A reader asks:

On this week’s episode, you guys point out that no one makes use of the 4% rule. I’ve been monitoring my annual bills for the previous few years and multiplying it by 25 as a ballpark determine of what I have to retire. Is that this not a great way to estimate? If not, what do you counsel? Sorry if it is a dumb query, however sure, I’ve learn this in plenty of blogs.

I’m certain there are some individuals who observe the 4% rule religiously. However definitely not as many as most monetary researchers assume.

Plans change. Returns differ. Inflation is unpredictable. Spending patterns evolve as you age. There are one-off gadgets you may’t plan for.

Both approach, you continue to should plan for retirement, set expectations and make choices about an unknowable future.

The 25x rule is smart to pair with the 4% rule because it’s merely the inversion of that quantity. In case your annual spending is $40k and also you multiply that by 25, you’ll get $1 million as a retirement objective. Simply to test our math right here, 4% of $1 million is $40k. Fairly easy.

It is very important acknowledge that 25x quantity is pretty conservative and provides you a wholesome margin of security.

Many individuals don’t spend as a lot in retirement as they in all probability ought to, given the scale of their nest egg. You additionally should think about different sources of earnings reminiscent of Social Safety.

It’s additionally value stating that the 4% rule itself is comparatively conservative. The entire level of this spending rule is to keep away from absolutely the worst-case situation the place you run out of cash.

Traditionally talking, more often than not you’ll have ended up with extra cash utilizing the 4% rule.

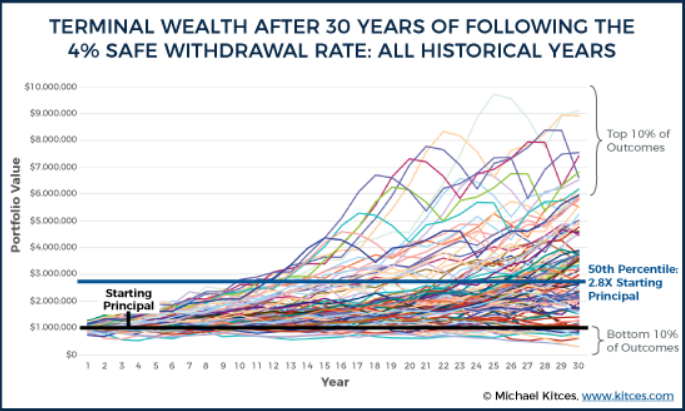

Michael Kitces carried out one among my favourite research on the topic that exhibits a spread of outcomes utilizing totally different beginning factors for a 60/40 portfolio:

Right here’s the kicker:

Because the chart exhibits, on common a 4% preliminary withdrawal fee leads to the retiree ending with practically triple the unique principal, on high of sustaining an preliminary withdrawal fee of 4% adjusted yearly for inflation! In reality, in solely 10% of the situations does the retiree even end with lower than 100% of their beginning principal (and in solely a type of situations does the ultimate worth run all the way in which right down to having nothing on the finish, which in fact is what defines the 4% preliminary withdrawal as “protected” within the first place).

The common result’s a tripling of the unique principal over 30 years, and that features your inflation-adjusted spending alongside the way in which. There was solely a ten% likelihood of ending up with much less principal after 30 years, the identical period of time you’ll have completed with 6x extra.

As they are saying, the previous is just not prologue. You don’t get to expertise the typical primarily based on a variety of outcomes. You solely get to do that as soon as. There isn’t a assure monetary markets will ship as they’ve up to now.

For those who’re a giant worrier, saving 25x your annual bills ought to let you relaxation simpler at evening.

The excellent news is you won’t want to avoid wasting that a lot cash.

And when you over-save, you may all the time overspend in retirement.

Talking of over-savings, one other reader asks:

My spouse and I are 35 and we’ve got $1.1M in retirement accounts invested 95% in S&P 500 index funds and 5% FLIN ETF. I’m questioning if we’ve got sufficient funds invested to cease contributions and nonetheless have the ability to retire comfortably at 60 years previous? We dwell in our long run home, and have two children below 4. We make $220k in mixed earnings and would love $10,000/month throughout retirement (not future inflation adjusted).

We’re speaking about somebody with the next:

- 25 years till their goal retirement date

- 2 younger youngsters

- a excessive earnings

- a seven-figure nest egg of their mid-30s (properly finished)

- an aggressive asset allocation

- a spending objective in retirement

They’re already successful.

It is a completely affordable query to ask. They clearly saved some huge cash of their 20s and 30s to get so far.

