Copper has had a risky few years; nevertheless, amid varied ups and downs, costs for the purple steel hit an all-time excessive on Could 20, 2024, buying and selling at US$5.20 per pound on the COMEX.

Apparently, by wanting backwards it’s simple to see that this spike was an anticipated characteristic of the long-term image for copper costs. The purple steel has rebounded after a downtrend from about 2011 to 2015, and over the previous few a long time costs have elevated much more dramatically.

Living proof — on the time of its new excessive in Could 2024, the copper value has elevated over 500 % since January 2000. Though this spectacular main improve would not account for inflation, it is nonetheless a sizeable achieve. Let’s take a deeper dive into copper costs going again even additional.

What components have impacted copper costs traditionally?

So what’s one of the best ways to view historic copper costs? In keeping with Stefan Ioannou of Cormark Securities, it’s most pragmatic to take a look at historic copper costs for the reason that Seventies or Nineteen Eighties.

That’s due to the rise of recent heap-leach expertise. Leaching has lengthy been utilized in mining operations, however the methodology in its fashionable type didn’t begin gaining reputation till round 1980.

“That basically modified the way in which we mine copper,” Ioannou defined. “Up till then, plenty of copper mining was for essentially the most half targeted on sulfide mineralization producing a copper focus that you simply’d ship to a smelter. With heap-leach expertise, rapidly the large porphyries (and) the oxidized caps related to giant porphyries down in South America grew to become viable.”

That seems like excellent news for rising copper provide, however as Ioannou famous, large-scale deposits are sometimes low grade, which means that they’re extra expensive to mine regardless of comparatively low-cost heap-leaching strategies.

Whereas Ioannou mentioned provide and demand dynamics are the principle driver for costs, grade and manufacturing prices are components as effectively. Demand for copper retains rising, and he urged that since “the low-hanging fruit has been mined,” miners should more and more go after harder, giant, low-grade and dear deposits.

“The value of copper dictates how low you possibly can go on the grade,” he mentioned. “Again pre-Seventies, I’m guessing plenty of copper was coming from quite a bit higher-grade mines … as we’ve been mining increasingly more of those large-scale deposits which are low grade, the associated fee on a per-pound foundation has gone up.”

What else has pushed historic copper costs?

Apparently, some take one other view on the historic efficiency of the copper value.

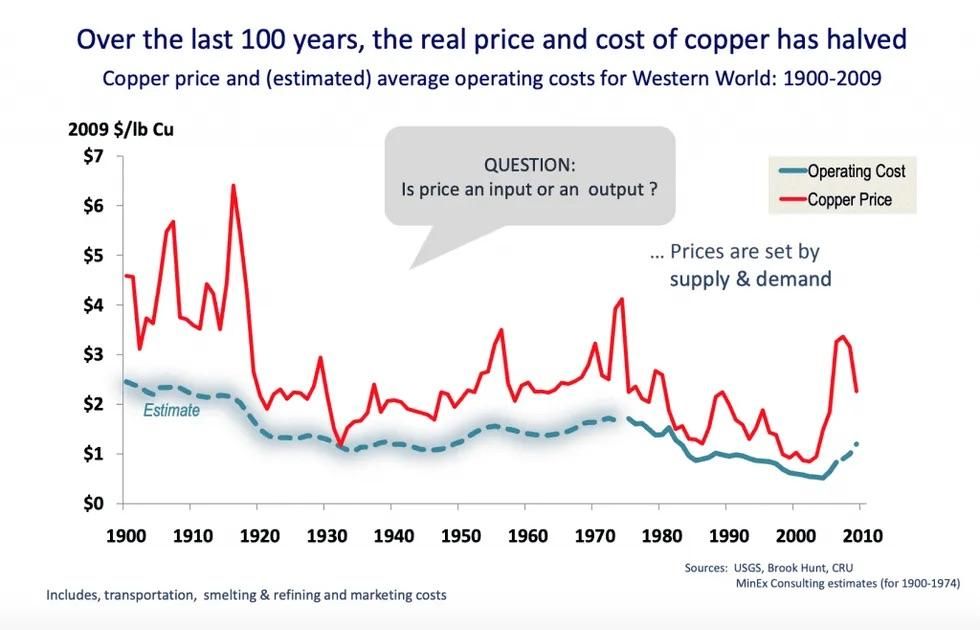

Richard Schodde, managing director at MinEx Consulting, gave a presentation on the topic again in 2010 that appears at an extended timeframe — 110 years, to be actual.

On that scale, historic copper costs have dropped considerably for the reason that 1910s. In 2015, Schodde instructed the Investing Information Community by electronic mail that actual copper costs had dropped about 50 % since 1910, and that manufacturing prices have additionally fallen because of economies of scale and advances in mining and processing applied sciences.

That may not sound like excellent news for copper, however Schodde seen the drop nearly as good total. He thinks the trade will proceed to innovate with the intention to exploit lower-grade deposits and meet rising world demand.

Plus, it’s value contemplating the place you get in. Trying on the graph under from Schodde, it wouldn’t be very best in case you invested in copper again within the 1910s. All of it comes all the way down to technique, timing and, frankly, a little bit of luck.

How does provide and demand form copper costs?

Many provide and demand components have contributed to the motion of historic copper costs over time. For instance, a report from the US Geological Survey notes that the Vietnam Conflict meant sturdy demand within the mid-Sixties and early Seventies, main to cost controls to restrict home copper costs.

A lot later, in July 1998, costs “had fallen to their lowest degree for the reason that Nice Despair,” whereas an earlier manufacturing growth within the Nineteen Eighties led costs to fall on the again of ensuing oversupply.

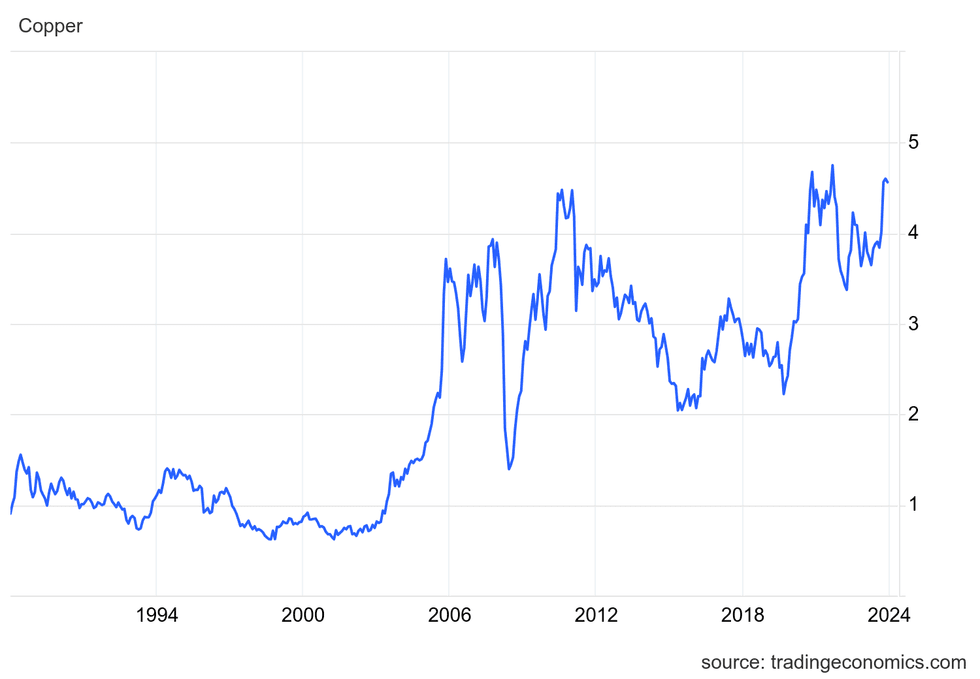

Historic copper costs from July 1988 to June 2024.

Chart by way of Buying and selling Economics.

International demand for copper is presently dominated by China, and people following the useful resource market will little doubt keep in mind a big spike in Chinese language demand that despatched costs for copper and different commodities hovering lately. China remains to be a robust copper demand driver, with the most up-to-date information displaying that it was the biggest shopper of refined copper at an estimated 6.75 million metric tons in 2023.

Macroeconomic volatility has impacted the Asian nation’s copper demand, and it’s robust to say what’s going to occur shifting ahead. Analysts have famous that the nation’s infrastructure and property sectors, each of which require giant quantities of copper and different commodities, are additionally displaying indicators of weak spot.

On the availability aspect, a report from the World Bureau of Steel Statistics confirmed that as of April 2024, the worldwide refined copper provide scarcity got here in at 120,900 MT, due largely to declining copper mine manufacturing from Anglo American (LSE:AAL,OTCQX:AAUKF). The closure of First Quantum Minerals’ (TSX:FM,OTC Pink:FQVLF) Cobre Panama mine and declining manufacturing at Chile’s Chuquicamata mine are additionally impacting copper mine provide at current.

What’s subsequent for copper?

Within the quick time period, copper value volatility remains to be within the playing cards because of market uncertainties, together with extended provide chain challenges, sticky inflation and the specter of recession within the world financial system.

Nonetheless, some analysts are fairly optimistic wanting long run. Goldman Sachs (NYSE:GS) has expressed confidence that copper’s long-term fundamentals stay sturdy with a transparent structural bull story. The agency sees copper costs reaching US$15,000 per metric ton (or US$6.80 per pound) by 2025.

That is an up to date model of an article initially printed by the Investing Information Community in 2015.

Don’t neglect to observe us @INN_Resource for extra updates!

Securities Disclosure: I, Melissa Pistilli, maintain no direct funding curiosity in any firm talked about on this article.

Editorial Disclosure: The Investing Information Community doesn’t assure the accuracy or thoroughness of the knowledge reported within the interviews it conducts. The opinions expressed in these interviews don’t replicate the opinions of the Investing Information Community and don’t represent funding recommendation. All readers are inspired to carry out their very own due diligence.

From Your Website Articles

Associated Articles Across the Net