Overview

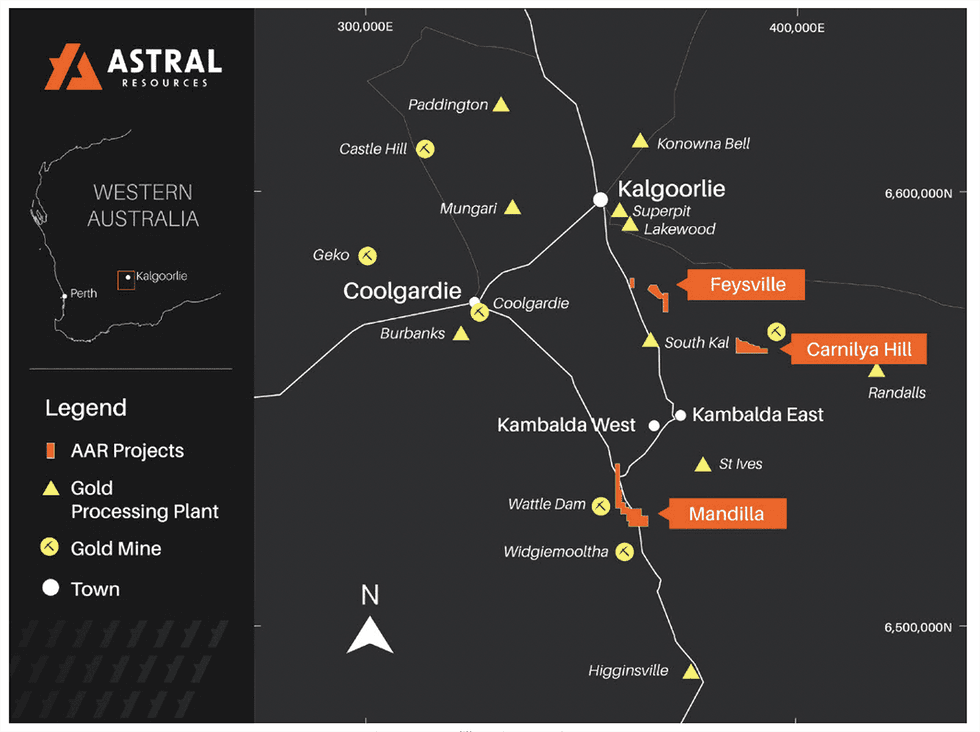

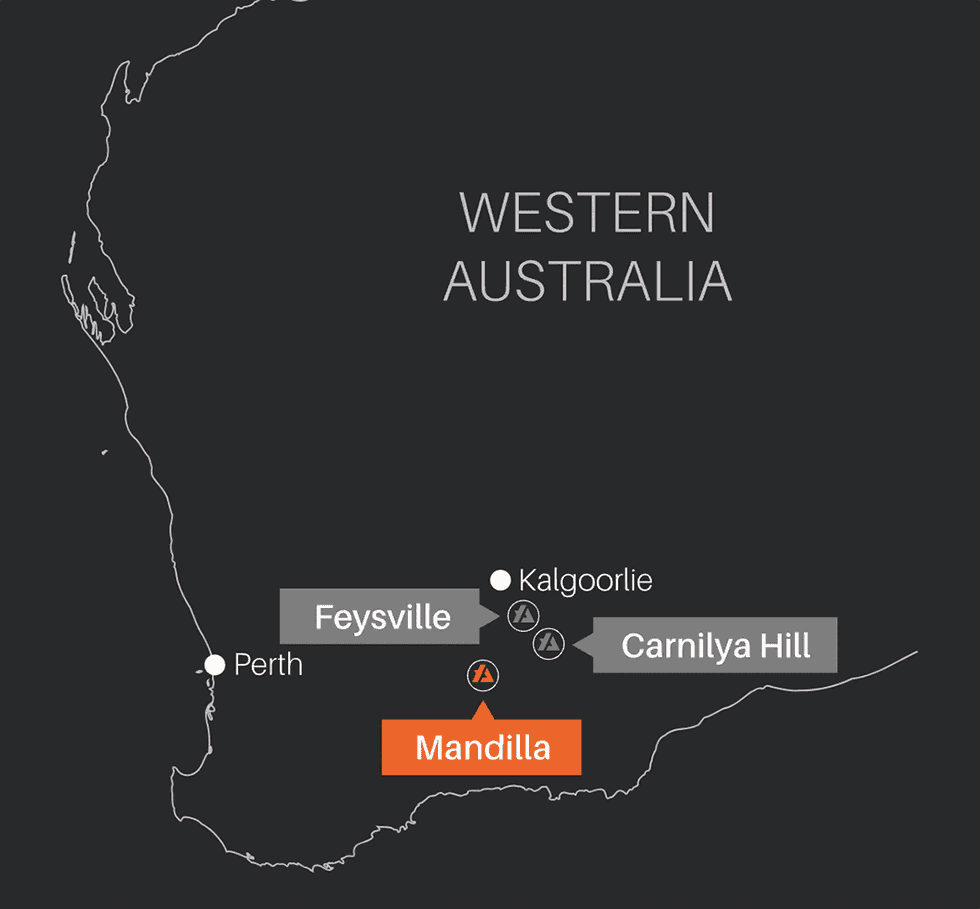

Astral Assets (ASX:AAR) is a gold mineral exploration firm with three gold initiatives in tier 1 mining jurisdictions of Western Australia. The three property are the Mandilla gold mission, the Feysville gold mission, and the Carnilya Hill gold mission. The flagship and one hundred pc owned Mandilla gold mission has a mineral useful resource containing 1.27 million ounces (Moz) of contained gold. The opposite key mission, one hundred pc owned Feysville, hosts a mineral useful resource estimate of three million tons (Mt) at 1.3 grams per ton (g/t) gold for 116,000 ounces (oz) of contained gold. Feysville may probably develop into a satellite tv for pc supply of high-grade ore feed for the flagship Mandilla gold mission.

The scoping research accomplished at Mandilla unveils sturdy mission economics. The cornerstone of the scoping research is the Theia deposit, which alone accounts for 81 p.c of the whole Mandilla mineral useful resource estimate. The deposit hosts a mineral useful resource estimate of 29 Mt at 1.1 g/t gold for 1.02 Moz of contained gold in a single massive open pit. The scoping research signifies a mine lifetime of 11 years with an annual manufacturing of 100,000 ounceswithin the first seven and a half years, dropping to 41,000 ouncesfor the remaining three and a half years. The research outlines compelling monetary metrics, together with NPV@8 p.c of AU$442 million, free money move of AU$740 million, and a payback interval of 9 months.

Astral Assets intends to extend manufacturing additional. The assay outcomes from the six-hole 1,832-metre drilling program accomplished at Theia deposit final 12 months point out a excessive potential for changing inferred assets to larger confidence indicated assets. Feysville presents one other thrilling alternative, which is clear from the current assay outcomes on the Kamperman prospect. In 2023, Astral drilled 10 holes at Kamperman intersecting high-grade gold, together with 4 metres at 94.8 g/t gold, 21 metres at 4.16 g/t gold, 35 metres at 2.19 g/t gold, 10 metres at 4.57 g/t gold, and 5 metres at 5.89 g/t gold.

The presence in Western Australia, a tier 1 mining jurisdiction, is encouraging and will consolation buyers. Western Australia has world-class infrastructure and a talented workforce. The Fraser Institute ranked it fourth globally and first in Australia as probably the most engaging jurisdiction for mining funding in 2023.

Astral advantages from a staff of execs boasting in depth experience in geology and mining. The corporate is led by managing director Marc Ducler, who has greater than twenty years of expertise within the mining business. The administration staff has a confirmed observe document of executing a number of profitable exploration and improvement initiatives, in addition to M&A.

Firm Highlights

- Astral Assets is an ASX-listed gold exploration firm within the Kalgoorlie area of Western Australia, a tier 1 jurisdiction and a mature mining area with profitable improvement historical past and granted mining leases.

- The corporate has three property – the Mandilla gold mission, the Feysville gold mission, and the Carnilya Hill gold exploration mission.

- The main target is on advancing its flagship Mandilla gold mission, with a mineral useful resource estimate of 37 Mt at 1.1 g/t gold for 1.27 Moz.

- The scoping research at Mandilla highlights the mission’s sturdy economics with a mine lifetime of 11 years, NPV@8 p.c of AU$442 million, and free money move of AU$740 million.

- Mandilla’s cornerstone Theia deposit, which includes 81 p.c of the mission’s assets, incorporates 29 Mt at 1.1 g/t gold, with 1.02 Moz of contained gold in a single massive open pit.

- Feysville mission hosts a mineral useful resource estimate of three Mt at 1.3g/t gold for 116 koz of contained gold. The mission may probably develop into a supply of satellite tv for pc ore feed to Astral’s flagship Mandilla gold mission.

- The corporate is led by an skilled staff with a confirmed observe document of advancing initiatives to improvement and M&A.

Key Tasks

Mandilla Gold Undertaking

The Mandilla gold mission is situated inside the northern area of the Widgiemooltha greenstone belt, roughly 70 kilometers to the south of the distinguished mining hub of Kalgoorlie, Western Australia. Mandilla consists of 4 deposits specifically, Theia, Iris, Eos and Hestia. The cornerstone of the mission is the Theia deposit, constituting 81 p.c of Mandilla’s assets, totaling 29 Mt at a grade of 1.1 g/t gold, amounting to 1.02 Moz of contained gold in a single open pit. We be aware that Mandilla has a complete mineral useful resource estimate of 37 Mt at 1.1 g/t gold for 1.27 Moz.

The scoping research signifies a mine lifetime of 11 years with an annual manufacturing of 100,000 ounceswithin the first seven and a half years, dropping to 41,000 ouncesfor the remaining three and a half years. Astral estimates the pre-production capital spend at AU$191 million, and the mission is anticipated to generate a free money move of AU$740 million (assuming a gold worth of A$2,750/oz). The mission’s NPV @8 p.c is estimated at AU$442 million, and the IRR at 73 p.c.

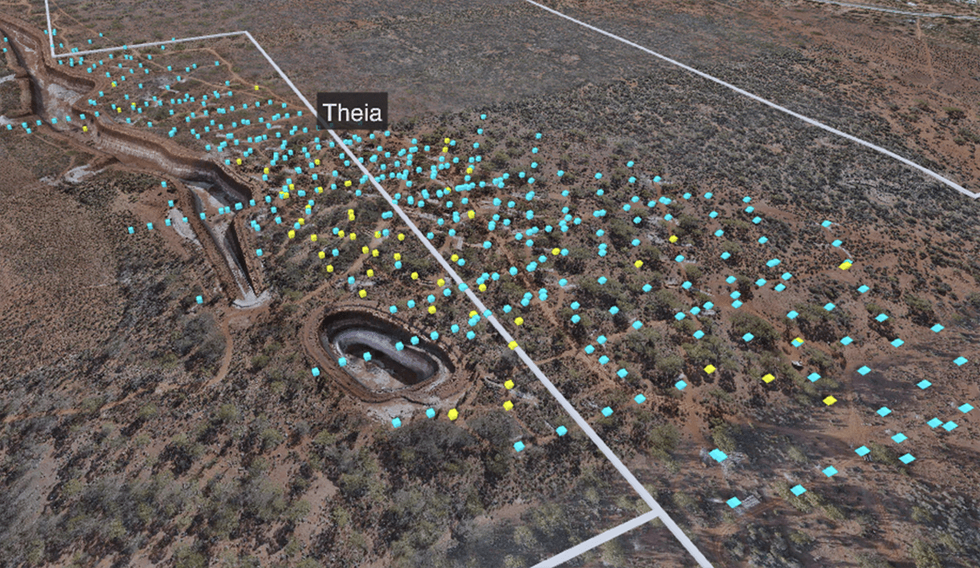

Drill collars at Theia deposit

Astral continues to advance exploration and useful resource growth efforts at Mandilla. The corporate accomplished a six-hole 1,832 metre drilling program at Theia deposit final 12 months. The assay outcomes have been launched and point out a excessive potential for the conversion of inferred assets to larger confidence indicated assets. The assay outcomes embrace: 39 metres at 5.4 g/t gold, 29 metres at 2.8 g/t gold, 28 metres at 1.4 g/t gold, 8 metres at 8.8 g/t gold.

Astral is planning to start a pre-feasibility research at Mandilla.

