Soar to winners | Soar to methodology

Main girls

“The way forward for finance is feminine and girls who wish to lead are well-positioned to excel on this business,” are the rousing phrases from Robyn Thompson, founding father of Castlemark Wealth Administration Inc. “Girls carry a useful and distinctive set of qualities to the business. Their robust communication abilities assist them clarify complicated monetary ideas in a means that shoppers can simply perceive, making them approachable and responsive.”

Wealth Skilled’s High 50 Main Girls in Wealth reside examples of these phrases and the torch bearers for the following era of females within the monetary business.

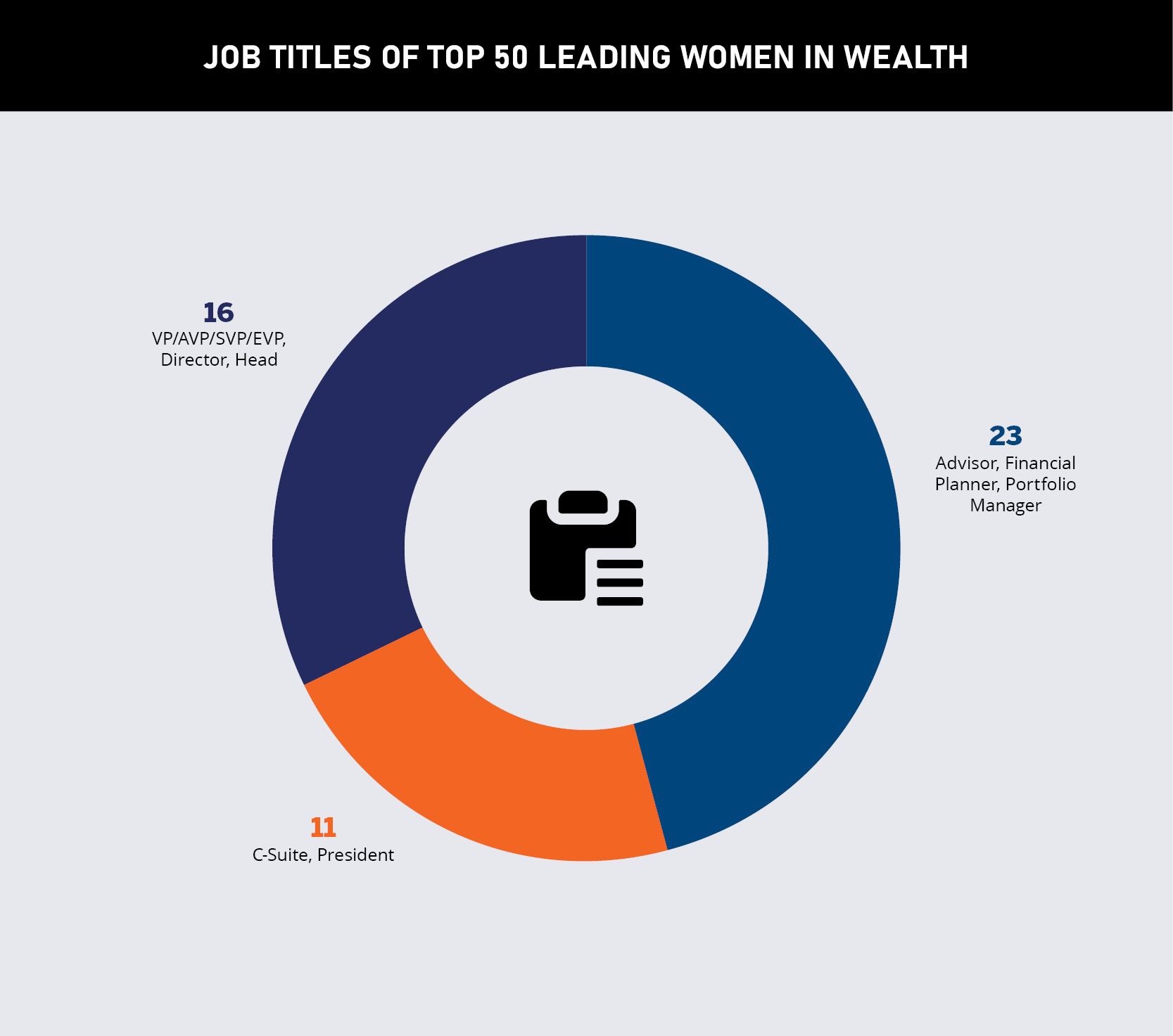

They’ve made an impression in each side of Canadian wealth administration, from monetary advisors and planners, to portfolio managers and presidents. They weren’t named on the celebrated checklist for income era or gross sales figures, however for his or her skilled accomplishments and business contributions.

Kelly Ho, accomplice at DLD Monetary Group, shares, “For years and years, we needed to attempt and actually put in 120 %, whereas males can put in 80 % and nonetheless get to the identical place. However I believe that the hole is closing and most people has realized that ladies are simply as succesful, if no more succesful, in relation to our empathy and element orientation.”

Girls’s position in Canadian wealth administration

Solar Life’s World Investments information exhibits that in Canada:

-

Girls symbolize 15–20 % of monetary advisors.

-

Feminine buyers are 2.5 instances extra snug taking funding dangers with feminine advisors.

-

Girls occupy 21.9 % of senior management roles and 10 % of extremely paid positions.

There are elevated alternatives for feminine advisors as Mackenzie Personal Wealth has predicted that:

-

The share of Canadian monetary wealth managed by ladies will enhance from 37 % on the finish of 2018 to 45 % by the top of 2028.

-

Feminine shoppers will make 2.5 instances the variety of referrals in comparison with male shoppers.

“Whereas there’s a demonstrated want for better feminine involvement within the business, it needs to be accomplished in the precise method,” says Thompson. “To draw extra feminine shoppers, companies first have to recruit extra feminine monetary advisors. An excellent place to begin is to create a tradition the place feminine advisors can thrive. Companies that wrap themselves in a pink bow, or perpetuate outdated stereotypes about ladies and cash that aren’t backed by educational analysis, won’t serve anybody properly.”

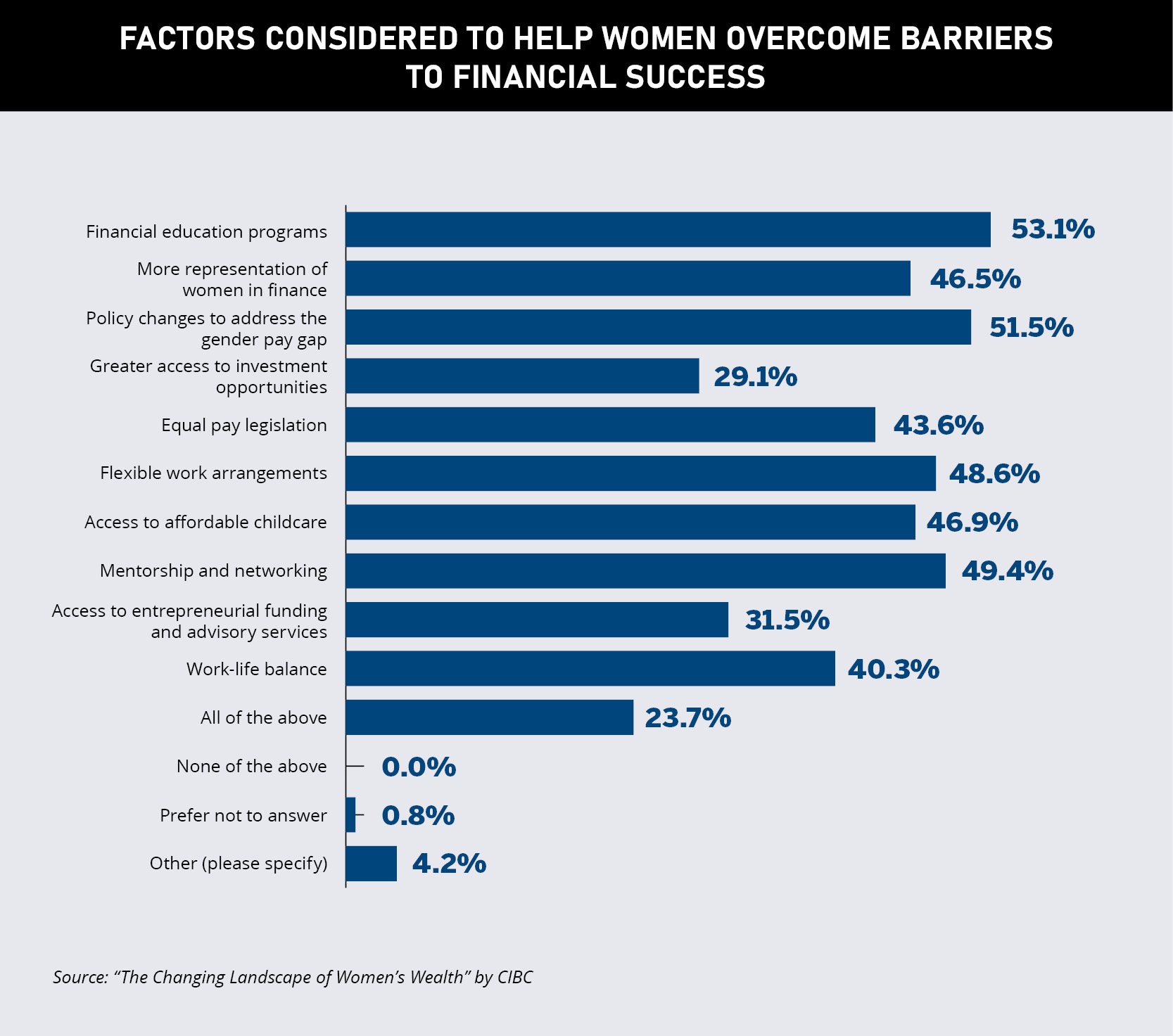

Analysis included in CIBC’s report “The Altering Panorama of Girls’s Wealth,” exhibits that advisors, corresponding to WPC’s High 50 Main Girls in Wealth, are key to enabling all Canadian ladies to attain monetary success.

Thompson provides, “By creating extra inclusive environments and selling feminine illustration in management roles, companies can higher serve this rising demographic and be certain that ladies’s voices are heard.”

This can be a view shared by Léony deGraaf Hastings of deGraaf Monetary Methods who highlights that the better help ladies obtain, the higher the Candian finance sector will probably be.

“As ladies are so underrepresented within the business, it’s much more vital to hunt out our tribe and supply help to 1 one other. By cheering one another on, we’ll uplift feminine entrepreneurs to larger ranges of success,” she feedback. “Encouraging extra ladies to enter and thrive in wealth administration won’t solely enhance gender equality but in addition carry new views and concepts which can be sure to drive development and innovation within the business.”

With some shoppers proven to favor feminine advisors, there’s clear proof that extra ladies needs to be handed management roles.

“These within the C-suite can not ignore the numbers after they see ladies doing exceptionally properly within the wealth business by having the ability to purchase enterprise and work with shoppers who belief them,” says Ho. “The numbers don’t lie, and outcomes say it’s all about how so many ladies are doing so properly and succeeding.”

Success tales of the High Girls in Canadian Finance

Following in her father’s footsteps, La Gamba helps shoppers all through the Higher Toronto Space.

“The folks I wish to work with are people who want steering and recommendation. All of them have distinctive challenges based mostly on their very own buildings, circumstances and careers, and so they need somebody who’s going to know that,” she says.

“Girls have a special perspective and method to threat and alternative. In some instances, we’ve got super confidence, however in areas the place we would not, that lends itself to a cautious method that advantages shoppers”

Sara La GambaSPM Monetary

La Gamba joined the business in 2009 with Freedom 55 Monetary and have become president of King Monetary and Advantages Inc. in 2012, earlier than transferring to SPM in 2018.

“There are distinctive qualities that I believe ladies have when it comes to how they function their follow, how they work with their shoppers, how they view planning, and the way they assist shoppers obtain their objectives. What I’ve seen is that we add one thing that was lacking,” she explains.

Wolfe oversaw the corporate’s main rebranding in Could 2024, when Horizons ETFs grew to become World X, one of many world’s largest ETF platforms with greater than $710 billion in property throughout 19 nations and markets.

“It was an enormous enterprise, and we had simply six months to do it. I’m so pleased with the crew that we managed to ship on time,” she says.

“I imagine in giving again to ladies who’re within the business and simply beginning out, by teaching and mentorship”

Stephanie WolfeWorld X Investments Canada

Wolfe beforehand held positions corresponding to head of Canada advertising at BlackRock and strategic advisor, ladies’s section for BMO Personal Wealth. In 2019, she based Wolfe Collective Wealth, a agency that coaches ladies and teaches them to speculate.

Booker is understood for a strategic, results-oriented method, persistently delivering high-impact initiatives and adept at constructing high-performing groups together with growing robust relationships with stakeholders.

Booker was headhunted by Revesco in 2023 to create a technique to develop a brand new fund to $1 billion. She has constructed strong threat administration and compliance processes, making certain that operations are safe and environment friendly, whereas growing a complete advertising technique.

“We don’t have to do enterprise the best way males do and we don’t have to steer an organization like they do”

Juli Ann BookerRevesco Properties

“My position has concerned facilitating fairness partnerships with 5 new companies, broadening our community and strengthening our place within the business,” she says. “I created processes to make sure investor relations excellence and launched new applied sciences to streamline the funding course of from begin to end, sustaining top-tier communication with buyers.”

Upon graduating from Wilfrid Laurier College with a Bachelor of Arts in Sociology, Zollo joined Solar Life Monetary in 2009.

“I began the advisory journey at 21. I cherished it and by no means regarded again,” she says.

“It was essential to me to at all times preserve a really skilled presence, and I believe as a result of I did that, I at all times felt like a part of the dialog”

Sara ZolloAssante Capital Administration

In 2021, Zollo moved to Assante Capital Administration, the place she works with households, professionals, and enterprise homeowners to alleviate monetary stresses. She helps her shoppers assemble monetary plans and transition into retirement.

Having discovered a distinct segment of ladies managing funds on their very own, she says, “I discover they have an inclination to favor to work with a feminine advisor. So, present feminine shoppers will refer me to different ladies, and that’s naturally developed my follow.”

Curpen’s father, who had moved to BC from Mauritius, based his follow with Primerica in 1990, figuring out the necessity to enhance monetary literacy amongst minorities. She earned her license at age 19 and later took over the workplace. Curpen now has 27 years of expertise serving to middle-income Canadians develop into debt-free.

“There’s an enormous want for minority ladies, particularly, to have entry to frequent sense monetary literacy that wasn’t tied to a sure product,” says Curpen. “We’re not nervous about our second property or our Maserati. We’re nervous about sending our youngsters to highschool, and retiring not underneath a bridge. That’s why I just like the monetary literacy method by giving folks data and so they can select what they wish to do with it.”

“Individuals want management, however I need folks to wish to observe me. I don’t wish to push anyone in a route”

Jennifer CurpenPrimerica

Canada’s High Feminine Monetary Advisors

have solid their very own path

La Gamba has created her personal street to success. Earlier in her profession, she took discover of an older advisor in his 70s and whose guide she was taking on, realizing his means of working wasn’t for her.

“His shoppers had been used to going moose searching with him. It’s a really totally different dynamic that you could have with shoppers typically, male versus feminine. I needed to actually show myself and present them they had been going to get worth working with me,” she explains. “We’re most likely not going to go moose searching, however I can have an espresso with you and be sure to’re taken care of.”

And she or he provides, “It’s straightforward for girls to have imposter syndrome, too. I believe it’s a standard trait and that’s one thing I’ve been working actually arduous to maneuver previous.”

One other of the highest monetary advisors in Canada, Booker makes a speciality of difficult herself and has earned the nickname ‘The Fixer’.

“I’m at my greatest when there isn’t a plan and I get to create one. I nonetheless do at the least three crossword puzzles a day as a result of I simply love fixing issues,” she says.

And she or he maintains the identical mindset by surrounding herself with individuals who pose a problem.

“I imagine firmly in having folks round which can be smarter than you or else you’re not going to develop,” feedback Booker. “That’s a mistake some folks make. They wish to be the very best at all the pieces. I’m actually good at taking in data and choosing it aside and determining the very best answer as a pacesetter.”

A few of her achievements at Revesco embrace:

-

creating an investor portal

-

implementing an unbiased advisory committee overseeing potential conflicts of curiosity

-

rolling out an ESG coverage encompassing asset administration and human assets

“They spotlight my capability to drive strategic initiatives, foster innovation, and lead with a imaginative and prescient that aligns with the evolving wants of the wealth administration business,” she says.

Being on the entrance foot resonates with Curpen, one other Main Lady in Wealth. She says, “I’m very reactive to folks and if that resonates with somebody, then that’s the sort of consumer I need.”

One other space that speaks to Curpen is the scenario of ladies who’re unable to depart a relationship as a result of they depend on their accomplice or aren’t financially literate. Nevertheless, of Canadian ladies who do go away their companions, 80 % change their monetary advisor inside a yr.

“That market section actually means one thing to me, as a result of if you don’t have monetary choices, you don’t have choices,” she provides.

For Curpen, who leads 151 workers, what makes her success extra passable is that she took over the follow within the aftermath of the 2008 market crash.

She recollects, “All the things went to hell and most of my shoppers had been all older than me, and it’s a really outdated Caucasian, male-dominated business, and so to come back into it as a younger, and a very young-looking, feminine minority was actually tough.”

Wolfe additionally feels a way of accomplishment. She started working within the ETF area within the early days.

“It was very thrilling to really be part of that disruption and it’s nice to see ETFs are available in and the way they’ve developed and grown, and simply to be part of that complete channel in monetary providers,” she says.

As a board member of Girls in ETFs, which goals to help range and inclusion throughout the Canadian monetary service business by training and occasions, Wolfe has an fascinating tackle being a lady within the business.

“I don’t suppose it hindered me, however typically it was tough to take part in actions outdoors of labor after I had the duty of being a caregiver, however that was purely societal and never an organization factor,” she explains.

Wolfe performed an integral position in Horizons ETFs turning into World X and was concerned in revolutionary plans, corresponding to signing monetary media persona Jon Erlichman to an unique contract to broadcast on YouTube.

“‘Innovation meets investing’ is our tagline however innovation results in disruption,” she shares. “That is part of my ethos and the values set that we’ve got inside World X, and it’s thrilling to see what’s subsequent.”

Equally feeling a way of anticipation is Zollo, who thrives on being a pillar of power for shoppers. Serving to folks is her motivation for staying within the business.

“From a lady’s perspective, an enormous a part of what we do is caring about our shoppers. It’s not simply concerning the investments or the suggestions which we finally earn a dwelling from,” she says. “It’s about actually serving to. Individuals get to essentially know and belief you, and also you’re a confidante to them. I take that very critically.”

Together with bringing a stage of confidence, Zollo ensured her technical abilities had been on par with anybody, enabling her to counteract gender bias. “I solidified my data base, and I knew I used to be bringing worth to the dialog, so I by no means felt at an obstacle to my male counterparts.”

This forward-thinking and growth-oriented method, which started along with her in search of out mentors early in her profession, continues to serve Zollo.

“Even now, after 15 years within the business, I at all times know who I wish to be in 5 years. You must have a imaginative and prescient of the person who you wish to be very clearly. I say 5 years as a result of something shorter simply comes too rapidly and it takes time to develop.”

Lifting others up

Whereas gender equality within the wealth business has improved, there’s nonetheless a distance to go.

“Girls in monetary providers typically face a spread of systemic points rooted in historic norms, biases, and buildings which have lengthy formed the business. Regardless of altering social norms, ladies are nonetheless extra prone to bear the brunt of caregiving obligations, starting from childrearing to eldercare,” says deGraaf Hastings. “By showcasing profitable feminine professionals and mentors, companies can supply real-world examples that ladies can relate to and aspire towards.”

To encourage ladies to remain within the monetary business, Wolfe created and arranged a significant occasion known as ‘Breaking Obstacles’ in 2023.

“The purpose was to have ladies networking, but in addition instilling that you could transfer to a special a part of finance, from wealth administration to capital markets, maybe into the funds division from hedge funds. There’s quite a lot of alternatives as a result of we’ve got a singular ability set,” states Wolfe. “Girls who’re coming into monetary providers ought to preserve an open thoughts to all of the alternatives obtainable to them.”

Zollo echoes that, as she is co-authoring a handbook to information new advisors within the early levels of their careers.

She says, “The attrition fee is excessive within the first 5 years, with 90 % of people that enter the business not staying past that. If you happen to keep, you might have an important likelihood of constructing a profitable profession.”

For Booker, being a lady in a management place comes with a duty to vary outlooks, which she shares by encouraging and championing different ladies.

“I acquired nice recommendation from a male mentor – it was to take a look at the positives of being a feminine chief and lean into it,” she says. “In wealth, we’re arduous lined to imagine that we have to be robust and aggressive as a pacesetter, however it’s okay to be extra emotional and empathetic. Each time I meet a lady on this business, I give them reward for simply surviving as a result of typically you’re the one lady within the room. We have to repair one another’s crowns.”

