There’s a lot respectable (in addition to dramatic) discuss concerning the failing US, its debased foreign money and its identity-fractured/inflation-taxed middle-class which has been more and more described extra aptly because the working poor.

The Finish, or Simply Change?

However is America coming to an finish? Will the USD lose its world reserve foreign money standing? Will the dollar disappear? Will gold or BTC save us from all that’s breaking earlier than our media-clouded eyes and more and more centralized state?

Nope.

America is slipping, however not ending.

The USD is being repriced not changed.

The dollar remains to be a key spending, liquidity and FX foreign money. Nevertheless it’s not the premier financial savings asset or retailer of worth.

Gold (now a Tier-1 asset btw…) will proceed to retailer worth (i.e., protect wealth) higher than any fiat cash; and BTC will definitely make convexity headlines sooner or later.

And sure, everyone knows the Fourth Property died lengthy earlier than Don Lemon or Chris Cuomo stained our screens or insulted our collective IQ.

And as for centralization, it’s not coming, however already right here.

Be Ready Quite than Emotional

So, sure there may be large cause for knowledgeable and real concern, however somewhat than anticipate the top of the world, it could be far simpler to logically put together for a altering world.

Quite than debate left or proper, black or white, straight or trans, protected or efficient, sensible (Barrington Decision) or silly (Fauci), we’d probably serve our particular person and collective minds much better by embracing the logical and tabling the emotional.

Towards that finish, we’d be equally higher off counting on our personal judgement somewhat than that of the kids making home, financial or international coverage selections from DC to Belgium…

Logically talking, the USD (and US of A) is altering.

Like its current swath of weak management, the dollar and US IOU are quantifiably much less liked, much less trusted, much less inherently robust and effectively…far lower than they had been at Bretton Woods circa 1944.

Change Is Apparent

Since our biggest technology stormed the seashores of Normandy in June of 44, we’ve gone from being the world’s main creditor and producer to the world’s biggest debtor and labor-off-shorer by June of 2024.

This isn’t fable however reality. A current Normandy veteran admitted that he not acknowledges the nation he fought for—and that’s price a pause somewhat than “patriotic” critique.

When the post-2001-WTO-daft coverage makers weaponized what ought to have been a impartial world reserve foreign money in 2022 in opposition to a significant nuclear energy (i.e. stole $400B price of Russian property) already in financial mattress with a China-driven and now rising BRICS coalition, the “payback” writing was on the wall for the dollar—as many people understood from day-1 of the Putin of sanctions.

De-Dollarization Is a Actuality, not a Headline

Briefly, many countries of the world, together with the oil nations, shortly understood that the world desires a reserve asset that may’t be frozen/stolen at will and that concurrently retains (somewhat than loses) its worth.

However somewhat than finish the USD because the world reserve foreign money, most of that world is solely going round (or exterior of) it…

Or much more bluntly, the prior hegemony of the UST, and by extension, the USD, irrevocably modified in 2022.

Thank You Ronni & Luke

Because of data-focused and credit score/currency-savvy thinkers like Ronnie Stoeferle and Luke Gromen, we are able to plainly see the info somewhat than drama of those traits.

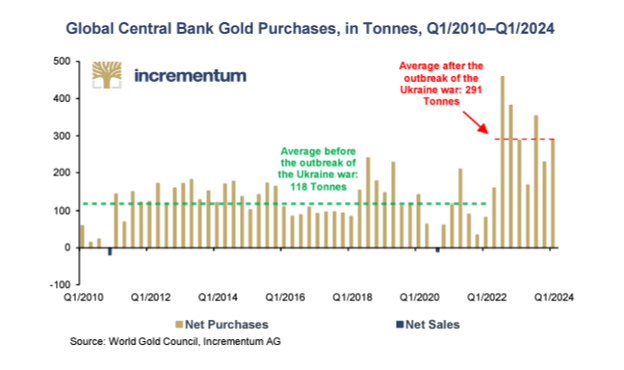

The actions somewhat than mere phrases of the BRICS+ nations and world central banks, preferring to avoid wasting in bodily gold somewhat than US IOU’s, communicate loudly for themselves, which Stoeferle’s goal charts remind.

That’s, because the US weaponized its Greenback, there was an plain transfer away from the dollar and its UST in favor of gold as a reserve asset:

The COMEX et al…

The arduous info are in, and dozens of BRICS+ international locations are buying and selling exterior the USD, buying in native currencies for native items, after which web settling the surpluses in bodily gold, which is much better/fairer priced in Shanghai than in London or New York, two crucial exchanges which might be seeing extra bodily deliveries out of their exchanges than in.

