I’m a giant proponent of simplicity, primarily as a result of I’ve witnessed the ill-effects of complexity within the finance world.

Recommendation doesn’t must be sophisticated to be efficient.

The 2 most essential medical breakthroughs of the fashionable period are probably penicillin and washing your palms to cease the unfold of an infection in hospitals.

Life expectations are rising as a result of individuals stop smoking, put on seatbelts and apply sunscreen.

There are in fact different components at play right here however more often than not the easy explanations get you many of the method there.

Inventory market pundits, analysts and portfolio managers spend quite a lot of time and power analyzing financial and monetary information — financial development, inflation, rates of interest, company earnings, monetary statements, authorities insurance policies, and many others.

Many alternative variables impression particular person shares and the inventory market as an entire so it pays to solid a large internet when attempting to know the drivers.

I additionally assume there are some easy explanations within the markets that folks don’t pay sufficient consideration to.

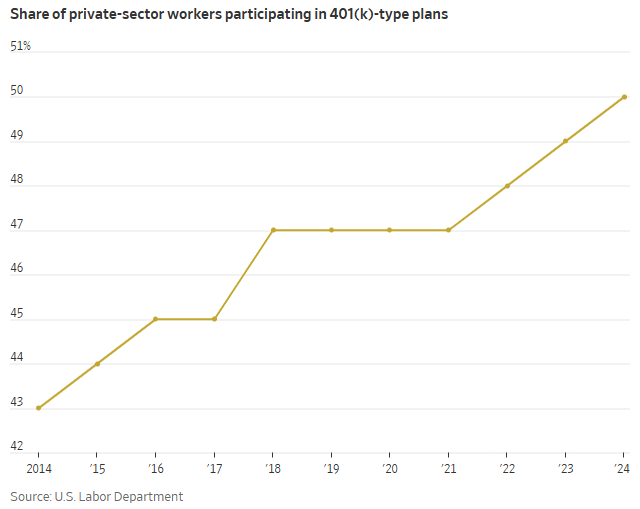

The Wall Road Journal talks in regards to the development in outlined contribution retirement plans:

It took practically 50 years, however half of private-sector staff are saving in 401(ok)s for the primary time.

Lengthy after workplaces began utilizing these retirement plans rather than conventional pensions, they’re lastly reaching a tipping level. Round 70% of private-sector workers within the U.S. now have entry to a 401(ok)-style retirement plan. A decade earlier, 60% had entry and 43% contributed, in response to the U.S. Labor Division.

That is excellent news.

The chart says loads:

There’s loads of short-term speculative habits occurring within the markets nowadays however tax-deferred retirement plans encourage good long-term habits — opt-out sign-ups, computerized contributions, targetdate funds, computerized rebalancing, escalated financial savings charges, and many others.

Persons are shopping for shares at common intervals. The variety of individuals doing so will increase each single 12 months.

Worth is pushed by provide and demand. Extra individuals shopping for shares, whatever the market atmosphere, has to have an effect.

Demographics may also be one of many less complicated explanations for a lot of financial traits over the subsequent 20-30 years.

