Overview

Imaginative and prescient Blue Assets Ltd, a battery commodity/resource-focused funding firm based by Sir Mick Davis (former CEO of Xstrata Plc), made a major strategic funding in NextSource Supplies in 2021 to totally fund the development of its Molo graphite mine in Madagascar. Manufacturing has begun, with Section 1 mine operations presently present process ramp as much as attain its nameplate manufacturing capability of 17,000 tpa of graphite focus.

In response to UK’s Benchmark Minerals Intelligence, battery demand for flake graphite is predicted to develop between 5-7 fold by 2035. This dramatic spike in demand is because of graphite’s important position because the anode materials in lithium-ion batteries. Electrical car batteries comprise between 60 to 90 kilograms of graphite per battery. By quantity, graphite is the most important uncooked materials in a lithium-ion battery. As the electrical car market continues to develop, investing within the corporations that produce these beneficial battery supplies and have first-mover benefit can present important value-creation and publicity to this increasing market.

NextSource Supplies Inc. is a battery supplies improvement firm based mostly in Toronto, Canada that’s intent on turning into a vertically built-in world provider of battery supplies by means of the mining and value-added processing of graphite and different minerals.

The Firm’s Molo graphite challenge in Madagascar is without doubt one of the largest identified and highest-quality graphite assets globally, and the one one with SuperFlake® graphite.

The Firm can also be creating a major downstream graphite value-add enterprise by means of the staged rollout of Battery Anode Amenities able to large-scale manufacturing of coated, spheronized and purified graphite for direct supply to battery and automotive clients, outdoors of current Asian provide chains, in a completely clear and traceable method.

Graphite in Madagascar is famend for its high quality and flake dimension. For nearly a century, Madagascar has been exporting flake graphite to the world however in restricted portions. Molo will catapult Madagascar to a high 5 graphite producing nation. With its Inexperienced Large vanadium challenge additionally inside shut proximity to the Molo challenge, NextSource Supplies controls two very strategic sources of battery supplies at one supply.

For additional details about NextSource go to our web site at www.nextsourcematerials.com or contact us a +1.416.364.4911 or e-mail Brent Nykoliation, Govt Vice President, Company Improvement at brent@nextsourcematerials.com or e-mail Craig Scherba, President and CEO at craig@nextsourcematerials.com.

NextSource’s one hundred pc owned and totally permitted Molo graphite challenge drew investor consideration for its massive, high-quality flake graphite deposit and distinctive SuperFlake graphite focus. Sir Mick Davis’s strategic funding of US$29.5 million in NextSource in Could 2021 offered the complete funding to deliver the Molo Graphite mine into manufacturing.

“This funding in NextSource underlines our perception that the large secular change in demand for important battery materials assets isn’t being met by an applicable supply-side response, largely on account of capital constraints,” Davis said.