Immodestly, we noticed this coming years forward of the White Home…

This implies a long time of artificially rigging valuable metallic pricing on legalized fraud platform just like the COMEX are coming to a post-Basel III and post-sanction sluggish finish.

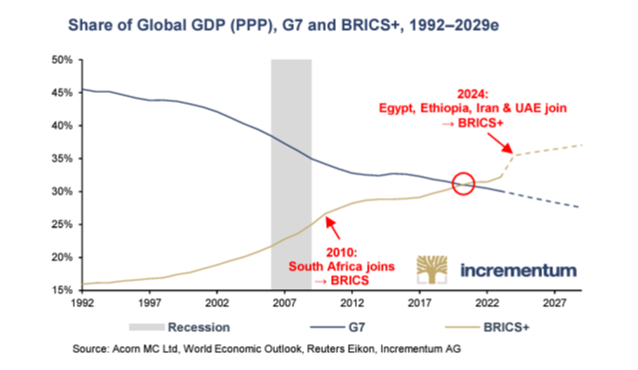

This issues, as a result of prefer it or not, the rising energy of the BRICS+ nations, generationally uninterested in being the canine wagged by the USD’s inflation-exporting tail, are rising in financial energy away from a debt-driven West, which once more, the info (world share of GDP) clarify somewhat than sensational.

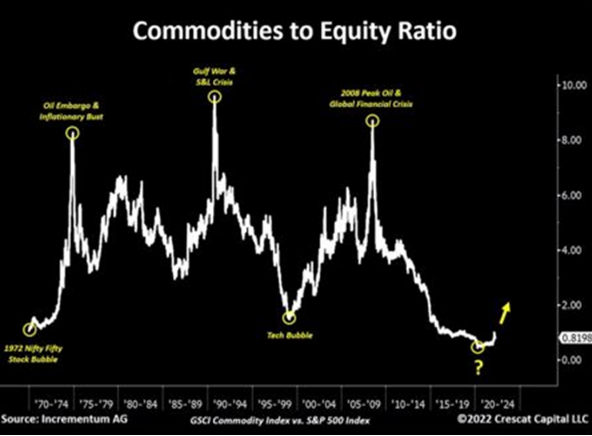

The Chart of the Decade?

Ronni posted a equally crucial chart over a yr in the past, asking, considerably rhetorically, if it was not the chart of the last decade?

That’s, he requested if the world is transferring towards a commodity super-cycle whereby actual property start their sluggish rise in opposition to falling (but presently inflated) fairness markets and a falling (but more and more debased) USD.

As Grant Williams, would say, this could make far-sighted traders all go hmmm.

Commodity Markets: Change is Gonna Come to the Petrodollar

And as for commodities, currencies and therefore gold, the adjustments are throughout us, at the very least for these with eyes to see and ears to listen to.

Towards this finish, we are able to’t ignore what has been occurring within the world power markets, matters which I’ve beforehand (and so-far, accurately) addressed right here and right here.

However in relation to understanding oil, the USD and gold, Luke Gromen leads the best way in clear pondering and has knowledgeable us in addition to anybody.

He reminds, for instance, that oil, like every other object of worldwide provide and demand (i.e., commerce), will be equally net-settled in gold somewhat the UST-linked petrodollars.

(In 2023, by the best way, 20% of world oil gross sales had been exterior of the USD, a reality in any other case unthinkable till the Biden White Home sanctioned Russia.)

The implications of this easy commentary (in addition to its affect on) the USD, commodity pricing and gold are extraordinary.

Oil: The Current Previous, Previous to Sanctions…

Earlier than the US weaponized its USD in opposition to Russia (and publicly insulted its key oil accomplice, Saudi Arabia), the world towed the road of each the UST and the USD-denominated oil commerce, which was very, very, very handy for Uncle Sam and his Modis Operandi of exporting US inflation to everybody else.

For instance, previously, when commodity costs obtained too excessive, nations like Saudi Arabia would take in USTs and successfully go lengthy the USD, which the US pumps out sooner than the Saudis do oil…

This, in fact, was good for stabilizing and absorbing an in any other case over-produced and debasement-vulnerable USD whereas concurrently serving to US authorities bonds keep liked and therefore yield’s compressed/managed.

In a approach, this was even good for world progress, because it saved the USD secure and low sufficient for nations like China and different EM international locations to develop.

