Galan Lithium Restricted (ASX: GLN) (Galan or the Firm) is happy to announce that the Catamarca Ministro – Ministerio de Mineria (Mines Division Minister) has granted Galan the total Section 2 mining allow for 21ktpa LCE manufacturing at its 100% owned HMW lithium brine venture in Argentina. The grant of the allow means Galan has the power to increase manufacturing as much as 21ktpa LCE, topic to securing venture finance and following the supply of Section 1 (as much as 5.4ktpa LCE).

Highlights

- Section 2 Hombre Muerto West (HMW) mining allow has been granted, securing the pathway for Galan’s continued growth at HMW at an environment friendly business scale as much as 21,000 tpa LCE

- The granted allow consists of all building actions together with ponds, plant, onsite laboratory, energy and different required infrastructure

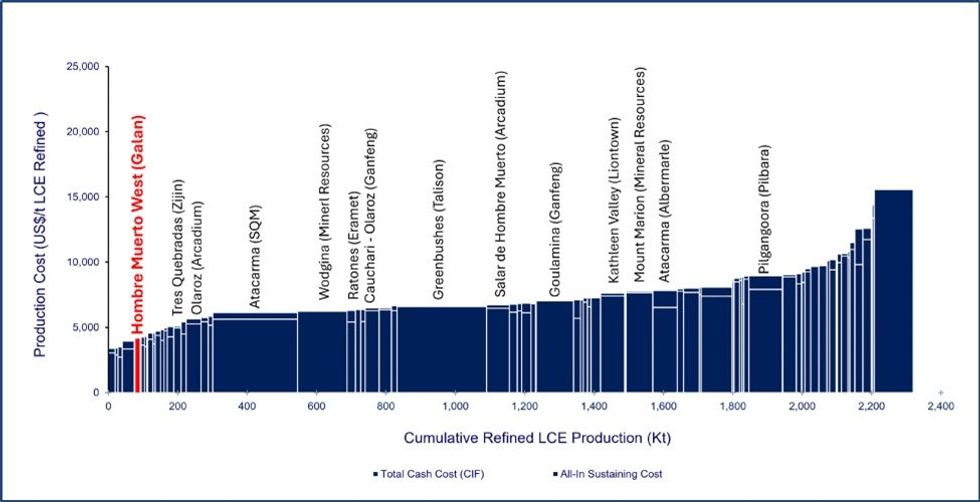

- HMW Section 2 manufacturing can be money move optimistic at at the moment’s lithium carbonate costs. Unbiased benchmarking highlights HMW as being throughout the first quartile of the lithium trade AISC price curve

- The granting of Section 2 permits helps Galan’s utility for the RIGI, Argentina’s new incentive regime for giant scale investments

Galan’s Managing Director, Juan Pablo (JP) Vargas de la Vega, commented:

“We’re delighted with the grant of the Section 2 mining allow which continues to solidify our robust relationship with the native Catamarcan authorities. It should enable Galan to extend manufacturing over threefold from Section 1 and produce a premium high quality lithium chloride product, which is in excessive demand.

Importantly, HMW is positioned within the first quartile of the fee curve and Section 2 manufacturing can be money move optimistic even at at the moment’s prevailing lithium carbonate costs. HMW is now poised to be a long run and resilient globally important supply of lithium provide.”

Determine 1. Wooden Mackenzie 2028 Lithium Price Curve: AISC (US$/t LCE)Wooden Mackenzie Disclaimer “The foregoing info was obtained from the Lithium Price Service™ a product of Wooden Mackenzie.” “The info and knowledge supplied by Wooden Mackenzie shouldn’t be interpreted as recommendation and you shouldn’t depend on it for any objective. You could not copy or use this knowledge and knowledge besides as expressly permitted by Wooden Mackenzie in writing. To the fullest extent permitted by legislation, Wooden Mackenzie accepts no accountability on your use of this knowledge and knowledge besides as laid out in a written settlement you’ve got entered into with Wooden Mackenzie for the supply of such of such knowledge and knowledge.” Data sourced in December 2024.

Determine 1. Wooden Mackenzie 2028 Lithium Price Curve: AISC (US$/t LCE)Wooden Mackenzie Disclaimer “The foregoing info was obtained from the Lithium Price Service™ a product of Wooden Mackenzie.” “The info and knowledge supplied by Wooden Mackenzie shouldn’t be interpreted as recommendation and you shouldn’t depend on it for any objective. You could not copy or use this knowledge and knowledge besides as expressly permitted by Wooden Mackenzie in writing. To the fullest extent permitted by legislation, Wooden Mackenzie accepts no accountability on your use of this knowledge and knowledge besides as laid out in a written settlement you’ve got entered into with Wooden Mackenzie for the supply of such of such knowledge and knowledge.” Data sourced in December 2024.

Wooden Mackenzie’s emissions benchmarking service has additionally positioned HMW throughout the first quartile of the trade greenhouse gasoline emissions curve. Robust environmental, social and governance ideas have been a governing tenet of the event technique for HMW, which focuses on the manufacturing of a lithium chloride focus from typical evaporation permitting for considerably diminished power and water consumption. In step with Galan’s dedication to social ideas, at the very least 70% native content material in employment and contracting alternatives has been focused at HMW and stays a eager focus for the Authorities of Catamarca and Galan. Expertise and coaching alternatives have been supplied to extend native participation, with a view to creating a talented native workforce and provide chain for sustainable long-term operations.

Galan has demonstrated appreciable progress on the HMW venture, together with:

- 2019: Discovery properly drilled, marking the inception of the HMW venture.

- 2020-2024: Mineral Useful resource established and expanded, now ranked as a worldwide High 20 lithium useful resource.

- 2023: Completion of Section 1 and Section 2 Definitive Feasibility Research (DFS), validating the venture’s technical and financial viability (https://wcsecure.weblink.com.au/pdf/GLN/02720109.pdf).

- 2023: Secured all required approvals for Section 1 building and commenced building.

- 2024: Continued building and constructed a lithium stock within the ponds of over 6,000 tonnes LCE.

- 2025: Full mining allow for Section 2 granted, securing the pathway for continued growth.

Chairman of Galan, Richard Homsany, commented:

“The grant of the Section 2 mining allow is testomony to the arduous work and dedication of our devoted crew, and likewise highlights the robust long-term relationships we have now fostered with the Authorities of Catamarca and native communities, who we sincerely thank for his or her continued ongoing assist. By motion we have now demonstrated the advantages of our HMW operations: economically although the technology of employment, procurement and commerce alternatives and socially by schooling, neighborhood applications and coaching alternatives. We sit up for persevering with to work in co-operation with the Authorities of Catamarca and all stakeholders to maximise the advantages of Galan’s operations in the neighborhood, and guarantee they’re sustainable.”

The HMW venture is separated into 4 manufacturing phases. The Section 1 DFS relies on the manufacturing of 5.4ktpa LCE of lithium chloride focus, with manufacturing anticipated within the second half of 2025.

The Section 2 DFS, introduced on 3 October 2023, targets medium-term manufacturing of 21ktpa LCE of lithium chloride focus. Arcadium Lithium Plc, which is topic to a change of management transaction from Rio Tinto Restricted, produced round 20ktpa LCE from the adjoining mining allow at Salar de Hombre Muerto in 2023.

Section 3 at HMW goals to realize 40ktpa LCE inside a 2-5 yr horizon while Section 4 represents a longer-term goal of 60ktpa LCE, leveraging lithium brine sourced from each HMW and Galan’s different 100%-owned venture in Argentina, Candelas.

The phased growth of the HMW and Candelas Mineral Assets mitigates funding and execution danger and permits for steady course of enchancment. The manufacturing of lithium chloride as a product is in demand from lithium converters as battery chemistry is trending in the direction of lithium iron phosphate know-how. Galan acquired permission to promote lithium chloride from the Catamarca Authorities earlier in 2024.

The Section 2 mining allow additionally helps Galan’s utility for the Argentinian Régimen de Incentivo para Grandes Inversiones (RIGI). Topic to assembly the eligibility standards for RIGI, the RIGI can present the next key incentives:

- The company revenue tax charge is ready at 25% (ordinarily 35%)

- Accelerated depreciation

- Absence of cut-off dates within the computation of tax loss carry forwards

- Concessions on import responsibility, VAT and withholding tax

- Higher flexibility on overseas change actions

- Fiscal stability for a interval of 30 years

Galan’s JP Vargas de la Vega additional acknowledged:

“Our plan for HMW is unchanged, starting with Section 1. Our quick focus is finalising the financing and offtake preparations for Section 1. As soon as secured, our operations crew will full building and begin first manufacturing of lithium chloride focus. Whereas the operations crew advances Section 1 building our company crew, supported by advisors, will begin a venture financing course of for Section 2.”

Click on right here for the total ASX Launch

This text consists of content material from Galan Lithium, licensed for the aim of publishing on Investing Information Australia. This text doesn’t represent monetary product recommendation. It’s your accountability to carry out correct due diligence earlier than performing upon any info supplied right here. Please discuss with our full disclaimer right here.