A reader asks:

Everyone says the best solution to make investments is to easily purchase an S&P 500 index fund. Nonetheless, while you look into the returns of every of the 11 sectors that make up the S&P 500, it turns into clear that some sectors constantly outperform others. I’ve just lately found SPDR Choose Sector ETFs and am questioning what your take is on utilizing them to reconfigure the weighting of an S&P 500 indexing fund? I like the concept of eliminating the true property, utilities and supplies sectors from my portfolio and easily reweighting the remaining 8 sectors to replicate the S&P500 weighting as carefully as doable. Any ideas on this technique?

I get some variation of this query no less than annually.

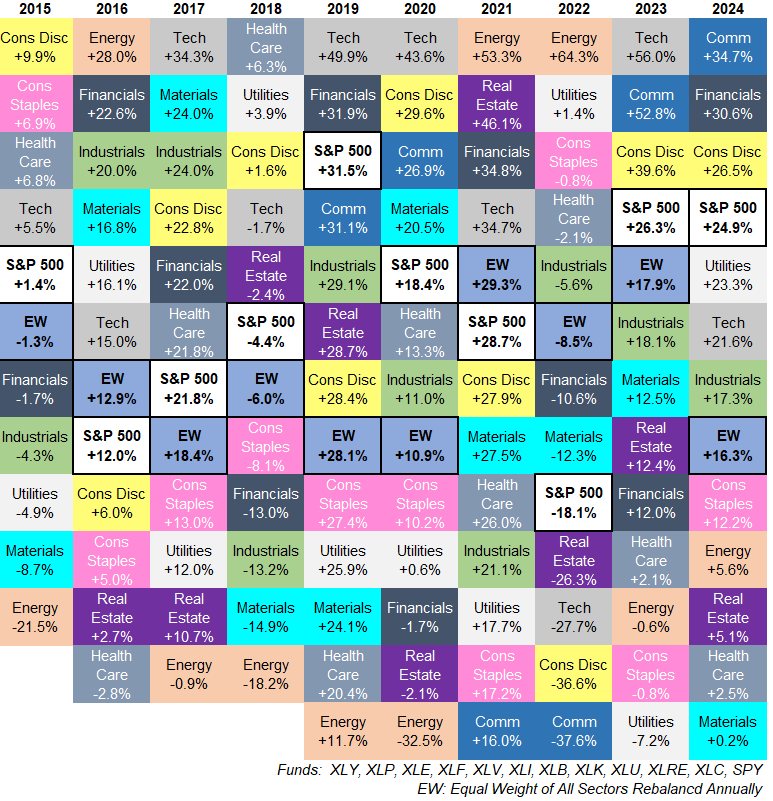

It is a good excuse to replace my annual sector quilt:

It’s not almost as eye-catching as my asset allocation quilt as a result of they’ve added two new sectors (actual property and communications) previously decade. Oh nicely.

Tech shares had been clearly the best-performing sector of the previous 10 years with 20% annual positive aspects. The one different sectors with 10 12 months annual returns within the double-digits had been client discretionary (+13%), financials (+11%) and industrials (+11%). Power was the worst sector with 5% annual returns from 2015-2024.

I perceive the will to select sectors. Certain, choosing shares is tough however sectors might help you catch traits by investing in a bunch of shares.

I’m sorry to say I’ve some issues with this sector-picking technique.

