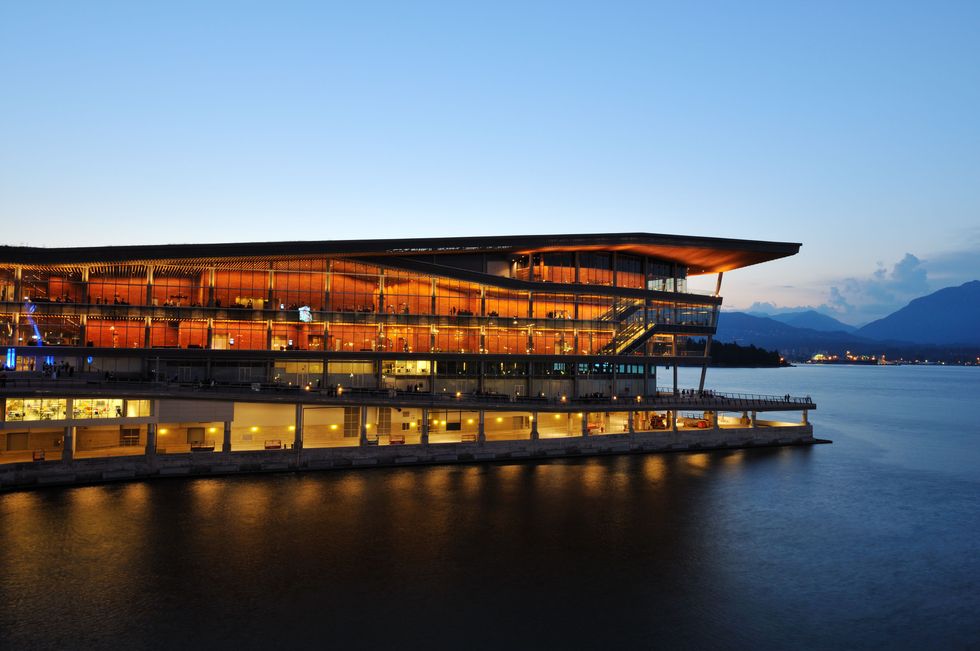

The annual Vancouver Useful resource Funding Convention (VRIC) passed off on the Vancouver Conference Heart from January 19 to twenty, bringing collectively an illustrious listing of audio system, panelists and visitors.

Get a style of the occasion with key insights shared through the two day present.

VRIC day 1: Trump commerce and gold outlook

Along with useful resource investing, VRIC had a powerful deal with geopolitics.

Throughout his opening remarks, Jay Martin, CEO of Cambridge Home, underscored Canada’s huge useful resource potential, whereas additionally highlighting that the nation is not capitalizing on its mineral abundance.

That is evidenced by Canada’s weak financial system — the slowest of all of the G7 nations.

Canada is at a tipping level, Jay Martin stated in his opening remarks at #VRIC2025. The nation has forgotten its aggressive benefit within the useful resource business, however has all the appropriate substances to return to its core energy.

“I really feel that Canada has a possibility proper now,”… pic.twitter.com/kCVvHSAdm4

— Useful resource Investing (@INN_Resource) January 19, 2025

Following his opening handle, Martin welcomed Dr. Pippa Malmgren, Col. Douglas Macgregor and Dr. Pascal Lottaz to the stage to debate the worldwide geopolitical outlook.

All three panelists remarked on the broad-based uncertainty on the planet, and Macgregor urged the viewers to look to tangible belongings for safety on this atmosphere.

In the course of the #VRIC International Geopolitical Outlook panel, Col. Douglas Macgregor emphasised that onerous belongings are crucial, whether or not you develop them or dig them up from the bottom. @DougAMacgregor #INNatVRIC #VRIC2025 #mining pic.twitter.com/y6dY9ZuSwd

— Useful resource Investing (@INN_Resource) January 19, 2025

This sentiment was reiterated by Frank Giustra, CEO of Fiore Group, through the gold outlook panel.

Giustra defined that gold will profit from US volatility and political instability.

“The Trump Commerce of 2025 is excessive volatility,” Lobo Tiggre stated throughout his Trump Commerce 2025 presentation at #VRIC. He advisable #gold for stability and gave recommendation to traders on the best way to reap the benefits of the volatility this 12 months. @duediligenceguy #INNatVRIC #VRIC2025 pic.twitter.com/h4VkBimHMB

— Useful resource Investing (@INN_Resource) January 19, 2025

“The obvious, primary factor to do, is purchase gold,” Tiggre informed the viewers. “And I am prepared to say that with gold close to nominal all-time highs, as a result of I do not see shopping for gold as a hypothesis on larger costs … It is as a result of it is financial savings, it is insurance coverage — it’s actual wealth you can maintain in your hand and use in case of utmost want.”

Later within the day, Martin sat down with Amir Adnani, president, CEO, director and founding father of Uranium Vitality (NYSEAMERICAN:UEC)to debate the rising demand for nuclear vitality.

Adnani highlighted the tech sector’s growing want for vitality to energy information facilities. He pointed to the most important tech and energy offers that occurred in 2024, notably Microsoft’s (NASDAQ:MSFT) nuclear energy buy settlement with Constellation Vitality (NASDAQ:CEG). The deal will see Constellation restart Three Mile Island Unit 1.

“When Trump says ‘drill, child, drill,’ what he actually means is ‘vitality, vitality, vitality’ — and that would not be higher captured within the tendencies we’re seeing with know-how firms,” stated Adnani.

