Overview

Firetail Sources (ASX:FTL) is an Australian exploration firm constructing a strategic portfolio of battery metals in Australia and Peru.

Batteries are a important basis of the transition to a greener and extra sustainable future. Consequently, between electrical autos and renewable power, world demand for batteries is anticipated to extend from 185 GWh in 2020 to over 2,000 GWh by 2030. That is anticipated to have a profound affect in the marketplace for battery and base metals resembling lithium, nickel, cobalt and copper.

Firetail Sources goals to leverage this important alternative to seek out the important sources to assist the world’s journey to electrification. Underneath the course of a confirmed board and administration staff with many years of collective expertise in mining exploration, improvement and manufacturing, Firetail Sources boasts a diversified asset portfolio with a number of drill-ready targets and superior exploration tasks that each one have great potential to extend shareholder worth.

Firetail’s Australian Yalgoo-Dalgaranga, Mt. Slopeaway and Paterson tasks are all situated in confirmed geologic domains and show important upside for substantial mineral sources. The corporate’s more moderen acquisition of two tasks in Peru strongly enhances these belongings.

Because the world’s third-largest copper producer, Peru has an enormous mining business with a powerful prominence within the nation’s nationwide financial system. Lengthy acknowledged as a wonderful, low-risk mining jurisdiction, the nation just lately accepted roughly $600 million value of latest mining tasks. Unsurprisingly, almost each main world mining firm is both working within the jurisdiction or is conscious of it.

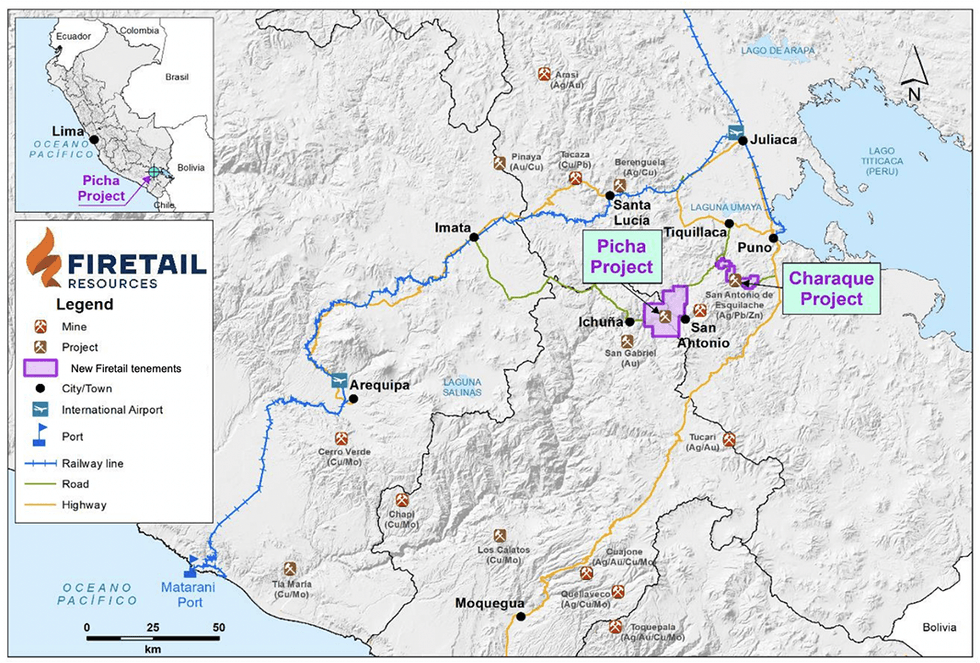

Though solely just lately acquired, Firetail’s Picha Copper venture is now one among its most promising belongings. The Picha Undertaking was acquired as a part of a deal that features a farm-in settlement with Barrick Gold Company (TSE:ABX) for an earn-in of as much as 70 p.c curiosity within the Charaque Undertaking.

Picha is situated alongside a NNW regional development of carbonate-replacement (CRD) and epithermal deposits, together with the San Gabriel Gold Undertaking (Buenaventura NYSE:BVN), which is totally permitted and in development; and the Berenguela Ag, Cu, Mn, Zn Deposit (Aftermath Silver TSXV:AAG).

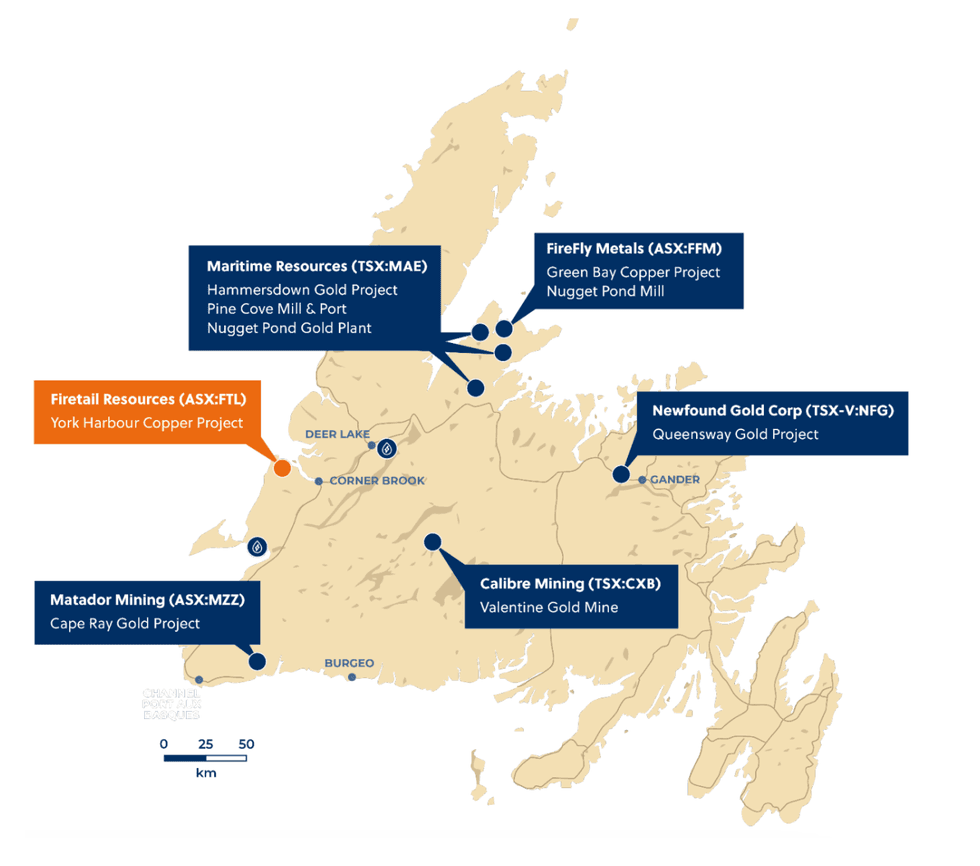

In 2024, Firetail Sources introduced the acquisition of York Harbour copper venture, Canada. The corporate has signed a binding possibility settlement to amass as much as 80 p.c of York Harbour venture by way of a staged earn-in. York Harbour is a Cyprus-style volcanogenic large sulphide (VMS) exploration venture, situated 180 km west-south-west of FireFly Metals Ltd (ASX:FFM) Inexperienced Bay copper venture.

With a diversified portfolio of battery and base metals belongings in two main mining jurisdictions, Firetail is completely positioned to benefit from the transition to inexperienced power, driving appreciable shareholder worth within the course of.

Picha (Copper)

Situated in Southern Peru’s Moquegua and Puno departments, Picha represents Firetail’s most up-to-date acquisition. Meant as a complement to the corporate’s portfolio of battery metals belongings, the extremely potential 200-square-kilometre copper venture hosts a number of drill-ready targets which Firetail plans to check within the coming months. Picha was obtained as a part of a deal that included a farm-in settlement with Barrick Gold Company for the Charaque Undertaking situated 30 kilometres to the northeast.

Firetail just lately confirmed its official drill allow for Picha and website preparations are underway for a October drilling marketing campaign.

Undertaking Highlights

- Promising Geology: Picha is situated inside Peru’s Epithermal Au-Ag-Cu-Pb-Zn metallogenic zone alongside a north-northwest regional development of carbonate-replacement and epithermal deposits.

- Close by Tasks: Picha is located roughly 17 kilometres east-northeast of Compania de Minas Buenaventura’s San Gabriel gold-copper-silver venture, which hosts:

- Reserves of 14.9 Mt with 4.04 grams per ton (g/t) gold and 6.43 g/t silver representing 1.94 Moz gold.

- Sources of 24.86 Mt with 2.10 g/t gold and eight.46 g/t silver.

- A number of Mineralisation: The venture is potential for a number of kinds of copper mineralisation, together with epithermal, stratabound, polymetallic carbonate substitute and porphyry-style. It additionally hosts a number of untested and geologically important geochemical and geophysical anomalies, displaying comparable mineralisation to the Storm/Seal copper venture on Somerset Island.