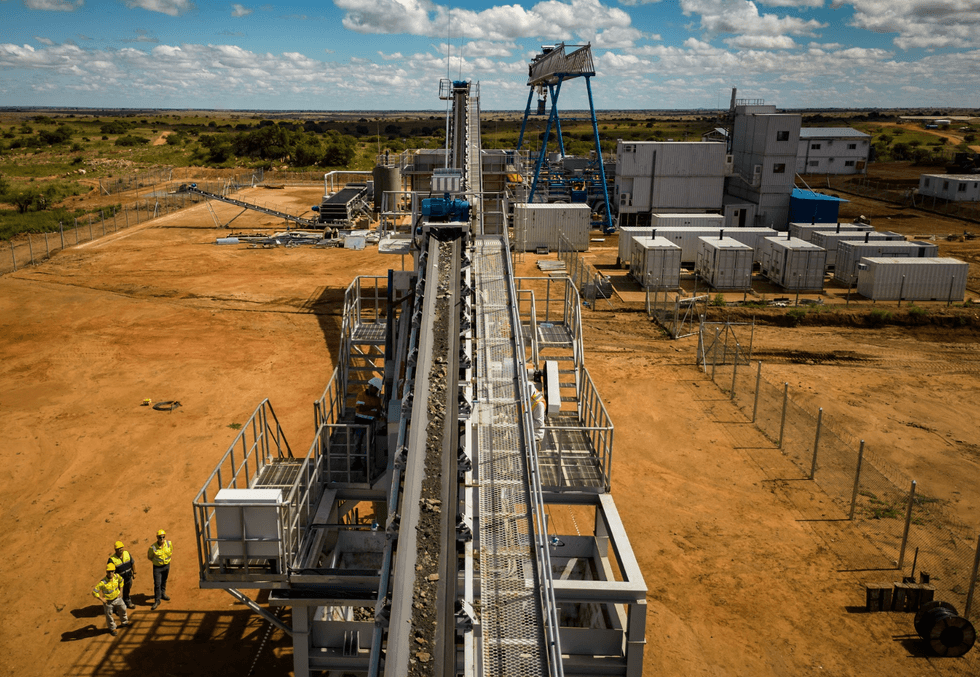

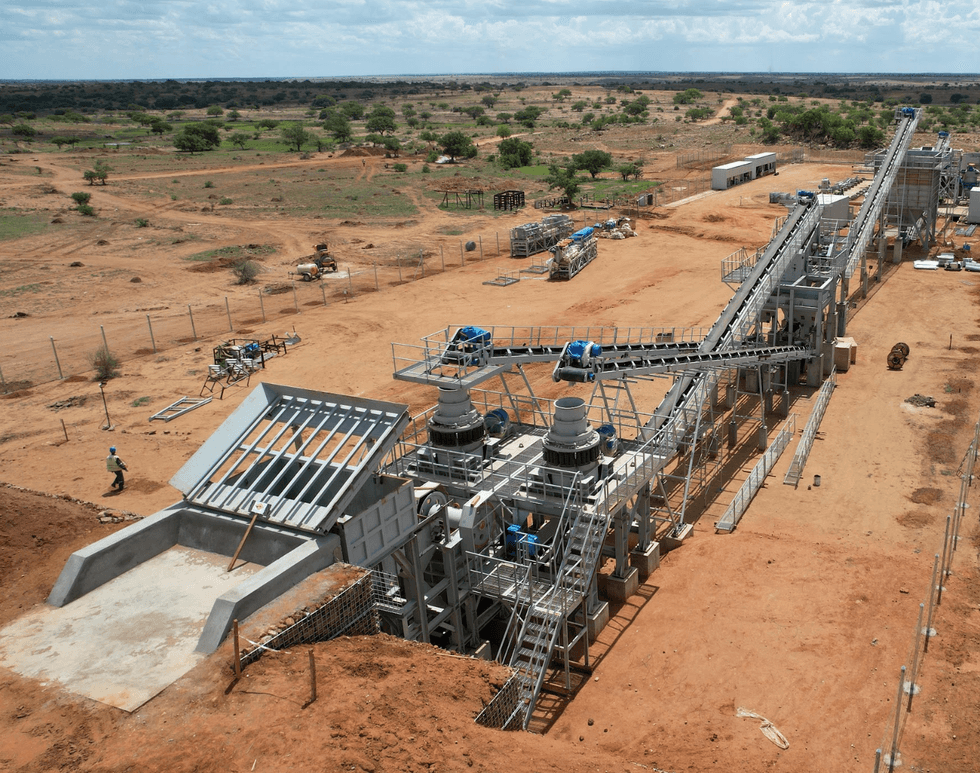

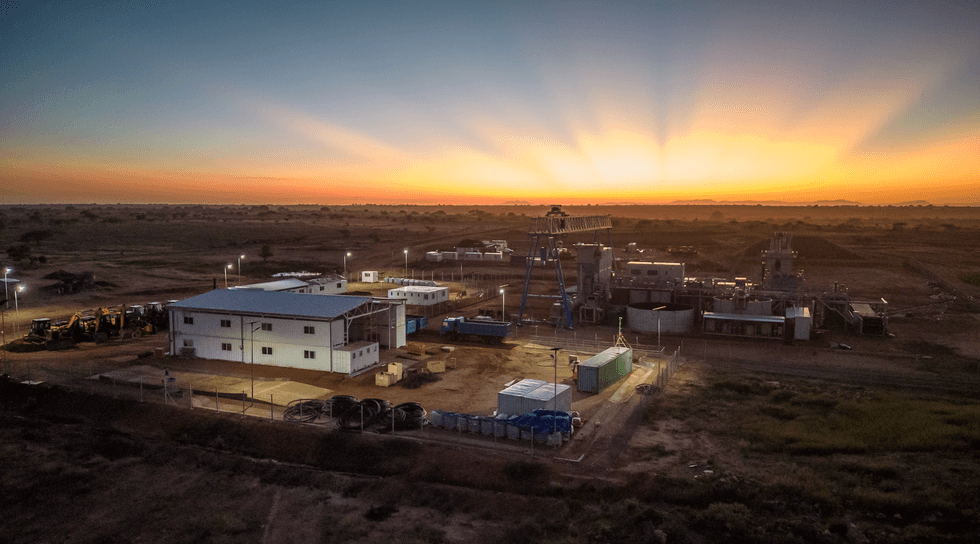

The corporate utilized an all-modular construct strategy to assemble the Molo mine. Section one manufacturing will likely be roughly 17,000 tonnes each year over the primary two years with additional deliberate growth in yr three.

The corporate made its first bulk container cargo of SuperFlake® graphite in October 2023 to its downstream technical accomplice’s battery anode facility to be processed into spheronized, purified graphite (SPG) that may then be additional processed into coated SPG (CSPG) as a part of massive scale, multi-step verification exams being performed by automotive EV provide chains in South Korea and Japan. The primary sequence of verification check outcomes are anticipated again in Q1 2024.

In April 2021, the corporate finalized an unique technical partnership with a Japanese firm that

supplies SPG to main Japanese anode and battery makers, who in flip provide the Tesla and Toyota provide chains. NextSource has secured the licensing of a well-established course of to provide SPG that’s presently utilized in EV provide chains, in addition to a coating expertise that has been verified by a significant Japanese coating firm to provide CSPG. The corporate has additionally executed a business offtake settlement with thyssenkrupp Supplies Buying and selling GmbH, a global buying and selling and providers firm headquartered in Essen, Germany, for the sale of 35,000 tpa of the SuperFlake® graphite merchandise.

NextSource’s different extremely potential challenge, the Inexperienced Large vanadium challenge in Madagascar, stands out for its sediment-hosted deposit profile, which is barely seen in roughly 5 p.c of whole vanadium occurrences.

The corporate believes strongly in vanadium’s potential market progress with the popularization of VRBs as a number one expertise for inexperienced vitality functions. Since challenge acquisition in 2007, NextSource has spent over US$20 million on the exploration and improvement of the Inexperienced Large.

NextSource’s administration group and administrators deliver many years {of professional} mine improvement and capital markets experience. NextSource has assembled a formidable group with a confirmed monitor document in mine operations and constructing shareholder worth. This positions the corporate for important progress and financial success because it strives to satisfy the world’s growing demand for graphite.

Firm Highlights

- The Molo graphite challenge in Madagascar is without doubt one of the largest identified and highest-quality graphite assets globally, and the one one with SuperFlake® graphite. The Molo mine has begun manufacturing, with Section 1 mine operations presently present process ramp as much as attain its nameplate manufacturing capability of 17,000 tpa of graphite focus.

- Imaginative and prescient Blue Assets, a fund headed up by Sir Mick Davis that invests in strategic battery supplies, is NextSource’s largest shareholder.

- Sir Mick Davis is NextSource’s chairman and this mining heavyweight brings years of beneficial expertise in mine improvement and operations experience.

- NextSource will full a feasibility research in November 2023 for its Section 2 growth of an extra 150,000 tonnes with the intention to meet the numerous forecasted demand for graphite. Timing for Section 2 development is predicted to take 18 months to finish from a last funding determination and when funding is in place, which might be predicated on securing an OEM offtake.

- NextSource is one in all extraordinarily few graphite corporations to have secured long run offtakes with respected companions. The primary is for the sale of 20,000 tonnes each year with a distinguished Japanese dealer that provides the Tesla and Toyota battery provide chains, and the second is with thyssenkrupp Supplies Buying and selling for the sale of 35,000 tonnes each year of SuperFlake® graphite focus.

- The Firm can also be creating a major downstream graphite value-add enterprise by means of the staged rollout of Battery Anode Amenities (BAFs). These BAFs will likely be able to large-scale manufacturing of spherical, purified graphite (SPG) and coated SPG (CSPG) utilizing established processing experience for direct supply to battery and automotive clients, outdoors of current Asian provide chains, in a completely clear and traceable method. Building of its Section 1 BAF in Mauritius is predicted to be accomplished by the tip of 2024.

- The Firm additionally owns the Inexperienced Large vanadium challenge, a complicated stage NI 43-101 useful resource that is without doubt one of the world’s largest identified vanadium deposits. The sediment-hosted geophysical profile of this vanadium deposit is well-suited for vanadium redox batteries, that are a number one battery expertise for big scale vitality storage functions.

- NextSource Supplies is listed on the Toronto Inventory Alternate (TSX) beneath the image “NEXT” and on the OTCQB beneath the image “NSRCF”.

Key Tasks

Molo Graphite Mine and Undertaking

The Molo graphite challenge ranks as one of many largest-known and highest-quality flake graphite deposits on the planet. The property is over 62.5 hectares, sits within the Tulear area of Southwestern Madagascar and is situated 11.5 kilometers east of the city of Fotadrevo.

The Molo mine has begun manufacturing, with Section 1 mine operations presently present process ramp as much as attain its nameplate manufacturing capability of 17,000 tpa of graphite focus.

Complete mixed graphite assets at Molo are 141.28 million tonnes at 6.13 p.c whole graphitic carbon, with a contained ore reserve of twenty-two.44 million tonnes at 7.02 p.c graphitic carbon. The corporate has delineated over 300-line kilometers of steady graphite mineralization at floor. NextSource has nearly a vast provide of graphite it could actually deliver to the market in lockstep with demand.

NextSource has superior flake dimension distribution and properly above the worldwide common. The Molo asset is comparatively distinctive for having virtually 50 p.c premium-priced massive and jumbo flake graphite and may obtain as much as 98 p.c carbon purity with easy flotation alone. Molo SuperFlake® has been verified by end-users and meets or exceeds all standards for the highest demand markets for flake graphite; anode materials for lithium-ion batteries, refractories, graphite foils and graphene inks.

NextSource has accomplished a sequence of feasibility research on the challenge since 2015, with an up to date feasibility research for part two mine growth anticipated in This fall 2023.

For all particulars and assumptions regarding the parameters of the mineral useful resource, reserve estimates, and knowledge verification procedures for part one of many Molo Undertaking, please confer with the corporate’s web site at nextsourcematerials.com.

Inexperienced Large Vanadium Undertaking

The 100-percent-owned Inexperienced Large vanadium challenge is an advanced-stage exploration challenge situated in South-central Madagascar and is without doubt one of the world’s largest identified vanadium deposits. The challenge leverages ultimate mining circumstances and is in shut proximity to NextSource’s Molo graphite mine.

The Inexperienced Large Undertaking is a uncommon sort of vanadium deposit as a result of it’s sediment-hosted. No magnetic metals are related to Inexperienced Large’s vanadium, making the challenge ultimate for producing high-purity vanadium pentoxide, a key materials in vanadium redox batteries.

The property’s NI 43-101 compliant useful resource measures an estimated 60 million tonnes of vanadium pentoxide at a mean grade of just about 0.7 p.c at a 0.5 p.c cut-off.

Administration Group

Brent Nykoliation — Govt Vice-president

Brent Nykoliation joined the senior administration group at NextSource Supplies as vice-president in 2007 and leads the event and implementation of strategic partnerships and offtakes with provide chain clients. As well as, Nykoliation oversees all communications with institutional traders and analysts for the corporate.

He brings over 20 years of senior administration expertise, having held advertising and marketing and strategic improvement positions with a number of Fortune 500 companies in Canada, notably Nestlé, Residence Depot and Whirlpool.

Nykoliation holds a Bachelor of Commerce with Honours diploma from Queen’s College.

Marc Johnson — Chief Monetary Officer

Marc Johnson is a bilingual senior government with over 20 years of enterprise expertise, together with ten years at public companies as CFO, VP of company improvement and different monetary administration positions, and ten years in capital markets in funding banking and fairness analysis. Johnson is a chartered monetary analyst and a chartered skilled accountant and joined as CFO in October 2015. He additionally holds a bachelor of commerce (finance) from the John Molson Faculty of Enterprise at Concordia College in Montreal.

Jonathan (Johnny) Velloza- Interim Chief Working Officer

Jonathan Velloza has a wealth of technical and working expertise within the mining business spanning 30 years throughout which he managed operational optimization processes and huge capital expansions throughout a variety of commodities and in lots of jurisdictions. Velloza was beforehand Deputy CEO and COO of Gem Diamonds and CEO of Chemaf. Previous to this, he was with BHP Western Australia Iron Ore the place, from 2013 to 2015, he was normal supervisor on the largest iron ore mine within the BHP portfolio, main various profitable operational effectivity packages. He additionally acted as a senior exploration supervisor in Zambia and in Chile for BHP from 2011-2013, operations supervisor at AngloGold Ashanti from 2009-2010 and held quite a few managerial positions at De Beers from 2001-2009.

Velloza holds a Bachelor’s diploma in Mining Engineering from The College of Johannesburg and a Bachelor’s diploma in Enterprise from The College of South Africa.

Danniel Stokes – VP, Particular Tasks

Daniel Stokes joined NextSource in 2022. Throughout his profession, he has been chargeable for offering challenge administration assist throughout a various portfolio of initiatives in mining, infrastructure, and nuclear industries; creating instruments, implementing greatest practices and mentoring apprentices. Stokes holds levels in engineering and enterprise and has a qualification in challenge administration from the Affiliation for Undertaking Administration.

Markus Reichardt – VP, Sustainability

Markus Reichardt joined NextSource in 2023 and brings a sensible understanding of integrating ESG into all levels of the challenge cycle based mostly on a 25 yr monitor document in operational, senior company and advisory roles within the assets, agricultural and renewables sectors throughout the creating world.

Reichardt is chargeable for driving the Group’s security, well being, surroundings, social, local weather change and high quality efficiency and initiatives.

Reichardt is a former company environmental supervisor of AngloGold and holds levels in historical past and restoration ecology.

Wilhelm Reitz – Basic Supervisor, Molo Mine

Wilhelm Reitz is a mine administration skilled with 28 years of expertise within the world mining sector, with the final 11 years focussed on important minerals and in creating applied sciences by means of design, engineering, and analysis on graphite. Reitz held senior administration roles with AfriGold in Senegal and West African Diamonds in Sierra Leone and Guinea. Previous to becoming a member of NextSource, he was concerned in creating and managing graphite mines in Madagascar for Stratmin International and Greenwing Assets. Reitz holds a BSB Diploma in Management and Administration and studied with AIM in Australia, college of administration.

Lydia Boarlaza – Nation Supervisor, NextSource Supplies

Lydia Boarlaza joined NextSource as Nation Supervisor in January 2021 and has had intensive administration expertise within the Madagascar mining sector over her profession. She has served on the whole supervisor and resident supervisor roles for varied corporations together with Madagascar Consolidated Mining S.A., Madagascar Oil S.A., Avana Group, Hunt Oil Madagascar, and Shell Exploration & Improvement Madagascar BV. She is a member of the board of administrators of Madagascar Chamber of Mines, member of the Nationwide Committee throughout the EITI Madagascar, and member of the Ladies in Mining and Assets Affiliation in Madagascar.

Board of Administrators

Sir Mick Davis — Chairman

Sir Mick Davis is the CEO of Imaginative and prescient Blue Assets and a extremely profitable mining government accredited with constructing Xstrata plc into one of many largest mining corporations on the planet earlier than its acquisition by Glencore plc. Earlier than itemizing Xstrata on the LSE as CEO he was CFO of Billiton plc and Chairman of Billiton Coal which he joined from the place of Eskom CFO. Throughout his profession in mining, he has raised over US$40bn from world capital markets and efficiently accomplished over US$120bn of company transactions, together with the creation of the Ingwe Coal Company in South Africa; the itemizing of Billiton on the LSE; the merger of BHP and Billiton; in addition to quite a few transactions at Xstrata culminating within the sale to Glencore plc. Sir Mick Davis is a chartered accountant by career and holds an honours diploma in commerce from Rhodes College, South Africa and an honorary doctorate from Bar Ilan College, Israel.

Hanré Rossouw – President and Chief Govt Officer

Hanré Rossouw joins NextSource from his position as government director and chief monetary officer of Sasol Restricted with intensive expertise within the world pure assets business during the last 25 years. A British and South African nationwide, Rossouw has held senior positions in main world mining and funding corporations the place his roles concerned enterprise improvement, M&A, capital markets, asset administration and progress optimization. Rossouw was chief monetary officer and government director of Royal Bafokeng Platinum between October 2018 and March 2022 having joined after 5 years as a portfolio supervisor at Investec Asset Administration. He was latterly CFO of the Alloys Division having been a part of the small head workplace group which accomplished quite a few worldwide transactions and related fundraisings as a part of a company improvement plan which grew the market capitalization fivefold throughout his tenure. Rossouw labored at each Accenture and as a challenge supervisor with De Beers Group having began within the mining business as a metallurgist with Anglo American in 1998. He studied chemical engineering at Stellenbosch College and Economics on the College of South Africa in addition to finishing an MBA on the College of Oxford’s Mentioned Enterprise Faculty.

Ian Pearce – Director

Ian Pearce is the previous CEO of Xstrata Nickel, and was the previous COO of Falconbridge Restricted, which was acquired by Xstrata Plc in 2006. Xstrata Plc’s acquisition of Falconbridge was one of many largest mining takeovers globally and one of many largest takeover bids in Canadian historical past. Pearce was additionally a founding accomplice of X2 Assets who, together with Sir Mick Davis, made up the group of six ex-Xstrata executives who shaped the mid-tier diversified mining and metals firm. He presently serves as a director for a number of world corporations within the mining and metals, vitality, and sustainability industries. Pearce beforehand served as chair of the Mining Affiliation of Canada and chair of the Nickel Institute. He holds a BSc from the College of the Witwatersrand, South Africa and an HNDT in Mineral Processing from the College of Johannesburg, South Africa.

Craig Scherba — Director and Chief Improvement Officer

Craig Scherba was appointed president and CEO in September 2012 and has been a director since January 2010. Beforehand, Scherba served as vp of exploration of the corporate, since January 2010. Scherba was a managing accomplice for six years with Taiga Consultants, a mining exploration consulting firm. He has been knowledgeable geologist since 2000, and his experience consists of supervising massive Canadian and worldwide exploration packages. Scherba was an integral member of the exploration group that developed Nevsun Assets’ high-grade gold, copper and zinc Bisha challenge in Eritrea. He served as the corporate’s nation and exploration supervisor in Madagascar throughout its preliminary exploration stage, discovering each the Molo Graphite and the Inexperienced Large Vanadium deposits.

Brett Whalen — Director

Brett Whalen has over 20 years of funding banking and M&A experience, spending over 16 of these years at Dundee Company. Throughout his tenure at Dundee, Whalen was straight concerned in finishing roughly $2 billion in M&A offers and helped elevate over $10 billion in capital for useful resource sector corporations. Whereas a vp and portfolio supervisor of Goodman & Co., he oversaw the funding of $6 million into NextSource, enabling the corporate to realize key technical milestones, notably the completion of its July 2017 Section One Feasibility Examine and the idea and design of the entire modular construct strategy NextSource will likely be utilized for development of each Section One and Section Two of the Molo mine. Whalen has intensive information of each graphite and vanadium and the overall battery supplies business.

Whalen has held board seats of a number of TSX-listed and privately held corporations and holds a BA (Honours) diploma in Economics and Finance from Wilfrid Laurier College.

Christopher Kruba — Director

Christopher Kruba is vice-president and authorized counsel to Nostrum Capital Company and several other associated companies which are a part of the Toldo Group. The Toldo Group is headquartered in Windsor, Ontario and consists of a number of privately held companies in Canada and the US, a few of which have massive manufacturing operations in diversified sectors and others which are concerned in energetic and passive investments throughout capital markets all through North America, Europe and Africa. Along with his obligations as counsel to the Toldo Group, Kruba serves as company secretary to all the businesses, is a member of the group’s funding committee and serves on the board of administrators of lots of the corporations.