Overview

Wyoming has the biggest uranium reserves of all of the US states and is the house of in-situ restoration (ISR) uranium mining, with experimental ISR mining in the course of the early Sixties and business ISR mining beginning in 1974. The state is an vitality powerhouse within the US, second solely to Texas in vitality manufacturing and accounting for greater than 80 p.c of the nation’s uranium manufacturing. It has a manufacturing historical past that dates again to the late Nineteen Forties. With a hovering uranium worth that handed $90 by the top of 2023, many analysts consider the worth will stay on the upper finish for years to come back.

GTI Power (ASX:GTR,OTCQB:GTRIF) is a mineral exploration firm centered on growing a portfolio of enticing uranium tasks in the USA. The corporate now boasts roughly 42,000 acres within the prolific Nice Divide and Powder River Basins, that are low-cost ISR uranium-producing districts inside 100 miles of one another.

In 2022, the corporate accomplished a further 103 mud rotary exploration drill holes to extend the whole development size for GTI’s tasks within the Nice Divide Basin to 7.5 miles.

The corporate has additionally commenced work at its Inexperienced Mountain ISR uranium undertaking subsequent to Rio Tinto’s (ASX:RIO) uranium deposits. GTI has historic drill information confirming the presence of uranium mineralised roll fronts on the properties.

The corporate is led by a extremely skilled administration and exploration group with an in depth observe report within the mineral exploration business. GTI’s operational group has confirmed improvement and engineering experience with a historical past of success in ISR uranium deposit discovery in Wyoming.

GTI’s acquisition of Branka Minerals in November 2021 gave the corporate management of the biggest non-US or Canadian-owned uranium exploration landholding within the Nice Divide Basin, with roughly 19,500 acres. The landholding included underexplored and extremely potential sandstone-hosted uranium properties that are the corporate’s Wyoming tasks right now. This holding then grew with the acquisition of the 13,800-acre Inexperienced Mountain undertaking in 2022.