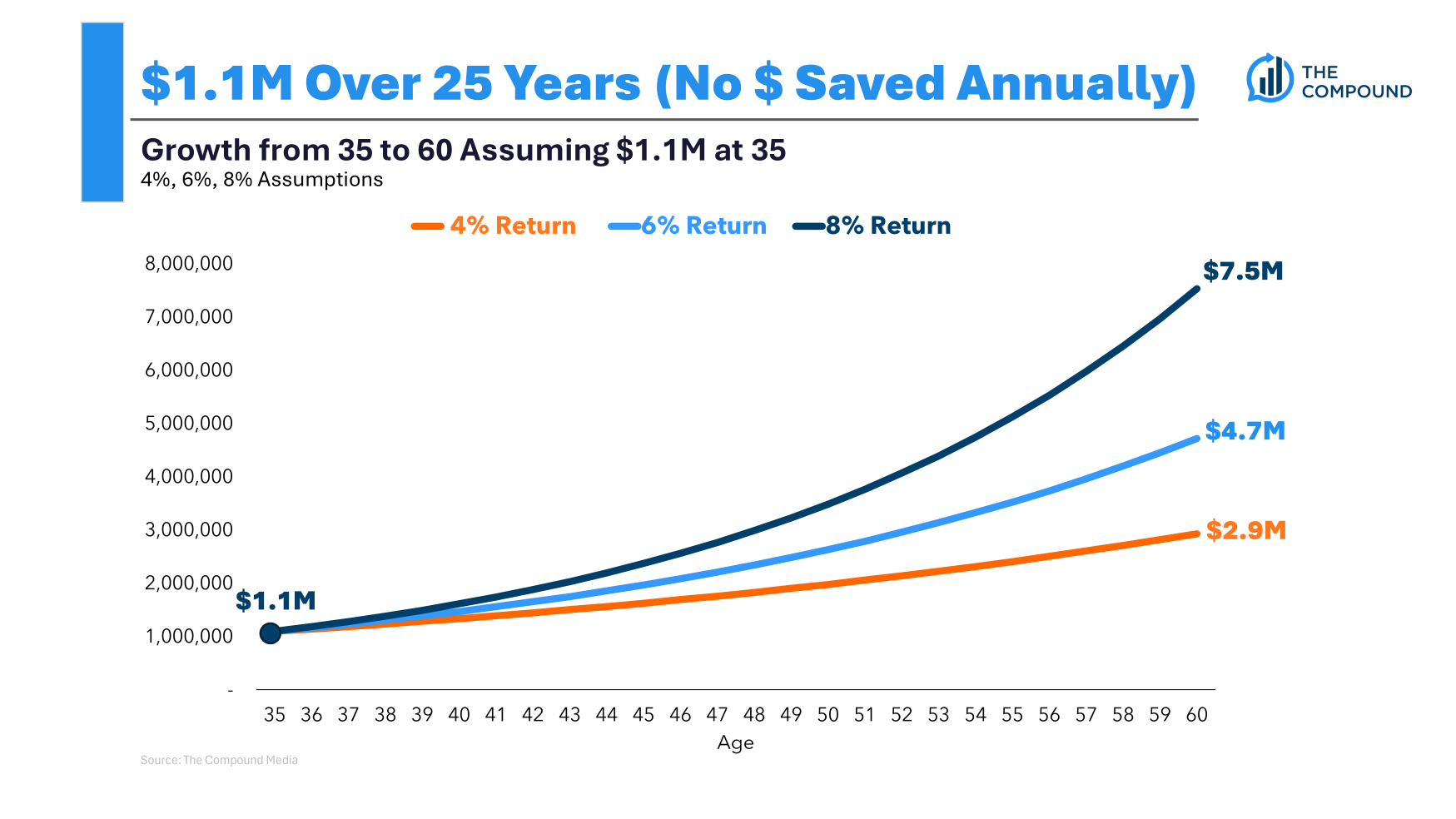

I did some back-of-the-envelope math right here. Reaching their objective would take a return of round 4% per yr. Over 25 years, $1.1 million would flip into a bit greater than $2.9 million. Utilizing the 4% rule would produce round $117k in annual earnings within the first yr, or simply shy of $10k monthly.

At a 6% return now we’re $4.7 million ($15.7k/month). And when you may earn 8% per yr that $1.1 million would develop to $7.5 million by the point you’re 60, ok for $25k/month in spending.

So that you’re proper on observe, assuming the world doesn’t crumble within the subsequent two-and-a-half a long time.

However why not give your self some wiggle room, simply in case?

