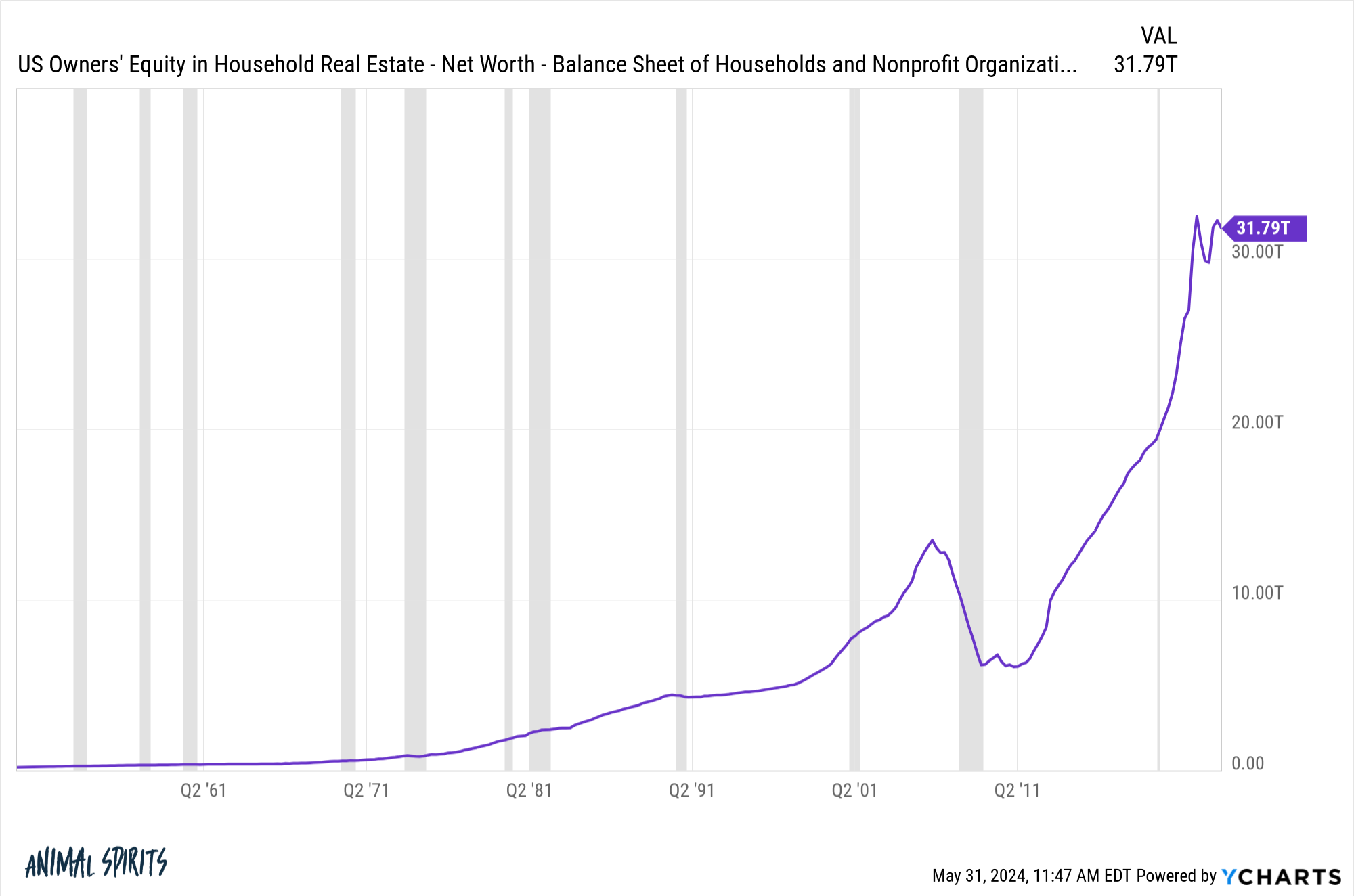

The pandemic housing growth means People have extra dwelling fairness than ever.

Households have added roughly $12 trillion in dwelling fairness because the finish of 2019:

To place this quantity in context, there was solely ~$6 trillion in dwelling fairness following the bursting of the housing bubble following the Nice Monetary Disaster.

