- Federal judges in Kansas and Missouri have issued injunctions blocking key parts of the SAVE plan, affecting tens of millions of pupil mortgage debtors.

- These rulings go away over 8 million debtors unsure about their reimbursement phrases and eligibility for pupil mortgage forgiveness.

- The authorized actions stem from lawsuits led by state attorneys basic, difficult the SAVE plan’s implementation earlier than a key July 1 deadline.

Two Obama-appointed Federal judges in Kansas and Missouri have issued injunctions blocking key parts of the Saving on a Worthwhile Training (SAVE) reimbursement plan, a brand new income-driven pupil mortgage reimbursement program. The rulings come at a vital time, as simply as over 8 million debtors had been set to learn from decreased funds and mortgage forgiveness below the plan.

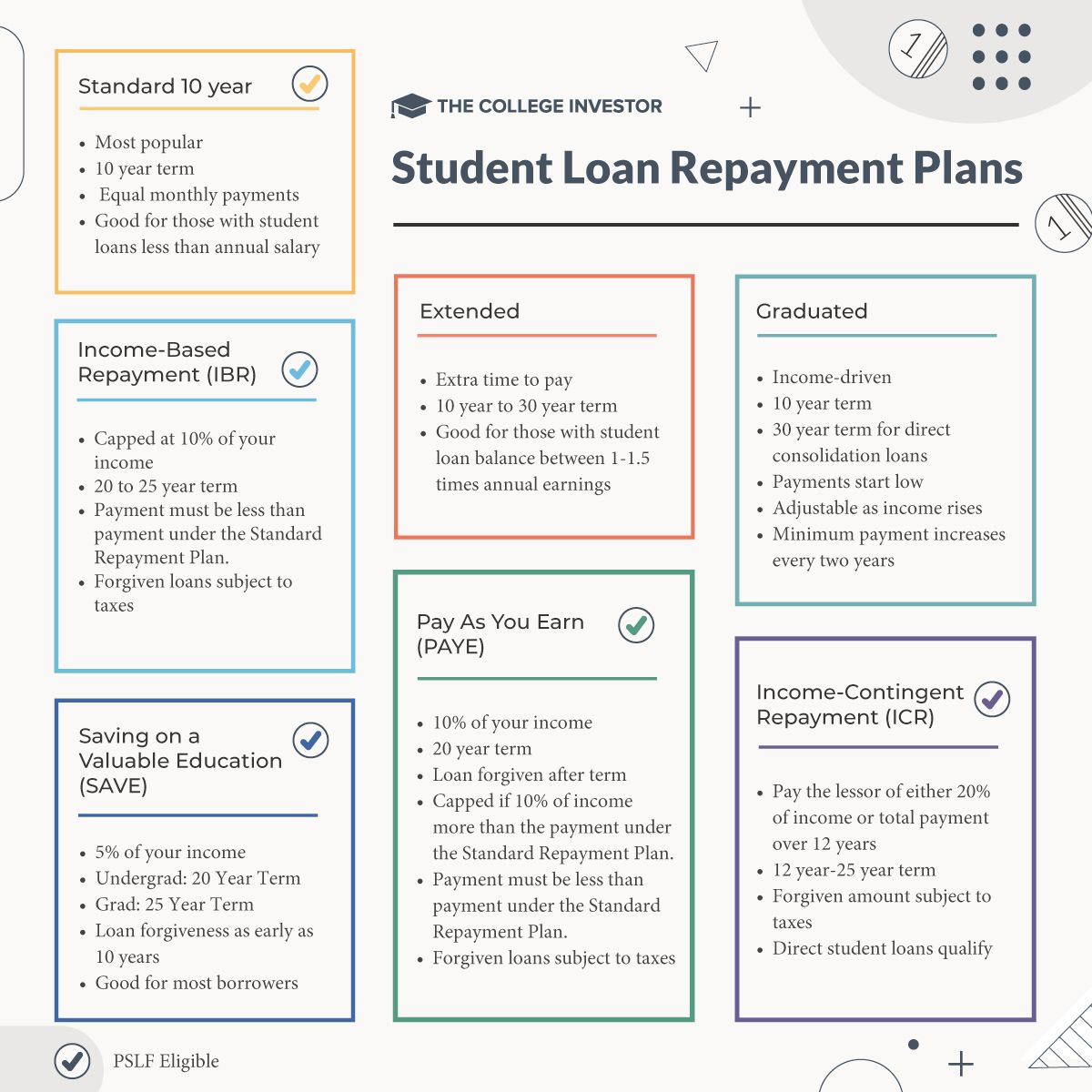

The SAVE plan, launched in August 2023 by President Biden, goals to offer aid to pupil mortgage debtors by reducing month-to-month funds and providing mortgage forgiveness after sure intervals.

July 1 was a key date for the brand new decrease reimbursement plan quantity to take impact. This injunction leaves debtors unsure in regards to the future.

Injunctions In Kansas And Missouri

In Kansas, a federal decide has issued a preliminary injunction that briefly halts the U.S. Division of Training’s efforts to chop pupil mortgage funds in half for over 8 million debtors, efficient July 1.

In the meantime, a separate ruling in Missouri blocks the Division from cancelling money owed completely for any debtors below the SAVE plan.

These authorized actions have added a major disruption within the pupil mortgage system, which has been struggling to regain stability following a three-and-a-half-year pause on funds, curiosity, and collections that expired in September.

The Division of Training had already introduced that debtors on the SAVE plan can be in administrative forbearance throughout July with a view to keep away from the chaos that occurred when funds resumed final fall.

The lawsuits main to those injunctions had been spearheaded by coalitions of state attorneys basic. On March 28, 2024, a bunch of 11 states, led by Kansas Legal professional Normal Kris Kobach, filed a go well with to cease the SAVE plan. An analogous lawsuit adopted on April 9, 2024, led by the Missouri Legal professional Normal, involving seven states. These states signify a few quarter of the debtors enrolled within the SAVE plan, with over 2.5 million residents taking part, however the fits search to invalidate the plan nationwide.

How Does The SAVE Plan Assist Debtors?

The SAVE plan was designed to ease the burden of pupil mortgage debt by adjusting month-to-month funds primarily based on debtors’ incomes to as little as 5% of discretionary revenue. This leads to considerably decreased funds, and even $0 funds, for low-income debtors.

As of now, greater than 8 million debtors are enrolled within the plan, with 4.6 million benefiting from a $0 month-to-month cost. Moreover, the plan presents debt cancellation after 20 or 25 years, or after 10 years for individuals who borrowed as much as $12,000.

The SAVE plan is one among a number of revenue pushed reimbursement plans accessible to debtors. The primary of those plans was launched in 1994, with the SAVE plan being made accessible to debtors in August 2023.

Future Outlook

With the latest court docket rulings, the way forward for the SAVE plan and its advantages to debtors cling within the stability.

It is possible the Biden Administration will enchantment these rulings within the coming days, however within the meantime, tens of millions of debtors await readability on their pupil loans.

Do not Miss These Different Tales: