It’s well-known that we’re embarking on an estimated $70 trillion generational wealth switch that’s positive to influence the monetary providers trade, and wealth and funding trade particularly. In keeping with a McKinsey & Firm report girls would be the largest beneficiaries of the wealth switch and management a lot of the $30 trillion in monetary belongings. In keeping with the report, girls reside 5 years longer than males, are anticipated to make extra monetary family selections, and 70% of girls change advisors inside one 12 months of their partner dying.

So, do monetary advisors must take this demographic energy shift critically? Completely.

Profiting from the brand new alternative

From the above stats, it’s simple to see why it’s vital to know find out how to cater to and capitalize on girls’s funding targets and targets and perceive how they might differ from males’s. Research present that girls could also be extra risk-averse when investing and make investments much less – but additionally are prone to be extra aware about moral and impactful investing – together with investing with extra women-owned or lead funds and SMAs.

On this market setting, all traders are more and more prone to look to diversify their belongings exterior of the normal U.S. and overseas equities, fastened earnings and alternate options. And in opposition to this backdrop, a method so as to add range into an funding portfolio could also be to think about including extra women-owned asset administration companies and women-managed funding methods to their record of permitted managers to higher align their investments with their values and beliefs, and improve return on funding.

Monetary advisors trying to keep aggressive and leverage this new alternative ought to begin pondering now about find out how to meet altering expectations and diversified calls for from new clientele.

Fortunately, the Zephyr platform may help monetary advisors be higher geared up to help their shoppers who want to diversify their investments throughout genders when constructing funding portfolios.

No detective work wanted: Discovering prime tier women-owned SMAs

It’s no secret that the monetary providers and funding administration industries are dominated by males. In truth, girls make up between 25% to 30% of all U.S. monetary advisors, regardless of being the vast majority of the inhabitants at practically 51% (U.S. Census Bureau).

Towards this backdrop, a method so as to add range into an funding portfolio could also be to think about including extra women-owned asset administration companies and women-managed funding methods to their record of permitted managers to higher align investments with consumer values and targets, and improve return on funding.

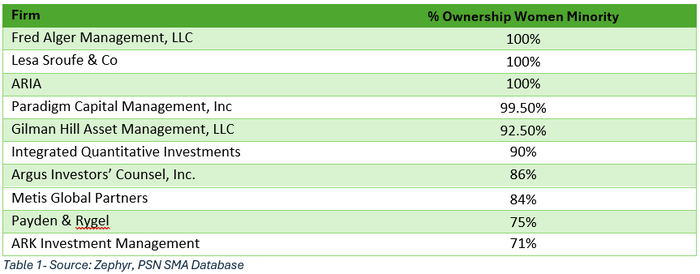

There are greater than 2,800 SMA suppliers inside Zephyr’s PSN SMA database. Of these 2,800 companies, 54 of them are majority women-owned (% possession > 50). Listed here are some funding administration companies which might be majority owned by girls and provide funding methods which were awarded as PSN Prime Weapons*.

Along with top-level searches for women-owned asset administration companies (and checking which provide prime performing SMAs), the Zephyr platform additionally enables you to conduct the identical filter on women-managed SMAs methods. Beneath are some women-managed SMA methods which have just lately been acknowledged as PSN Prime Weapons.

Girls are on the cusp of controlling the vast majority of monetary belongings by 2030, which makes it essential for monetary advisors to know find out how to finest cater to a rising variety of potential new shoppers. To assist girls (and all shoppers) obtain their funding targets, monetary advisors ought to take into account individually managed accounts, which might present enhanced transparency, management and adaptability to higher align your shoppers’ funding targets to their values and beliefs.

PSN Prime Weapons are an vital reference for plan sponsors, monetary advisors and asset managers, showcasing the perfect performing separate accounts, managed accounts and managed ETF methods every quarter. Discover out extra about how we choose PSN Prime Weapons winners, or how you possibly can get entangled in submitting information and being up for choice!