Out of the $32 trillion in whole fairness, let’s say half of it’s tappable (which means owners can money it out).

That’s some huge cash simply sitting there in an illiquid asset.

The issue is nobody is tapping it proper now as a result of mortgage charges are so excessive. Nobody of their proper thoughts needs to do a cashout refi to go from 3% to 7%.

And a house fairness line of credit score appears absurd. I checked my HELOC price this week. It’s 8.3%!

If and when rates of interest fall or we go right into a recession, there might be a flood of house owners trying to pull that fairness out for dwelling renovations, down funds on a brand new place, holidays or no matter else individuals spend their cash on.1

Dwelling fairness is sort of a big piggy financial institution simply sitting there for owners.

However dwelling fairness isn’t essentially the most liquid of piggy banks. Fortunately, different extra cash-like choices are fairly full lately as effectively.

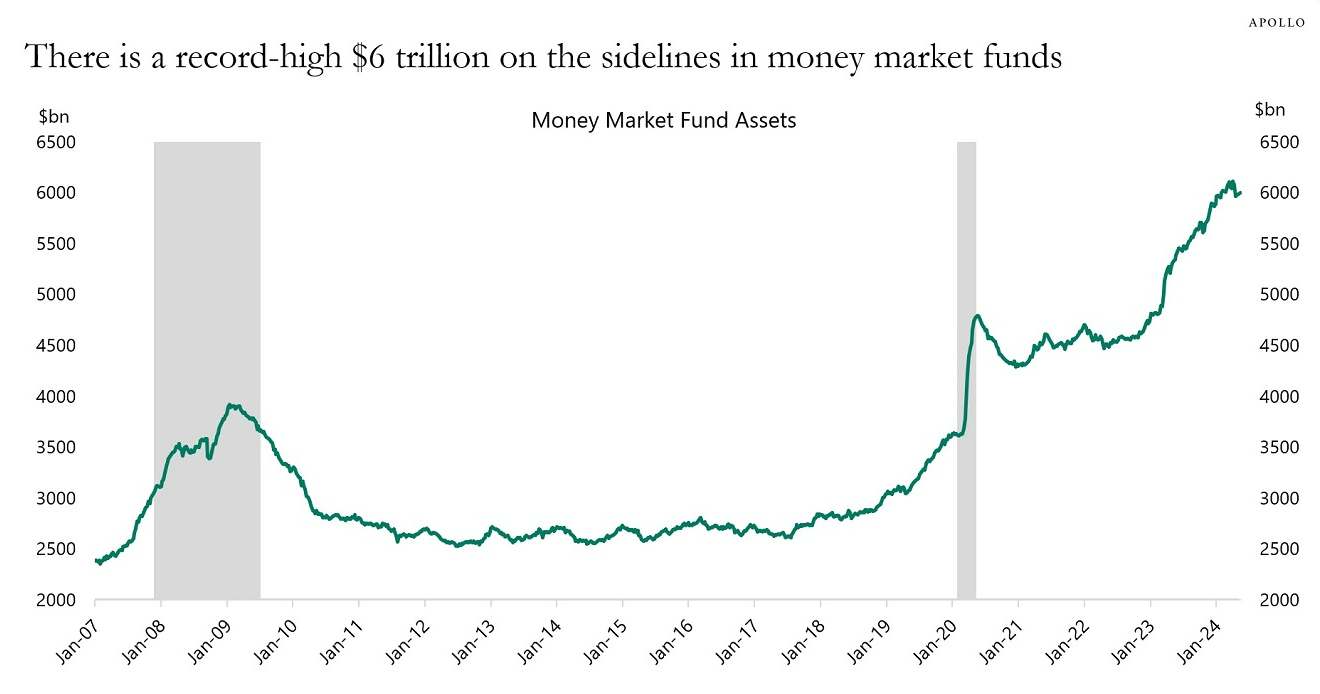

Cash market funds have gone from round $3.5 trillion earlier than the pandemic to $6 trillion now:

The flexibility to earn 5%+ helps, in fact. Then there’s one other $2-3 trillion in CDs, which supply equally engaging short-term yields.

Yields on cash market funds, CDs, financial savings accounts and short-term authorities paper (T-bills) have a tendency to trace the Fed Funds Charge, which has remained increased for longer than most individuals would have anticipated.

Traders and savers are taking benefit.

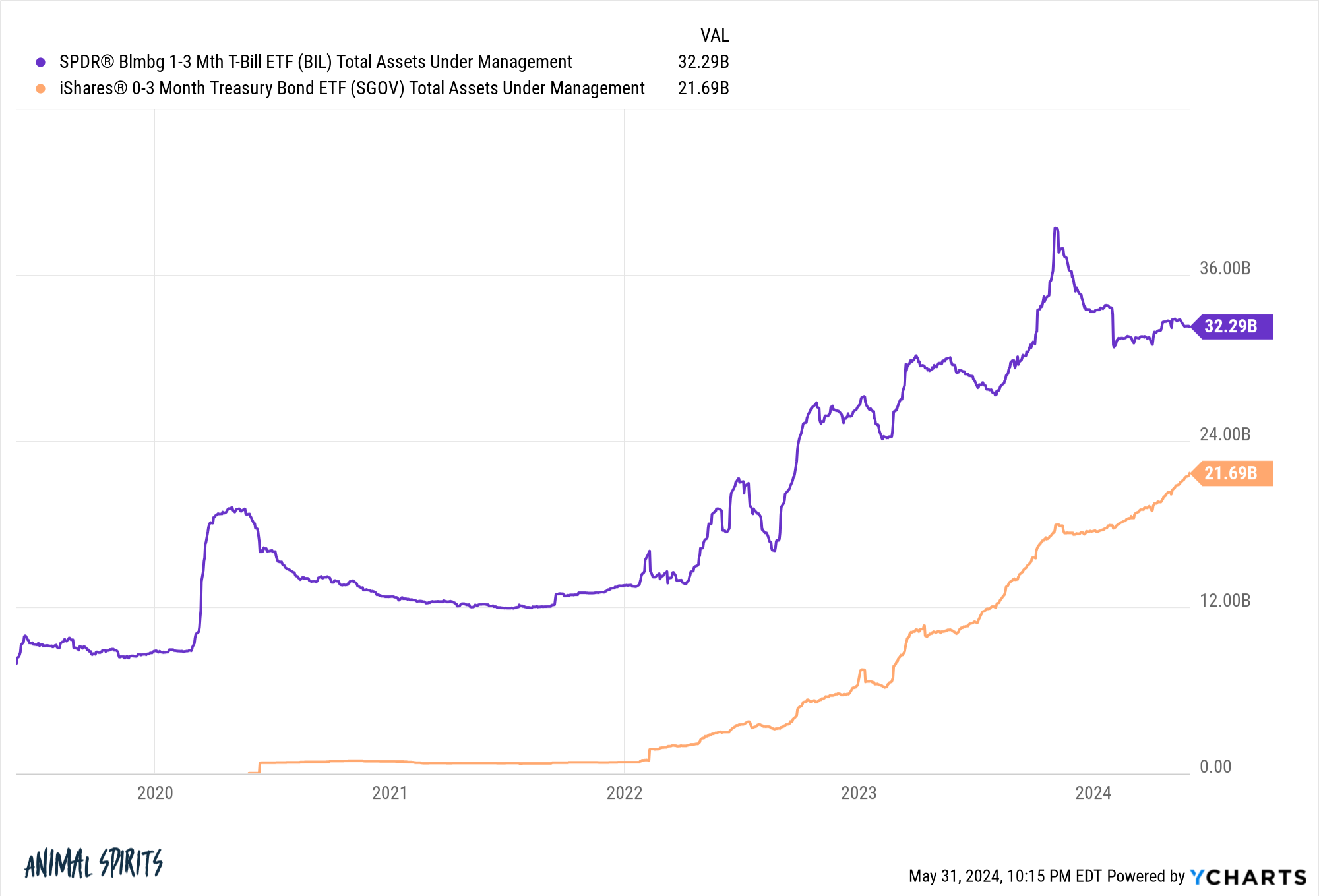

Simply have a look at the expansion in belongings for the 2 largest T-bill ETFs:

Property are up round 5x since 2020.