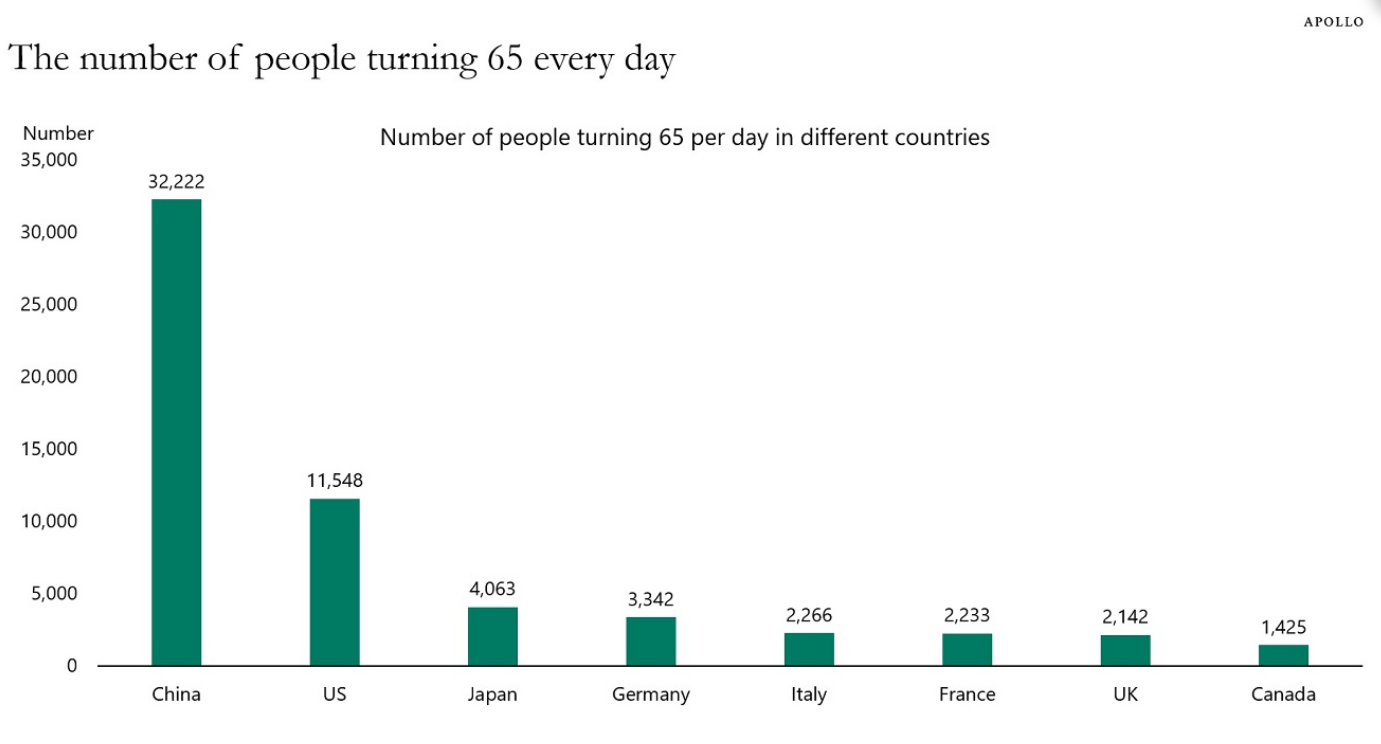

Torsten Slok reveals the variety of individuals turning 65 on daily basis by nation:

In China, greater than 30,000 persons are hitting retirement age on daily basis. In america, it’s greater than 11,000. This cohort controls an infinite quantity of wealth (greater than $82 trillion within the U.S. alone).

So the place are the impacts of an growing older inhabitants with a rising pile of wealth being felt?