- Important Exploration Potential: Firetail has recognized 13 exploration targets by a mixture of geological mapping, floor sampling and geophysical surveys. So far, the corporate has collected 651 rock/chip samples and 289 soil samples and carried out 118 line-kilometre IPs and 240 line-kilometre magnetic surveys. Highlights of its exploration work embody:

- Widespread floor copper mineralisation coincident with IP anomalies.

- Channel Pattern Outcomes

- Cobremani: 41.6 metres at 1.12 p.c copper and 22.85 g/t gold.

- Maricate: 17.6 metres at 1.95 p.c copper and 29.58 g/t gold.

- Cumbre Coya: 32.85 metres at 0.61 p.c copper and 209.76 g/t gold.

- Fundicion Goal: Identification of a giant chargeability anomaly reflecting potential sulphide mineralisation and/or alteration at depth indicative of a giant porphyry physique. This anomaly is roughly 2 kilometres lengthy and a couple of kilometres throughout at its widest level.

- Further Drill Targets: Firetail’s second IP survey revealed further anomalies, together with:

- Ichucollo: Semi-contiguous 2.5-kilometre lengthy IP anomaly with coincident floor mineralisation and pattern outcomes of 24 metres at 1.08 p.c copper, 13 metres at 1.38 p.c copper and 30 metres at 0.79 p.c copper. Manto-type mineralisation on the goal’s southern finish additionally averages 1.45 p.c copper over 18 metres.

- Huancune: A 1.5-kilometre lengthy anomaly coincident with floor mineralisation. A number of channel samples starting from lower than 0.5 p.c copper as much as 3.95 p.c copper.

Charaque (Copper)

The Charaque Copper Undertaking is situated roughly 30 kilometres northeast of Firetail’s Picha venture, consisting of eight claims masking roughly 60 sq. kilometres. The area across the venture is an energetic exploration space the place a number of main mining firms preserve important landholdings, together with Barrick Gold, Teck Sources (TSE:TECK.B) and Fresnillo (LON:FRES).

Charaque was acquired by way of a farm-in settlement between Firetail and Barrick Gold which entitles the latter to earn as much as a 70 p.c curiosity within the venture.

Yalgoo & Dalgaranga (Lithium)

Firetail’s Yalgoo and Dalgaranga lithium tasks collectively span greater than 1,750 sq. kilometres in Western Australia’s extremely potential Murchison area. Situated near Geraldton Port and with quick access to all essential infrastructure, the 2 tasks host identified lithium-caesium-tantalum (LCT) pegmatites with a powerful rubidium affiliation. Firetail just lately accomplished a small maiden drilling program within the Johnson Effectively space of Yalgoo, itself the location of a historic lepidolite mine.

Rock chip sampling of surrounding areas is ongoing together with an in depth evaluation of lithium prospectivity. Outcomes and a venture replace are anticipated inside 4 to 6 weeks.

Undertaking Highlights

- Yalgoo Exploration Outcomes: So far, exploration at Yalgoo has returned extremely promising outcomes, together with:

- A 25-kilometre “Goldilocks Zone” at Yalgoo confirmed to host LCT pegmatites with historic outcomes of as much as 3.75 p.c lithium oxide.

- Rock chip assay outcomes of as much as 0.54 p.c lithium oxide and below 1 p.c rubidium.

- Excessive-grade rubidium, together with 10 metres at 0.44 p.c rubidium from 10 metres.

- Dalgaranga Exploration Outcomes: Firetail has accomplished detailed geological mapping within the venture’s north, returning anomalous lithium, rubidium, caesium and tantalum values indicative of LCT pegmatites. The corporate plans to undertake additional mapping within the space.

- Dalgaranga’s Sturdy Prospectivity: Dalgaranga counts a number of superior important minerals tasks amongst its neighbours which collectively verify its prospectivity:

- King Tamba (ASX:KTA): Maiden mineral useful resource estimate (MRE) of 5 Mt at 0.14 p.c rubidium oxide with a lithium oxide credit score. Open mineralisation in all instructions with a deliberate infill drill program to develop MRE.

- Aldoro Sources Restricted (ASX:ARN): Aldoro’s Niobe Tantalum-Lithium venture has delivered a maiden inferred JORC MRE of 4.6 Mt at 0.17 p.c rubidium oxide and 0.07 p.c lithium oxide. Potential to improve is current due to mineralisation at shallow depth.

