A reader asks:

Slightly about me: I’m 38 (getting near center age) and moved to the U.S. from India in 2008 for my grasp’s diploma. I began working full-time in 2011 however delayed contributing to my 401(ok) till 2014, as I wasn’t positive I’d keep right here completely. Life modified after I met my spouse, and now we’ve got stunning twin daughters. My 401(ok) is now round ~$380K, with allocations to ETFs and shares like QQQ, SMH, AMZN, GOOG, and LRCX together with large-cap S&P 500 index funds. I even have round $575K in taxable brokerage accounts. My two questions are: (1) Am I taking over an excessive amount of danger? (2) How does my progress examine to others in my age group?

This can be a cool story.

This man got here to America for an training, began a household and is now effectively on his approach to monetary freedom. The American dream.

The opposite facet of the American dream is monetary nervousness. Nearly everybody has it, even folks with a number of cash.

You and your loved ones are doing fairly effectively. Regardless of a late begin to 401k financial savings, between the tax-deferred and taxable brokerage account you’re price practically $1 million. That’s an unimaginable accomplishment earlier than age 40.

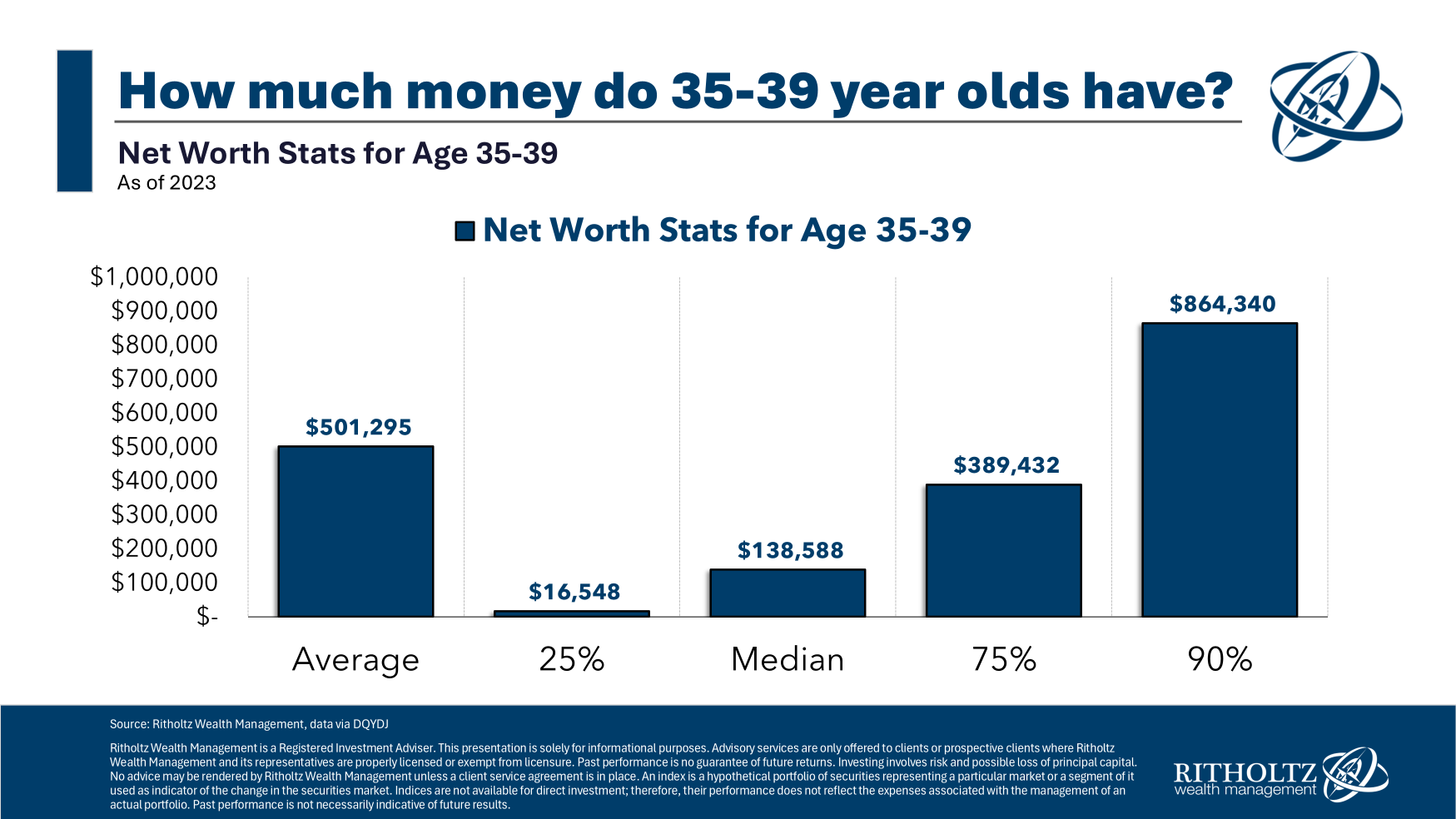

Your progress in comparison with others in your age group is robust to fairly robust:

The median web price for folks within the 35-39 age vary is rather less than $140,000. Your $955,000 places you squarely within the prime 10% of your peer group.1

It may be fascinating to have a look at these numbers to see the way you stack up however I’m not a fan of evaluating your funds to that of your age group, mates, neighbors, co-workers or anybody else.

What good does it do you?

The one factor that issues is how you’re progressing in the direction of your personal private objectives. Different folks don’t have the identical danger profile, time horizon or circumstances as you. It’s foolish to make use of others as your benchmark as a result of the one end result is probably going jealousy and envy.

Cash objectives are private similar to your danger profile. It’s arduous to say when you’re taking an excessive amount of danger or not as a result of danger is subjective.

Listed below are some inquiries to ask your self on the subject of monitoring progress and determining your danger profile:

When are you going to spend the cash? This helps you determine your time horizon for investing.

What are your present spending habits? Spending is the largest blindspot for private finance specialists. It’s not all about saving; you should take pleasure in a few of your cash, however you should have a very good deal with in your spending ranges to know your monetary wants.

How a lot cash do you make? Revenue is among the most vital variables on the subject of constructing wealth. It’s a must to save a few of that revenue however it’s a lot simpler to avoid wasting while you make more cash.

How a lot do you save every year? Your financial savings charge is an efficient approach to chart your monetary progress. A ten% financial savings charge ought to be the purpose. Something within the 20-30% vary or up and you’re doing incredible.

When do you need to retire? It’s OK when you don’t know but however that is useful in figuring out how lengthy till you want some extra conservative property to see you thru retirement.

How large of a margin of security do you require? Threat urge for food is private and sometimes decided extra by your persona, upbringing and previous experiences. Some folks want a much bigger margin of security than others. Your desire for danger comes all the way down to some mixture of math and emotions (which aren’t simple to quantify).

How snug are you with volatility and drawdowns? You’ve survived to date with an all-equity portfolio. How effectively did you deal with the Covid crash of 2020 or the 2022 bear market? The perfect predictor of future conduct is previous conduct.

How a lot cash are you keen to see evaporate? Greenback losses matter greater than share losses the extra money you accumulate. A 40% drawdown on $100,000 is a lack of $40,000. All it takes to lose $40,000 on a $1 million portfolio is a 4% loss. Shedding 40% of your portfolio means seeing $400,000 evaporate. What’s your line within the sand? That may assist higher decide your asset allocation and willingness to just accept kind of danger.

Do you could have a portfolio or a plan? Shares, mutual funds and ETFs are holdings that make up a portfolio. However ticker symbols alone don’t make an funding plan. A plan requires making good selections forward of time about your asset allocation, purchase and promote selections, rebalancing coverage and matching your investments together with your objectives.

Your objectives are the one benchmark that issues.

Invoice Candy joined me on Ask the Compound this week to debate this query:

We additionally touched on questions on managing your brokerage account, one of the best ways to optimize asset location, RSUs vs. HELOCs when paying for a house renovation and jewellery as an asset class.

Additional Studying:

10 Cash Revelations in my 40s

1And these peer rankings are web price figures. This reader didn’t point out how a lot debt or dwelling fairness his household has, if any.