Highlights

- Siren has entered right into a definitive settlement with Canadian listed RUA Gold Inc. (CSE:RUA) for the sale of the Reefton Undertaking to consolidate the Reefton Goldfield.

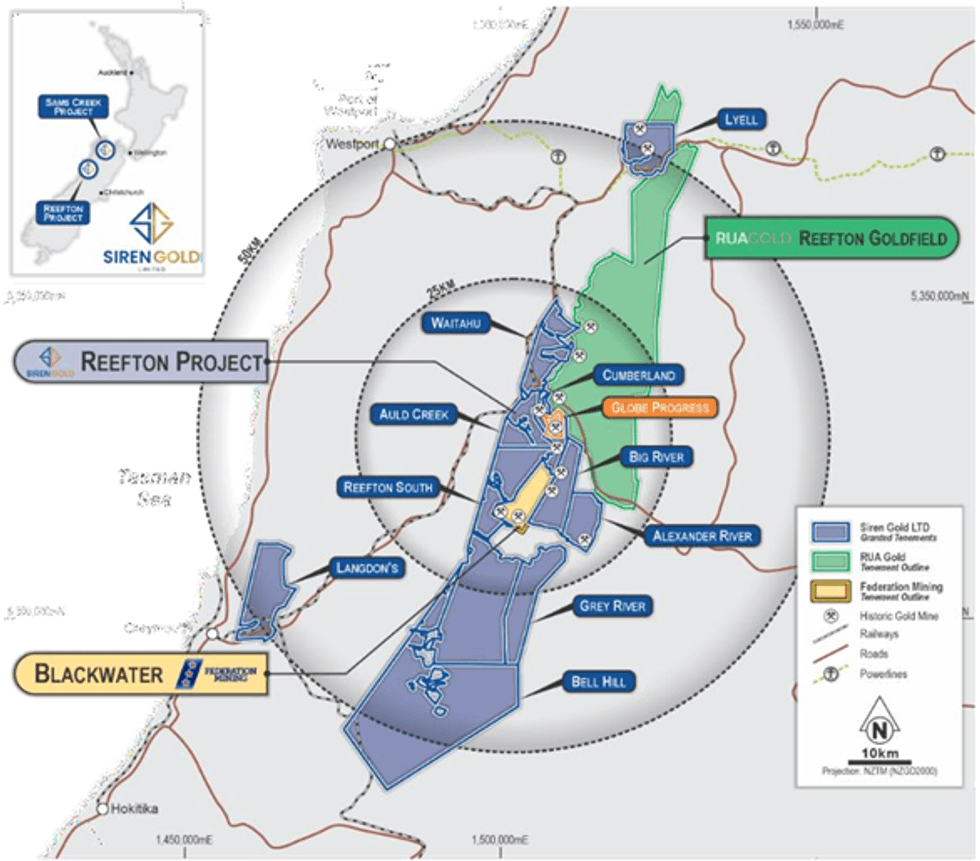

- This transaction will create the biggest gold explorer on the Reefton Goldfield on the West Coast mining district of New Zealand’s South Island.

- The transaction will create the biggest tenement bundle of 1,242km2, on the high-grade Reefton Goldfield that has produced +2Moz at 15.8 g/t Au.

- The proposed transaction is for RUA to amass Siren’s 100% owned subsidiary, Reefton Assets Pty Ltd (NZ), with the important thing outcomes being:

- RUA to amass the Reefton Undertaking for A$20m, comprising A$2m in money and A$18m in RUA shares.

- Siren Chairman Mr Brian Rodan will be part of the RUA Board on completion of the transaction.

- Acquisition value of A$45/oz, based mostly on Reefton’s present 444,000 oz inferred Mineral Useful resource Estimate (MRE)2.

- Put up transaction, Siren will maintain roughly 30.2% of RUA’s widespread shares excellent, sustaining a big curiosity within the Reefton challenge in addition to buying an curiosity within the high-grade Glamorgan Undertaking within the North Island of New Zealand.

- Siren will retain the Sam’s Creek Undertaking with a present MRE of 824koz @ 2.8g/t Au and stay listed on the ASX (Refer Desk 1).

- The overall consideration equates to roughly A$0.10 per issued share of Siren, which represents a 28.4% premium over Siren’s closing share value on 12 July 20241.

- Put up transaction Siren could have money and investments of over $20m, representing 10cps per SNG share, and it’ll give attention to the Sam’s Creek Undertaking, which at present has a MRE of 824koz of gold and a pending mining allow utility, while shareholders will stay invested in Reefton by means of the RUA shareholding.

- The transaction is topic to customary situations and approvals resembling shareholder and regulatory approvals and is predicted to shut in This autumn 2024.

Consolidation of the Reefton Goldfield

Siren Gold Restricted (ASX: SNG) (“Siren” or the “Firm”) is happy to announce that it has entered right into a definitive settlement dated 14 July 2024 (the “Definitive Settlement”) with Reefton Acquisition Corp., a completely owned subsidiary of Canadian Securities Alternate listed RUA Gold Inc. (“RUA”), whereby RUA will purchase 100% of the capital of Reefton Assets Pty Ltd. (“Reefton Assets”), a completely owned subsidiary of the Firm, for A$20 million in money and shares of RUA (the “Transaction”). Reefton Assets owns 100% of the tenements that comprise Siren’s Reefton Undertaking.

The Transaction, anticipated to be accomplished in November 2024, gives Siren with a money cost of $2 million and $18 million in widespread shares of RUA (the “RUA Shares”). Following completion of the Transaction, Siren would personal roughly 30.2% of the present estimated issued and excellent RUA Shares. The Transaction eliminates the necessity for a probably dilutive near-term fairness elevating to proceed exploration at Reefton, whereas retaining continued possession and upside within the enlargement and future improvement of the Reefton Undertaking.

The Transaction will set up RUA because the dominant landholder within the area, with roughly 1,242km2 of tenements within the historic Reefton Goldfield. Following completion of the Transaction, RUA will likely be effectively positioned because the pre-eminent gold explorer on the Reefton Goldfield in New Zealand, with a professional forma market capitalisation of roughly C$60 million (A$64.9 million)2. Combining properties and exploration actions within the Reefton Goldfield gives quite a lot of strategic advantages, together with:

i. Consolidation of the tenement bundle, creating the dominant Reefton Goldfield explorer

ii. Important challenge synergies for mine improvement and a central processing hub

iii. Bigger exploration applications with extra constant information stream

iv. Combines mine allowing and expedites eventual challenge development

v. Mixed firm greatest positioned to additional consolidate the Reefton Goldfield

vi. Siren retains upside in exploration and improvement of a consolidated Reefton

vii. Siren will have the ability to give attention to exploration and improvement at Sams Creek

viii. RUA will likely be centered on exploration and improvement of the mixed Reefton belt

Determine 1: Tenement map of the Reefton Goldfield district.

Determine 1: Tenement map of the Reefton Goldfield district.

Siren Managing Director and CEO, Victor Rajasooriar commented:

“Siren’s imaginative and prescient for the Reefton area has been to create a big excessive grade gold producer with a central processing facility fed by quite a few underground mines. This transaction is a big step in realising this imaginative and prescient and an excellent end result for Siren shareholders. Siren can give attention to the multi-million-ounce potential at Sams Creek whereas RUA can proceed to discover the consolidated Reefton Undertaking. This transaction is at a ~3.8x premium EV/ Useful resource a number of in comparison with Siren’s present share value and can allow Siren to fast-track Useful resource progress at Sams Creek, whereas RUA can fast-track gold and antimony Useful resource progress at Reefton. New Zealand is open for enterprise and this partnership with RUA permits Siren to fast-track exploration and improvement of its asset base.”

RUA CEO, Robert Eckford commented:

“The transaction between RUA and Siren Gold is a big step in RUA turning into the biggest tenement holder of the extremely potential Reefton Goldfield district, residence to host rocks with high-grade gold and antimony. This transaction is a pure match for our portfolio and creates the chance for actual synergies, which, together with native data, units us for a fast re-rating from additional exploration success and useful resource delineation throughout the mixed land bundle.”

Click on right here for the total ASX Launch

This text contains content material from Siren Gold, licensed for the aim of publishing on Investing Information Australia. This text doesn’t represent monetary product recommendation. It’s your accountability to carry out correct due diligence earlier than performing upon any info offered right here. Please consult with our full disclaimer right here.