Prismo Metals Inc. (“Prismo” or the “Firm”) (CSE:PRIZ)(OTCQB:PMOMF) is happy to announce that it has acquired commitments for six,500,000 items of the Firm (“Items”) at a value of $0.17 per Unit for gross proceeds of $1,105,000 to be issued on a non-brokered non-public placement foundation (the “Personal Placement”). The overall quantity of the Personal Placement has been dedicated to and the Firm expects that the Personal Placement will probably be totally subscribed at a closing anticipated to happen on or round June 18, 2024

Every Unit consists of 1 widespread share within the capital of the Firm (a “Share“) and one-half of 1 widespread share buy warrant of the Firm (every complete warrant, a “Warrant“). Every Warrant entitles the holder to buy one widespread share within the capital of the Firm for a interval of twenty-four (24) months from the date of subject at an train value of $0.25.

Steve Robertson, President of Prismo Metals commented: “The latest strengthening in commodity costs has resulted in renewed curiosity from traders in exploration corporations like ours. We’re happy to welcome a number of new incoming shareholders who will probably be collaborating within the Personal Placement. Our priorities this 12 months stay to start out drilling at our Scorching Breccia copper challenge positioned within the coronary heart of the Arizona copper belt and to check the Palos Verdes vein at depth on our silver challenge of the identical title in Mexico.”

Mr. Robertson added: “The anticipated exploration program at Scorching Breccia will deal with diamond drilling 5 holes with an anticipated depth of 1,000 metres every, for a program complete of 5,000 metres. The precise depth of every drill gap will probably be decided by the stratigraphy encountered. The exploration staff wish to guarantee your entire Paleozoic carbonate sequence, that are probably the most potential host rock for mineralization, is intersected. Preparations for the beginning of drilling will probably be underway as soon as the ultimate Bureau of Land Administration (“BLM“) allow is totally in place, which is anticipated to happen within the close to future.”

Relating to the Palos Verdes silver challenge in Mexico, Craig Gibson, Co-Founder and Chief Exploration Officer stated: “Instantly following closing of the Personal Placement, we’ll mobilize our drilling crew at our Palos Verdes for our subsequent part of drilling. We’re planning to drill roughly 3,600 meters in ten holes to be accomplished in two phases. These holes will probably be drilled from Vizsla Silver Corp. concessions adjoining to the Palos Verdes concession and can goal the Palos Verdes vein at depth. This drill program follows a advice offered by the Panuco Joint Technical Committee. The Joint Technical Committee is comprised of Prismo’s CXO Dr. Craig Gibson, Vizsla Silver’s VP Exploration Dr. Jesus Velador, and Dr. Peter Megaw.”

About Scorching Breccia

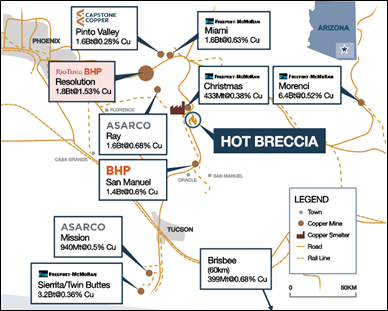

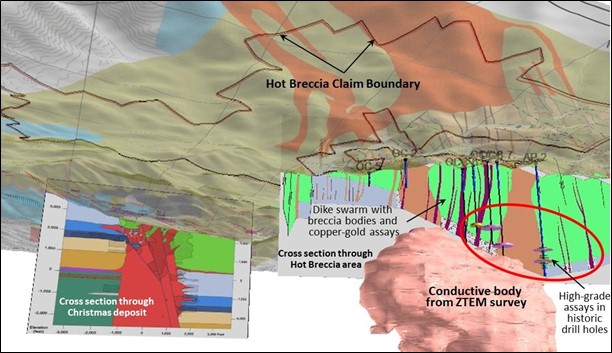

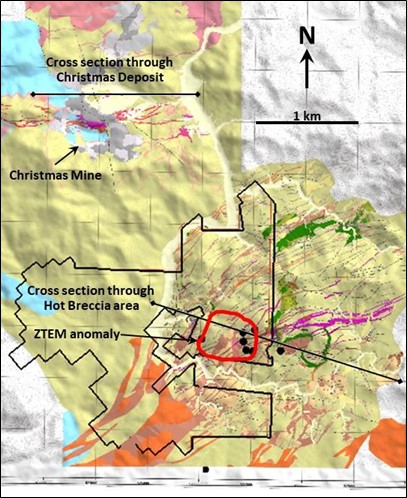

The Scorching Breccia property consists of 1,420 hectares 227 contiguous mining claims positioned on the planet class Arizona Copper Belt between a number of very well-understood world-class copper mines together with Morenci, Ray and Decision (Determine 1). Scorching Breccia exhibits many options in widespread with these neighboring programs, most prominently a swarm of porphyry dikes and sequence of breccia pipes containing quite a few fragments of nicely copper-mineralized rocks blended with fragments of volcanic and sedimentary derived from appreciable depth. Prismo ran a ZTEM survey final 12 months that recognized a really giant conductive anomaly instantly beneath the breccia outcrops (Figures 2 and three).

Sampling on the challenge has proven the presence of copper and gold mineralization related to polymictic breccia that has introduced fragments of sedimentary rocks and mineralization to the floor from depths believed to be 400-1,000 meters under the floor. Drilling of deep holes, presumably together with a twin of an historic gap, is deliberate.

Gold mineralization starting from anomalous values of 0.1-0.3 g/t to twenty-eight g/t with native copper has additionally been encountered on the floor related to dikes (see Information Launch of July 11, 2023).

Determine 1: Location of the Scorching Breccia copper challenge in Arizona.

Determine 2. View of the subsurface wanting northeasterly exhibiting the conductive physique from the ZTEM survey and cross sections of the Christmas deposit and the Scorching Breccia space. Historic drill holes are proven with copper assays as disks inside the purple ellipse; the magenta shade signifies > 1% Copper.

Determine 3. Plan view of the floor geology exhibiting the recent breccia land boundary in black and the cross sections from Fig. 2. The floor projection of the conductive physique proven in Fig. 2 is roughly outlined in purple.

Assay outcomes from historic drill holes are unverified because the core has been destroyed, however info has been gathered from memos, images and drill logs that include some, however not all, of the assay outcomes and descriptions.

About Palos Verdes

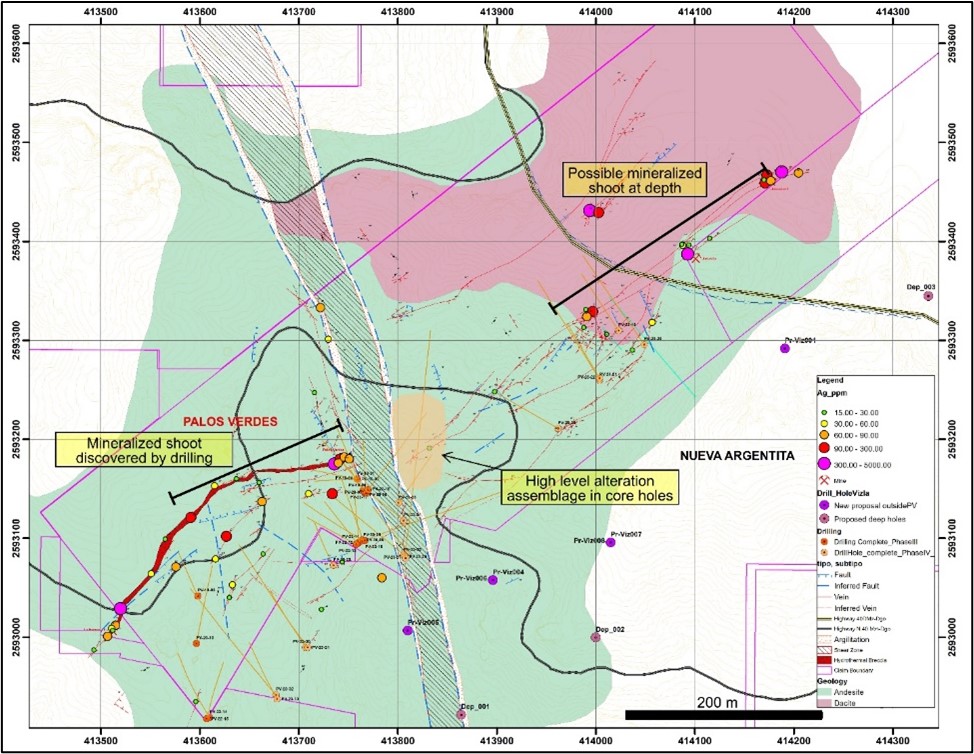

The Palos Verdes challenge is positioned within the historic Pánuco-Copala silver-gold district in southern Sinaloa, Mexico, roughly 65 kilometers NE of Mazatlán, Sinaloa, within the Municipality of Concordia. The Palos Verdes concession (declare) covers 700 meters of strike size of the Palos Verdes vein, a member of the north-easterly trending vein household positioned within the japanese a part of the district outdoors of the realm of contemporary exploration. Shallow drilling (www.prismometals.com ). This mineralization is open in all instructions and the at the moment deliberate drilling program is designed to observe it alongside strike and to depth.

A geochemical sampling program performed in late 2023 centered on slender and most strongly mineralized parts of the vein was performed alongside the uncovered strike size of the Palos Verdes vein system. The perfect pattern from that program assayed 930 g/t silver and 10.55 g/t gold with 15.4% zinc and 4.5% lead (2,605 g/t Ag/Eq) over 0.5 meters. Strongly anomalous values of valuable steel and indicator parts happen above the mineralized shoot recognized throughout drilling and in addition alongside the vein system additional to the northeast. This space could point out the presence of a second blind mineralized shoot that will even be examined by the deep drilling from Vizsla floor.

Desk 1. Assay highlights for Palos Verdes sampling program.

| Pattern |

UTM Coordinates WGS84 |

Size |

Au |

Ag |

Cu |

Pb |

Zn |

|

|

E |

N |

meters |

g/t |

g/t |

% |

% |

% |

|

|

126032 |

414,003 |

2,593,429 |

0.5 |

0.833 |

280 |

– |

– |

– |

|

126035 |

414,173 |

2,593,467 |

1.0 |

0.854 |

174 |

– |

– |

– |

|

126036 |

414,171 |

2,593,459 |

1.0 |

0.152 |

103 |

– |

– |

– |

|

126037 |

414,188 |

2,593,470 |

1.0 |

5.96 |

433 |

– |

– |

– |

|

126038 |

414,205 |

2,593,469 |

1.0 |

0.249 |

75.5 |

– |

– |

– |

|

126041 |

414,093 |

2,593,387 |

1.0 |

0.969 |

415 |

– |

– |

– |

|

126068 |

413,520 |

2,593,029 |

0.5 |

0.174 |

103 |

– |

– |

– |

|

126072 |

413,591 |

2,593,121 |

0.5 |

0.184 |

98.8 |

– |

– |

– |

|

126077 |

413,627 |

2,593,102 |

0.5 |

1.285 |

326 |

– |

– |

– |

|

126079 |

413,663 |

2,593,137 |

0.5 |

0.331 |

78.1 |

– |

– |

– |

|

126083 |

413,722 |

2,593,333 |

0.5 |

0.459 |

65 |

– |

– |

– |

|

126085 |

413,740 |

2,593,176 |

0.5 |

0.203 |

82.6 |

0.94 |

4.55 |

14.23 |

|

126086 |

413,736 |

2,593,175 |

0.5 |

10.55 |

930 |

0.78 |

4.50 |

15.40 |

|

126088 |

413,746 |

2,593,182 |

0.5 |

0.073 |

76.8 |

0.78 |

1.14 |

2.03 |

|

126089 |

413,744 |

2,593,076 |

0.5 |

0.034 |

24.5 |

0.22 |

2.33 |

3.40 |

|

126095 |

413,734 |

2,593,145 |

0.5 |

1.19 |

190 |

– |

– |

– |

|

517878 |

413,751 |

2,593,180 |

0.5 |

0.079 |

61.7 |

0.32 |

0.73 |

11.85 |

|

517879 |

413,742 |

2,593,180 |

0.5 |

0.182 |

129 |

0.18 |

8.22 |

15.65 |

The Firm accomplished its third drill marketing campaign final 12 months with 2,923 meters drilled in 15 holes with excessive grade mineralization encountered in a number of holes. Assays beforehand reported from this program embrace the highest-grade intercept recorded on the challenge in gap PV-23-25 with 102 g/t gold, 3,100 g/t silver and 0.26% zinc over 0.5 meters, or 11,520 g/t silver equal (see Information Launch of July 27, 2023). The final eight drill holes in this system, PV-23-26 to PV-23-33 have been drilled to check the bounds of the mineralized shoot within the western portion of the vein at depth and to the east of the NW fault.

Holes PV-23-27 and PV-23-29 to PV-23-33 examined the mineralized shoot to outline the bounds of mineralization and reduce variably mineralized vein materials (Desk 1). The angle of inclination of a number of holes was very steep at -75 levels, and drilling from the Vizsla Silver floor will present extra helpful info.

Holes PV-23-26 and PV-23-28 explored to the east of the NW fault and didn’t reduce important mineralization however supplied priceless info for the following holes that must be drilled deeper from the adjoining Vizsla Silver floor.

2023 Palos Verdes Drilling Highlights

PV-23-25:

- This gap intersected 11,520 g/t Ag equal over 0.5 meters (3,100 g/t Ag, 102 g/t Au and 0.26% Zn)

- This intercept is a part of a wider mineralized interval with 4,311 g/t Ag equal over 1.35 meters (1157 g/t Ag, 38 g/t Au and 0.1% Zn)

- A second interval greater within the gap yielded 512 g/t Ag equal over 0.3 meter (384 g/t Ag, 1.36 g/t Au and 0.27% Zn)

PV-23-24:

- This gap intercepted 1,234 g/t g/t Ag equal over 0.7 meter (60 g/t Ag, 11.9 g/t Au and three.9% Zn)

- This interval is inside a wider 2.6-meter interval with 384 g/t Ag equal (32 g/t Ag, 3.3 g/t Au and 1.57% Zn)

- A second interval greater within the gap yielded 302 g/t Ag equal over 1.2. meters (95 g/t Ag, 1.84 g/t Au and 1.2% Zn)

PV-23-20:

- This gap intercepted 189 g/t g/t Ag equal over 0.9 meters (58 g/t Ag and 1.58 g/t Au) and is the primary mineralized intercept within the northeastern portion of the concession

PV-23-32:

- This gap intersected 450.2 g/t Ag equal over 0.3 meters (45 g/t Ag, 0.83 g/t Au, 0.43% Pb, and 0.47% Zn) as half of a bigger zone of two.2 meters with 115 g/t Ag equal

- A second interval deeper within the gap yielded 391.5 g/t Ag equal over 0.4 meters (17 g/t Ag, 3.56% Pb, 6.03percentZn) inside a bigger interval of 5.55 meters with 103.8 g/t Ag equal

PV-23-33:

- This gap intersected 112.7 g/t Ag equal over 0.35 meters (37 g/t Ag, 0.489 g/t Au, 0.36% Pb, and 0.56% Zn)

- A second interval deeper within the gap yielded 105.6 g/t Ag equal over 0.3 meters (20 g/t Ag, 0.22% Pb, 1.79% Zn)

- A 3rd interval contained 382.2 g/t Ag equal over 0.45 meters (144 g/t Ag, 0.45% Pb, 5.12% Zn) inside a 0.75-meter interval of 253.4 g/t Ag equal (95 g/t Ag, 0.31% Pb, 3.39% Zn)

Determine 4. Geologic and drill gap map of the Palos Verdes and adjoining concessions with silver assays from the latest sampling and exhibiting floor projection of the mineralized shoots and the high-level alteration assemblage mentioned within the textual content. Deliberate deep drill holes from Vizsla Silver floor proven in purple and purple shade. Broad hachured swath is the northwest-trending construction interpreted to have offset the japanese extension of the vein.

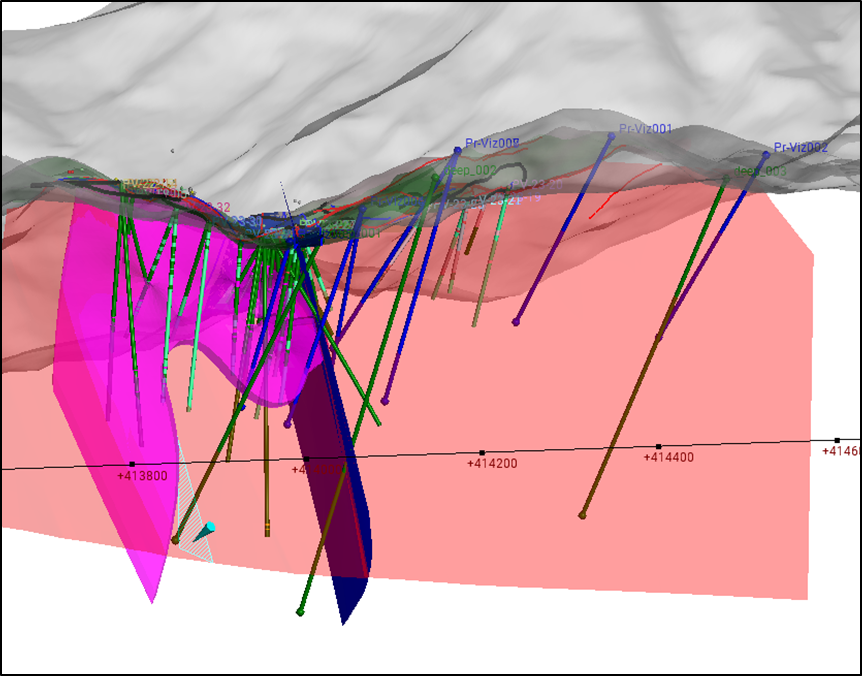

Determine 5. View of subsurface at Palos Verdes, wanting northerly, with the Palos Verdes vein projection in purple and the high-grade mineralized shoot in magenta, apparently truncated by the NW fault, blue.

Desk of drill highlights for the beforehand unreported holes on the Palos Verdes Challenge:

|

Gap |

From |

To |

Width |

Est True width (m) |

Au |

Ag (g/t) |

Cu |

Pb |

Zn |

*Ag eq (g/t) |

|

PV-27 |

0.90 |

1.30 |

0.40 |

0.10 |

0.216 |

107 |

– |

0.02 |

0.02 |

126.2 |

|

PV-32 |

109.40 |

111.60 |

2.20 |

1.41 |

0.16 |

17.5 |

0.27 |

0.92 |

1.30 |

115.4 |

|

111.30 |

111.60 |

0.30 |

0.19 |

0.83 |

45.0 |

0.68 |

4.32 |

4.67 |

333.9 |

|

|

150.10 |

155.65 |

5.55 |

3.57 |

0.20 |

20.7 |

0.16 |

0.61 |

1.09 |

103.8 |

|

|

155.25 |

155.65 |

0.40 |

0.26 |

0.04 |

17 |

0.21 |

3.56 |

6.03 |

391.5 |

|

|

PV-33 |

225.65 |

226.40 |

0.75 |

0.26 |

0.03 |

94.8 |

2.28 |

0.31 |

3.39 |

253.4 |

|

225.95 |

226.40 |

0.45 |

0.14 |

0.04 |

144 |

3.65 |

0.45 |

5.12 |

382.2 |

*Silver equal values are calculated utilizing the next metals costs: Au, US$1,750/oz, Ag, $21.24/oz, Pb, $0.97/lb and Zn, $1.34/lb. Cu was not used within the calculation, and metallurgical recoveries weren’t thought-about as there isn’t any knowledge accessible for the Palos Verdes vein. True width estimated from gap inclination and estimated vein dip, the place recognized.

Desk of drill gap knowledge for holes not beforehand launched:

|

Gap |

Goal |

Easting |

Northing |

Elev |

Azim |

Incl |

Depth (m) |

|

|

PV-23-26 |

NW fault |

413,807 |

2,593,082 |

1,236 |

10 |

-45 |

327.00 |

|

|

PV-23-27 |

PV vein |

413,814 |

2,593,082 |

1,226 |

320 |

-75 |

234.00 |

|

|

PV-23-28 |

NW fault |

413,801 |

2,593,136 |

1,244 |

35 |

-60 |

117.00 |

|

|

PV-23-29 |

SW PV hole |

413,735 |

2,593,073 |

1,216 |

330 |

-75 |

183.00 |

|

|

PV-23-30 |

SW PV hole |

413,707 |

2,592,990 |

1,202 |

330 |

-50 |

180.00 |

|

|

PV-23-31 |

SW PV hole |

413,709 |

2,592,990 |

1,200 |

330 |

-75 |

246.00 |

|

|

PV-23-32 |

SW PV hole |

413,677 |

2,592,942 |

1,211 |

315 |

-50 |

199.50 |

|

|

PV-23-33 |

SW PV hole |

413,678 |

2,592,938 |

1,216 |

330 |

-75 |

250.50 |

|

Coordinates in UTM WGS84 utilizing handheld Garmin GPS.

Further Data In regards to the Personal Placement

The Personal Placement will probably be made accessible to subscribers pursuant to the accredited investor and buddies, household and enterprise affiliate exemptions supplied below sections 2.3(1) and a couple of.5 of Nationwide Instrument 45-106 Prospectus Exemptions.

The Personal Placement will even be made accessible to current shareholders of the Firm who, as of the shut of enterprise on April 3, 2024, held Shares (and who proceed to carry such Shares as of the deadline of the Personal Placement), pursuant to the prevailing securityholder exemption set out in BC Instrument 45-534 Exemption From Prospectus Requirement for Sure Trades to Current Safety Holders (the “Current Securityholder Exemption“). The Current Securityholder Exemption limits a shareholder to a most funding of CAD$15,000 in a 12-month interval until the shareholder has obtained recommendation relating to the suitability of the funding and, if the shareholder is resident in a jurisdiction of Canada, that recommendation has been obtained from an individual that’s registered as an funding vendor within the jurisdiction. If the Firm receives subscriptions from traders counting on the Current Securityholder Exemption exceeding the utmost quantity of the Personal Placement, the Firm intends to regulate the subscriptions acquired on a pro-rata foundation.

The Firm intends to make use of the proceeds from the Personal Placement to fund drilling at its Palos Verdes challenge, and for normal working capital functions. There could also be circumstances, nevertheless, the place, for sound enterprise causes, a reallocation of funds could also be essential.

The Firm could pay finder’s charges to eligible finders in reference to the Personal Placement, topic to compliance with relevant securities legal guidelines and Canadian Securities Trade insurance policies.

All securities issued in reference to the Personal Placement will probably be topic to a four-month maintain interval from the deadline below relevant Canadian securities legal guidelines, along with such different restrictions as could apply below relevant securities legal guidelines of jurisdictions outdoors Canada.

The securities being supplied haven’t been and won’t be registered below the U.S. Securities Act and is probably not supplied or bought in the US, or to, or for the account or advantage of, U.S. individuals or individuals in the US, absent registration or an relevant exemption from the registration necessities. This press launch shall not represent a proposal to promote or the solicitation of a proposal to purchase nor shall there be any sale of the securities in any State during which such provide, solicitation or sale could be illegal.

Debt Settlements

The Firm additionally publicizes that it has entered into debt settlement agreements with sure collectors of the Firm (the “Collectors“) pursuant to which the Firm has agreed to subject to the Collectors, and the Collectors have agreed to simply accept, an combination of 646,391 Items (the “Settlement Items“), in full and ultimate settlement of accrued and excellent indebtedness within the combination quantity of $109,886.

Every Settlement Unit consists of 1 Share and one-half of 1 Warrant. Every such warrant shall entitle the holder to buy one widespread share within the capital of the Firm for a interval of twenty-four (24) months from the date of subject at an train value of $0.25.

The Settlement Items will probably be topic to a statutory maintain interval of 4 months from the date of issuance below relevant Canadian securities legal guidelines, along with such different restrictions as could apply below relevant securities legal guidelines of jurisdictions outdoors Canada.

Up to date Disclosure Relating to Closing of Prior Debt Settlement Transaction

The Firm additionally needs to make clear its beforehand disseminated press launch dated April 5, 2024, saying the closing of the Firm’s beforehand introduced debt settlement transactions with sure collectors of the Firm (the “Prior Debt Settlement”). The press launch inadvertently disclosed in a single occasion that the Firm issued a complete of 788,235 Shares to ProDeMin, an organization managed by then President and CEO (now Chief Exploration Officer) of Prismo, Dr. Craig Gibson, within the Prior Debt Settlement. The precise variety of Shares issued to ProDeMin was 588,235 as elsewhere acknowledged within the information launch.

QA/QC

Samples taken by Prismo are analyzed by multielement ICP-AES and MS strategies internationally acknowledged analytical service suppliers. Licensed Reference Supplies together with normal pulps and coarse clean materials are inserted within the pattern stream at common intervals. Dr. Craig Gibson, PhD., CPG., a “Certified Particular person” as outlined by Nationwide Instrument 43-101 and Chief Exploration Officer and a director of the Firm, has reviewed and permitted the technical disclosure on this information launch.

Not for distribution to U.S. information wire providers or dissemination in the US.

About Prismo Metals Inc.

Prismo (CSE: PRIZ) is mining exploration firm centered on two valuable steel tasks in Mexico (Palos Verdes and Los Pavitos) and a copper challenge in Arizona (Scorching Breccia).

Please observe @PrismoMetals on Twitter, Fb, LinkedIn, Instagram, and YouTube

Prismo Metals Inc.

1100 – 1111 Melville St., Vancouver, British Columbia V6E 3V6

Contact:

Alain Lambert, Chief Government Officer alambert@cpvcgroup.ca

Steve Robertson, President steve.robertson@prismometals.com

Jason Body, Supervisor of Communications jason.body@prismometals.com

Neither the Canadian Securities Trade nor its Market Regulator (as that time period is outlined within the insurance policies of the Canadian Securities Trade) accepts duty for the adequacy or accuracy of this launch.

Cautionary Word Relating to Ahead-Trying Data

This launch consists of sure statements and knowledge which will represent forward-looking info inside the which means of relevant Canadian securities legal guidelines. Ahead-looking statements relate to future occasions or future efficiency and mirror the expectations or beliefs of administration of the Firm relating to future occasions. Typically, forward-looking statements and knowledge could be recognized by means of forward-looking terminology comparable to “intends” or “anticipates”, or variations of such phrases and phrases or statements that sure actions, occasions or outcomes “could”, “may”, “ought to”, “would” or “happen”. This info and these statements, referred to herein as “ahead‐wanting statements”, usually are not historic info, are made as of the date of this information launch and embrace with out limitation, statements relating to discussions of future plans, estimates and forecasts and statements as to administration’s expectations and intentions with respect to, amongst different issues: the anticipated deadline of the Personal Placement; the anticipated proceeds to be raised below the Personal Placement; the supposed use of any proceeds raised below the Personal Placement; the fee of any finder’s charges in reference to the Personal Placement; the issuance of the Settlement Items; the Firm’s plans to start drilling on the Scorching Breccia and Palos Verdes tasks and the anticipated depth thereof; and the anticipated receipt of the ultimate BLM allow and the timing thereof.

These ahead‐wanting statements contain quite a few dangers and uncertainties and precise outcomes may differ materially from outcomes prompt in any forward-looking statements. These dangers and uncertainties embrace, amongst different issues: delays in acquiring or failure to acquire required regulatory approvals for the Personal Placement and the Debt Settlement; market uncertainty; the shortcoming of the Firm to lift the anticipated proceeds below the Personal Placement; the shortcoming of the Firm to make the most of the anticipated proceeds of the Personal Placement as anticipated; delays or modifications in plans with respect to exploration tasks or capital expenditures, together with in respect of the Firm’s proposed drill packages; delays within the receipt of the ultimate BLM allow; the uncertainty of mineral useful resource exploration price estimates; well being, security and environmental dangers; worldwide demand for metals; metals costs and different commodity value and trade charge fluctuations; environmental dangers; competitors; potential to entry adequate capital from inner and exterior sources; and modifications in laws, together with however not restricted to tax legal guidelines, royalties and environmental rules.

In making the ahead wanting statements on this information launch, the Firm has utilized a number of materials assumptions, together with with out limitation: the Firm will get hold of the required regulatory approvals for the Personal Placement; the Firm will be capable to elevate the anticipated proceeds below the Personal Placement and on the timetable anticipated; the Firm will use the proceeds of the Personal Placement as at the moment anticipated; the Firm will subject the Settlement Items as anticipated; the Firm will start drilling on the Scorching Breccia and Palos Verdes tasks on the anticipated depth and on the timetable anticipated; and the ultimate BLM allow will probably be acquired and on the timetable anticipated.

Though administration of the Firm has tried to determine essential components that would trigger precise outcomes to vary materially from these contained in forward-looking statements or forward-looking info, there could also be different components that trigger outcomes to not be as anticipated, estimated or supposed. There could be no assurance that such statements will show to be correct, as precise outcomes and future occasions may differ materially from these anticipated in such statements. Accordingly, readers shouldn’t place undue reliance on forward-looking statements and forward-looking info. Readers are cautioned that reliance on such info is probably not applicable for different functions. The Firm doesn’t undertake to replace any forward-looking assertion, forward-looking info or monetary out-look which might be included by reference herein, besides in accordance with relevant securities legal guidelines. We search protected harbor.

SOURCE:Prismo Metals Inc.

View the unique press launch on accesswire.com