- Farm-in Settlement on Southern Yalgoo Tenement: Completion of the farm-in settlement accomplished with SensOre (ASX:S3N), by its joint-venture subisidiary Exploration Ventures AI Pty (EXAI) in partnership with German useful resource funding group Deutsche Rohstoff AG, on tenement E59/E2252, part of the Firetail Yalgoo Lithium Undertaking. As per the settlement, EXAI is to earn as much as 80 p.c of lithium rights on E59/E2252 by spending $3.5 million in two levels. Further concerns of as much as $600,000 will probably be fulfilled upon the supply of maiden mineral useful resource estimate (MRE) and pre-feasibility examine (PFS). SensOre will additional present Firetail entry to its proprietary AI know-how throughout the Yalgoo and Dalgaranga Lithium Tasks. The 2 firms will work intently collectively to determine and ensure Lithium exploration targets within the area.

Mt. Slopeaway (Nickel)

Located in Central Queensland, Firetail’s Mt. Slopeaway Nickel Undertaking incorporates an current JORC 2012-compliant inferred mineral useful resource of 4 MT at 1 p.c nickel, 0.2 p.c cobalt and 1 p.c manganese. Having just lately been awarded venture standing, Firetail plans to conduct environmental and heritage surveys. Planning of an onsite drilling program can also be underway.

Undertaking Highlights

- Present Progress: Along with drilling, heritage and environmental surveys, highlights of Firetail’s work at Mt. Slopeaway embody:

- Growth of a geological mannequin indicative of a manganese-cobalt-nickel layer on the base of a limonite part.

- Finalisation of a venture land entry settlement and completion of website earthworks.

- Section 1 reverse circulation (RC) drilling with outcomes exceeding historic nickel and cobalt assay information.

- A deliberate Section 2 RC and diamond drilling program to improve the venture’s present useful resource classification.

- Extensional drilling to probably develop the venture’s present inferred useful resource.

- Drilling Outcomes: A drilling program accomplished in This fall 2022 returned as much as 51 metres of thick laterite nickel-cobalt mineralisation.

Paterson (Copper)

Firetail’s Paterson Copper Undertaking spans 5 tenements throughout roughly 1,000 sq. kilometres in Western Australia. Heritage agreements for the venture are in place and desktop research are at present progressing, with a number of potential goal areas recognized for drilling.

Undertaking Highlights

- Shallow Intercepts: Paterson shows the shallowest identified historic gold/copper intercepts within the area, with as much as 6.5 p.c copper, 0.99 g/t gold and copper, 0.99 g/t gold and 1,330 elements per million (ppm) molybdenum throughout an roughly 50-metre broad magnetite alteration zone.

- Drilling Targets: Paterson has recognized the next potential targets for drilling at Paterson:

- 87WDRC2: 17 metres at 1.6 p.c copper and 317 ppm molybdenum together with 9 metres at 2.6 p.c copper and 456 ppm molybdenum from 84 metres.

- 87WDRC6: 9 metres at 2 p.c copper and 272 ppm molybdenum together with 5 metres at 3.1 p.c copper and 430 ppm molybdenum from 84 metres.

- 87WDRC8: 11 metres at 1.5 p.c copper and 181 ppm molybdenum together with 7 metres at 2.1 p.c copper and 250 ppm molybdenum from 83 metres.

- 87WDRC14: 13 metres at 1.1 p.c copper together with 6 metres at 2 p.c copper from 107 metres.

Administration Crew

Brett Grosvenor — Government Chair

Brett Grosvenor is a seasoned government with over 25 years of expertise within the mining and energy business. He holds a twin tertiary qualification in engineering and a Grasp in Enterprise. Previous to his present place, Grosvenor was the director of improvement at Primero Group, targeted on the event of tasks from an preliminary idea by to contract supply and operation.

Grosvenor is at present a director of ASX-listed Perpetual Sources and Firebird Metals. He’s a member of the venture steering group for Patriot Battery Metals and likewise the Australian Business Session Group for Battery and Crucial Minerals.

Glenn Poole – Chief Government Officer

Glenn Poole brings a wealth of expertise as a technical geologist and a confirmed monitor report in creating and rejuvenating mineral belongings with quite a few ASX listed firms. Most just lately, Poole was technical director and chief geologist at Greenstone Sources (ASX:GSR) previous to the merger with Horizon Minerals (ASX:HRZ). Throughout his time, Poole delivered important will increase in sources to the Coolgardie Gold and Norseman base metallic tasks. Previous to this, he was technical lead for Firefly Sources and developed the maiden sources for the Yalgoo Undertaking previous to the merger with Spartan Sources (ASX:SPR). Poole has additionally held senior positions inside Northern Star (ASX:NST) and Superior Gold.

Poole’s mixture of superior technical and company expertise will expedite the exploration and improvement of the York Harbour copper-zinc-silver venture in Newfoundland and Labrador. Poole holds a BSc in Geology from the College of Otago and a Grasp of Enterprise Administration (MBA) from La Trobe College.

Simon Lawson — Non-executive Director

Simon Lawson is knowledgeable geoscientist with greater than 16 years operational expertise spanning a number of commodities and jurisdictions, and was a founding member of Northern Star Sources (ASX:NST).

He holds a Grasp of Science in geology from Auckland College and has greater than 15 years of exploration, manufacturing and administration expertise in gold and base metals. He’s at present the managing director of Spartan Sources (ASX:SPR) previously Gascoyne Sources (ASX:GCY).

Cai Kecheng — Non-executive Director

Cai Kecheng is a consultant of Hong Kong Jayson Mining Co. (Jayson), a considerable shareholder of Firetail. Kecheng has over eighteen years of expertise in monetary funding and company technique. He’s at present the affiliate president and head of funding & technique for Jayson. Previous to that, he served as managing director at a lot of personal fairness corporations in Shanghai

George Bauk — Non-executive Director

George Bauk is an skilled director with over 17 years as a listed firm director and 30 years inside the sources business together with world operational and company roles.

He has expertise managing every thing from exploration to manufacturing in Australia and internationally, with experience throughout quite a lot of commodities together with uncommon earths, lithium, graphite, gold, uranium and copper. Throughout his time as managing director of Northern Minerals, he led his staff from a greenfields heavy uncommon earth explorer to one of many few world producers of high-value dysprosium exterior of China.

Alongside his place as director at Firetail, he’s additionally an government chairman of ASX-listed Valor Sources (ASX:VAL) and Lithium Australia (ASX:LIT), in addition to an government director of PVW Sources (ASX:PVW).

Robin Wilson — Technical Director

Robin Wilson has held senior exploration positions in a number of exploration and mining firms, together with Valor Sources, Polaris Metals, Tanganyika Gold, Troy Sources, CRA Exploration and Northern Minerals. He has additionally spent 5 years working in oil and gasoline exploration for Woodside Power.

Throughout almost 30 years of involvement in mineral exploration, Wilson has labored on gold, nickel, REE, uranium, copper, lithium and phosphate tasks all through Australia, Africa, South America and North America and was concerned within the preliminary discovery and outlining of a number of gold deposits in Australia. Between 2006 and 2021 he led the Northern Minerals exploration staff that found the Browns Vary REE deposits which have superior by improvement to manufacturing of HRE carbonate.

Frank Bierlein — Technical Advisor

Dr. Frank Bierlein is a geologist with 30 years of expertise as a guide, researcher, lecturer and business skilled. He served on the Firetail board of administrators from the time of its itemizing on ASX in April 2022 till July 2023. He stays a technical guide to Firetail, particularly for ongoing technical work on the Mt Slopeaway Undertaking.

Bierlein has held exploration and generative geology administration positions with QMSD Mining, Qatar Mining, Afmeco Australia and Areva NC and consulted for, amongst others, Newmont Gold, Resolute Mining, Goldfields Worldwide, Freeport McMoRan and the Worldwide Atomic Power Company.

He’s at present a Non-executive director of Blackstone Minerals, Affect Minerals and Variscan Mines.

Leon Bagas — Senior Exploration Geologist

Leon Bagas is an exploration geologist with forty years of business expertise. He has held senior exploration roles with a number of Australian firms and senior analysis positions for the College of Western Australia.

Bagas is very skilled in creating mineralisation fashions utilizing geochemistry and geochronology. Mixed together with his proficiency within the area, this makes Bagas a wonderful candidate to help within the improvement of the exploration and drilling applications at Firetail’s Paterson Orogen and Yalgoon-Dalgaranga venture areas.

Phillip Mackenzie — Senior Exploration Geologist

Phillip Mackenzie has labored in Central Queensland over a number of many years, exploring the Marlborough and Yeppoon terrain to evaluate and probe for nickel, cobalt, chromite, magnesite and gold associated to the Princhester Serpentinite. His work included administration of tasks and groups to carry out actions starting from regional sampling to useful resource drilling. Because of his work, a number of hundred drill holes focusing on lateritic nickel and cobalt have been assessed and an indicated useful resource decided for a mining lease.