Investor Insights

Chariot Company presents a singular worth proposition for seasoned traders, with its strategic possession of the most important land bundle for lithium exploration within the US and a portfolio of non-core belongings offering important income alternatives.

Overview

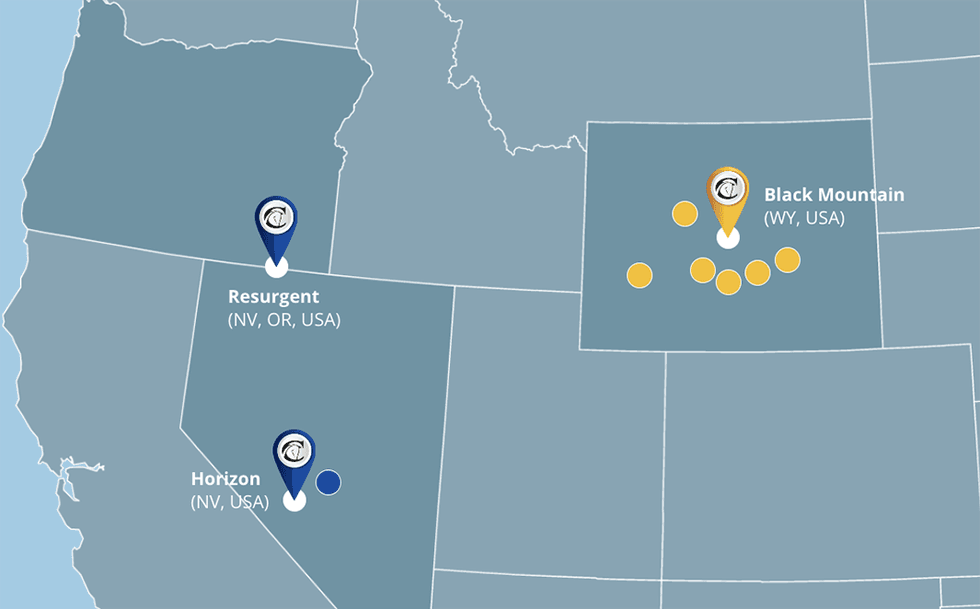

Chariot Company (ASX:CC9) is the most important landholder for lithium exploration within the US. It has a technique to focus on each hardrock lithium in Wyoming and claystone lithium in Nevada and Oregon. The flagship Black Mountain challenge in Wyoming has proven important mineralization with grades of as much as 6.68 p.c Li2O from rock chip samples. Chariot’s six different onerous rock initiatives in Wyoming span 443 claims masking 3,585 hectares.

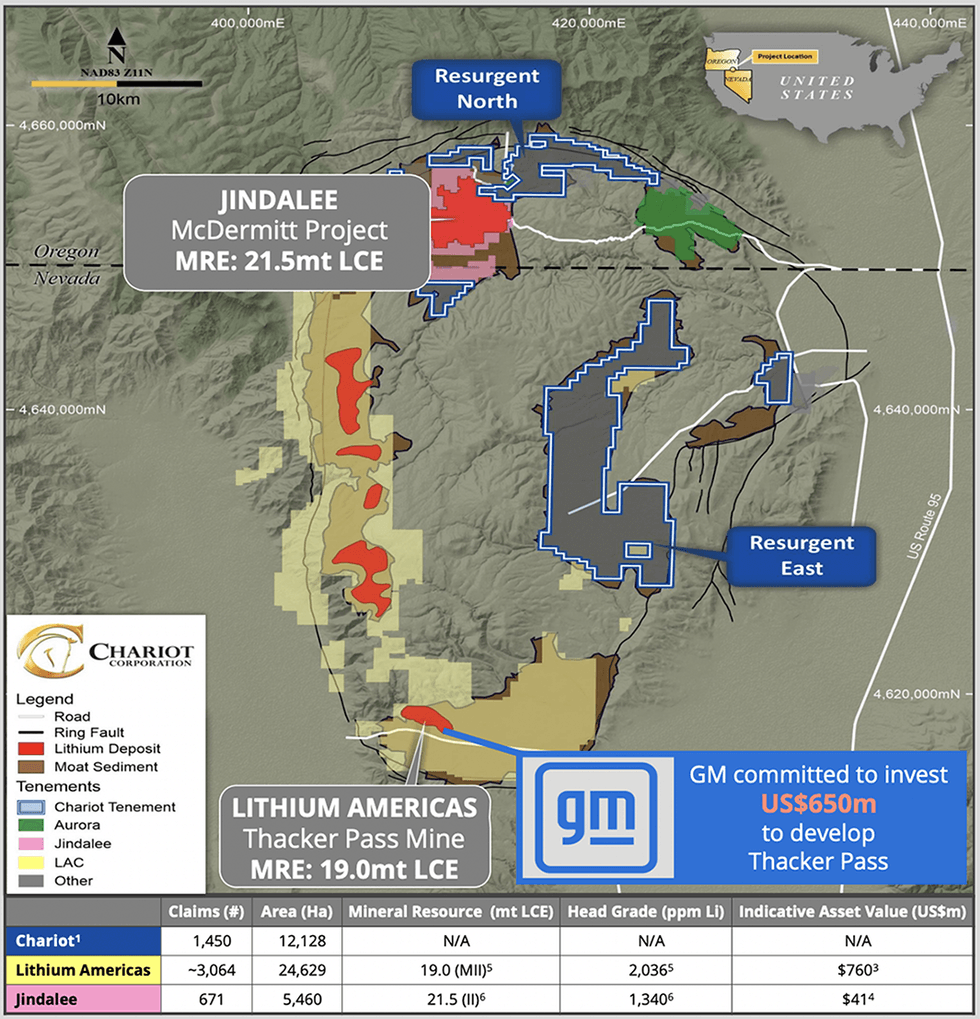

The second flagship challenge, Resurgent, has the second largest land place within the McDermitt Caldera, which hosts the 2 largest lithium assets found to this point (Thacker Move with 44.5 million tons (Mt) lithium carbonate equal (LCE) and McDermitt at 21.5 Mt LCE). The current $955-million funding in Thacker Move by Common Motors signifies curiosity from automakers seeking to safe a provide of battery uncooked supplies. The McDermitt Caldera’s dimension and scale potential current a possibility for Automotive OEMs, battery producers and others to acquire large-scale provide to fulfill their progress plans.

Because the world’s demand for lithium continues to develop, Chariot’s exploration and growth efforts within the US are well-timed and supply traders publicity to the quickly rising lithium market.

The corporate believes its two core initiatives, Black Mountain and Resurgent, symbolize early, potential lithium alternatives in the USA. Chariot has accomplished its section 1 drill program on the Black Mountain challenge consisting of 9 shallow holes, drilled from a complete of 1,132 metres. Part 2 drilling has commenced, which incorporates as much as 18 drill holes focusing on a high-grade spodumene useful resource to help the institution of a pilot mine.

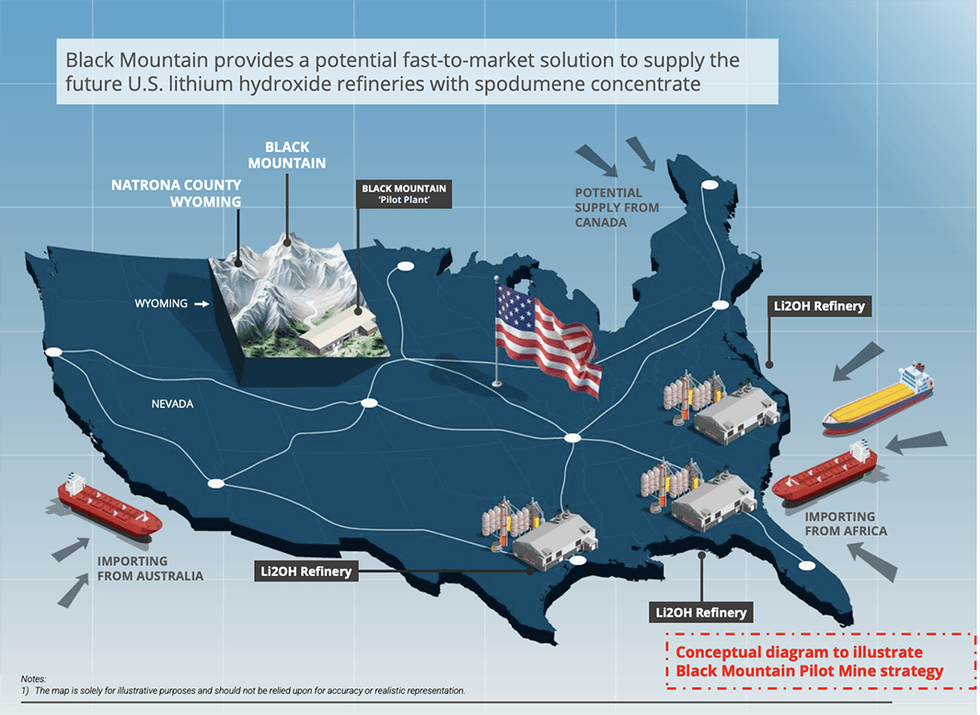

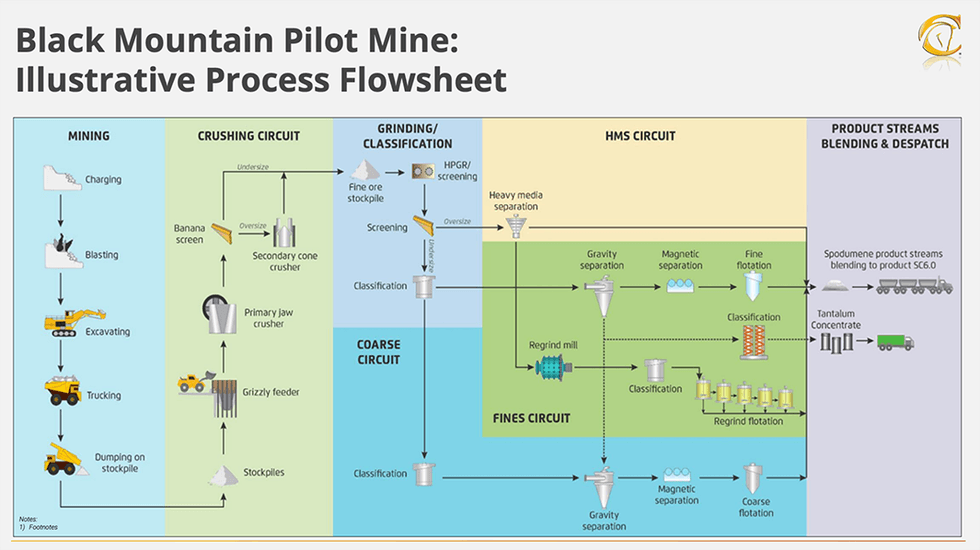

Chariot Company introduced a revised technique for the Black Mountain onerous rock lithium challenge to ascertain a small-scale “pilot mine”. Chariot goals to provide spodumene focus to a number of lithium hydroxide refineries beneath building within the southwestern United States. Strategically positioned in Wyoming, Chariot can leverage Wyoming’s small-mine allow system to supply short-term money circulate and doubtlessly optimize the event of larger-scale mining operations sooner or later.

Chariot boasts a world-class workforce with robust observe information in mining, exploration and the monetary companies sectors. The administration has important company and funding banking expertise. CEO, Shanthar Pathmanathan was an oil and funding banker with Macquarie and Deutsche Financial institution. On the geological aspect, Neil Stuart who’s a non-executive director is a lithium trade veteran having beforehand based Orocobre Ltd (which merged with Galaxy Sources and later with Livent) to type Arcadium Lithium, one of many largest lithium producers on the planet which has lately been acquired by Rio Tinto. The exploration workforce is led by Dr. Edward Max Baker, a geologist with over 40 years of expertise and several other discoveries. He was the chief geologist at Newcrest Mining, MIM Holdings, Rennison Goldfields and Mount Isa Mines. The collective expertise of the administration workforce, from funding banking (with fundraising and M&A expertise) to useful resource discoveries, will likely be helpful in advancing the corporate’s core initiatives.

Firm Highlights

- Chariot Company is a mineral exploration firm centered on discovering and growing high-grade and near-surface lithium alternatives within the US.

- Chariot holds the most important land place for lithium exploration within the US with onerous rock lithium and claystone hosted lithium exploration belongings.

- The corporate commenced buying and selling on the ASX in October 2023 after closing a extremely sought-after and oversubscribed AU$9 million preliminary public providing (which is along with AU$14.8 million being raised privately to assemble the portfolio).

- It’s presently centered on its two core initiatives within the US: (1) the Black Mountain challenge, a tough rock lithium challenge positioned in Wyoming; and (2) the Resurgent challenge, a claystone lithium challenge positioned in Oregon and Nevada.

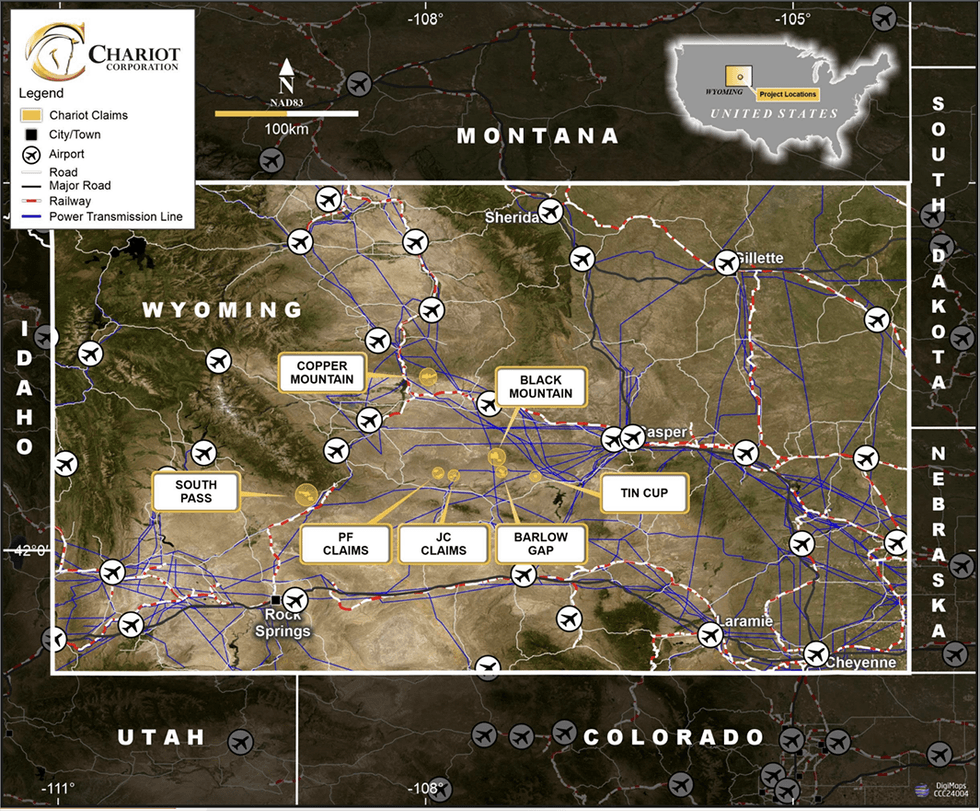

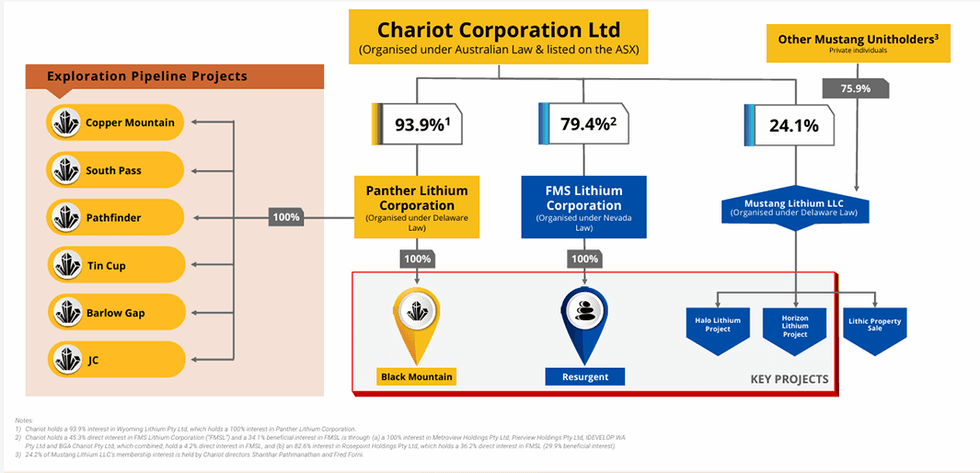

- Chariot additionally holds an exploration pipeline of six initiatives in Wyoming together with Copper Mountain, South Move, Tin Cup, Barlow Hole, Pathfinder and JC initiatives. These initiatives are potential for onerous rock lithium.

- By the corporate’s curiosity in Mustang Lithium, Chariot additionally has publicity to 2 claystone initiatives the place substantial preliminary drilling has been accomplished – Horizon Lithium and Halo Lithium. Horizon Lithium has a lithium useful resource estimate of 1.3 million tonnes indicated LCE and eight.8 million tonnes LCE inferred.

- Chariot lately introduced a revised technique for the Black Mountain onerous rock lithium challenge to develop a small-scale “pilot mine” to provide spodumene focus to a number of lithium hydroxide refineries beneath building within the southwestern United States.

- Chariot additionally holds pursuits in a number of initiatives which were both bought or conditionally divested by way of possibility agreements to publicly listed corporations. A publicly listed counterparty operates every of the divested initiatives and relying upon the actual transaction, the initiatives generate extra income for Chariot within the type of future funds and royalties.

- Chariot presents traders publicity to the nascent and quickly rising US lithium market.

Key Initiatives

Black Mountain Undertaking, Wyoming

The Black Mountain challenge is Chariot’s flagship onerous rock lithium challenge positioned in Natrona County, roughly halfway between Casper and Riverton, Wyoming. Chariot initially held a 91.9 p.c stake within the challenge with 134 mining claims masking 878 hectares. In 2024, the corporate expanded the challenge with 218 contiguous claims leading to a 206 p.c enhance in challenge tenure space. Black Mountain now includes 352 claims masking 2,686 hectares of tenure which subsequently elevated Chariot’s possession pursuits in its Wyoming lithium portfolio to 93.9 p.c.

The challenge is well-serviced by present roads and infrastructure. The declare space was acquired through declare staking of public land administered by the US Bureau of Land Administration.

The challenge options giant pegmatite outcrops on the floor with spodumene and tantalum mineralisation. Floor rock chip samples returned assays of as much as 6.38 p.c lithium oxide.

Black Mountain could symbolize a major onerous rock lithium alternative in a tier-1 mining jurisdiction within the US. The asset options a wonderful mixture of geological elements, and a supportive regulatory regime and is positioned in a largely unpopulated a part of Wyoming.

In connection to the corporate’s shift to establishing a pilot mine, the next elements regarding the Black Mountain Undertaking render it significantly appropriate for this purpose:

- Indications of near-surface lithium mineralization at Black Mountain make it appropriate for a shallow, open-pit pilot mine.

- Wyoming’s advantageous small-mine allow system presents a pathway for small mine permits that doesn’t impose limits on the mineral quantity which could be extracted however relatively locations annual limits on the mining actions to 10 acres (4.05 hectares) of disturbance and 35,000 cubic yards (26,760 cubic metres) of overburden elimination (refer Half 3 of this announcement).

- Black Mountain’s proximity to US lithium hydroxide refineries presently beneath building within the southwestern United States is anticipated to supply a geographic benefit in advertising and marketing product extracted from the mine.

Resurgent Undertaking, Nevada and Oregon

The Resurgent challenge is a claystone-hosted lithium challenge positioned within the McDermitt Caldera in Oregon and Nevada. The corporate owns a 79.4 p.c stake on this challenge. The Resurgent challenge includes 1,450 claims masking 12,128 hectares and is additional subdivided into two principal declare areas, recognized as ‘Resurgent North’ and ‘Resurgent East.’ Chariot has the second-largest land place within the McDermitt Caldera, which hosts two of the most important lithium mineral assets in North America, with a mixed mineral useful resource estimate of over 40 Mt LCE – Thacker Move at 19.1 Mt LCE and McDermitt at 21.5 Mt LCE.

The Resurgent North challenge targets the identical sedimentary models that host Jindalee Sources’ (ASX:JRL) McDermitt challenge with a mineral useful resource estimate of 21.5 Mt LCE. A floor sampling marketing campaign at Resurgent North performed in 2021 involving 289 samples returned values as excessive as 3,865 ppm lithium (over 3 times typical lithium claystone MRE cut-off grade). Of the 289 samples, 70 samples returned values higher than 100 ppm lithium, 20 samples returned values higher than 1,000 ppm lithium and 10 samples returned values higher than 2,000 ppm lithium.

The Resurgent East challenge targets the identical sedimentary models that host Lithium Americas’ (NYSE:LAC) Thacker Move lithium deposit (MRE at 19.1 Mt LCE). The similarity in geological traits with the 2 largest lithium deposits within the US additional validates the potential for a large-scale high-grade lithium discovery at Resurgent.

Exploration Pipeline Initiatives

Apart from the 2 core initiatives, the corporate has a pipeline of six lithium exploration initiatives comprising 443 claims and masking 3,585 hectares. Every of them is described under:

- Copper Mountain Undertaking: The challenge is positioned ~80 kilometres northwest of Black Mountain in Fremont County, Wyoming. It includes 83 mining claims masking 648 hectares. Copper Mountain has an extended historical past of prospecting and artisanal-scale manufacturing having been traditionally mined for mica, feldspar, beryl, lepidolite and tantalite. The corporate has already recognized a number of pegmatite goal areas and has plans for a geochemical and floor magnetics survey along with geological mapping.

- South Move Undertaking: The challenge is positioned in Fremont County, Wyoming, and includes 214 mining claims masking 1,750 hectares. This can be a giant and extremely potential challenge with an abundance of outcropping pegmatites that happen in swarms. The corporate notes the person pegmatites on the challenge may vary as much as a number of hundred metres large and several other thousand metres lengthy. There was no prior exploration for onerous rock lithium within the South Move challenge space.

- Regional Wyoming Exploration Pipeline Initiatives: It includes 4 onerous rock lithium mining initiatives specifically Tin Cup, Pathfinder, Barlow Hole and JC, comprising 146 mining claims masking 1,146 hectares.

- Barlow Hole Undertaking: This challenge is positioned in Natrona County, Wyoming, and includes 60 mining claims masking 501 hectares. That is an early-stage onerous rock lithium exploration challenge with outcropping pegmatites on a northeast pattern.

- Tin Cup Undertaking: The challenge is positioned in Fremont County, Wyoming, and includes 45 mining claims masking 376 hectares. There’s a lengthy historical past of exploration at The Tin Cup mining district relationship again to 1907. The area has been identified for small-scale mining for gold, copper and numerous gems together with crimson jasper, ruby and jade. That is an early-stage onerous rock lithium exploration challenge with outcropping pegmatites.

- Pathfinder Undertaking: That is an early-stage onerous rock lithium challenge positioned in Natrona County, and includes 32 mining claims masking 234 hectares.

- JC Undertaking: Positioned in Fremont County, Wyoming, the challenge includes 9 mining declare blocks spanning 75 hectares. That is an early-stage onerous rock lithium exploration challenge that options a number of small excavation pits and outcropping pegmatite dykes.

Divestment Initiatives

Chariot has been actively centered on creating worth through divestment of chosen lithium belongings in its portfolio, which embrace the next belongings: Lithic & Mustang (possession 21.4 p.c) and the WA Lithium portfolio (Chariot was the one hundred pc proprietor of this property previous to the sale to St George Mining Ltd). As well as, Chariot by way of its curiosity in Mustang Lithium has publicity to the Horizon and Halo claystone lithium initiatives in Nevada, USA. Each initiatives have accomplished drilling campaigns and Horizon introduced a useful resource of 1.3 million tonnes LCE and eight.8 million tonnes LCE inferred. These divestments and pursuits have the potential to generate extra gross proceeds (money and stock-based consideration) for Chariot along with future royalty funds.

The corporate has recognized 4 extra initiatives for divestment: Lida challenge (Nevada), Amargosa challenge (Nevada), Nyamukono challenge (Zimbabwe), and Mardabilla challenge (Western Australia).

Administration Staff

Shanthar Pathmanathan – Managing Director

Shanthar Pathmanathan has 14 years of funding banking expertise within the metals and mining, oil and fuel and chemical substances sectors. He was the CEO and managing director of Lithium Consolidated, an ASX-listed firm, which had one of many largest portfolios of onerous rock lithium exploration belongings, globally. Earlier than that, he held numerous funding roles with Deutsche Financial institution and Macquarie Group. He has a Bachelor of Legal guidelines from the College of Western Australia.

Frederick Forni – Govt Director

Frederick Forni is a senior finance skilled with over 25 years of funding banking expertise. He was a former senior managing director of Macquarie Holdings (USA) and held non-executive director roles with quite a few Macquarie Group entities and GLI Finance. He holds a B.A. in economics from Connecticut Faculty, a J.D., awarded cum laude, from Georgetown College Legislation Heart and an LL.M. in taxation from New York College Legislation College.

Neil Stuart – Non-executive Director

Neil Stuart is an exploration geologist with over 40 years’ of expertise and is a member of The Australian Institute of Geoscientists and a Fellow of The Australasian Institute of Mining and Metallurgy. He was a founding director of Orocobre Restricted, now Alkem (ASX:AKE). He has appreciable expertise throughout a number of commodities and was closely concerned in challenge delineation and acquisition in Australia, Mexico and Argentina. Over the past 20 years, he was concerned with the exploration and industrial growth of lithium initiatives. Stuart is on the board of quite a few ASX-listed corporations and is a graduate of the College of Melbourne (BSc.) and James Prepare dinner College (MSc.).

Dr. Edward Max Baker – Geological Advisor

Dr. Edward Max Baker is a Ph.D. geologist and a fellow of AusIMM. Baker has over 40 years of expertise and has made a number of discoveries. Baker was chief geologist for Newcrest Mining, MIM Holdings, Rennison Goldfields and Mount Isa Mines. Baker was co-founder and beforehand a vice-president of exploration at New York Inventory Trade-listed Integra Sources (NYSE:ITRG).

Ramesh Chakrapani – Chief Technique Officer

Ramesh Chakrapani has over 20 years of expertise within the funding banking and different asset investing area. Of which, over 15 years have been spent at The Blackstone Group the place he was a managing director and a member of the Hedge Fund Options Particular Conditions Investing Group. Chakrapani has invested throughout a various set of industries, asset courses, geographies and liquidity profiles, and has represented The Blackstone Group on the boards of chosen investments. He has a B.A. from Yale College.

David Bethke – Exploration Geologist

David Bethke is an exploration geologist with 6 years of expertise working primarily within the Mountain West and Alaska areas of the USA, specializing in each gold and lithium deposits. Throughout his profession, he has labored carefully with corporations equivalent to Jindalee and United Lithium to discover, pattern, drill, and map lithium deposits hosted in each onerous rock and claystone. In Alaska, he has labored in manufacturing for a number of well-known gold mining corporations, together with Coeur Mining and Northern Star Sources. David graduated cum laude from the College of Idaho with levels in geology and Spanish.