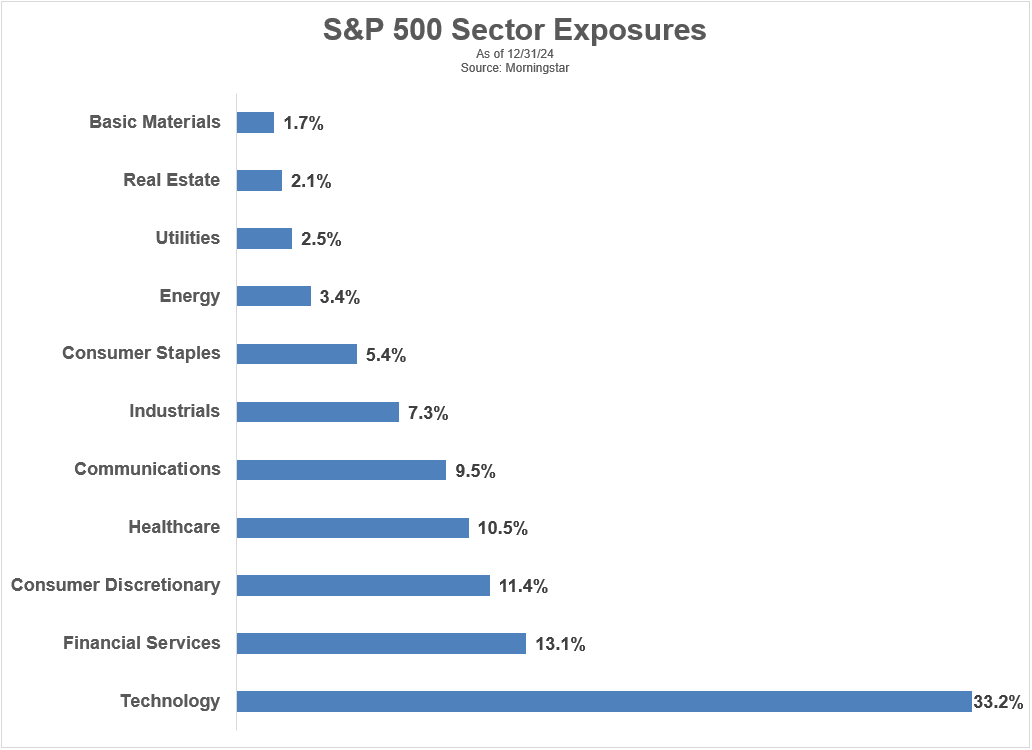

For one factor, it doesn’t transfer the needle all that a lot. Have a look at the sector weightings for the S&P 500 as of year-end 2024:

The three sectors our reader needs to underweight — supplies, actual property and utilities — are the three smallest sectors by far. They make up simply 6% of the overall. Taking them out of the equation is not going to make a huge impact on returns a method or one other.

I’m additionally a giant proponent of simplification. This technique is the alternative of that.

It requires extra holdings. You may need to rebalance as sectors change or names transfer out and in of the index.

In any case of that work, you’ll in all probability nonetheless find yourself underperforming the S&P 500 since you’ll be tempted to over and underweight different sectors which are outperforming or underperforming. The profitable and shedding sectors are usually not static over time.

Inventory-picking is tough. Sector-picking is not any picnic both.

The 2 best-performing sectors of the previous 10 years — tech and financials — had been the 2 worst-performing sectors of the primary 15 years of this century:

The worst performer from 2015-2024, power, was the very best performer from 2000-2014.

One of many largest advantages of indexing lies in its simplicity. There are not any additional factors awarded for the diploma of issue within the funding course of.

Don’t make investing extra difficult than it must be.

Personal the index and transfer on together with your life.

I went into much more element on this query on the most recent version of Ask the Compound:

We additionally answered questions on 2025 retirement account limits, Coast FIRE methods, when to take cash off the desk from the inventory market, find out how to account for pension and Social Safety revenue throughout retirement and the way different economies impression the U.S. markets.

Additional Studying:

Updating My Favourite Efficiency Chart For 2024

This content material, which accommodates security-related opinions and/or info, is offered for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There may be no ensures or assurances that the views expressed right here can be relevant for any specific info or circumstances, and shouldn’t be relied upon in any method. You must seek the advice of your personal advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “put up” (together with any associated weblog, podcasts, movies, and social media) displays the non-public opinions, viewpoints, and analyses of the Ritholtz Wealth Administration staff offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory providers offered by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments consumer.

References to any securities or digital belongings, or efficiency knowledge, are for illustrative functions solely and don’t represent an funding suggestion or supply to supply funding advisory providers. Charts and graphs offered inside are for informational functions solely and shouldn’t be relied upon when making any funding determination. Previous efficiency will not be indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to alter with out discover and should differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives cost from varied entities for ads in affiliated podcasts, blogs and emails. Inclusion of such ads doesn’t represent or suggest endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its staff. Investments in securities contain the danger of loss. For extra commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.