Alaris Acquisitions, a sell-side M&A consultancy to the wealth administration business, has launched The Alaris Lens Utility, a expertise platform to assist match consumers and sellers within the registered funding advisor area.

“The M&A panorama, in our view, simply looks like a bunch of noise,” stated Allen Darby, founder and CEO of Alaris. “What we’re making an attempt to create is a greater technique to reduce by means of all of the muddle and hopefully take dealmaking to a brand new stage, ushering in some much-needed transparency and readability for anybody who’s fascinated by transacting with a bigger agency.”

Previous to launching Alaris in 2019, Darby led the outbound M&A actions for United Capital. Darby created Alaris to deliver the mannequin he used at United Capital to the broader RIA M&A area. Jacqueline Martinez, who beforehand co-led the M&A staff at United Capital and certainly one of WealthManagement.com’s Ten to Watch in 2025, jumped on board with Darby in 2021 as managing accomplice.

Darby believes the prevailing matchmaking course of on this business is flawed. Traditionally, advisors had two suboptimal processes for locating a purchaser: going solo, negotiating with the consumers on their very own or hiring a sell-side advisor, like Alaris.

Whereas most RIAs are on the lookout for an excellent cultural match, the everyday sell-side advisor nonetheless makes use of the monetary public sale to match consumers and sellers.

“They undergo a couple of rounds eliminating consumers primarily based on the insufficiency of the provide,” Darby stated. “That’s their course of for narrowing the sector. It is fully math-centric. And the issue with that’s, it’s treating this transaction, which is frankly extra like a wedding, like promoting a bit of actual property or a automotive. There’s zero try to attempt to measure compatibility between the corporations.”

Lens goes concerning the course of otherwise, Darby stated. For the final 4 years, Darby and his staff have been cataloging a few of the greatest consumers within the business, from Edelman Monetary Engines and Prime Capital Funding Advisors to regional consumers like Trendy Wealth. They now boast 70 consumers on their roster, with whom they’ve spent no less than 30 hours every, usually of their places of work conducting qualitative interviews with their management groups. They’ve collected about 150 totally different knowledge factors on every purchaser and compiled all of this into the Lens utility.

“Inviting 50 or extra consumers into the method is, in my view, totally absurd,” Darby stated in a press release. “With that many potential consumers concerned, it turns into unattainable to dedicate the mandatory time to actually join along with your future accomplice and attain a spot of real cultural alignment.”

The app is constructed into two components. The primary is a “data heart,” a reside advertising and marketing website the place sellers can get educated on all issues M&A within the wealth administration area.

The second piece is an AI matching algorithm, which runs a two-way compatibility display screen between consumers and sellers.

For the sellers, Alaris captures the agency’s staffing, shopper segmentation, shopper expertise, expertise stack, operations and financials—the entire knowledge a purchaser would wish to know to judge the enterprise. It additionally captures qualitative info, corresponding to why the RIA is searching for a partnership, what they need the customer to deliver to the desk, the kind of autonomy profile they’re searching for, their progress profile and calendar wants.

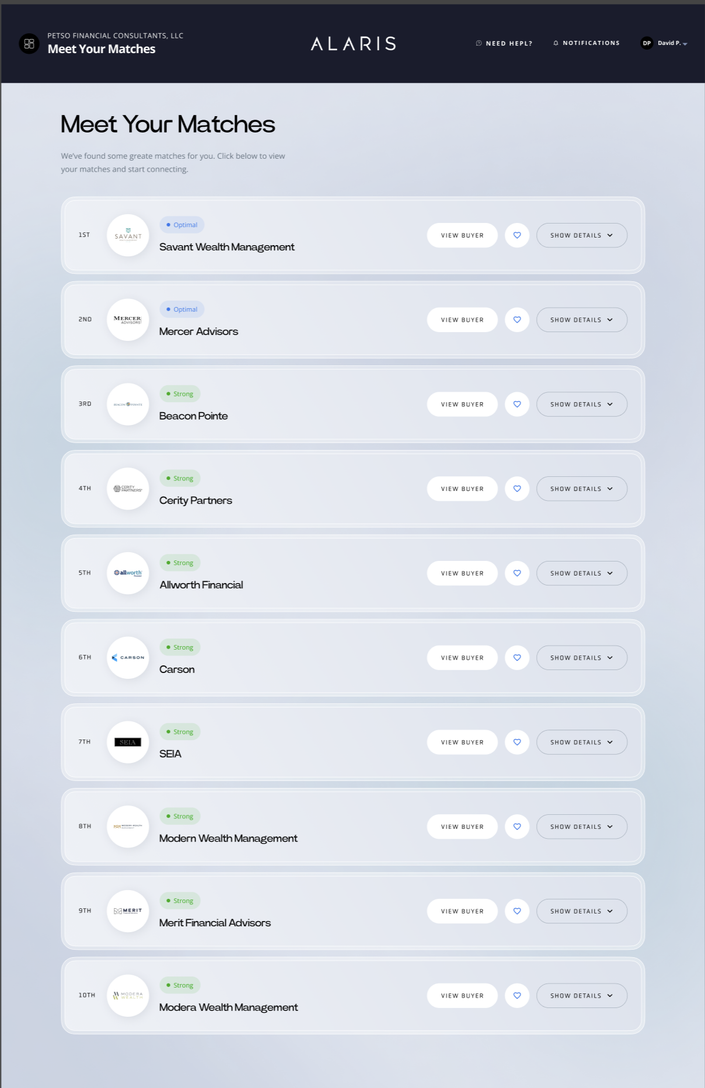

The algorithm takes all the information factors and context round these knowledge factors to search out matches, ranked by optimum match, robust match, reasonable match and weak match. Now, as an alternative of placing 50 potential consumers in entrance of the vendor, Lens narrows it right down to the highest 10 matches.

“It is a massive knowledge set of knowledge that we’re reasoning to a match on this broad set of objectable measurable factors of alignment,” Darby stated. “And in order that’s why once we go to match make, somewhat than do that shotgun e mail blast to the complete business, we will inform the vendor, ‘Listed here are your high 10 matches.’”

The vendor then narrows it right down to their high three selections that they are going to truly deliver to the desk and spend time with.

“We’re measuring compatibility as a result of, tradition you possibly can solely expertise, however we’ve acquired to clear the decks and never have 50 consumers on the desk,” Darby stated. “When you’ve got that many on the desk, you haven’t any time to get to know them, no time to get to that time of cultural conviction, which might solely come by means of experiencing and spending time with individuals.”