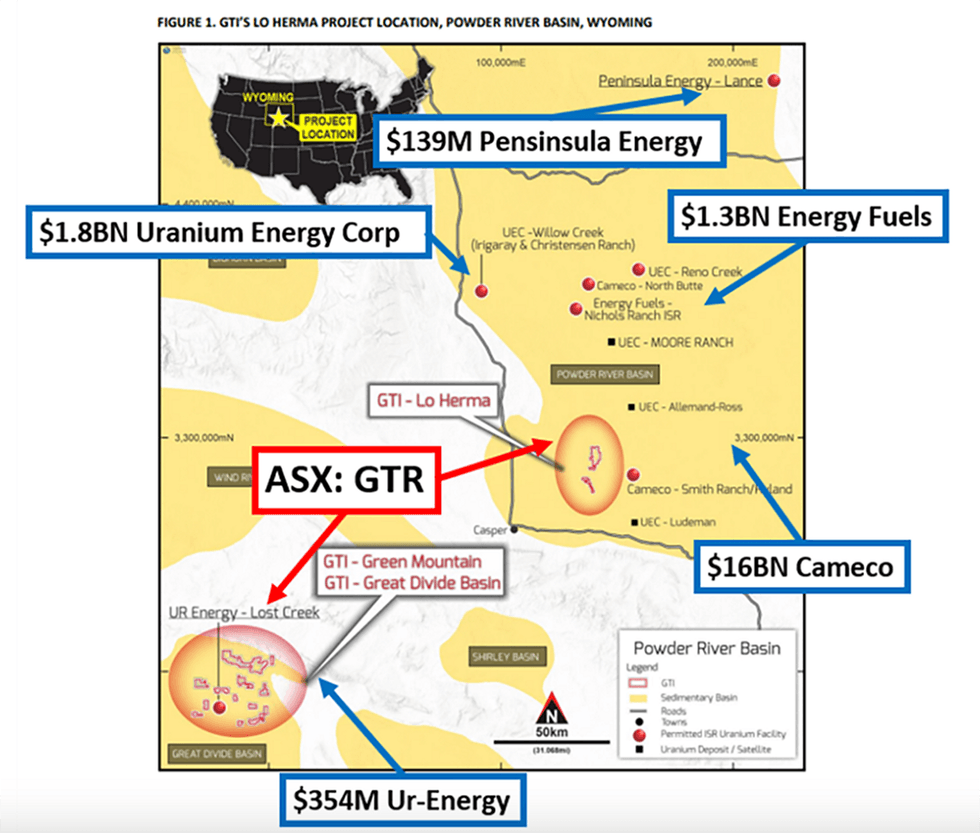

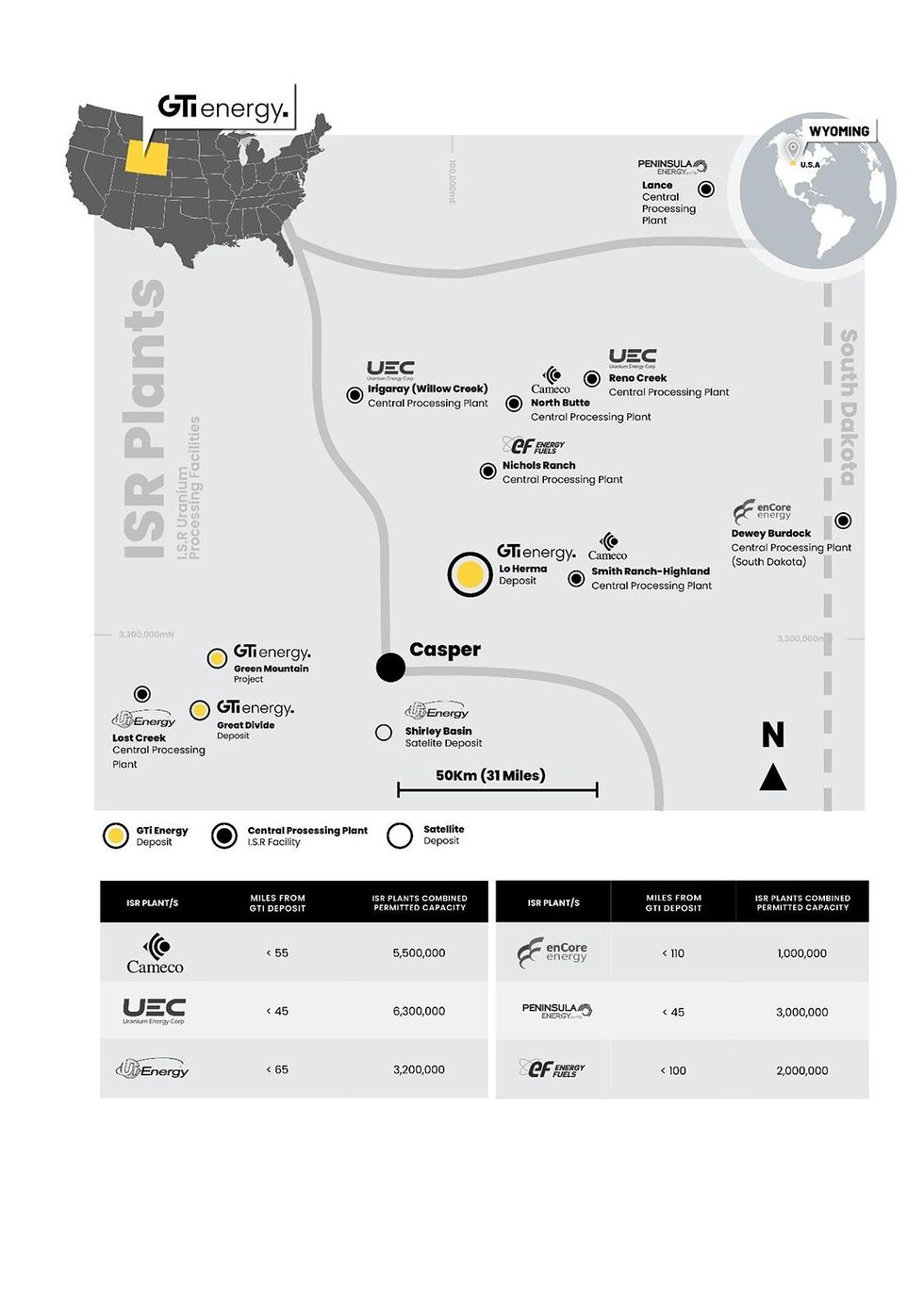

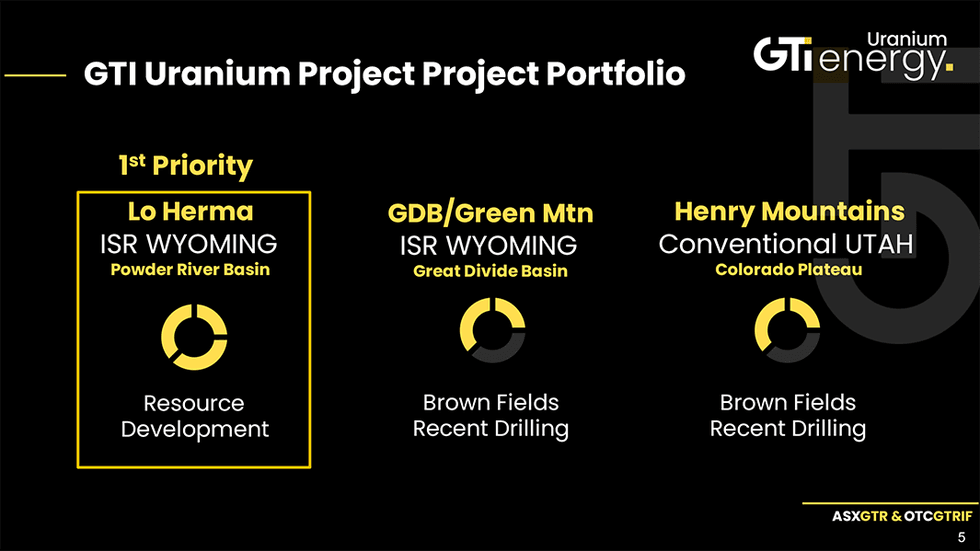

The corporate additional expanded its ISR uranium portfolio in 2023 by buying the Lo Herma Challenge in Wyoming’s prolific Powder River Basin uranium district. The newly staked 13,300 acres of claims are positioned inside 16 kilometers of Cameco’s Smith Ranch-Highland ISR uranium manufacturing plant – the biggest manufacturing web site in Wyoming

GTI Power leverages the strategic positioning of its Wyoming tasks, that are positioned close to Ur Power’s (TSX:URE,NYSE:URG) Misplaced Creek ISR manufacturing plant and the now-rehabilitated historic Rio Tinto Kennecott Sweetwater Mill. The Misplaced Creek plant is claimed by Ur Power to be the lowest-cost ISR uranium manufacturing plant outdoors of Kazakhstan.

GTI is dedicated to robust environmental, social and governance (ESG) initiatives to assist the clear vitality transition. In November 2021, the corporate adopted an internationally acknowledged Environmental, Social and Governance Stakeholder Capitalism Metrics framework, with 21 core metrics and disclosures.

In December 2021, GTI Power introduced it could be transitioning to carbon-neutral operations. The corporate has subsequently acquired its carbon impartial certification for its Australian head workplace and US area operations, by way of the Australian Authorities’s Local weather Lively Program.