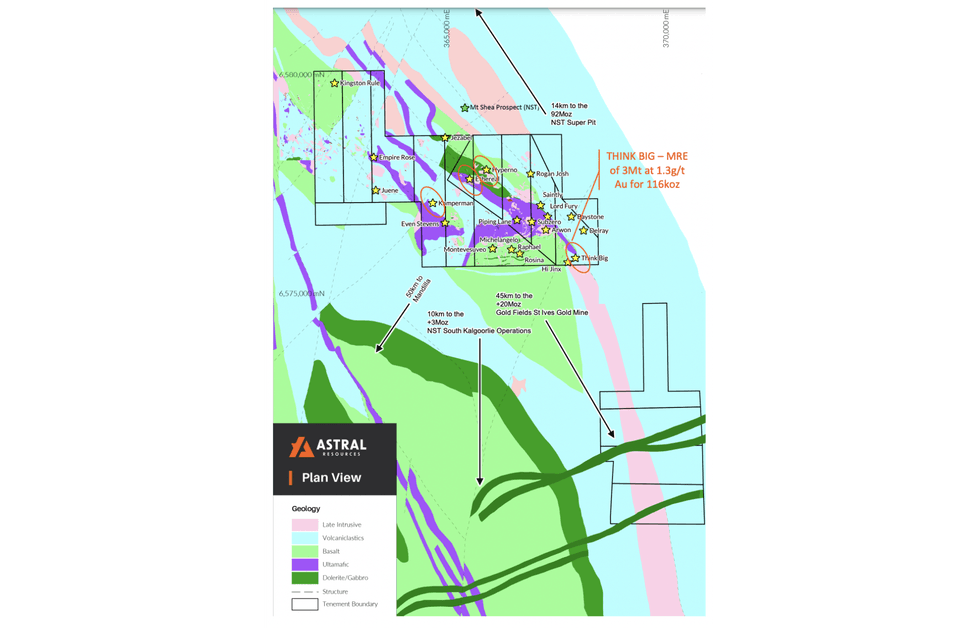

Feysville Gold Undertaking

The Feysville mission is located in Australia’s premier gold belt, merely 14 km south of the Golden Mile deposit, which boasts 70 million ounces, situated in Kalgoorlie. The mission has a mineral useful resource estimate of three Mt at 1.3 g/t Au for 116,000 ouncesof contained gold. The mission may probably develop into a supply of satellite tv for pc ore feed to Astral’s flagship Mandilla gold mission.

At Feysville, Astral is specializing in the high-grade Kamperman prospect. A current 19-hole 2,459 reverse circulation (RC) drilling program at Kamperman returned encouraging assay outcomes. The most recent drilling program yielded vital assay ends in 14 out of 19 RC holes. This excessive success fee continues to point that Kamperman has the potential to be a considerable supply of high-grade satellite tv for pc ore for the Mandilla processing plant. An additional 2,500-metre follow-up RC program is deliberate to increase recognized mineralization at Kamperman past the present 350-metre strike size.

Carnilya Gold Undertaking

The Carnilya Hill gold mission is located about 20 kilometers south-southeast of the corporate’s Feysville mission and roughly 40 kilometers southeast of Kalgoorlie, Western Australia. The mission encompasses varied tenements – M26/047-049, M26/453 – spanning roughly 2.65 sq. km. Astral holds rights for gold mining, whereas Mincor Assets NL (ASX:MCR) holds rights to nickel and different minerals.

Administration Group

Mark Connelly – Non-executive Chairman

Mark Connelly is a mining business veteran who has held positions of CEO and managing director with a number of multinational firms throughout many jurisdictions, together with Australia, North America, South America, Africa and Europe. He has a confirmed observe document in deal making and was principally liable for the merger of Papillon Assets and B2 Gold Corp in October 2014 (worth US$570 million), in addition to the important thing individual liable for the merger of Adamus Assets and Endeavour Mining for US$579 million. He’s at present the non-executive chair of Calidus Assets, Omnia Metals Group, Alto Metals, Warriedar Assets and Nickel Search.

Marc Ducler – Managing Director

Marc Ducler has greater than 20 years of expertise within the mining business. He has held senior operational administration roles with GoldFields, BHP, Fortescue Metals, MRL and Roy Hill. He was additionally the managing director of Egan Road Assets (a gold exploration and improvement firm) till it was acquired by Silver Lake Assets (ASX:SLR).

Peter Stern – Non-executive Director

Peter Stern has expertise in company advisory, specializing in M&A and capital elevating. He has spent six years with Macquarie Financial institution and three years with UBS and Deutsche Financial institution. He’s a graduate of Monash College with a Bachelor of Science (geology main). Stern is a fellow of the Australian Institute of Firm Administrators and the chairman of Troy Assets.

David Varcoe – Non-executive Director

David Varcoe is a mining engineer with over three many years of expertise. He has in depth operational and managerial expertise throughout varied commodities, together with gold, iron ore, copper, diamonds, coal, uranium and uncommon earths. His experience spans board positions, operations administration, mission administration and consulting. Varcoe is a principal guide with the main Australian agency AMC Consulting.

Justin Osborne – Non-executive Director

Justin Osborne is a geologist with over 30 years of expertise in exploration. He was beforehand the manager director at Gold Street Assets (ASX:GOR), the place he performed an important position in growing the world-class Gruyere gold deposit (6.6 Moz gold). Osborne additionally held senior positions on the exploration government staff at Gold Fields. He was instrumental in growing the Damang Superpit mission in Ghana and achieved vital discovery success on the St Ives gold mine.

Brendon Morton – Chief Monetary Officer & Firm Secretary

Brendon Morton has over 20 years of expertise, significantly within the international assets sector throughout Australia, Africa and Asia. He has held a number of government monetary and firm secretarial roles with ASX-listed and unlisted firms within the assets business.

Jed Whitford – Basic Supervisor Enterprise Growth and Tasks

Jed Whitford is a mining engineer with over 20 years of business expertise. His experience primarily encompasses gold and base metals operations, having labored with firms comparable to Western Mining, Gold Fields, Golder Associates, Xstrata and Glencore.

Julie Reid – Geology Supervisor

Julie Reid has 36 years of expertise working throughout Australia, Vietnam and Indonesia, overlaying a wide range of commodities in various geological terrains. She holds a Bachelor of Utilized Science from Curtin College of Know-how.