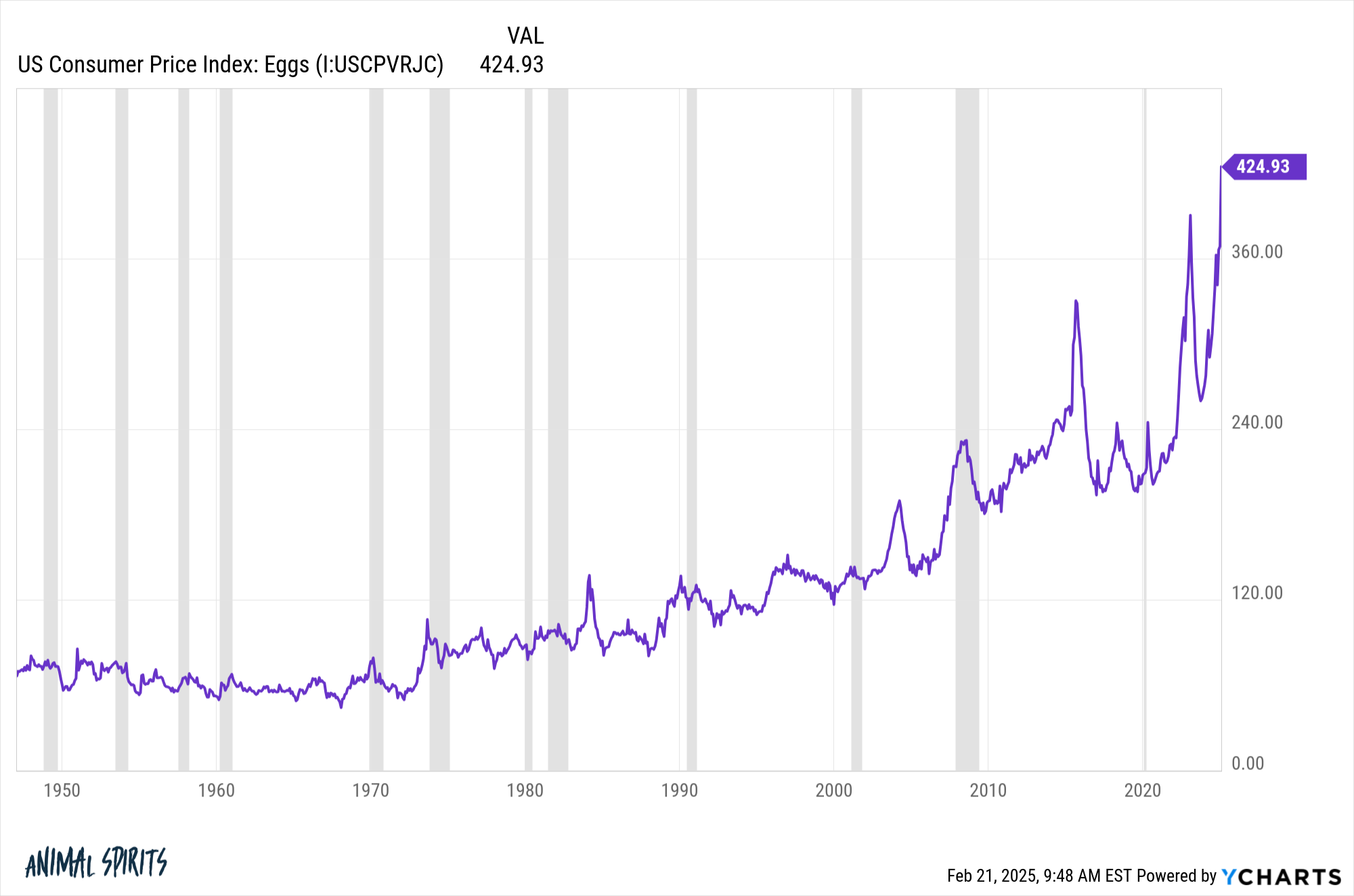

The most well liked chart within the markets proper now just isn’t Nvidia, Fartcoin or one of many quantum computing shares…it’s the value of eggs:

It appears to be like like a chart of Bitcoin, Gamestop or the most popular AI inventory on the road.

