Competitors heats up amongst AI heavyweights

As talked about, main tech corporations jumped headfirst into AI in 2024.

For its half, Google (NASDAQ:GOOGL) started the yr by rebranding its Bard chatbot as Gemini. The February resolution streamlined its AI merchandise beneath a single model, showcasing a transfer towards a extra refined and unified AI expertise. Its latest interplay, Gemini 2.0, was launched on December 11.

In the meantime, Microsoft (NASDAQ:MSFT) deepened its partnership with OpenAI, investing one other US$750 million throughout an October funding spherical price US$6.6 billion. This newest spherical introduced the corporate behind ChatGPT to a complete valuation of US$157 billion. In response to SEC filings, Microsoft’s whole funding in OpenAI has now reached US$13 billion.

NVIDIA (NASDAQ:NVDA), SoftBank (TSE:9434) and a handful of enterprise capital corporations additionally participated within the spherical, however beneath the stipulation that OpenAI shift management of its dealings to a for-profit arm.

This sparked rumors {that a} potential preliminary public providing on the horizon.

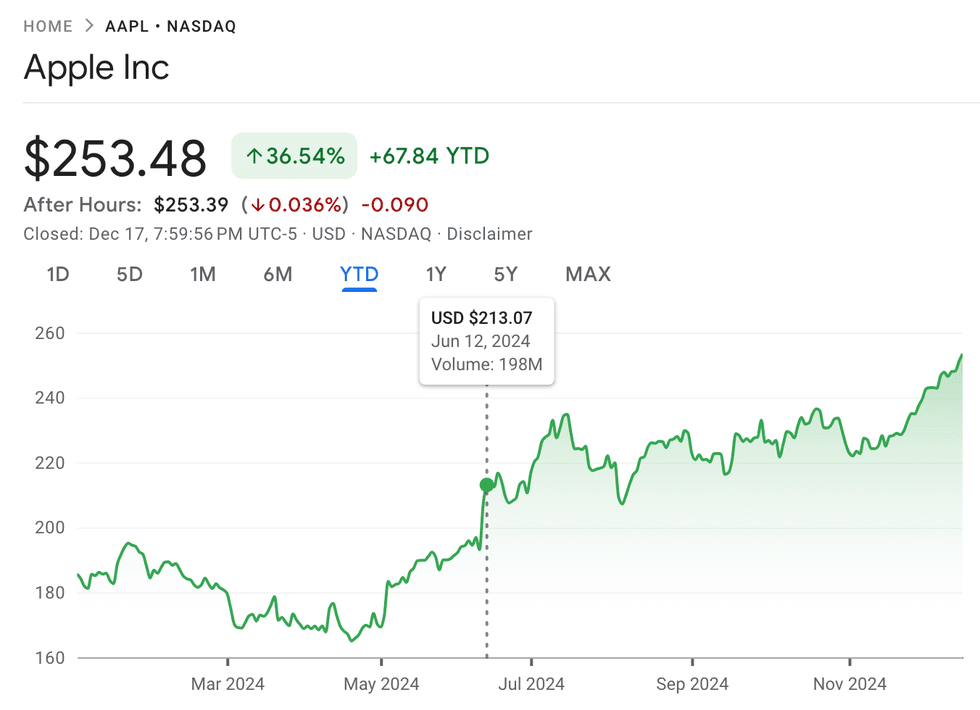

Apple (NASDAQ:AAPL), notably lacking from the record of buyers who participated in OpenAI’s October funding spherical, has opted for a extra unbiased path, specializing in inner AI improvement.

At its annual developer convention from June 10 to 14, it unveiled Apple Intelligence for iOS18, saying it was coming to iPhone 16, iPadOS 18 and macOS Sequoia customers. Nonetheless, the corporate additionally shared plans to combine ChatGPT in some merchandise, like its voice-activated assistant Siri, as a supplemental layer on high of Apple Intelligence.

Apple efficiency, January 1 to December 17, 2024.

Chart by way of Google Finance.

The corporate’s share worth gained nearly 8 p.c by the tip of the convention.

Apple Intelligence was launched for qualifying fashions on October 28, and the latest software program replace, together with ChatGPT for writing instruments and Siri, was launched on December 11.

OpenAI itself launched GPT-4o on Could 13, saying that it was optimized for multimodal duties like analyzing audio and video. Later within the yr, on September 12, the corporate previewed its first o1 mannequin. OpenAI’s o1 collection is designed to spend extra time “considering” earlier than it responds and possesses superior reasoning expertise.

Nonetheless, shortly after the mannequin was launched, The Info reported that o1 confirmed a slower fee of enchancment in comparison with earlier fashions, exposing potential limitations to steady developments in AI capabilities.

Amazon (NASDAQ:AMZN), whereas much less centered on consumer-facing AI merchandise, invested closely in constructing out its cloud infrastructure and allotted one other US$4 billion to AI analysis firm and OpenAI rival Anthropic on November 22. This brings Amazon’s whole funding in Anthropic to US$8 billion. As a part of this expanded partnership with Amazon, Anthropic additionally made Amazon Net Companies its major cloud supplier.

Meta (NASDAQ:META) centered on integrating generative AI throughout its platforms in 2024, resulting in enhancements like higher advert concentrating on and content material suggestions. The corporate additionally launched the MTIA v2 chip, an improved model of its AI inference chip that’s designed to deal with the large quantity of knowledge generated by Meta’s buyer base. The most recent model of Meta’s open-sourced massive language mannequin, Llama 3, was launched on April 18.

Elon Musk’s AI firm, xAI, upgraded its massive language mannequin Grok-2. A beta model of Grok-2 was launched on August 13 and was made accessible to all X customers on December 12. Grok-2 was skilled on xAI’s supercomputer Colossus, which is powered by 100,000 NVIDIA graphics processing models (GPUs) and got here on-line on September 11. The corporate held two US$6 billion funding rounds in 2024, and as of November 28 was valued at a staggering US$50 billion.

{Hardware} is king

Vertical integration gained momentum in 2024 as corporations invested in additional elements of the chip-making course of.

NVIDIA maintained its dominance, attracting consideration with excellent earnings seasons and intermittently incomes the title of the world’s most respected firm. The corporate set the stage for exponential additional progress when it launched its Blackwell structure on the GPU Know-how Convention in March.

Nonetheless, the corporate has confronted surprising design hurdles which have delayed the debut of Blackwell GPUs. Whereas no official launch date was set, it was broadly speculated that they might be accessible in direction of the tip of 2024. A progress replace will reportedly be introduced on the Shopper Electronics Present in January.

NVIDIA efficiency, January 1 to December 17, 2024.

Chart by way of Google Finance.

Superior Micro Gadgets (AMD) (NASDAQ:AMD), NVIDIA’s most direct competitor, reported a 9 p.c improve in income in Q2, pushed by its MI300X AI chip. MI300X combines GPU and central processing unit capabilities right into a single chip, giving a leg up over NVIDIA, which designs each chips individually to work collectively.

Additionally in 2024, AMD collaborated with a handful of software program and {hardware} corporations to develop a brand new AI accelerator normal that’s able to difficult NVIDIA’s NVLink.

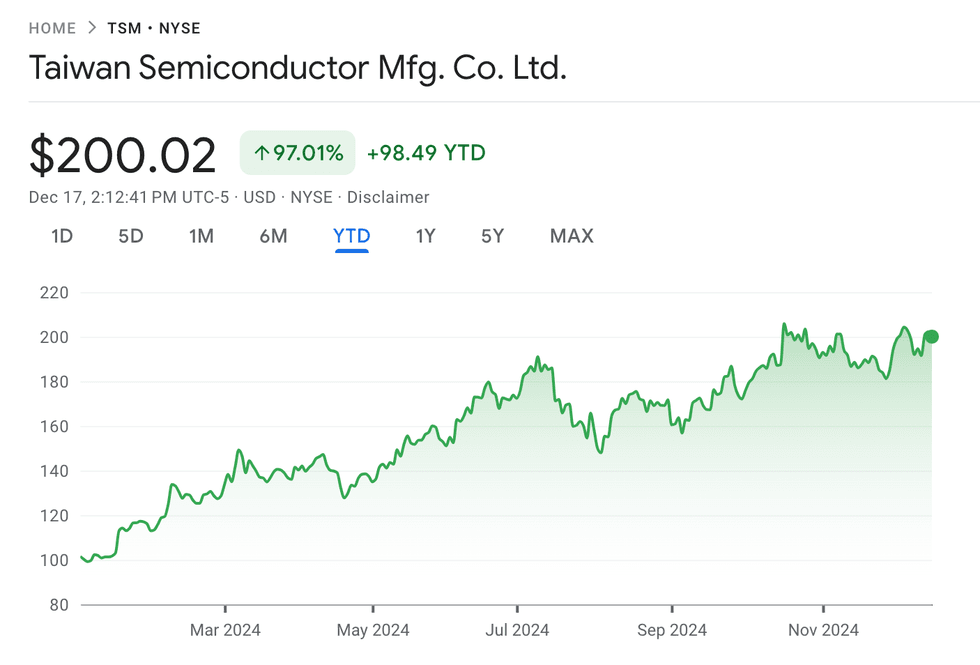

2024 introduced chip designers with a problem as clients like Apple and Google more and more moved chip design in-house. Made by Taiwan Semiconductor Manufacturing Company (TSMC) (NASDAQ:TSM), Apple’s A- and M-series chips characteristic a neural engine to allow on-device AI and powered a slew of recent merchandise launched this yr.

Google launched its Tensor G4 chip, designed in collaboration with Broadcom (NASDAQ:AVGO) and manufactured by TSMC. The G4 chip powers Google’s refreshed lineup of Pixel units, launched on August 13.

The shifting tendencies resulted in TSMC rising as an undisputed victor. The corporate reported excellent income and earnings in 2024, fueled by a surge in demand for highly effective chips and its superior manufacturing applied sciences.

Its share worth hit an intraday excessive of US$211.93 on October 17 following its Q3 outcomes, and it recorded an all-time excessive closing share worth of US$205.19 that very same day.

In response to a December 9 report by Taipei-based market intelligence supplier TrendForce, TSMC elevated its share of the wafer foundry market to 65 p.c within the third quarter.

TSMC efficiency, January 1 to December 17, 2024.

Chart by way of Google Finance.

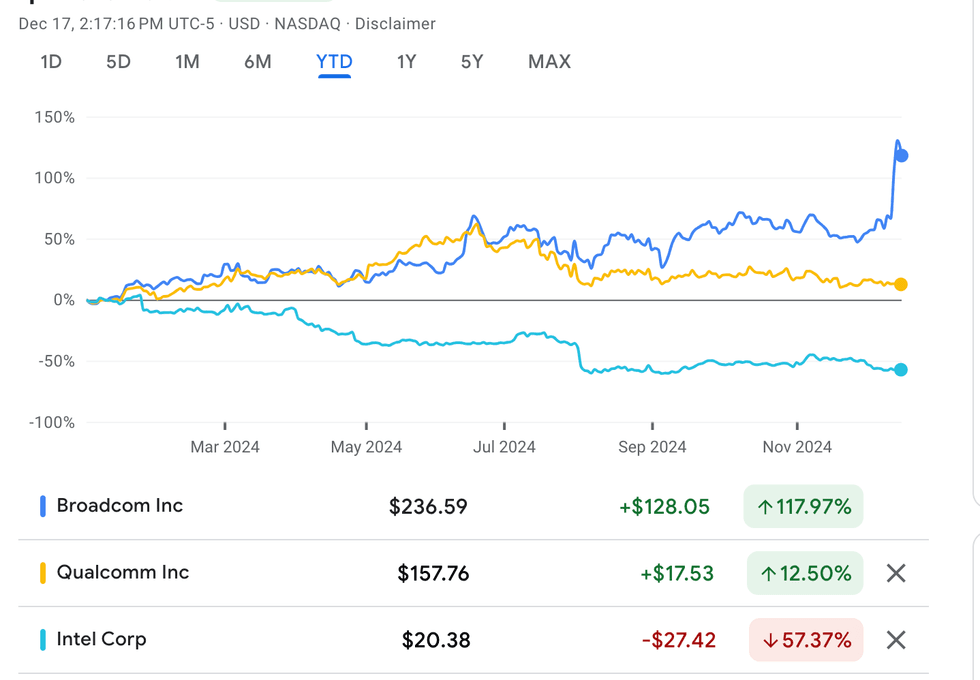

One other chip firm, Broadcom, efficiently navigated 2024 by diversifying into software program by its acquisition of VMware. Broadcom, which performs an important position within the semiconductor business by designing and manufacturing chips that allow the belief of software program targets, reported file income for its 2024 fiscal yr,

The rise was pushed by sturdy demand for its semiconductor merchandise and the profitable integration of VMware. The corporate’s AI-related income greater than tripled, and its quarterly dividend rose by 11 p.c.

In distinction, Qualcomm (NASDAQ:QCOM), which remained largely centered on the {hardware} market this previous yr, appeared extra weak to the business’s shifting tides.

Even business giants like Intel (NASDAQ:INTC) confronted their share of turbulence. Whereas its foundry enterprise struggled, Intel’s pc elements division did effectively, with its Core Extremely processors powering a lineup of AI-enabled laptops from Microsoft and Dell (NYSE:DELL). Dell additionally pushed into hybrid options and edge computing with its APEX portfolio.

Broadcom, Qualcomm and Intel efficiency, January 1 to December 17, 2024.

Chart by way of Google Finance.

AI hype pays dividends for tech giants

Regardless of a notable pullback in Q2 and Q3 due partly to investor considerations concerning the long-term returns of huge AI investments, 2024 was a yr of sturdy monetary performances for tech giants, as evidenced by their dividend payouts.

Meta introduced money dividend funds in Could and September, whereas in Microsoft stated in September that it could reward shareholders with a ten p.c improve to its quarterly dividend cost.

Alphabet additionally issued quarterly dividends for the primary time in 2024, distributing funds 3 times.

It is price noting that the preliminary surge in spending and subsequent pullback may have been influenced by quite a lot of components, together with hype cycles, macroeconomic circumstances and evolving understandings of AI’s capabilities and limitations.

Investor takeaway

Finally, regardless of occasional fluctuations and considerations, investor confidence within the tech sector remained sturdy all through 2024, with funding persevering with to circulate. As of mid-December, shares of Microsoft have been up over 21 p.c year-to-date, whereas Alphabet was up by over 44 p.c and NVIDIA was up an astonishing 166 p.c.

In 2024, the AI sector skilled speedy developments and fierce competitors, pushed by substantial investments from tech giants. Because the expertise continues to mature, the stage is ready for continued innovation and disruption, promising an thrilling future for AI and its functions.

Don’t neglect to observe us @INN_Technology for real-time information updates!

Securities Disclosure: I, Meagen Seatter, maintain no direct funding curiosity in any firm talked about on this article.