Though costs have since pulled again to the US$90 vary as of mid-year, there are many indicators that the market could also be in for loads of upside within the years forward.

For a few years, the uranium market’s back-and-forth battle to maneuver out of a somewhat entrenched trough had buyers asking, “When will uranium costs go up?” Now that they’ve, the questions that stay are whether or not they’re up sufficient to spur uranium mining exercise and whether or not or not they’ve additional to go.

Earlier than we attempt to reply these questions, we’ll take a look at what’s moved the uranium spot value previously, together with the vitality steel’s provide and demand dynamics.

How have uranium costs traded traditionally?

As briefly outlined above, uranium has skilled a large value vary this previous century — whereas its highest degree was almost US$140, the bottom U3O8 spot value got here in at simply US$7.

In 2003, the value of uranium started an upward development as demand for nuclear energy rose alongside the world’s want for vitality, particularly in development economies corresponding to China and India. These growing vitality calls for got here concurrently vital supply-side disruptions. For instance, in 2006, Cameco’s huge Cigar Lake mine in Saskatchewan flooded, stalling manufacturing for a number of years at one of many largest uranium deposits on the earth.

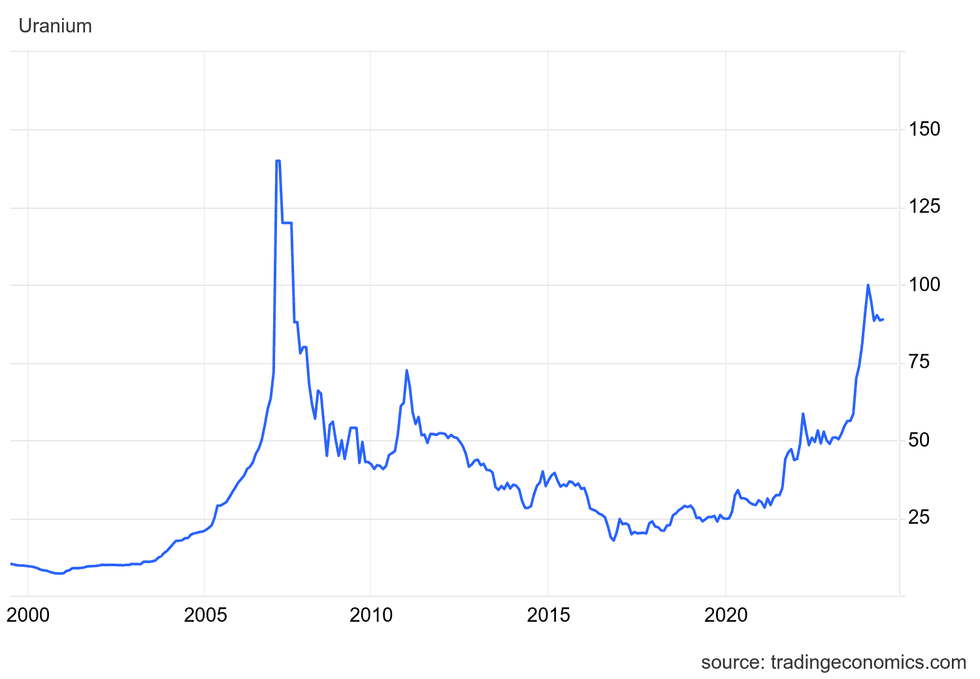

The shortcoming to maneuver this uranium ore to market was an enormous setback for the uranium business, and translated into explosive value development for the steel in 2007. Nonetheless, these spectacular positive factors had been quickly undone by the 2008 financial disaster, which despatched uranium on a downward spiral, slipping under the important thing US$50 degree in early 2009 and to the US$40 vary in 2010, as is proven within the uranium value chart under.

Uranium’s value historical past over the past 25 years.

Uranium value chart by way of Buying and selling Economics.

Initially of 2011, uranium received a severe push to the upside together with different vitality metals as the worldwide financial system started to get better. The tight provide state of affairs, heightened by years of low costs, additionally performed a component in pushing the spot value previous the US$70 degree.

The rally was short-lived, nonetheless, as Japan’s Fukushima nuclear catastrophe in March shook confidence within the sector. The uranium spot value started a gradual slide to lows not seen because the begin of the century, in the end bottoming out at US$18 in November 2017.

Though COVID-19-induced provide disruptions on the world’s high uranium mines briefly despatched the commodity to a 4 yr excessive of US$33.93 in Could 2020, it wasn’t till the autumn of 2021 that uranium began to search out its footing once more.

In September 2021, uranium started to point out indicators of life because it shot as much as a 9 yr excessive of US$50.80. The 2021 uranium value rally got here after provide cuts from main producers, together with Kazakhstan’s Kazatomprom and Canada’s Cameco (TSX:CCO,NYSE:CCJ), alongside the emergence of the launch of the Sprott Bodily Uranium Belief (TSX:U.UN).

Costs had been quickly see-sawing between US$38 and US$48 in October and November, however the begin of 2022 introduced civil unrest in Kazakhstan, in addition to Russia’s invasion of Ukraine. These occasions proved value optimistic for the uranium market, and by mid-April, uranium costs had reached an 11 yr excessive of US$64.61.

Trying on the demand facet, utility firms had as soon as once more returned to the desk to signal new long-term uranium provide agreements to safe value and provide. This coincided with uranium provide challenges associated to conversion and enrichment. The consequence was that from April 2021 to April 2022, the value of uranium soared by an eye-popping 106.47 %.

By H2 2022, uranium costs had begun to slip again to the US$50 vary. Very similar to the broader commodities market, uranium felt the squeeze of upper rates of interest as central banks, together with the US Federal Reserve, sought to curb rising inflation.

Whereas the uranium value remained caught within the low US$50s vary for a lot of 2023’s first half, optimistic fundamentals born out of the view that nuclear vitality is crucial to lowering world carbon emissions sparked one other main value rally starting within the fall. By January 2024, because the uranium spot value hit US$106 per pound, many market analysts had been loudly proclaiming that the subsequent uranium bull market is lastly right here.

What elements influence uranium provide and demand?

Uranium costs are primarily influenced by aboveground mine provide and demand for nuclear vitality. To grasp the place these stand, buyers on this sector sometimes look to:

- output from uranium mines

- the variety of nuclear reactors on-line, below development or deliberate

- the signing of long-term contracts between uranium suppliers and utilities firms

Analysts with a bullish lean imagine the uranium market cycle has reached its backside and {that a} break to the upside for uranium costs is supported by optimistic provide and demand fundamentals.

On the demand facet, nuclear vitality generated from 440 reactors across the globe provides about 10 % of the world’s vitality necessities. China alone is developing 27 new reactors in the mean time, whereas Russia is developing 4 with one other 20 confirmed or deliberate and India has seven nuclear reactors below development.

A World Nuclear Affiliation (WNA) report forecasts that nuclear era capability will develop from 391 gigawatts electrical (GWe) in 2023 to a complete of 686 gigawatts electrical GWe in 2040. About 83,840 metric tons (MT) of uranium can be required to feed these reactors, up considerably from the 65,650 MT of uranium in required in 2023, in response to the WNA’s uranium forecast. The agency initiatives that just about 130,000 MT can be wanted in 2040.

On the availability facet, main uranium producers are nonetheless not producing at full capability, whereas new uranium exploration and improvement initiatives are few and much between. Highlighting these circumstances, the WNA factors out that world uranium manufacturing dropped from 63,207 MT of uranium in 2016 to 47,731 MT of uranium in 2020. Though that determine ticked up barely larger in 2021 to 47,808 MT and once more in 2022 to 49,355 MT, the group notes that solely 74 % of 2022’s reactor necessities had been coated by main uranium provide.

Big cuts to world uranium manufacturing have come from Kazakhstan, the world’s largest uranium-producing nation. Liable for 43 % of worldwide uranium manufacturing, the Central Asian nation started lowering its annual manufacturing ranges in 2018.

In its 2023 monetary report, Kazakhstan’s state uranium agency Kazatomprom warned that it sees a serious provide deficit within the uranium market post-2030. “Within the present pricing atmosphere one other Kazatomprom-sized provide supply can be wanted to cowl future market wants,” stated Kazatomprom CEO Meirzhan Yussupov. In early 2024, the corporate diminished its manufacturing steerage in 2024 on account of a number of challenges, together with difficulties acquiring sulfuric acid.

Canada, Namibia, Australia, and Uzbekistan are additionally among the many world’s largest uranium producers. In Canada, Cameco shuttered the Saskatchewan-based McArthur River mine in 2018 and quickly closed Cigar Lake — the world’s high uranium mine — in response to the COVID-19 pandemic. In November 2022, the mining big introduced the McArthur River/Key Lake operation again on-line.

In 2023, Cameco produced 17.6 million kilos of uranium, falling wanting its unique manufacturing goal of 20.3 million kilos for the yr. The corporate’s 2024 steerage is ready at 22.4 million kilos.

Extra not too long ago, Boss Vitality (ASX:BOE,OTCQX:BQSSF) introduced in April 2024 that it had produced the primary drum of uranium out of its Honeymoon undertaking in South Australia as a part of its commissioning course of. The present mine plan solely makes use of 36 million kilos of the undertaking’s complete JORC useful resource of 71.6 million kilos. Boss’ aim is scale up manufacturing at Honeymoon to 2.45 million kilos of U3O8 yearly.

Regardless of this optimistic information, the WNA reviews that provide deficits are prone to proceed within the years forward as present world manufacturing ranges aren’t sufficient to satisfy forecasted demand.

“To fulfill the Reference State of affairs necessities from early within the subsequent decade, along with restarted idled mines, mines below improvement, deliberate mines and potential mines, different new initiatives will have to be introduced into manufacturing,” the WNA report states. “Appreciable exploration, modern strategies and well timed funding can be required to show these assets into refined uranium prepared for nuclear gasoline manufacturing inside this timeframe.”

When will uranium costs go up?

So when can buyers anticipate to see additional positive factors within the uranium value? And the way far can we anticipate uranium spot costs to climb?

A very good gauge for the place the winds are blowing is utilities contracts, as these entities are historically the best sources of uranium demand. In actual fact, solely about 10 to fifteen % of uranium trades occur on the spot market — the overwhelming majority of uranium is offered by means of giant long-term contracts between producers and utilities.

It is also helpful to observe the remainder of the nuclear gasoline cycle. Russia controls about 50 % of worldwide conversion and enrichment capability — this dominance amid the nation’s struggle with Ukraine has spiked costs for these providers. Current strikes by the US could influence this dominance. In mid-Could 2024, Biden signed into regulation a US invoice banning Russian uranium imports by means of the tip of 2040.

Chatting with the Investing Information Community in a June interview, Ben Finegold, director at Ocean Wall, referred to this as probably the most vital occasions for the uranium market since Russia’s invasion of Ukraine.

“I believe that we will begin to see a transfer a lot larger each when it comes to time period quantity and when it comes to time period costs,” he stated. “Gas consumers have gotten the readability that they want, significantly within the west now, on the US’ stance on the long run procurement of Russian uranium.”

Watch the video under to be taught extra about how Finegold sees this transfer as an incentive for US uranium mining and gasoline cycle funding.

Ben Finegold: Uranium’s New Paradigm — Market Dynamics and Find out how to Make investments

Ben Finegold: Uranium’s New Paradigm — Market Dynamics and Find out how to Make investments

Regardless that uranium spot costs are elevated at across the US$90 degree, Finegold stays bullish available on the market going ahead and thinks larger costs could possibly be within the playing cards. He sees the value ground for spot uranium at round US$85 per pound and round US$75 to US$80 per pound for time period costs.

“The value atmosphere is extremely supportive for buyers at these ranges,” Finegold stated. When it comes to precisely how excessive uranium costs may get this yr, he expects costs to surpass the US$106 mark reached in January.

In January 2024, the Financial institution of America (NYSE:BAC) elevated its uranium spot value goal for 2024 at US$105 per pound and US$115 per pound in 2025. As of early June 2024, analysts at Buying and selling Economics had been forecasting that uranium would commerce at US$94.66 in 12 month’s time.

That is an up to date model of an article first printed by the Investing Information Community in 2020.

Remember to comply with us @INN_Resource for real-time updates!

Securities Disclosure: I, Melissa Pistilli, maintain no direct funding curiosity in any firm talked about on this article.

Editorial Disclosure: The Investing Information Community doesn’t assure the accuracy or thoroughness of the knowledge reported within the interviews it conducts. The opinions expressed in these interviews don’t mirror the opinions of the Investing Information Community and don’t represent funding recommendation. All readers are inspired to carry out their very own due diligence.