Scholar mortgage debt impacts everybody from younger school grads to retirees. Whereas youthful debtors dominate the headlines, the info tells a extra advanced story—one the place graduate college students maintain a disproportionate share of debt and older Individuals face sudden compensation struggles, generally effectively into their golden years.

Do you know {that a} rising variety of retirees are seeing their Social Safety checks garnished to repay long-defaulted loans? Or that debtors with smaller balances are inclined to repay their loans quicker, leaving these with greater levels to hold the monetary burden for many years? These are simply among the placing patterns revealed within the newest federal pupil mortgage information.

Nearly all of debtors owe lower than $40,000 in federal pupil mortgage debt. Debtors with greater than $100,000 in federal pupil mortgage debt are typically graduate {and professional} college college students, and fogeys of dependent undergraduate college students.

Only a few debtors nonetheless owe federal pupil loans once they attain retirement age, and people are inclined to have been in default for a really very long time. And virtually all federal pupil mortgage debt is repaid inside 30 years.

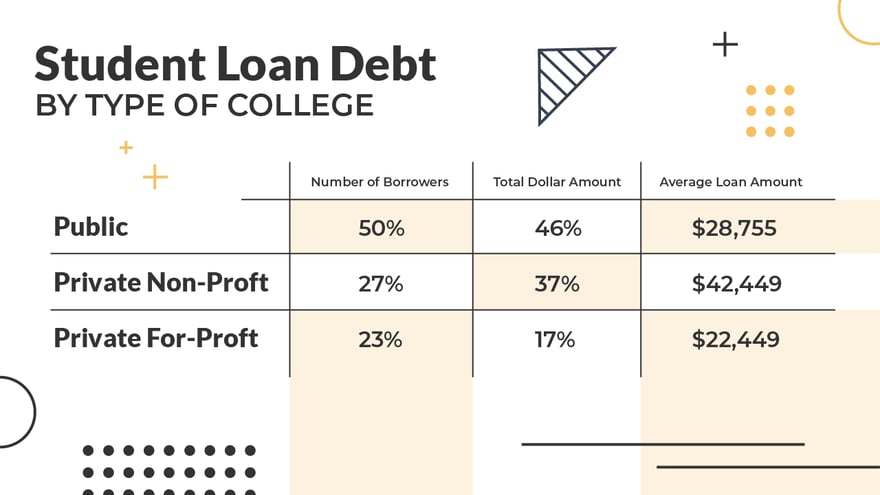

Solely a couple of quarter of federal pupil mortgage debtors attended for-profit schools, with half of debtors having attended public schools.

Let’s break down the info for the 42.7 million Individuals which have pupil mortgage debt.

Borrower Age

This desk reveals the distribution of the variety of debtors and the overall quantity of debt by borrower age, as of September 30, 2024.

Though solely 6% of debtors are age 62 and older, the U.S. Authorities Accountability Workplace (GAO) discovered that they’re disproportionately in default.

Practically a 3rd of debtors age 65 and older are in default (27% of debtors age 65-74 and 54% of debtors age 75 and older), in contrast with 19% of debtors age 50-64, 12% of debtors age 25-49 and three% of debtors beneath age 25. When a borrower is unable to repay their pupil loans, the scholar mortgage debt persists into previous age.

This will have an effect on the monetary safety of retired individuals, because the federal authorities can offset as much as 15% of Social Safety retirement advantages to repay defaulted federal pupil loans. The offset of Social Safety profit funds – cash that retirees must pay for meals, housing and drugs – is a morally chapter coverage. The federal authorities offers with one hand whereas taking again with the opposite.

Quantity Of Debt Per Borrower

This desk reveals the distribution of the variety of debtors and the overall quantity of debt by borrower age by the quantity of debt per borrower, as of September 30, 2024.

Three quarters of debtors (74%) owe lower than $40,000 in pupil mortgage debt.

Though solely 8% of debtors owe $100,000 or extra, collectively these debtors characterize 40% of complete federal pupil mortgage debt excellent. These debtors possible embrace extra graduate pupil mortgage debtors than undergraduate debtors.

Sort Of Faculty

This desk reveals the distribution of the variety of debtors and the overall quantity of debt by borrower age by the kind of school, as of September 30, 2024.

Though personal for-profit schools get blamed for delivering much less worth to their college students, they characterize lower than 1 / 4 of all debtors and fewer than a fifth of complete pupil mortgage debt, partially as a result of they characterize a smaller proportion of faculty enrollment.

Default charges had been affected by the cost pause throughout the pandemic, and the 12-month on-ramp after the pandemic. The default charge measures the proportion of loans getting into compensation throughout one federal fiscal yr that default by the tip of the third following federal fiscal yr. Accordingly, it is going to take a number of years after the tip of the pandemic earlier than the cohort default charges yield significant measurements.

Instantly previous to the pandemic, personal for-profit schools represented 19% of the loans getting into compensation, however 29% of the loans getting into default. The default charge of debtors at for-profit schools was one-and-a-half instances the common total default charge.

This compares with personal non-profit schools, which had been 25% of the loans getting into compensation and 18% of the loans getting into default, and public schools, which had been 56% of the loans getting into compensation and 54% of the loans getting into default.

Distribution Of Scholar Mortgage Debt By Age And Debt Measurement

This desk reveals the distribution of the variety of debtors by debt dimension and borrower age, as of September 30, 2024.

Greater than half of debtors are beneath age 50 and owe lower than $40,000.

Amongst debtors owing lower than $40,000, the variety of debtors peaked at age 25-34 after which declines because the debtors become older. Amongst debtors owing $40,000 or extra, the variety of debtors peaked at age 35-49 after which declines because the debtors become older. The larger age could also be an indication of the impression of debt from graduate {and professional} college.

This desk reveals the distribution of complete pupil mortgage {dollars} by debt dimension and borrower age, as of September 30, 2024.

This desk reveals the common pupil mortgage quantity by debt dimension and borrower age, as of September 30, 2024.

There may be not a lot variation inside every debt dimension group, aside from the youngest age group, which tends to have a better common mortgage quantity for debt dimension $40,000 to $200,000 and a decrease common mortgage quantity for debt dimension of $200,000 or extra.

You could find extra pupil mortgage debt statistics right here.

Extra Tales: