A reader asks:

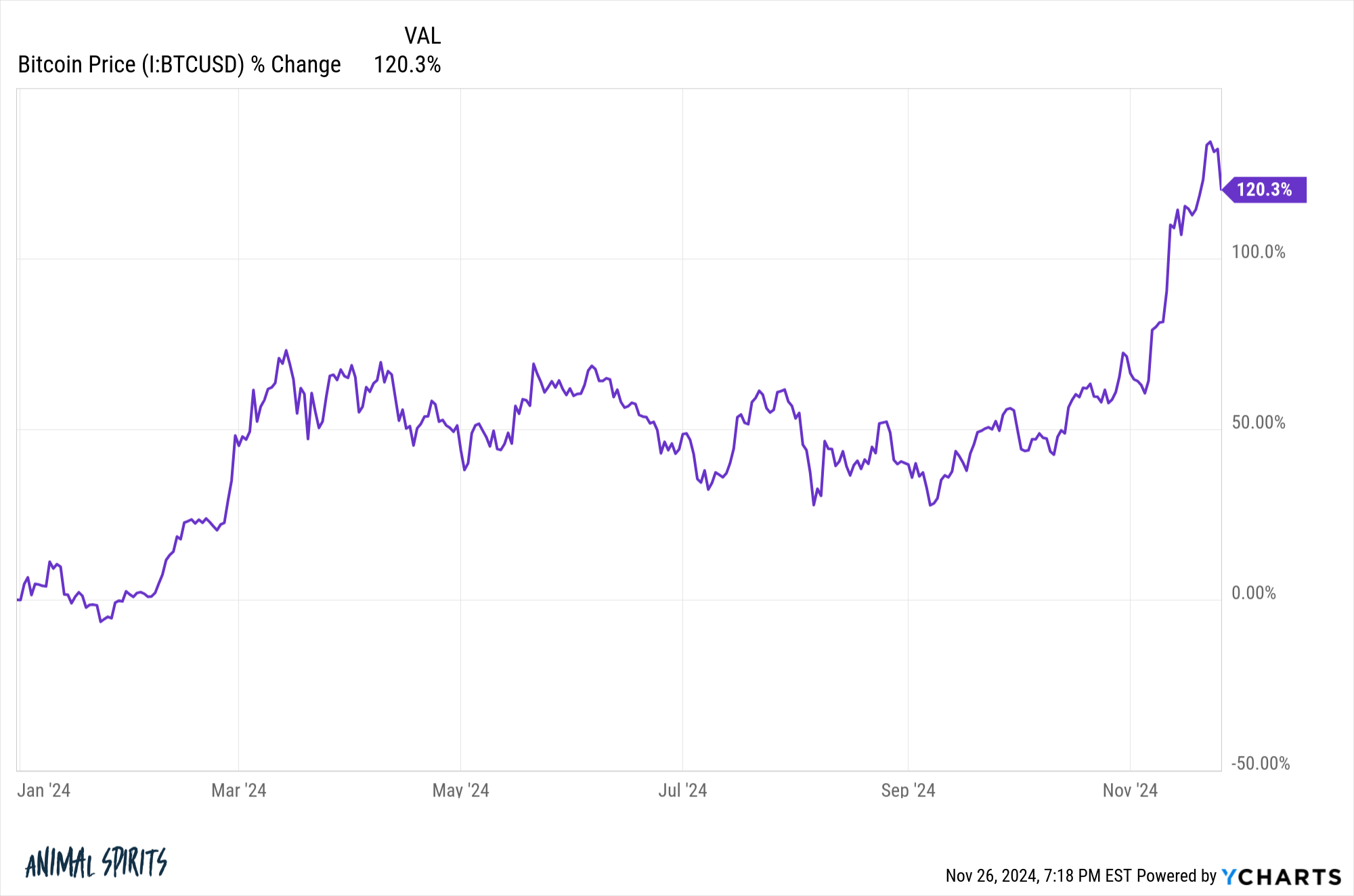

I’m considering of including bitcoin to my portfolio through one of many new ETFs nevertheless it looks like I’ve already missed the boat with the insane run-up this 12 months. Is it too late so as to add? I don’t need to be a muppet.

I’ve many ideas on this query however first a narrative from my e book Don’t Fall For It:

Isaac Newton’s contributions in arithmetic, astronomy, physics, alchemy, theology, engineering, and know-how make him arguably an important determine of the scientific revolution. Not solely was the person a world-renowned scientist, however he additionally took half in debates on financial coverage throughout the authorities and helped pursue counterfeiters in his work with the Royal Mint.

Newton died a wealthy man as his life’s work paid nicely however nobody remembers how a lot cash Newton made or squirreled away. The one story anybody is aware of about Sir Newton with regards to cash issues was his expertise shedding a boatload of money investing within the Sea bubble.

Newton is extensively attributed with the quote, “I can calculate the movement of heavenly our bodies, however not the insanity of individuals,” after shedding his shirt in South Sea Firm shares. That is the chef’s kiss of behavioral finance quotes. It’s been used numerous occasions as a result of it makes the right level that even one of many smartest individuals on the planet can succumb to his feelings when cash is concerned.

Sadly, Newton seemingly by no means mentioned the primary a part of the quote. He’s on document responding to a query in regards to the ever-rising worth of the South Sea inventory worth by saying, “I couldn’t calculate the insanity of the individuals,” however the “calculate the movement of the heavenly our bodies” half was seemingly added in later by different writers to beef up the narrative. No matter the place the whole lot of the quote originated, Newton’s expertise continues to be price revisiting as a result of investing within the South Sea Firm supplies classes for the remainder of us who won’t ever be one of the influential minds in recorded historical past.

Newton died a rich man with an property valued at roughly £30,000, however misplaced anyplace from £10,000 to £20,000 from his foray into the beast that was the South Sea bubble. That £20,000 could be the equal of roughly £20 million as we speak. By all accounts, Newton was a conservative, shrewd, and profitable investor earlier than the South Sea inventory caught his fancy, investing prudently in principally shares and authorities bonds.

The South Sea Firm was an revolutionary experiment on the outset so the truth that Newton was an early investor made him one thing of a enterprise capital pioneer. He started shopping for up shares in 1712, only a 12 months after it was included, and a full seven to eight years earlier than the insanity of the crowds took the value to the stratosphere. Newton noticed some good good points in his buying and selling account on the preliminary worth surge and proved to be a momentum dealer by making six extra purchases as the value continued to rise. A majority of these purchases have been at costs larger than the place he ended up promoting out however he was nonetheless capable of take some good points and almost double his preliminary funding. But after he bought the value stored proper on rising because the bubble actually took off as he sat together with his money was on the sidelines.

To cite Michael Corleone (Al Pacino) in The Godfather, Half III, “Simply once I thought I used to be out, they pull me again in!”

The ever-rising share worth sucked Newton in hook, line, and sinker. After promoting out of his whole stake, Newton would soar again in just some quick weeks later at double the value he bought. It was a panic purchase, almost certainly brought on by greed’s greatest good friend, the concern of lacking out. FOMO shortly was the concern of being in, as Newton was taking a look at a lack of almost 80% on his capital by the tip of 1723.

Researchers consider Newton is the one giant investor who initially took income on his funding within the South Sea Firm, solely to leap again in at a later date and lose the majority of his cash.

For the remainder of his life Newton claimed he couldn’t bear to say the title of the corporate that triggered him such grief and losses. John Blunt’s pump-and-dump of large proportions had snagged one of the clever individuals to ever stroll the earth.

OK, again to the query at hand.

Jeff Foxworthy voice: If you happen to change into curious about Bitcoin at $100,000…you may be a efficiency chaser.

If you happen to weren’t curious about Bitcoin at $20k, $30k, $40k, $50k, $60k, and many others., I’d be involved if it’s solely interesting to you now at $100k.

That’s to not say it couldn’t work out for you. The worth may hold going larger. Nobody is aware of how excessive Bitcoin will go when it’s on a heater like this. You would actually make some cash using the momentum prepare.

My greatest query is that this: Why now?

The ETF got here out in January when costs have been a lot decrease. Why didn’t you purchase it again then?

I’d be nervous in regards to the behavioral profile of any investor who is barely taking a look at Bitcoin as a purchase candidate round $100k. That appears like a pure FOMO play and it hardly ever works.

Now, perhaps you inform your self it’s solely a commerce otherwise you’re now a convert to crypto. Truthful sufficient. Possibly you possibly can greenback value common right into a place should you’re actually curious about investing.

The issue is nobody is proof against the siren tune of FOMO. Even probably the most sensible individuals on the earth may be blinded by cash feelings.

This has nothing to do with the prospects for Bitcoin and the whole lot to do with human nature.

I mentioned this query in additional element on the most recent episode of Ask the Compound:

On this week’s present we additionally touched on questions on diversification as a youthful investor, a pep discuss for youthful generations, monetary planning with Chat GPT and paying down your mortgage vs. investing in fastened earnings.

Additional Studying:

Why I’m Promoting Some Bitcoin