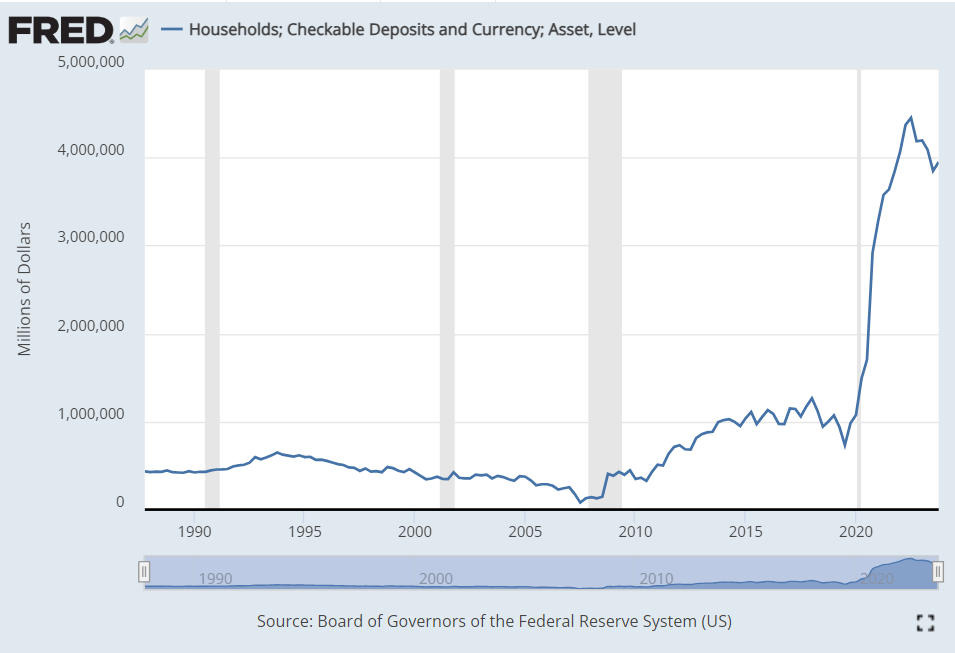

There was the same rise within the amount of cash individuals maintain in checking accounts:

That’s one other $4 trillion, which was solely round $1 trillion simply earlier than the pandemic.

The unusual factor concerning the rise in checkable deposits is these are largely accounts with little-to-no yield. It looks like extra of a defensive technique than something, which doesn’t make a complete lot of sense contemplating how plentiful short-term yields are lately.

To every their very own.

I couldn’t discover any good knowledge about on-line financial savings accounts, but when my private expertise means something, there are much more belongings in these accounts than within the 0% rate of interest world.2

These belongings aren’t evenly distributed (they by no means are) however many American households are flush with money and different sources of liquidity like by no means earlier than.

If the economic system ever decides to decelerate or rates of interest fall or we’ve got some type of monetary asteroid strike, there’s quite a lot of money on the sidelines.

I’m not saying all of that money or dwelling fairness or cash in T-bills will assist stave off a recession.

However there’s a backstop for lots of people if and when the excrement hits the fan.

Additional Studying:

What’s the Proper Financial savings Charge?

1I suppose it’s attainable owners are accountable and go away that fairness alone. However I function with the baseline that People like to borrow and spend cash. Name me loopy.

2I’m not sitting on an extreme amount of money however greater than I used to be earlier than 5% charges had been a factor.

This content material, which incorporates security-related opinions and/or info, is offered for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There may be no ensures or assurances that the views expressed right here will likely be relevant for any specific details or circumstances, and shouldn’t be relied upon in any method. You need to seek the advice of your personal advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “publish” (together with any associated weblog, podcasts, movies, and social media) displays the non-public opinions, viewpoints, and analyses of the Ritholtz Wealth Administration workers offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory companies offered by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments consumer.

References to any securities or digital belongings, or efficiency knowledge, are for illustrative functions solely and don’t represent an funding advice or supply to supply funding advisory companies. Charts and graphs offered inside are for informational functions solely and shouldn’t be relied upon when making any funding choice. Previous efficiency isn’t indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to vary with out discover and will differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives cost from numerous entities for ads in affiliated podcasts, blogs and emails. Inclusion of such ads doesn’t represent or suggest endorsement, sponsorship or advice thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investments in securities contain the chance of loss. For added commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.