This aligns with La Gamba, who volunteers with The Institute for Superior Monetary Training, and is a part of a ladies advisors’ group based by one other advisor who felt there weren’t sufficient individuals who regarded like her within the business.

She says, “We met just lately and there have been 18 of us, and it was such an energizing day. There have been ladies who’ve been within the enterprise for 30 years, and girls who’ve been within the enterprise for 2 years. We share views on how being a lady within the enterprise presents totally different alternatives to shoppers.”

And Curpen’s work has been acknowledged by the Black Enterprise Affiliation of BC, which named her Greatest Skilled Service Supplier. She was additionally voted onto the board of the Canadian Basis for Monetary Planning, and volunteers as vice chairman (human rights) for Carifika, a worldwide non-profit aiming to unify African and Caribbean communities by fostering financial, instructional, well being, and cultural development for future generations.

Thompson provides, “Mentorship amongst ladies within the wealth administration business is a sport changer. It creates a supportive community that helps sort out the systemic challenges ladies face on this male-dominated subject.”

- Adrienne Energy

Monetary Advisor

Edward Jones - Angelina Hung

Chief Govt Officer

Monetary Tech Instruments - Anik Armand

Senior Wealth Supervisor

Desjardins Securities - Anna Dayan

Area Head Metro East and Head of TD Wealth Household Workplace

TD Financial institution - Annie Desrosiers

Advisor

BMO - Annie Sinigagliese

Chief Govt Officer

Canadian Unbiased Finance and Innovation Counsel - Brittany Puglia

Regional Vice President, Advisor Distribution at TD Asset Administration

2024 Canadian Chapter of Girls in ETFs Management Staff Member - Caitlin Gubbels

Managing Director and Head of Personal Fairness Funds

CPP Investments - Carmela Marino

COO and CSO

Ferrari Group - Catherine Dangerfield

Assistant Area Head

TD Wealth - Catherine Pickard

Funding Affiliate

Clark Monetary Advisory Group with Scotia McLeod - Christina (Tina) Chow

Senior Portfolio Supervisor and Senior Wealth Advisor

Raymond James - Danielle Martin

Senior Wealth Advisor

ScotiaMcLeod - Danielle Nichol

Chief Advertising Officer

Wellington-Altus Personal Wealth - Diana Orlic

Wealth Advisor, Portfolio Supervisor, Funding Advisor

Richardson Wealth - Elizabeth Wallace

Senior Supervisor, Funding and International Change

Ontario Financing Authority (OFA) - Erin Griffiths

Senior Vice President, Shopper Options, Canadian Wealth Administration

Scotiabank - Erin O’Connor

EVP, Managing Director

HiFi - Han Tran

Director of Operations

Vo-Dignard Provost Group

Nationwide Financial institution Monetary - Harleen Bains

MD and Head, World Markets Institutional Gross sales

RBC Capital Markets - Izumi Miki McGruer

Regional Vice President

Canada Life - Jaclyn Nemethy BSc, CHS, CEA, CLU, CFP

Regional Director, Strategic Relationships

PPI Administration - Kait Jack

Vice President, Exterior Shopper Advisor

JP Morgan Asset Administration - Karen Kazina

Senior Funding Advisor Assistant

Tetrault Wealth Advisory Group - Kelly Trihey, CFA

Portfolio Supervisor

iA Personal Wealth - Laura Paglia

President and Chief Govt Officer

Funding Business Affiliation of Canada - Laurie Bonten

Senior Wealth Advisor

Wellington-Altus Personal Wealth - Lisa Currie

Monetary Advisor

Edward Jones - Mary Medeiros

Chief Working Officer

Harvest ETF - Robyn Thompson

Founder

Castlemark Wealth Administration/Robyn Thompson Cash - Sandra T. Giannou

Managing Director and Head, Deposit Options and Inside Securitization, World Funding and Treasury

Nationwide Financial institution - Selena Woo

VP, Advisory Companies, Associates

Nicola Wealth - Sheryl Purdy

Funding Advisor

Leede Monetary - Sophia Ito

Wealth Advisor

Nicola Wealth - Stacey Madge

Board of Administrators

Solar Life Monetary - Tania Tetrault

Funding Advisor

Tetrault Wealth Advisory Group - Tashia Batstone

Chief Govt Officer

FP Canada - Wendy Chui

Senior Funding Advisor

TD Wealth Personal Funding Recommendation - Whitney Hammond

Chief Govt Officer

Sovereign Wealth Administration