Right here’s a query from a podcast listener:

On a latest episode of TCAF (Ep. 171 with Harvey Schwartz) you and Josh point out how wealth administration has drastically modified over the past ~20 years particularly citing that CFP candidacies are at report highs whereas CFA candidacies are at report lows. Understanding you and Ben are each charterholders, what do you consider this development and the way would you recommend a youngster contemplate these choices for extra-curricular training and accreditation?

We get A LOT of questions on this.

Questions from younger individuals seeking to set themselves up for a prolonged profession in monetary companies. Questions from older individuals seeking to break into wealth administration. Questions from people who find themselves uncertain which path is true for them.

I’ve loads of ideas on the matter however let’s try the numbers first.

Suppose Advisor has an replace on the variety of CFPs:

In 2024, the variety of licensed monetary planners hit 103,093 — a rise of 4.3% over 2023, based on the Licensed Monetary Planner Board of Requirements, with a complete of 10,437 candidates sitting for the examination.

Almost 60% of newly minted CFPs are below the age of 35.

There are extra CFA charterholders than these with a CFP. The quantity I discovered from the CFA Institute was greater than 200,000 charterholders worldwide, so about double the variety of CFPs.

However the development is fascinating right here. The arrow is pointing up for CFPs and down for CFAs.

The Monetary Instances wrote a narrative on the traits in CFA examination participation:

The most recent accessible outcomes for CFA Institute, which oversees the checks, present 116,727 individuals sat all three ranges of the examination within the first eight months of the yr, down 2,735 on the identical interval in 2023.

Final yr there have been 163,000 examination registrations, 40 per cent down from the height of 270,456 in 2019.

Try the variety of exam-takers for the CFA by yr:

It’s in a extreme bear market from the pre-pandemic days.

I wrestled with this query after I was looking for my place within the finance business too. I’ve at all times been extra of an analytical thinker and didn’t have a lot publicity to wealth administration early in my profession so I went the CFA route.

Taking the examination didn’t essentially make me a greater investor however it did make me extra knowledgable and employable. Most of the roles I used to be making use of for out of faculty required you to both sit for the exams or have already got the CFA designation.

I do know for a incontrovertible fact that simply sitting for the extent one examination received me an interview that ultimately led to a job provide. So it was well worth the gruelly three years of learning.

However that was 15-20 years in the past. What if I needed to make that call now?

I’m not so positive I’d go the CFA route once more figuring out what I now know.

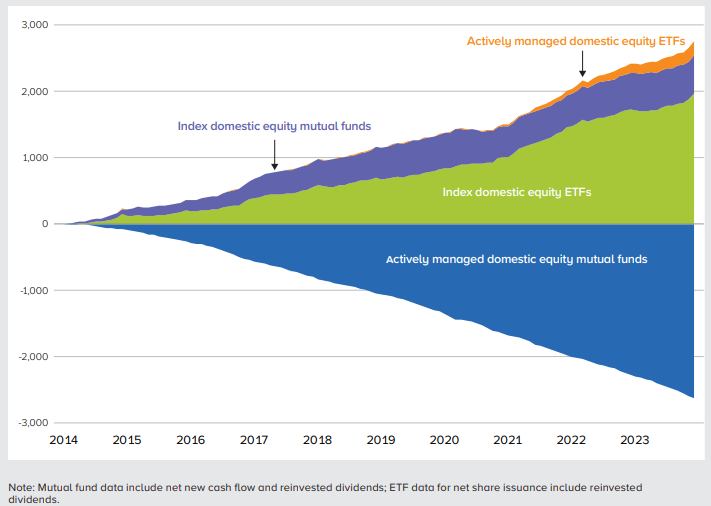

The CFA is a portfolio administration designation and whereas portfolio administration will at all times be vital, safety choice shouldn’t be an enormous precedence prefer it was prior to now. Index funds and ETFs are swallowing up the fund business. There’s a far higher emphasis on asset allocation, index publicity and thematic funds than old style energetic safety choice.

Simply have a look at the fund circulation knowledge (through ICI):

Then again, the marketplace for monetary recommendation is ready to blow up within the years forward.

I firmly imagine one of many greatest bull markets within the finance house over the subsequent 20-30 years will likely be offering monetary recommendation to retired child boomers and managing the transition of trillions of {dollars} to their heirs. There are 70 million child boomers who management $82 trillion of wealth. They want it to final all through retirement after which see a clean transition to their youngsters.

The CFP is a monetary planning designation and the necessity for monetary planning will solely develop in significance within the years forward. And most advisors are themselves getting into retirement age.

In VC-speak, the TAM is far greater for the CFP than the CFA.

Being a monetary advisor requires extra intrapersonal abilities so it’s not for everybody.

However if you wish to go the place the expansion is, the CFP makes extra sense than the CFA.

Michael and I talked about CFAs, CFPs and extra on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

The CFA vs. MBA Choice

Now right here’s what I’ve been studying currently:

Books: