As the first element of the anode materials in lithium-ion batteries, graphite performs a vital position in North America’s push to ascertain a safe provide chain in help of the rising electrical car (EV) business.

However the useful resource additionally has a various set of functions past the battery area, from pencils and greases to refractory merchandise and fire-retardant constructing supplies. As such, graphite could also be a compelling funding alternative for a lot of.

By gaining a deeper understanding of graphite’s provide and demand dynamic, together with its many industrial functions past batteries, traders can extra readily determine promising funding alternatives with this important mineral.

Key useful resource for electrification and sustainability

In recent times, graphite has develop into a key EV battery materials. Consultants consider that it’ll possible stay so for no less than a decade. It’s because the vast majority of fashionable EV batteries include between 40 and 60 kilograms of graphite.

Consequently, Benchmark Mineral Intelligence predicts that graphite demand from the battery sector will improve no less than 250 % by 2030, notably as corporations like Tesla (NASDAQ:TSLA) search to assemble megafactories and gigafactories. Failure to broaden present graphite provide chains will lead to a big deficit, the analyst agency notes.

In gentle of this looming scarcity, cross-commodity value reporting company Fastmarkets expects graphite’s market value to extend, pushed by mounting underlying prices.

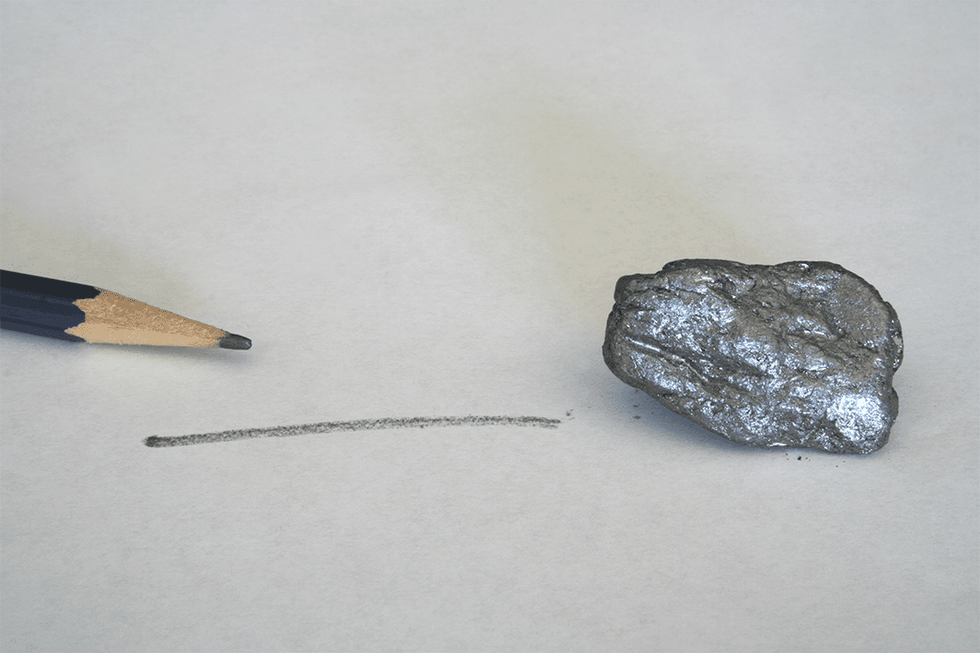

Whereas graphite has acquired appreciable consideration for its position in EV batteries, its makes use of lengthen far past, spanning industries resembling electronics, automotive, aerospace and industrial equipment. Frequent functions of graphite embrace pencils, polishes, electrical motor brushes and to create graphene sheets, a cloth 10 instances lighter and 100 instances stronger than metal. Graphite can be used as a liner for crucibles and ladles and performs a key position in metal manufacturing.

This versatility implies that even when one has little curiosity within the battery sector, the useful resource continues to be price contemplating as an funding — notably provided that graphene might doubtlessly change metal, carbon fiber and a variety of different supplies within the close to future.

Varieties of graphite

Graphite could be produced in considered one of two methods. Pure graphite, because the title suggests, is mined from current graphite deposits. These deposits can happen in three completely different types: flake, amorphous and crystalline vein graphite.

A seam mineral shaped by way of contact metamorphism, amorphous graphite’s excessive warmth tolerance means it is effectively suited to industrial processes resembling metal manufacturing. The mineral can be used to make brake linings, gaskets, clutch supplies and pencil lead.

Flake graphite types when carbon is subjected to each excessive temperature and excessive strain. The most important purchaser and shopper of flake graphite is the automotive business, as the fabric is utilized in a number of car parts. Flake graphite can be a key element in EV batteries and nuclear reactors.

Crystalline vein graphite is understood for its extremely excessive purity. It additionally has the next thermal and electrical conductivity than the opposite forms of pure graphite. As such, it may be used for all the identical functions as flake graphite.

Artificial graphite is usually constructed from superheated petroleum coke with extra supplies added to advertise bonding — the general course of is called calcination. Graphite produced synthetically is denser, extra conductive and extra pure than pure graphite. Nonetheless, it is usually costly and energy-intensive to supply. Artificial graphite is primarily used for power storage and to supply electrodes, making it a key useful resource for photo voltaic and sustainable power.

Investments in North America

In gentle of China’s export restrictions, graphite exploration and growth corporations will play a important position in establishing a secure different provide of the useful resource. Following the October 2023 announcement of stated restrictions, graphite corporations in each North America and the European Union started working to safe authorities funding for his or her initiatives. Buyers can anticipate partnerships between the private and non-private sectors to develop into more and more frequent as governments proceed to push for each decarbonization and provide chain stability; collaboration between mining corporations, electronics corporations and automotive producers are additionally anticipated to extend.

There are a number of current investments in North America that traders could discover price trying into.

Metals Australia (ASX:MLS)

Metals Australia owns one graphite and a number of other battery metals initiatives in Canada and Australia.

The corporate’s flagship undertaking, Lac Wet, is located in a serious graphite province in Japanese Quebec. Along with exceptionally high-grade and widespread graphite sampling outcomes, Lac Wet has quick access to each transportation and power infrastructure, together with hydroelectric energy.

MLS is progressing growth research and enterprise key measures to advance the Lac Wet graphite undertaking together with a prefeasibility examine for a 100,000 metric ton each year flake graphite focus plant, a metallurgical and laboratory companies settlement with SGS Laboratories, assessing a downstream battery-grade spherical graphite focus purification possibility and scoping examine, in addition to participating a contractor for drilling and full-service help.

Metals Australia could be very effectively funded to finish all deliberate research. Given its useful resource dimension, grade and potential for vital progress it’s additionally more likely to come onto the radar of governments supporting growth of important minerals initiatives in North America.

Syrah Assets (ASX:SYR,OTC Pink:SYAAF)

Syrah Assets produces graphite from its Balama / Nicanda Hill property in Mozambique.

In effort to provide US markets, it just lately accomplished its Vidalia lively anode materials plant, a large-scale facility with an preliminary manufacturing capability of 11.25 kilotonnes each year. Established with funding and help from the US authorities, the ability started operations within the first quarter of 2024. Syrah is at the moment working to additional develop the plant and safe offtake agreements to make sure Last Funding Resolution Readiness.

The corporate goals to be the primary main non-Chinese language built-in producer of pure graphite lively anode materials.

Nouveau Monde Graphite (TSXV:NOU,NYSE:NMG)

Nouveau Monde owns a number of graphite property all through Quebec. The corporate has secured vital funding from Panasonic Holdings (TSE:6752) and Basic Motors (NYSE:GM) by way of multi-year offtake agreements totaling $50 million, and a further $275 million dedication for the development of the downstream battery anode plant, topic to last funding determination. The corporate’s key promoting level is its inexperienced enterprise mannequin, which makes use of pure graphite to supply parts for EVs, renewable power storage and shopper electronics.

Investor takeaway

Graphite has made headlines lately because of its pivotal position in enabling the clear power transition. Nonetheless, the functions and potential of this important mineral are way more complete than batteries and power storage. Graphite has lengthy been essential to the manufacturing and automotive sectors, whereas rising functions resembling graphene hulls and plating present unimaginable promise for the long run. Consultants consider the long run is brilliant for graphite, supported by the bulletins of funding from the personal and authorities sectors, notably in North America.

This INNSpired article is sponsored by Metals Australia (ASX:MLS). This INNSpired article supplies info which was sourced by the Investing Information Community (INN) and accepted by [add link to company profile][in an effort to assist traders study extra in regards to the firm. Metals Australia is a shopper of INN. The corporate’s marketing campaign charges pay for INN to create and replace this INNSpired article.

This INNSpired article was written in line with INN editorial requirements to teach traders.

INN doesn’t present funding recommendation and the knowledge on this profile shouldn’t be thought-about a advice to purchase or promote any safety. INN doesn’t endorse or advocate the enterprise, merchandise, companies or securities of any firm profiled.

The knowledge contained right here is for info functions solely and isn’t to be construed as a suggestion or solicitation for the sale or buy of securities. Readers ought to conduct their very own analysis for all info publicly out there in regards to the firm. Prior to creating any funding determination, it is suggested that readers seek the advice of immediately with Metals Australia and search recommendation from a professional funding advisor.