Since 1947, the value of eggs has grown at an annual fee of two.4%, a couple of p.c decrease than the general annual inflation fee of three.5%.

However during the last 5 years egg costs have gone up an en extraordinary 15.5% versus the general inflation fee of 4.1%. Egg costs have kind of doubled up to now 12 months.

A nasty pressure of chicken flu has impacted our egg-laying buddies, constrained provide, and raised costs. It’s estimated that greater than 100 million hens have been misplaced because the chicken flu broke out in 2022. Issues are getting loopy on the grocery shops.

That is from Bloomberg:

Grocery shops from New York to Chicago and Los Angeles have already restricted purchases, whereas Waffle Home added a brief egg surcharge of fifty cents per unit.

The state of affairs has gotten so dire that at a busy Complete Meals in Chicago’s Lincoln Park neighborhood, the egg cabinets had been fully empty on Tuesday night, rendering purchase-limit indicators redundant.

Egg costs have turn out to be the latest member of the inflation zeitgeist this decade. There are memes like this on social media on a regular basis now:

It’s not simply social media. I’ve had loads of conversations with folks about quickly rising egg costs, a scarcity of provide and, for some, a battle to seek out eggs on the retailer.

Clearly, larger costs on the grocery retailer are painful to your backside line. Eggs are a superb supply of protein so it’s comprehensible why persons are so up in arms about paying extra on the checkout counter.

However there’s one thing else occurring right here. Egg costs are extremely risky. Ultimately one would count on costs to return again to Earth. When that occurs it’s not like persons are going to rejoice. The ache of upper costs is at all times worse than the enjoyment one receives from decrease costs.

Daniel Pulter, a professor at Purdue College, studied weekly egg sale information in California to find out how the modifications in worth impacted shopper demand. Ori and Rom Brafman sum up Pulter’s work of their e book Sway:

Now, conventional financial concept holds that individuals ought to react to cost fluctuations with equal depth whether or not the value strikes up or down. If the value goes down a bit, we purchase a little bit extra. If the value goes up a bit, we purchase rather less. In different phrases, economists wouldn’t count on folks to be extra delicate to cost will increase than to cost decreases. However what Putler discovered was that customers utterly overreacted when costs rose.

It seems that, relating to worth will increase, egg patrons are a delicate bunch. In case you scale back the value of eggs, shoppers purchase a little bit extra. However when the value of eggs rises, they reduce their consumption by two and a half occasions.

Egg costs have an uneven demand profile.

When costs drop folks purchase a little bit extra. However when costs rise they lower means again on egg consumption.

Folks overreact to cost beneficial properties as a result of losses sting twice as unhealthy as beneficial properties really feel good. You would name this irrational, however I favor to assume it’s simply who we’re as people–it’s in our DNA.

For this reason loss aversion is an important idea in all of finance.

It shapes your actions, overreactions and notion of threat.

That feeling of loss aversion by no means goes away, so the trick is discovering methods to cope with actual and perceived losses in a means that retains your feelings out of the decision-making course of.

Additional Studying:

Why the Inventory Market Makes You Really feel Dangerous All of the Time

This content material, which incorporates security-related opinions and/or info, is offered for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There might be no ensures or assurances that the views expressed right here might be relevant for any explicit details or circumstances, and shouldn’t be relied upon in any method. It is best to seek the advice of your personal advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “submit” (together with any associated weblog, podcasts, movies, and social media) displays the non-public opinions, viewpoints, and analyses of the Ritholtz Wealth Administration staff offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory providers offered by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments shopper.

References to any securities or digital belongings, or efficiency information, are for illustrative functions solely and don’t represent an funding advice or supply to supply funding advisory providers. Charts and graphs offered inside are for informational functions solely and shouldn’t be relied upon when making any funding choice. Previous efficiency just isn’t indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to alter with out discover and should differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives cost from numerous entities for ads in affiliated podcasts, blogs and emails. Inclusion of such ads doesn’t represent or indicate endorsement, sponsorship or advice thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its staff. Investments in securities contain the chance of loss. For extra commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.