Overview

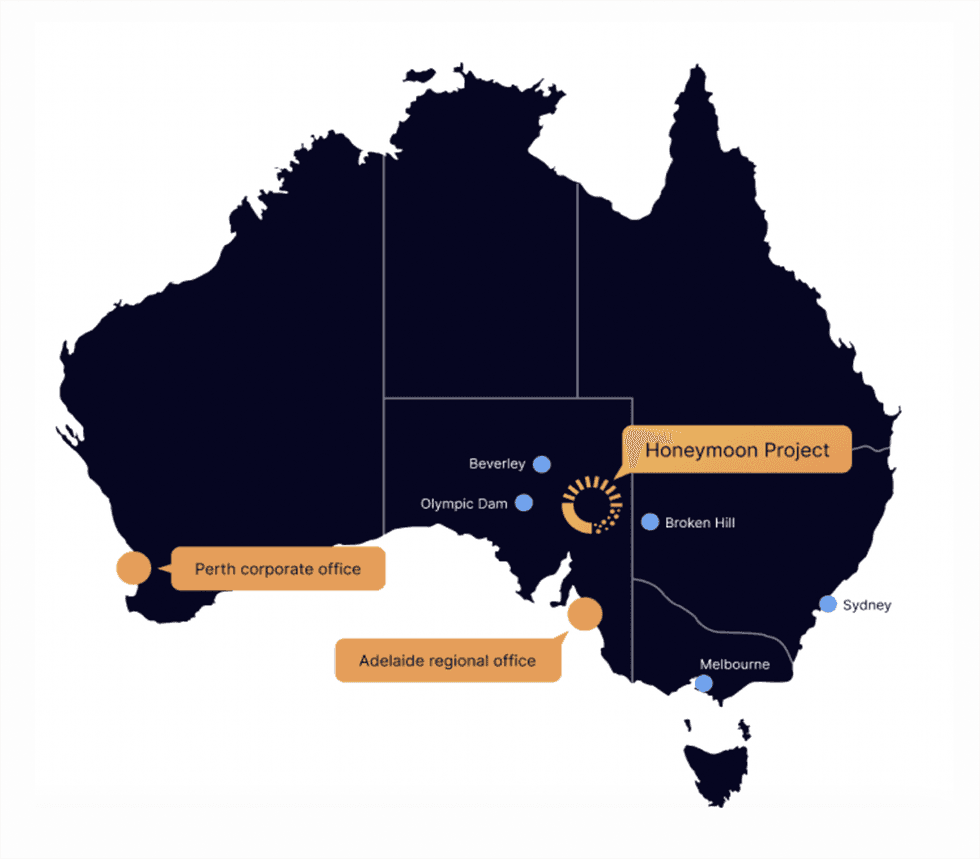

Boss Vitality (ASX:BOE) is a listed Australian producer of uranium. The corporate has two initiatives – the 100% owned Honeymoon uranium undertaking in South Australia and the 30 p.c owned Alta Mesa undertaking within the US.

The macro-environment and steps taken by the US authorities stay favorable for uranium producers reminiscent of Boss Vitality. America Congress just lately enacted laws prohibiting the importation of Russian uranium merchandise. Often called the Prohibiting Russian Uranium Imports Act (HR 1042), this laws was handed by the Home of Representatives on December 11, 2023, and later accepted by the Senate on April 30, 2024. The prohibition is legitimate till 2040.

The laws’s sundown provision, set for 2040, goals to encourage the sustained deployment of uranium conversion and enrichment amenities and providers in america and its allied nations over the long run. This could profit home suppliers reminiscent of Boss Vitality.

In line with UxC estimates, annual uranium demand might surge by practically 65 p.c, exceeding 300 million kilos (Mlbs) U308 by 2030, up from the present demand degree of 197 Mlbs U308. In the meantime, the projected mine provide for 2024 is roughly 155 Mlbs U308, suggesting a deficit of practically 40 Mlbs.

Furthermore, there may be an anticipated surge in demand for uranium because of the projected 18 p.c enhance in nuclear reactor capability from 2023 to 2030. Nuclear power will likely be crucial in assembly the worldwide ambition of web zero emission. Thus, making certain a safe provide is essential, and the Honeymoon mine is strategically positioned to supply uranium from South Australia to a market going through escalating geopolitical instability.

Spot uranium costs have jumped dramatically. They’re the best since 2008, at over US$80/lb. As a result of tightness of the uranium provide/demand steadiness, costs are anticipated to stay robust.

The corporate’s first drum manufacturing in April 2024 on the Honeymoon mine is timed with robust market fundamentals. Boss has entered into two binding gross sales agreements to promote ~1.8 Mlbs U308 to 2 main Western utilities in 2032. These agreements guarantee a secure income movement for Boss, supply robust revenue margins, and reinforce the belief utilities positioned within the provide from the Honeymoon Uranium Mine in South Australia.

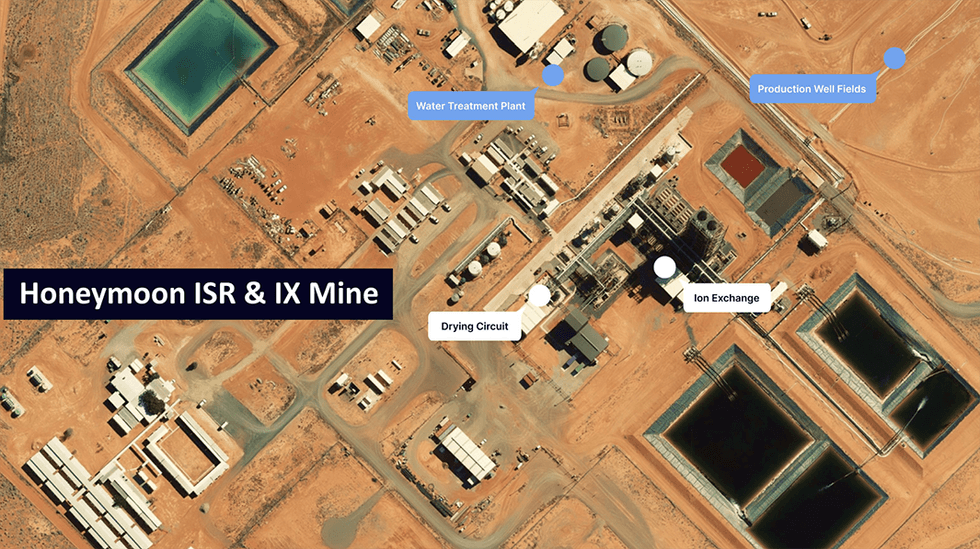

Honeymoon makes use of in-situ restoration (ISR) coupled with ion change for uranium extraction and processing. The method is environmentally pleasant and extra price environment friendly in comparison with conventional mining.

Boss is increasing its senior administration workforce to align with its increasing presence as a world uranium producer. Justin Laird, a extremely skilled monetary government, has been appointed CFO, whereas Robert Gordon, a revered mine manufacturing government, has taken on the position of normal supervisor at Honeymoon.

As of 31 March 2024, the corporate had AU$100 million in money and no debt. It additionally holds a strategic stock of 1.25 Mlb of U308, which has a present spot market worth of AU$169 million. Boss Vitality possesses a number of producing uranium mines and is strategically positioned to capitalize on the enhancing fundamentals of the uranium market.

Firm Highlights

- Boss Vitality is an Australia-based uranium producer centered on its two key initiatives – the 100% owned Honeymoon Uranium Undertaking in South Australia and the 30 p.c owned Alta Mesa Undertaking within the US.

- In June 2024 Boss grew to become a multi-mine uranium producer by means of the Honeymoon and Alta Mesa Tasks.

- The Honeymoon uranium mine commenced manufacturing in April 2024, with the primary sale of uranium anticipated in July 2024.

- Annual manufacturing at Honeymoon is forecast to succeed in 2.45 Mlbs of U3O8.

- The Alta Mesa uranium mine commenced manufacturing in June 2024, with first sale of uranium anticipated in October 2024.

- Annual manufacturing at Alta Mesa is forecast to succeed in 1.50 Mlbs of U3O8. As soon as steady-state operations are established, Boss’s 30 p.c share of the manufacturing quantities to 500,000 lbs per yr.

- Uranium costs have been the best since 2008 at over US$80/lb. Costs are anticipated to stay robust because of the tightness of the uranium provide/demand steadiness. The corporate’s first manufacturing is timed with robust market fundamentals.

- The corporate has signed two gross sales agreements to provide 1.8 million kilos of U3O8 to main energy utilities in Europe and the US, spanning eight years from 2024 to 2032. The corporate plans to pursue further agreements as the value of uranium will increase.

Key Tasks

Honeymoon Uranium Undertaking

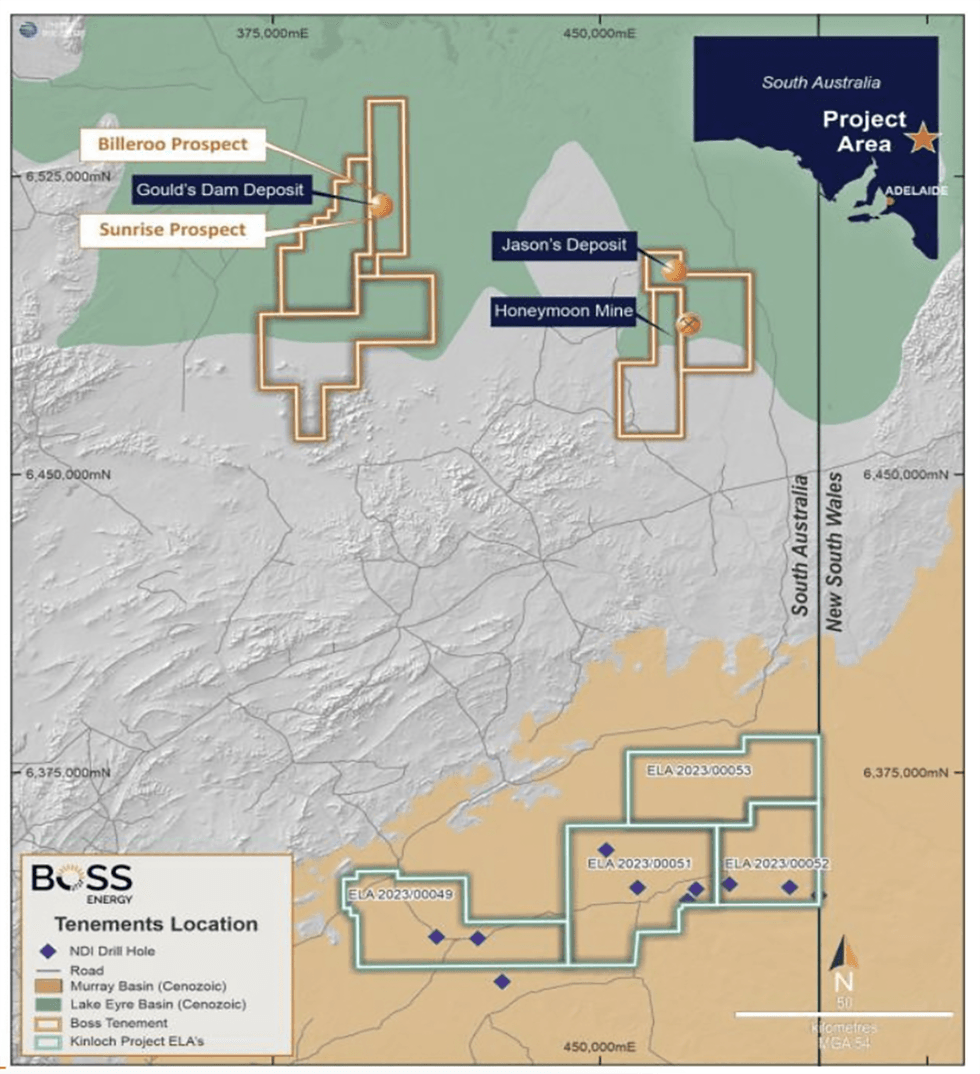

The 100% owned Honeymoon uranium undertaking is located in South Australia, roughly 80 kms northwest of the city of Damaged Hill. The undertaking is house to the historic Honeymoon uranium mine, Australia’s second working in-situ restoration uranium mine. It started manufacturing in 2011 underneath the earlier possession of Uranium One. Operations at Honeymoon have been halted in November 2013 attributable to declining uranium costs. Subsequently, Boss Vitality acquired the undertaking in 2015. The corporate has since restarted the mine, with the primary drum of uranium produced in April 2024.

Boss Vitality’s enhanced feasibility research (EFS), launched in June 2021, demonstrates the monetary robustness of the Honeymoon mine. It signifies an 11-year mine life, a manufacturing fee of two.45 Mlb/annum, and a pre-tax NPV of 8 p.c of US$309 million on the U3O8 worth of US$60/lb. The prevailing EFS relies on simply 50 p.c of the present JORC useful resource, i.e. solely 36 Mlbs of the full JORC Useful resource of 71.6 Mlbs.

Utilizing the remaining recognized JORC useful resource, there may be appreciable potential to extend the mine’s lifespan and improve the manufacturing nameplate capability of two.45 Mlb each year. Boss Vitality is at present implementing methods to spice up each the manufacturing fee and the lifespan of operations at Honeymoon. This consists of focusing on satellite tv for pc deposits reminiscent of Gould’s Dam (25 Mlb of U3O8) and Jason (11 Mlb of U3O8).

These goal deposits are anticipated to extend the forecasted manufacturing at Honeymoon from 2.45 Mlbs each year of U308 to over 3 Mlbs each year.

Alta Mesa Undertaking

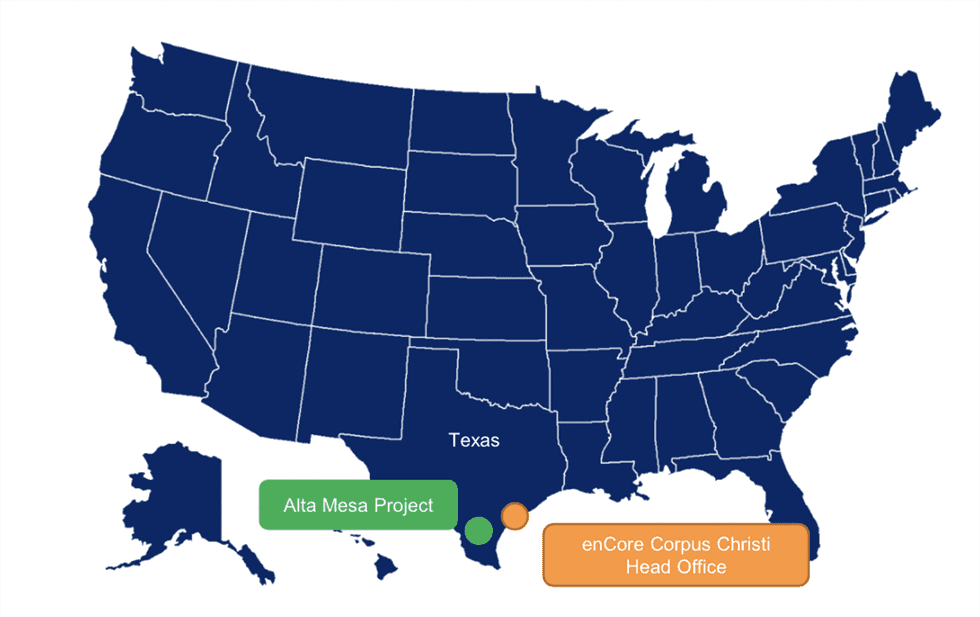

The 30 p.c owned Alta Mesa undertaking is a high-grade uranium ISR undertaking in South Texas, a prolific US district for sandstone-hosted ISR manufacturing, having traditionally produced ~80 Mlbs. South Texas is essentially the most progressive allowing manufacturing jurisdiction in america, and the everyday AISC for comparable ISR initiatives within the area is US$30-35/lb.

Boss Vitality bought its 30 p.c stake within the Alta Mesa undertaking from enCore Vitality for US$60 million in money. enCore Vitality is a good US uranium developer and operator with a powerful observe file. They efficiently initiated operations on the Rosita ISR re-start undertaking in america in simply 20 months. Previous to this, the enCore Vitality workforce managed the Alta Mesa undertaking earlier than present process care and upkeep.

The Alta Mesa undertaking boasts an NI 43-101 compliant useful resource with 3.41 Mlbs at 0.109 p.c U3O8 within the measured and indicated class, and 16.97 Mlbs at 0.120 p.c U3O8 categorized as inferred. The undertaking has an annual manufacturing capability of 1.5 Mlbs U3O8, with Boss Vitality’s share at 500,000 lbs each year. The undertaking commissioning is on observe, with the primary manufacturing anticipated in Might 2024.

Administration Staff

Duncan Craib – Government Director and CEO

Duncan Craib has been the chief government officer of Boss Vitality since January 2017. He has vital expertise in mining, particularly within the uranium business. He has labored in senior management roles throughout geographies, together with Australia, the UK, Namibia and China. Earlier than becoming a member of Boss Vitality, Craib was the finance director at Swakop Uranium. He performed a major position in creating and setting up the Husab uranium mine in Namibia, a undertaking valued at US$2.5 billion. Husab, thought-about world-class, was commissioned in 2016.

Justin Laird – Chief Monetary Officer

Earlier than becoming a member of Boss, Justin Laird was the supervisor of enterprise initiatives at Wesfarmers (ASX:WES). Throughout his nine-year tenure, he held numerous senior roles in enterprise growth, led transaction and finance groups, expanded new ventures, and fulfilled different industrial and strategic duties. He’s a chartered accountant.

Wyatt Buck – Non-executive Chairman

Wyatt Buck has vital uranium mining expertise, having labored with Cameco Company for practically 15 years. He was the final supervisor of the McArthur River uranium mine and Key Lake Mill, the most important uranium mining operation on the planet. He has held key operational positions at Paladin Vitality (ASX:PDN), serving as each normal supervisor and managing director of the Langer Heinrich uranium undertaking in Namibia. He held these roles from the initiation of development in February 2006 till attaining design-level manufacturing. From 2011 onward, Buck has served as operations director at First Quantum Minerals (TSE:FM), the place he has supervised mining operations throughout numerous areas, together with Finland, Spain, Turkey, Australia and Mauritania.

Jan Honeyman – Non-executive Director

Jan Honeyman is an skilled human assets skilled, most just lately with world miner First Quantum Minerals, the place she was the director of HR for 16 years. Previous to this, she labored in HR and expertise administration with numerous firms, together with Halliburton.

Bryn James – Non-executive Director

Bryn James is a member of the Australian Institute of Mining and Metallurgy, with over twenty years of involvement within the Australian uranium sector. He possesses intensive expertise throughout all phases of the mining course of, with a particular deal with uranium in-situ restoration (ISR), in addition to mine growth and manufacturing. Beforehand, he labored with ISR uranium producer Heathgate Assets. He additionally served because the chief working officer of Canada-based uranium developer Laramide Assets (ASX/TSX:LAM,OTC:LMRXF).

Robert Gordon – Common Supervisor

Robert Gordon brings huge expertise in working processing vegetation and managing initiatives throughout the world assets sector. Beforehand, he served as the method plant operations supervisor at Newcrest Mining. His experience spans numerous features of metallurgy, together with hydrometallurgy, which aligns with the processes utilized by Boss at Honeymoon.

Jonathan Owen – Undertaking Supervisor

Jonathan Owen brings over 25 years of expertise in all features of the mining cycle, from feasibility to handover. With a background in undertaking administration and growth, he boasts appreciable expertise, together with a decade spent at First Quantum Minerals as a undertaking supervisor overseeing the African Sentinel copper/nickel growth. Extra just lately, he performed a pivotal position within the handover of the Cobre Panama copper/gold processing plant.

Jason Cherry – Geology Supervisor

Jason Cherry is a seasoned uranium exploration geologist with 17 years of expertise and has experience in numerous mining kinds of uranium mineralization. He spent a number of years at Honeymoon, the place he performed a major position within the discovery of latest uranium assets, together with the satellite tv for pc deposits of Jasons and Goulds Dam.