once more proved it could actually thrive even throughout unfavorable market circumstances. Within the meantime, the corporate’s dividend stays enticing for buyers searching for long-term earnings progress.