VRIC day 2: Inventory picks and sizzling takes

VRIC’s second day additionally featured a wide selection of audio system providing priceless perception into commodities markets.

Kicking off the morning, David Lin of the David Lin Report spoke with Robert Kiyosaki, public speaker and creator of “Wealthy Dad, Poor Dad.” In the course of the chat, Kiyosaki confirmed off the board sport he and his spouse created in 1996, Cashflow. The well-known monetary speaker revealed that he initially wrote “Wealthy Dad, Poor Dad” as a way to promote the board sport.

Like yesterday’s audio system, Kiyosaki warned of greenback devaluation and urged traders to look to “exhausting belongings.”

He additionally supplied value forecasts for each gold and Bitcoin.

At #VRIC Robert Kiyosaki, creator of the guide Wealthy Dad, Poor Dad, informed the viewers he forecasts gold will attain US$15,000 this 12 months, and likewise shared a guess of US$250,000 for Bitcoin in 2025. @theRealKiyosaki #VRIC2025 #INNatVRIC pic.twitter.com/x6DG2BwF4F

— Useful resource Investing (@INN_Resource) January 20, 2025

Concern in regards to the affect potential US tariffs might have on Canada was additionally an ongoing theme through the second day of the convention, which coincided with Donald Trump’s inauguration.

Throughout a panel entitled “North America 2025: Inflation, Trump and a Inventory Market Bubble?” David Rosenberg, founder and president of Rosenberg Analysis, famous that cross-border tariffs would probably increase inflation in each nations.

There is no such thing as a urge for food within the US for inflation, so if Donald Trump’s insurance policies result in inflation, his legacy “will go down in flames,” David Rosenberg informed the viewers at #VRIC. @EconguyRosie #VRIC2025 #INNatVRIC pic.twitter.com/1i5DvNRxpS

— Useful resource Investing (@INN_Resource) January 20, 2025

Earlier than the mid-day break, legendary investor and speculator Rick Rule took to the stage for a presentation known as “Exhibitors at This Convention, That I Personal; Why, and What May Go Unsuitable.” The proprietor of Rule Funding Media listed almost two dozen firms that he has cash in, entering into alphabetical order.

In a jam packed room at #VRIC Rick Rule took to the stage to provide a fast overview of the shares he owns which might be in attendance on the convention. For individuals who missed it, discover the ticker symbols for his full listing under. @RealRickRule #VRIC2025 #INNatVRIC$ALS.TO $AHR.V $ARG.TO… pic.twitter.com/0A27SzSt3U

— Useful resource Investing (@INN_Resource) January 20, 2025

The businesses Rule listed embody:

- Altius Minerals (TSX:ALS,OTCQX:ATUSF)

- Amarc Sources (TSXV:AHR,OTCQB:AXREF)

- Dolly Varden Silver (TSXV:DV,OTCQX:DOLLF)

- Equinox Gold (TSX:EQX,NYSEAMERICAN:EQX)

- Fireweed Metals (TSXV:FWZ,OTCQX:FWEDF)

- Fortuna Silver Mines (TSX:FVI,NYSE:FSM)

- GoGold Sources (TSX:GGD,OTCQX:GLGDF)

- IsoEnergy (TSX:ISO,OTCQX:ISENF)

- Snowline Gold (TSXV:SGD,OTCQB:SNWGF)

- Uranium Vitality

- Vizsla Silver (TSX:VZLA,NYSEAMERICAN:VZLA)

Later within the day, financial geologist Brent Prepare dinner, founding father of Exploration Insights, took to the stage to supply insights on how traders can use drill outcomes to tell their funding selections.

“It is crucial that geologists and administration perceive what success seems to be like, and that is what I talked about proper from the start. What the economics are you want for deposit, what the deposit seems to be like after which calculate what you have to be seen within the outcomes as they arrive via. As a rule, you may discover the deadly flaw,” stated Prepare dinner.

Geologist Brent Prepare dinner suggested traders evaluating useful resource shares to verify the corporate’s exploration outcomes for consistency of grades, which he stated is extra vital than excessive grades over brief intervals.

One other tip he gave is to verify mineral useful resource estimates for the “CV”… pic.twitter.com/VFUblye5xD

— Useful resource Investing (@INN_Resource) January 20, 2025

Prepare dinner later joined Jamie Keech, govt chairman and co-founder of Vida Carbon, to speak about mining shares.

Jamie Keech informed traders they should not fall in love with a useful resource firm in a #VRIC discuss with Brent Prepare dinner and Trevor Corridor.

“Mining firms aren’t actual companies. They’re levered bets on commodity costs. They’re the type of shares you can purchase at cyclical bottoms… pic.twitter.com/GILMYcUL7K

— Useful resource Investing (@INN_Resource) January 20, 2025

As the ultimate day of the convention drew to a detailed, publication author Jeff Clark, editor of Paydirt Prospector, joined a number of different specialists to offer a silver market outlook. In the course of the panel, Clark reminded attendees that almost all of the dear metals catalysts because the Seventies have been unforeseeable.

Don’t overlook to comply with us @INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, maintain no direct funding curiosity in any firm talked about on this article.

Editorial Disclosure: The Investing Information Community doesn’t assure the accuracy or thoroughness of the knowledge reported within the interviews it conducts. The opinions expressed in these interviews don’t mirror the opinions of the Investing Information Community and don’t represent funding recommendation. All readers are inspired to carry out their very own due diligence.

Affiliate Disclosure: The Investing Information Community could earn fee from qualifying purchases or actions made via the hyperlinks or commercials on this web page.

From Your Website Articles

Associated Articles Across the Net