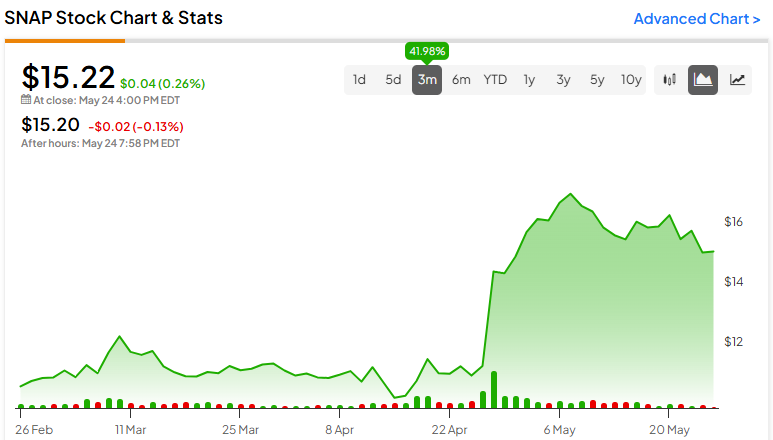

Snap inventory (NYSE:SNAP) rebounded after its Q1 earnings. For my part, the current share value rally gives buyers a sexy promoting alternative. The social media and digicam expertise firm has failed to realize significant revenue margins regardless of exhibiting encouraging consumer and income progress metrics. Whereas its adjusted metrics could declare profitability, they are often fairly misleading. Additional, SNAP’s valuation seems overly excessive relative to its total prospects. For that reason, I stay bearish on the inventory.

Income Progress Reaccelerates However Fails to Enhance Margins

Snap’s post-earnings rally could initially appear considerably justified, on condition that the corporate achieved a reacceleration in income progress. However, Snap as soon as once more failed to spice up its margins to significant ranges, which is the idea of my bear case. Let’s take a deeper have a look at its Q1 report.

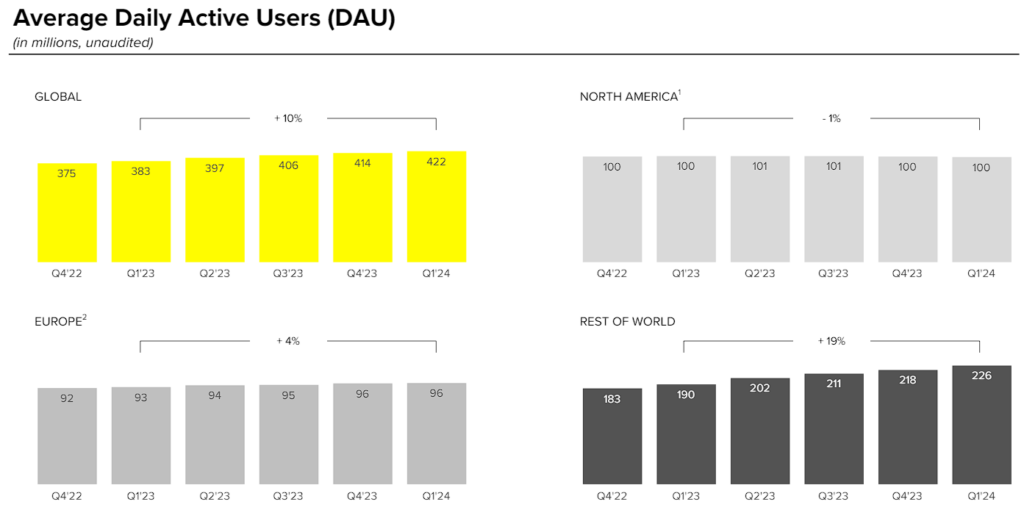

For the quarter, revenues elevated by 21% year-over-year to $1.2 billion. This marked an acceleration of 16 share factors over the prior quarter’s progress fee, which was powered by double-digit energetic day by day consumer progress (DAUs), basic enhancements to its promoting platform, and better demand for Snapchat’s promoting options. In flip, this was because of the enchancment within the promoting panorama from final 12 months.

Extra particularly, Snap’s DAUs reached 422 million in Q1, a rise of 39 million or 10% year-over-year. Administration attributed this enhance to a number of efforts made to broaden and deepen consumer engagement. As an illustration, the continuing momentum of Snap’s 7-0 Pixel Buy optimization mannequin resulted in a rise of 75% in purchase-related conversions in comparison with final 12 months.

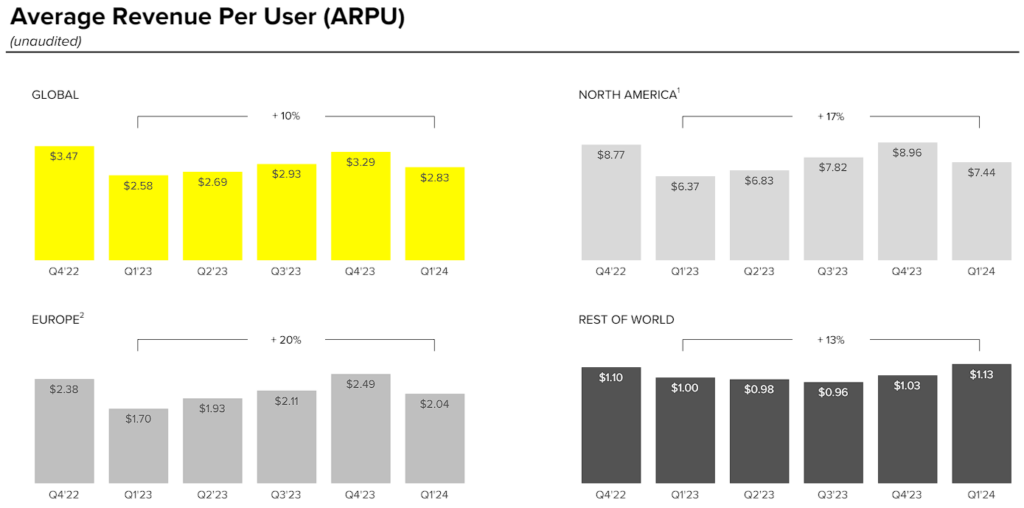

Additional, Snap recorded progress within the whole time spent watching content material on a worldwide foundation year-over-year. This led to elevated advertiser curiosity within the platform, which, mixed with a extra favorable advert surroundings in comparison with final 12 months, led to its common income per consumer (ARPU) progress of 10% to $2.83.

Regardless of these enhancements, Snap as soon as once more failed to realize significant margins. In reality, its working margin was as soon as once more detrimental at -28%. At this level, Snap is a 13-year-old firm that has achieved large scale. Thus, seeing steady working losses is completely inexcusable, for my part.

The corporate could declare it has reached profitability by boasting constructive adjusted EBITDA and free money circulation. These two metrics got here in at $45.7 million and $37.9 million, respectively. Nonetheless, there are two essential concerns to keep in mind. Firstly, these figures are comparatively insignificant on a standalone foundation. Secondly, they’re simply questionable, on condition that in each figures, stock-based compensation (which is dilutive to shareholders) of $254.7 million has been added again for the quarter.

Subsequently, Snap retains destroying shareholder worth, even after posting a rebound in revenues. It could be an oblique worth destruction by means of dilutive compensation, however that is precisely what’s taking place. In spite of everything, its GAAP figures clearly present this by means of the continuing working losses. Additional, there’s additionally no plan in sight for the corporate to achieve significant GAAP margins, whereas current income progress positive aspects might flip if the advert business had been to take a breather. Thus, Snap finds itself in a troublesome spot.

Snap’s Valuation Is Loopy

Apart from the truth that Snap’s funding case gives no visibility to buyers, with the shortage of significant income prone to final for a number of extra years, the inventory’s valuation seems somewhat loopy. Following Snap’s post-earnings rally, the inventory is now buying and selling at about 60.7 occasions this 12 months’s anticipated adjusted earnings per share. Not solely is that this a number of seemingly based mostly on non-GAAP earnings, which embrace the dilutive nature of stock-based compensation, however it’s in itself absurd, given Snap’s flawed fundamentals.

Taking this a step additional, SNAP inventory can also be buying and selling at about 36 occasions subsequent 12 months’s anticipated non-GAAP earnings per share. Thus, whereas Wall Avenue expects important earnings progress subsequent 12 months, a questionable half in itself, the present valuation nonetheless seems fairly inflated even on a two-year ahead foundation.

Is SNAP Inventory a Purchase, In response to Analysts?

After its current rally, Wall Avenue seems to have blended emotions in regards to the inventory. SNAP inventory includes a Maintain consensus score based mostly on eight Buys, 18 Holds, and two Promote rankings assigned previously three months. At $15.59 per share, the common Snap inventory value goal suggests 2.4% upside potential.

For those who’re unsure which analyst to comply with if you wish to purchase and promote SNAP inventory, probably the most worthwhile analyst protecting the inventory (on a one-year timeframe) is Ross Sandler from Barclays (NYSE:BCS), boasting a median return of 47.12% per score and a 62% success fee.

The Takeaway

To sum up, whereas Snap’s Q1 income progress and consumer engagement metrics could seem promising, the corporate’s steady lack of ability to realize significant profitability stays an ideal concern. The doubtful nature of its adjusted monetary metrics worries me even additional.

Within the meantime, Snap’s present valuation seems excessively wealthy relative to its lack of GAAP income and the dilutive nature of SBC, which artificially boosts adjusted metrics. For these causes, I stay bearish on Snap’s long-term outlook and see the current share value rally as a sexy alternative for buyers to promote their inventory.