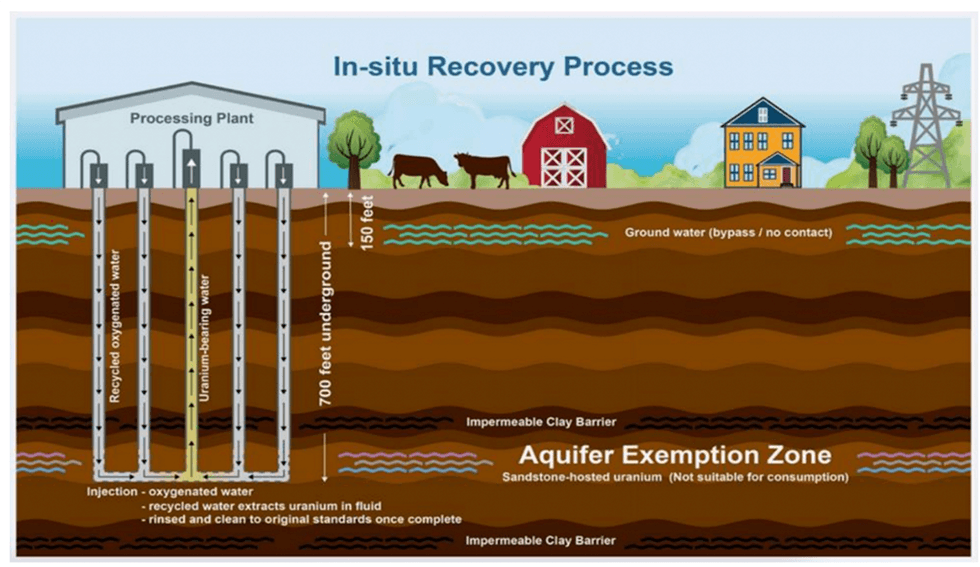

GTI Power is positioned for development with the pursuit of ISR mining on its Wyoming tasks, presenting a possibility for low working bills and capital expenditures with low environmental influence in comparison with typical mining. ISR mining helps the corporate’s objective of low-impact mining and carbon neutrality on its Wyoming tasks.

In 2021, the corporate accomplished area exploration on its Henry Mountains undertaking in Utah. In the identical yr, GTI Power additionally started a 15,000-meter drill program on its Wyoming tasks, concluding this system in early 2022. The drilling confirmed that the focused ISR-amenable uranium mineralization was current on the Thor undertaking. In 2022, the corporate accomplished a further 103 mud rotary exploration drill holes to extend the whole development size for GTI’s tasks within the Basin to 7.5 miles.

Firm Highlights

- GTI Power owns a number of promising property in Wyoming’s prolific and in-situ restoration (ISR) uranium-producing Nice Divide and Powder River Basins. Wyoming is the main US uranium manufacturing state and is “uranium-friendly”.

- GTI’s flagship Lo Herma undertaking contains 13,300 acres of floor in Wyoming inside circa 16 kilometers of Cameco’s $16-billion ISR uranium plant (the biggest permitted ISR manufacturing facility in Wyoming) and 80 kilometers of 5 permitted ISR uranium manufacturing services, together with UEC’s Christensen Ranch (as a result of restart in August 2024) and Peninsula Power’s (ASX:PEN) Lance Challenge (as a result of recommence manufacturing in late 2024).

- GTI’s Nice Divide Basin tasks are strategically positioned close to Ur Power’s (TSX:URE,NYSE:URG) Misplaced Creek ISR manufacturing plant which has re-commenced manufacturing.

- Maiden uranium useful resource and up to date exploration goal on the Lo Herma ISR undertaking delivered an inferred mineral useful resource estimate of 5.71 Mlbs uranium oxide at a median 630 ppm plus an exploration goal of a further 5.87 to 10.26 Mlbs potential at common grade of 500 to 700 ppm.

- Up to date complete sources throughout its Wyoming tasks of seven.37 Mlbs plus an exploration goal of a further 11.97 to 19.79 Mlbs potential at common grade of 500 – 700 ppm.

- In early 2022, the corporate accomplished an additional 103 mud rotary exploration drill holes to extend the whole development size for GTI’s tasks within the Nice Divide Basin to 7.5 miles.

- In late 2023, GTI accomplished 26 holes at Lo Herma to confirm the historic information base & affirm exploration potential alongside development & at depth.

- GTI acquired a 1,771 drill gap information set over Lo Herma with a substitute worth of AU$15 million.

- GTI acquired its carbon impartial certification for its Australian head workplace and US area operations, by way of the Australian Authorities’s Local weather Lively Program.

- GTI goals to make the most of ISR mining at its Wyoming tasks, which gives decrease environmental influence, decrease opex and capex than typical mining.

- GTI Power has a extremely skilled exploration group together with the latest appointment of ISR specialist, Matt Hartmann, with a historical past of profitable uranium discovery in Wyoming.

Key Tasks

Wyoming Tasks

The Wyoming tasks are positioned within the Powder River & Nice Divide Basins in Wyoming and the Henry Mountains (Colorado Plateau) Utah, United States. The Greta Divide Basin tasks encompass the Thor, Logray, Loki, Odin, Teebo, Wicket and Inexperienced Mountain claims. The roughly 13,000 hectare group of tasks is potential for ISR-amenable sandstone-hosted roll-front uranium. The Wyoming tasks are located 5 to 30 kilometers from Ur-Power’s Misplaced Creek ISR plant. The tasks are additionally positioned close to Rio Tinto’s Sweetwater/Kennecott Mill.

GTI Power’s land holding within the Nice Divide Basin was bolstered by the acquisition of the Inexperienced Mountain undertaking comprising 5,585 hectares of contiguous ISR uranium exploration claims which abuts the Rio Tinto claims at Inexperienced Mountain. Historic drill information and geophysics confirms the presence of main uranium mineralisation on the tasks.

Preliminary drilling at Lo Herma commenced in November 2023 and was accomplished in December with 26 drill holes efficiently verifying the historic Lo Herma drill gap database. A drilling allow modification is at present in progress aiming to optimise follow-up drilling, enhance the whole variety of drill holes, and assemble monitoring wells for groundwater information assortment. Drilling is anticipated to renew by July 2024 with an enlarged program, and the mineral useful resource estimate and exploration targets are anticipated to be up to date within the fourth quarter of 2024.

The corporate started preliminary exploration on Thor in 2021, and in 2022, it accomplished a further 103 mud rotary exploration drill holes. The drilling of 70 holes was beforehand reported on the Thor prospect and a further 33 holes mixed have now been accomplished on the Odin, Teebo and Loki prospects. These 33 holes have found a further mixed 4.26 kilometers of ISR amenable uranium mineralised roll entrance traits rising the whole development size for GTI’s tasks within the Basin to 12.07 kilometers.

In February 2023, GTI Power secured, by staking, roughly 3,500 hectares of unpatented mineral lode claims generally known as the Lo Herma undertaking, about 16 kilometers from Cameco’s Smith Ranch-Highland ISR Uranium facility and Power Fuels Nichols Ranch ISR plant. Lo Herma additionally lies inside 97 kilometers of the businesses main the restart of uranium manufacturing within the USA, together with Uranium Power, Ur-Power, Power Fuels, Encore Power and Peninsula Power.

The corporate subsequently, secured a fabric historic information package deal for the undertaking, which allowed GTI Power to report a maiden uranium useful resource and exploration goal replace on the Lo Herma ISR undertaking, together with a cut-off grade of 200 components per million (ppm) uranium oxide and a minimal grade thickness (GT) of 0.2 per mineralised horizon as 4.12 million tonnes of mineralisation at a median grade of 630 ppm uranium oxide for five.71 million kilos (Mlbs) of uranium oxide contained metallic. The inferred mineral useful resource estimate is 5.71 Mlbs uranium oxide at a median of 630 ppm.

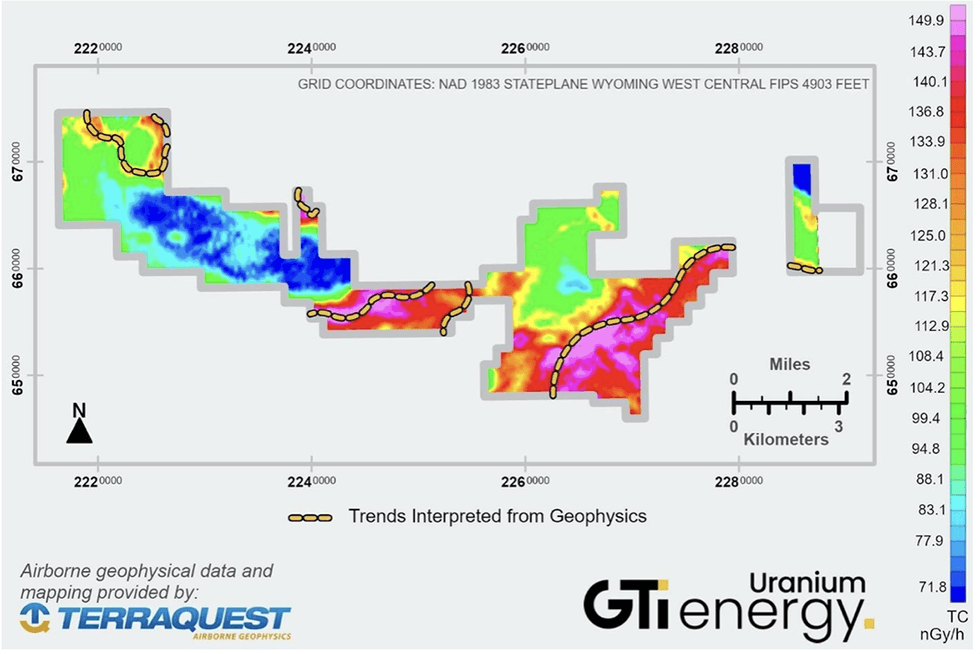

The corporate additionally accomplished assortment of aerial geophysical information at its Lo Herma, Inexperienced Mountain and Loki West ISR uranium exploration tasks in Wyoming. The survey was performed utilizing a twin-engine plane loaded with a set of sensors that present detailed radiometric, magnetic and electromagnetic information, permitting for correlation between the three merchandise.

The airborne geophysical survey at its Inexperienced Mountain undertaking consequently up to date its drill plan with 16 potential drill holes. The allow utility course of is underway for the 2024 drill program which goals to check the validity of the historic Kerr McGee drill gap maps, in addition to the interpreted mineralised areas as decided from the airborne geophysical survey.

Henry Mountains Uranium Challenge

GTI’s uranium/vanadium tasks in Utah are thought of appropriate for typical mining and are positioned on the east flank of the Henry Mountains, protecting 3,860 acres. The permits host historic manufacturing, open underground workings and have an exploration allow in place. The tasks noticed important work from 2019 to 2021 together with two drill applications totaling 52 drill holes and geophysical logging of a further 76 historic drill holes. GTI subsequently elected to prioritise work at its newly acquired Wyoming ISR tasks till such time as exercise and funding within the area improves. The corporate’s tasks lie inside ~100 miles of Power Fuels’ (NYSE American: UUUU) (TSX: EFR) White Mesa Mill and inside a couple of miles of Anfield Power’s (TSX.V: AEC) Shootaring (Ticaboo) mill web site. The homeowners of each of those mills are actively pursuing mill re-starts.

As well as, Western Uranium & Vanadium (CSE:WUC) (OTCQX:WSTRF) has introduced the acquisition of a mill web site in Inexperienced River Utah and work to design and allow the power for processing uranium and vanadium. The plant, which might be positioned ~80 miles from GTI’s tasks, is meant to course of feed from Western’s lately restarted Sunday Mine Complicated over 160 miles away. Western suggested of a mine operations restart at Sunday in February 2024. Western acknowledged its new “mineral processing plant” will recuperate uranium, vanadium and cobalt from ore from Western’s mines and that produced by different miners. Western stated, on February 13, 2024, it expects the plant to be licensed and constructed for annual manufacturing of 1 million kilos U3O8 and 6 million kilos of V2O5, with preliminary manufacturing in 2025.

Primarily based on the renewed curiosity in exploration, mining, and processing of uranium ore on this area, GTI is at present evaluating potential paths for additional exploration, useful resource improvement, or different worth creating actions with its Utah tasks.

Administration Workforce

Nathan Lude – Non-executive Chairman

Nathan Lude has broad expertise working within the asset and fund administration, mining, and vitality industries. Lude is the founding director of Benefit Administration, a company advisory agency. Lude has beforehand held directorships with ASX-listed mining corporations.

At the moment, he’s the chief director of ASX-listed Hartshead Sources (ASX:ANA). Lude has grown a big enterprise community throughout Australia and Asia, establishing robust ties with Australian broking corporations, establishments, and Asian buyers.

Bruce Lane – Government Director

Bruce Lane has important expertise with ASX-listed and enormous industrial corporations. Lane has held administration positions in lots of world blue-chip corporations in addition to useful resource corporations and startups in New Zealand, Europe and Australia. He holds a grasp’s diploma from London Enterprise College and is a graduate member of the Australian Institute of Firm Administrators. Lane has led plenty of profitable acquisitions, fund elevating and exploration applications of uranium and different minerals tasks over the past 15 years most notably with ASX listed corporations Atom Power Ltd & Stonehenge Metals Ltd & Fenix Sources Ltd (FEX).

James (Jim) Baughman – Government Director

James Baughman is a extremely skilled Wyoming uranium geologist and company government who will assist information the corporate’s technical and business actions within the US. Baughman is the previous president and CEO of Excessive Plains Uranium (offered for US$55 million in 2006 to Uranium One) and Cyclone Uranium.

Baughman has greater than 30 years of expertise advancing minerals tasks from grassroots to superior stage. He has held senior positions (i.e., chief geologist, chairman, president, performing CFO, COO) in non-public and publicly traded mining & mineral exploration corporations throughout his 30-year profession.

He’s a registered member of the Society of Mining, Metallurgy, Exploration and a member of the Society of Financial Geologists with a BSc in geology (1983 College of Wyoming) and is a registered skilled geologist (P. Geo State of Wyoming). Baughman is a registered member of the Society of Mining, Metallurgy, and Exploration (SME) and a certified individual (QP) on the Toronto Inventory Alternate (TSX) and Australian Inventory Alternate (ASX).

Petar Tomasevic – Non-executive Director

Petar Tomasevic is the managing director of Vert Capital, a monetary companies firm specializing in mineral acquisition and asset implementation. He has labored with a number of ASX-listed corporations in advertising and marketing and investor relations roles. Tomasevic is fluent in 5 languages. He’s at present appointed as a French and Balkans language specialist to help in undertaking analysis for ASX-listed junior explorers. Most lately, he was a director at Fenix Sources (ASX:FEX), which is now transferring into the manufacturing part. He was concerned within the firm’s restructuring when it was generally known as Emergent Sources. Tomasevic was additionally concerned within the firm’s Iron Ridge asset acquisition, the RTO financing, and the event part of Fenix’s Iron Ridge undertaking.

Simon Williamson – Non-executive Director

Simon Williamson was basic supervisor and director of Cameco Australia till late 2023 and has important uranium business expertise, networks and abilities from his 13 years at Cameco. Throughout his tenure with Cameco, Williamson managed relations with key authorities ministers and departments and neighborhood stakeholders. He managed undertaking approvals processes, together with negotiations with State and Federal companies and reviewing the PFS for the Yeelirrie undertaking.

Williamson was intimately concerned in acquiring environmental approval for the Kintyre and Yeelirrie uranium tasks, together with growing and implementing a program of environmental baseline research, authorities and neighborhood session and negotiating land entry. Previous to his appointment as basic supervisor, he led the federal government and regulatory affairs, environmental and radiation security actions of Cameco in Australia. He additionally held roles with minerals business contributors in Australia and the US together with varied positions at Cliffs, Sons of Gwalia the WA Chamber of Minerals & Power and WMC the place he negotiated the mine closure standards for a gold undertaking close to Sacramento, California.

Matt Hartmann – Director

ISR uranium specialist Matt Hartmann is an government and technical chief with greater than 20 years of worldwide expertise and substantial uranium exploration and undertaking improvement expertise. He first entered the uranium mining area in 2005 and adopted a profession path that has included senior technical roles with Strathmore Minerals and Uranium Sources. He’s additionally a former principal guide at SRK Consulting the place he offered advisory companies to explorers, producers and potential uranium buyers. Hartmann’s ISR uranium expertise has introduced him by way of all the cycle of the enterprise, from exploration, undertaking research and improvement, to manufacturing and properly area reclamation. He has offered technical and managerial experience to numerous uranium ISR tasks throughout the US together with, Smith Ranch – Highland ISR Uranium Mine (Cameco), Rosita ISR Uranium Central Processing Plant and Wellfield (at present held by enCore Power), the Churchrock ISR Uranium undertaking (at present held by Laramide Sources), and the Dewey-Burdock ISR Uranium undertaking (at present held by enCore Power).

Matthew Foy – Firm Secretary

Matthew Foy is an energetic member of the WA State Governance Council of the Governance Institute Australia. Foy has greater than 14 years of expertise in facilitating ASX-listing rule compliance. His core competencies are within the secretarial, operational, and governance disciplines for publicly listed corporations. Foy has a working information of the Australian Securities and Investments Fee and Australia Inventory Alternate reporting. He has doc drafting abilities that present the premise for worthwhile contributions to the boards on which he serves.