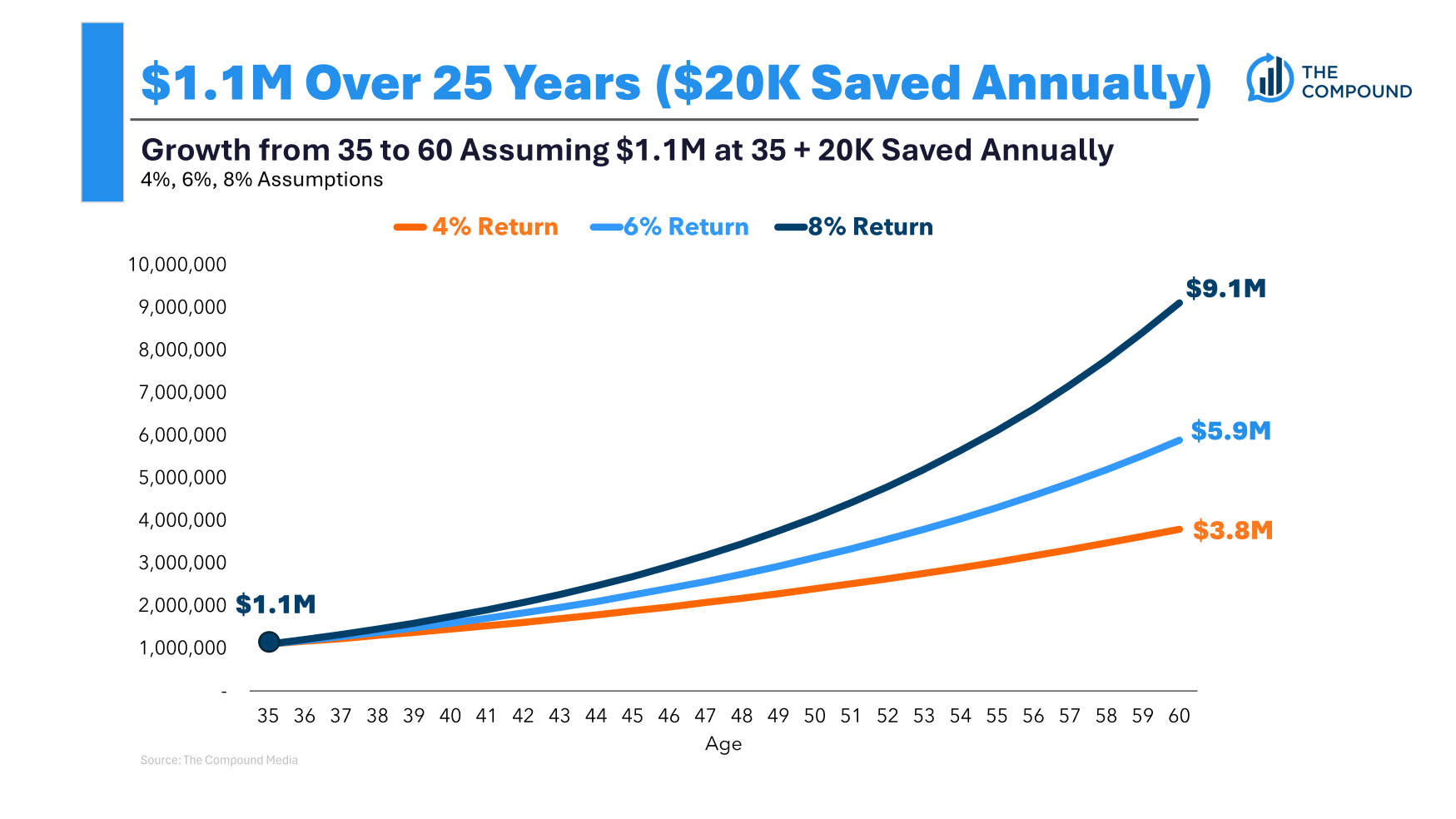

What when you saved round 10% of your earnings or $20k a yr?

That 4% return offers you $3.8 million ($12.6k/month). A 6% return is $5.8 million ($19k/month). At 8%, you go from $7.5 million to $9.1 million ($30k/month).

Now you’ve gotten a much bigger margin of security ought to issues change.

These are spreadsheet solutions. Life by no means works out just like the assumptions on a retirement planning spreadsheet. Issues are much more risky in the true world than in monetary planning software program. The feelings of cash can’t be solved by means of linear calculations.

However that’s the purpose right here — it is smart to present your self a bit respiratory room simply in case actuality doesn’t align with expectations, your plans change or life will get in the way in which.

Quite a bit can occur between 35 and 60.

The excellent news is you’ve already finished a lot of the heavy lifting by saving a lot cash. Compounding, even at below-average charges of return, ought to have the ability to deal with many of the onerous work from right here so long as you keep out of the way in which.

However I nonetheless assume it is smart to avoid wasting extra money simply in case.

Jill Schlesinger from Jill on Cash joined me on Ask the Compound this week to cowl these questions:

We additionally mentioned questions on suggestions for getting and promoting shares, dealing with a fancy housing state of affairs and discovering a facet hustle.

Additional Studying:

You In all probability Want Much less Cash For Retirement Than You Assume