These different nations, in flip, would maintain shopping for the “risk-free-returning” UST’s and thus assist refund (“reflate”) the US’s personal debt-based “progress narrative.”

In any case, if each one else is shopping for his IOU’s, Uncle Sam can without end go deeper and deeper into debt-financing the American Dream, proper?

Oil: Current Info, Put up the Sanctions…

Effectively, that’s true provided that you assume the world by no means adjustments, and that reported–i.e., totally dishonest inflation–makes our UST’s really “risk-free” somewhat than simply returning nothing however destructive actual yields.

Happily (or sadly), the remainder of the world is seeing the adjustments which DC pretends to cover.

Particularly, and as of November of final yr, the Saudi’s met with a bunch of BRICS+ nations on the lookout for methods across the USD and UST in relation to buying and selling amongst themselves—and this consists of the oil commerce.

Take into consideration that for a second.

Which means what has been working in favor of the USD and sovereign bond market because the early 70’s (i.e., world demand for the USD by way of oil) is slowly (however absolutely) unwinding proper earlier than Biden’s barely open eyes…

All these a long time of prior assist/demand for USDs and USTs goes down not up, which implies unloved UST’s should be supported by faux (i.e., inflationary) at-home liquidity somewhat than immortal international demand.

This, by the best way, results in foreign money debasement—the endgame of all debt-soaked nations.

Oil: The Altering Future, Put up Sanctions…

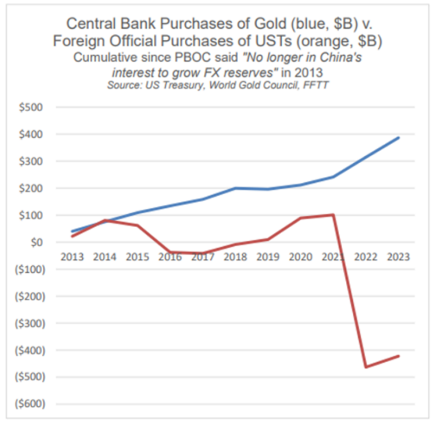

It additionally implies that commodities, from copper to sure, even oil, can and can proceed to be bought exterior the Greenback and web settled in gold, which probably explains why central banks have been web stacking gold (high line) and net-dumping USTs (backside line) since 2014…

Once more, watch what the world is definitely doing somewhat than what your politico’s (and even financial institution wealth advisors) are telling you.

Gold & Oil: Inconceivable to Ignore?

As for gold and oil within the foregoing backdrop of a altering somewhat than static world, any sane investor has to present critical consideration to the altering petrodollar dynamics which Luke Gromen has been monitoring with sober farsightedness.

The compressed however inevitably rising tremendous cycle (Stoeferle chart above) in commodities this time round will differ markedly from previous rallies.

As oil, for instance, goes up (for any variety of causes), the previous system that after recycled these prices in UST purchases can (and has) pivoted/modified to a different asset.

You guessed it: GOLD.

Suppose it by means of: Russia can promote oil to China, Saudi Arabia can promote oil to China. However now in Yuan not USDs. These buying and selling companions can then take their Yuan funds to purchase Chinese language “stuff” (as soon as made in America…) and at last web settle any surpluses in gold somewhat than USTs.

That gold can then be transformed into any EM/BRICS+ native foreign money (from rupees to reals) somewhat than {Dollars} to commerce amongst themselves for different uncooked commodities, of which many BRICS+ nations are useful resource wealthy.

This, by the best way, just isn’t some distant risk, however a present and ongoing actuality. It will probably devastating to USD demand and therefore energy.

When copper and different commodities, together with, oil begins repricing (and stockpiling) exterior the USD with rising frequency, the Greenback’s so-called “hegemony” turns into more and more arduous to imagine, telegraph or maintain.

The Ignored Gold/Oil Ratio

As Luke Gromen observes, however few want to see…if/when gold turns into the “de facto launch valve for non-USD commodity pricing and web settlement,” the affect it will have on the long-term gold worth is solely a matter of math somewhat than debate.

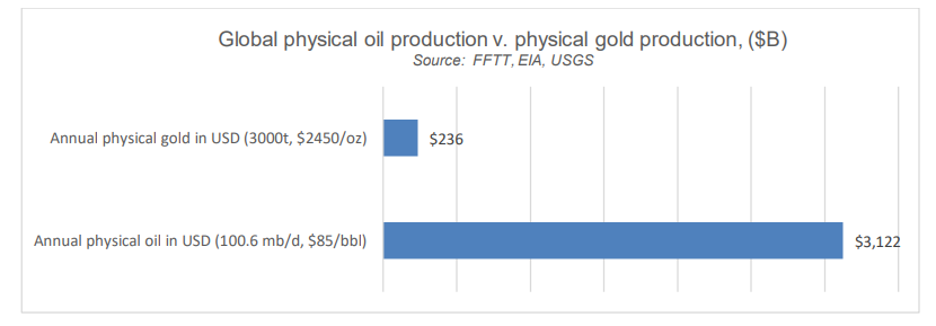

He repeatedly reminds that the worldwide oil market is 12-15x the scale of the worldwide gold markets in bodily manufacturing phrases:

We thus can surmise that gold can and shall be pushed greater by oil particularly and different commodities on the whole, a actuality already in play as measured by the worldwide gold/oil ratio, which has risen (not so coincidentally) by 4x since Moscow started stacking gold in 2008 whereas the Fed was getting ready to mouse-click trillions of faux {Dollars} in DC…

The Most (Intentionally) Misunderstood Asset…

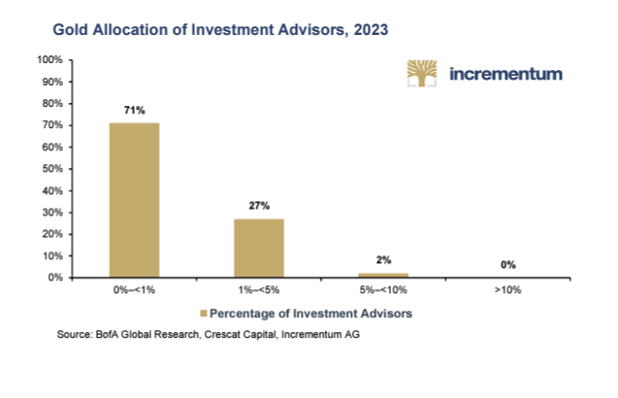

In the meantime, as we stare in awe on the consensus-think which nonetheless locations gold at solely 0.5% of world asset allocations (the 40Y imply is 2%) and simply barely over 1% of all household workplace allocations (nonetheless crawling additional and additional on the danger department for yield), now we have to marvel whether it is human nature (or simply political and financial self-interest) to concern change, even when the proof of it’s all round us.

But few see gold’s actual function…

For gold traders (somewhat than speculators) who assume generations forward somewhat information cycles per day, and who perceive that preserving wealth is the key to having wealth, this asset (and alter) just isn’t feared.

It’s understood.

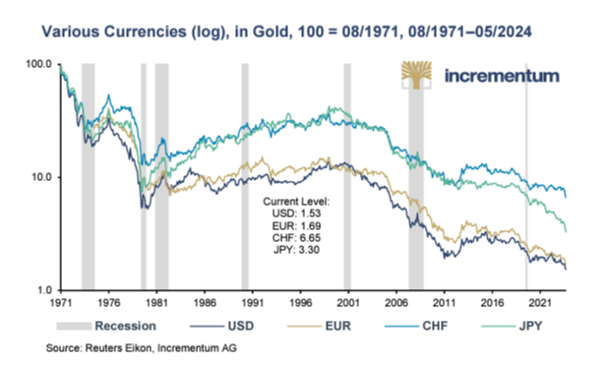

And that’s how we perceive gold. It preserves wealth whereas paper currencies destroy it.

That’s the reason regardless of constructive actual yields, a relative robust USD and so-called contained inflation, gold is breaking away from these correlations and making all-time-highs regardless of their profiles as conventional gold “headwinds.”

It’s so easy.

Gold is trusted way over damaged currencies from broke international locations, together with the as soon as revered USA particularly and the West and East on the whole:

As Ronni accurately says: “In gold we belief.”

Makes loads of (widespread/historic) sense. Simply do the mathematics and learn some historical past…

About Matthew Piepenburg

Matthew Piepenburg

Associate

VON GREYERZ AG

Zurich, Switzerland

Telephone: +41 44 213 62 45

VON GREYERZ AG world shopper base strategically shops an vital a part of their wealth in Switzerland in bodily gold and silver exterior the banking system. VON GREYERZ is happy to ship a singular and distinctive service to our extremely esteemed wealth preservation clientele in over 90 international locations.

VONGREYERZ.gold

Contact Us