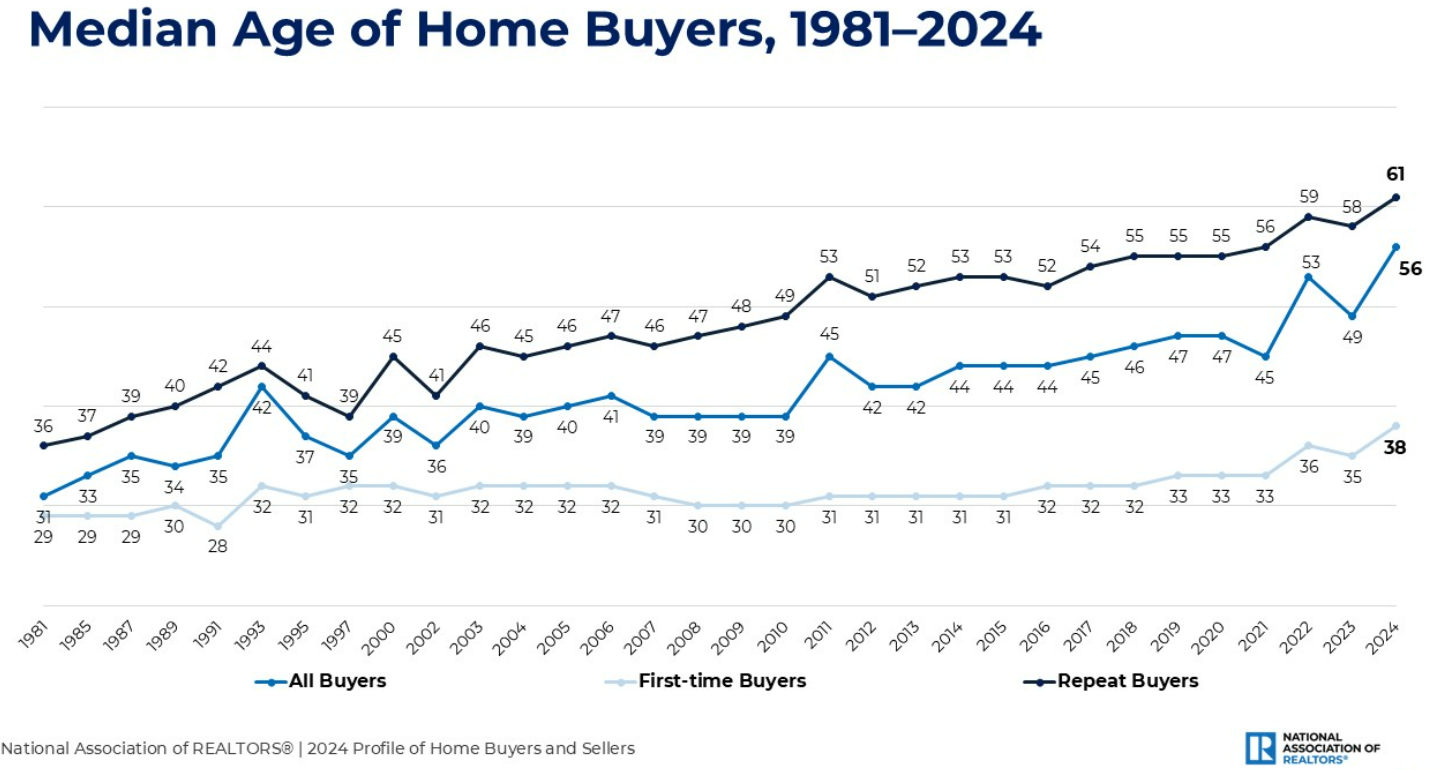

You may clearly see it within the housing market:

The median age of first-time homebuyers has gone from 31 in 1981 to 38 now. It was 33 as just lately as 2021, which mirror how way more costly it’s to purchase a home nowadays.

However take a look at the median age of repeat patrons — from 36 in 1981 to 61 right this moment!

It definitely helps that many child boomers have a considerable amount of fairness of their properties. It’s additionally true that some 40% of all residential actual property is owned outright, which means no mortgage.

That makes it a lot simpler for older householders to maneuver with out having to cope with 7% mortgage charges in lots of circumstances.

All of that child boomer wealth goes to make an impression for the subsequent era attempting to purchase a home too.

The sum of money that will likely be inherited within the coming years has been estimated at anyplace from $84 trillion to $105 trillion. However that cash received’t be evenly distributed. The highest 2% controls round half of that wealth.

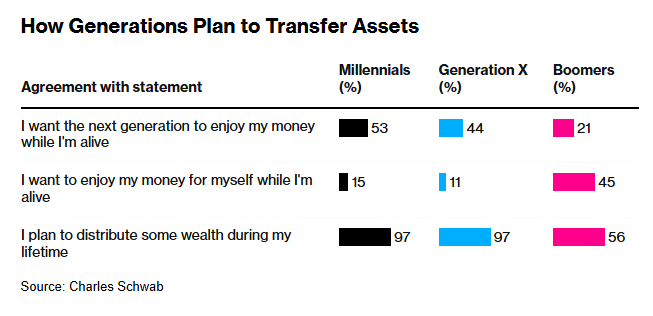

Lots of the child boomer era plans on ready to move that cash down:

If most of that cash has a time horizon that skips a era, versus being spent down, it’s onerous to ascertain the wealthiest era in historical past crashing the inventory market by promoting their property in retirement.

I’m not right here to let you know the inventory market can’t or received’t go down sooner or later. After all it’s going to. We simply had a bear market two years in the past.

However there are forces at play within the inventory market which can be extending investor time horizons.

Good luck betting in opposition to these forces within the long-run.

Additional Studying:

The Computerized Investing Revolution