The Firm has made important progress with the Pre-Feasibility Examine (“PFS“) on the flagship undertaking, Laguna Verde, and seen encouraging outcomes from the Direct Lithium Extraction (“DLE”) pilot plant in Chile and shall be producing battery-grade lithium carbonate for potential strategic companions to guage. The Firm can also be pursuing a twin itemizing on the Australian Inventory Alternate (“ASX“) and goals to be buying and selling on the ASX in This fall 2024.

Highlights of the Interval:

Operational:

Company:

-

Board adjustments:

-

Government Chairman Steve Kesler assumed the duties of CEO on an interim foundation, following the resignation of CEO, Aldo Boitano in April.

-

The seek for a brand new CEO is effectively underway and the chosen candidate shall be introduced in the end.

-

-

·Money place:

-

The Firm’s money place on the interval finish, together with proceeds acquired from Mortgage Notes shortly after interval finish, was £2.1 million.

-

Submit-period Highlights:

-

Operational:

-

Pump assessments and a reinjection effectively at Laguna Verde, deliberate to be undertaken in This fall 2024, will assist outline the brine extraction and reinjection wellfield design and the sustainable manufacturing charge required for the PFS.

-

A plant location research was accomplished by Worley for the Laguna Verde undertaking and concluded that the DLE and eluate focus must be undertaken at undertaking web site and the purification and carbonation near Copiapo which is at a decrease elevation with good technical assist domestically accessible. This latter plant could be expanded sooner or later to additionally course of concentrated eluate from the Viento Andino undertaking.

-

Completion of the primary stage of manufacturing of concentrated eluate from the Firm´s DLE pilot plant which has been shipped for conversion to battery-grade lithium carbonate by course of companions in North America.

-

Company:

-

ASX Itemizing:

-

The Firm is in search of to dual-list on the Australian Securities Alternate (“ASX”). Though the Firm introduced an extension to the ASX IPO timetable on 20 September 2024, to permit it to deal with some procedural issues raised by ASX, the intention stays to finish the IPO earlier than the yr finish. An related capital increase is deliberate to allow completion of the PFS and continuance of different work programmes. However, the Firm continues to think about its funding choices on an ongoing foundation as part of its regular apply.

-

-

·CEOL Course of:

-

The Authorities has streamlined the CEOL course of, saying an replace on the finish of Septemberprioritising six salt flats for lithium improvement together with Laguna Verde, the Firm’s flagship undertaking, as having probably the most beneficial circumstances to advance lithium exploration and extraction. CEOL functions to be submitted by 31st December 2024.

-

-

Native stakeholders:

-

CTL attended a seminar organised by CESCO alongside native indigenous communities. The President of the Colla Pai-Ote neighborhood publicly endorsed CTL’s Laguna Verde undertaking as the best way ahead for the lithium business in Chile, which was extensively reported within the Chilean media.

-

CTL’s DLE carousel gear is now put in on the College of Atacama as a part of an ongoing partnership. The DLE gear shall be accessible for analysis programmes. The long-term collaboration between the College and CTL will assist nurture the talents required for fostering the lithium business within the Atacama area.

-

Steve Kesler, Government Chairman and Interim CEO, CleanTech Lithium stated:

“The primary half of 2024 has seen important operational and strategic progress on our lithium initiatives in Chile. This contains the manufacturing of top of the range lithium chloride eluate with low impurities from our DLE pilot plant, which has a capability to supply one tonne per 30 days of lithium carbonate equal. A drilling, pump testing and reinjection programme was began at Laguna Verde geared toward updating the JORC useful resource estimate, offering knowledge for the PFS and creating of a maiden reserve estimate.

“The Firm can also be within the strategy of itemizing on the ASX change, which can assist its future improvement, because it enters potential strategic companion discussions and progresses in the direction of manufacturing. While this course of has been delayed, the ASX market is effectively versed within the lithium sector and a significant variety of the Firm’s present shareholders have Australian hyperlinks.

“With the PFS effectively underway and undertaking improvement ongoing, backed by the sturdy assist from native indigenous communities and aligned with the aims of Authorities’s Nationwide Lithium Technique, we sit up for the long run with confidence.”

CHAIRMAN AND INTERIM CEO REVIEW

The next assessment is a glance again on the highlights from the primary half of 2024:

Enterprise Technique

CleanTech Lithium continues to make nice strides in assembly the target of turning into a number one provider of battery-grade lithium carbonate to assist the world’s transition to scrub power. The progress made in the direction of constructing sustainable lithium initiatives in Chile the place the Firm is planning to make use of Direct Lithium Extraction (“DLE”) powered by renewable power immediately addresses the Chilean Authorities’s ambition to drive optimistic change in sustainability and social and financial improvement.

The ‘Nationwide Lithium Technique’, proposed by the President of Chile in late April 2023, goals to make sure Chile stays a high producer and provider of lithium – a important part for batteries in Electrical Automobiles and power storage programs (“ESS”). The established mining jurisdiction is at the moment the biggest provider of copper on the planet and one of many largest suppliers of battery grade lithium. To maneuver to a world run on clear power, new lithium initiatives are wanted, and Chile has the established infrastructure, business experience and workforce to convey initiatives like CleanTech Lithium‘s into manufacturing within the subsequent few years.

New initiatives have to be in-built the correct method and the Authorities has prescribed using DLE (or comparable sustainable applied sciences) for all new lithium improvement initiatives going ahead. CleanTech Lithium‘s technique is to play a big position in helping the Chilean authorities to realize this ambition. The Firm believes it’s most the superior improvement stage DLE firm working in Chile and the achievements made within the first half of 2024 is proof of this. It is rather encouraging to see the Firm’s DLE Pilot Plant producing samples of battery-grade lithium carbonate which can quickly be examined by potential strategic companions.

The Firm’s enterprise technique is targeted on delivering long-term sustainable development and returns for all stakeholders, constructed on 4 pillars:

-

develop the Firm’s superior lithium initiatives (Laguna Verde, Viento Andino) and progress the early-stage exploration initiatives (Arenas Blancas and Llamara) in Chile;

-

utilise progressive applied sciences, together with DLE and, the place attainable, renewable power to sustainably produce lithium carbonate;

-

produce industrial battery-grade lithium carbonate with excessive lithium recoveries and quick manufacturing time; and

-

provide immediately into the EV and battery storage market by way of strategic companions and offtake agreements.

To this finish, the Firm’s speedy aims are as follows:

-

replace the JORC useful resource estimate for Laguna Verde on completion of the 2024 drilling campaigns and declare a maiden reserves estimate;

-

full deliberate hydrogeological research and metallurgical assessments at Laguna Verde, together with finishing a brand new reinjection effectively and pump assessments to offer the information required to additional advance modelling of the sub-surface aquifer and design the extraction and reinjection wellfields;

-

ship a Pre-Feasibility Examine (“PFS”) on the Laguna Verde Undertaking and start the Definitive Feasibility Examine (“DFS”) quickly afterwards;

-

full the method check work on the DLE Pilot Plant and make battery grade lithium carbonate accessible for provide to potential offtake and strategic companions to begin product qualification;

-

proceed the required work to finish the environmental baseline research that commenced in 2022 and undertake the research required to allow submission of the EIA in 1H 2025;

-

enter right into a Particular Lithium Operation Contract (CEOL) with the Chilean State in relation to the Laguna Verde and Viento Andino Initiatives to commercially promote lithium;

-

proceed to collaborate with the native indigenous communities, universities and different native stakeholders to make sure long-term assist for the initiatives, and

-

enter into substantive discussions with potential offtake and strategic companions with a view to reaching settlement on a future enterprise relationship, together with establishing a funding bundle for the development phases of the Laguna Verde Undertaking, together with fairness participation, debt and different buildings, to convey the undertaking on stream and begin promoting lithium carbonate on the earliest attainable alternative.

Abstract of Firm Exercise

Within the first six months of the yr, CleanTech Lithium made additional progress towards delivering its PFS. This included commencing a five-well drilling programme at Laguna Verde, the commissioning of its DLE pilot plant and first manufacturing of extremely concentrated eluate for additional processing to make battery-grade lithium carbonate. The PFS is instrumental to assist discussions with potential strategic companions. The Firm can also be in search of to dual-list on the Australian Securities Alternate (“ASX”). Though the Firm introduced an extension to the ASX IPO timetable on 20 September 2024, to permit it to deal with some procedural issues raised by ASX, the intention stays to finish the IPO earlier than the yr finish. However, the Firm continues to think about its funding choices on an ongoing foundation as part of its regular apply.

Operations

Well being and Security

The Firm maintains a zero-harm security tradition centered on steady enchancment to realize an harm free and wholesome work atmosphere, with no misplaced time incidents (“LTIs”), main incidents, or close to misses reported within the first half of 2024.

5-Nicely Drilling Programme at Laguna Verde

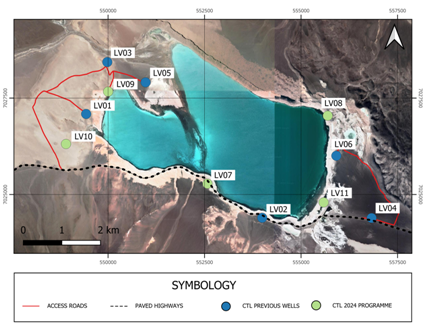

The Firm commenced a 5 effectively drilling programme at Laguna Verde largely geared toward changing Inferred useful resource to extra Measured & Indicated useful resource which can then have technical and financial modifying elements utilized from the PFS to find out a maiden reserve. The programme was designed in collaboration with Montgomery & Associates, a number one worldwide hydrogeology and useful resource analysis consultancy.

The drill programme started in Q1 2024, with the graduation of wells LV07 and LV11 and suspended in Might on the onset of the winter shut-down interval, with the plan to recommence in October. The programme will even embrace extra pump testing and reinjection testing in This fall 2024 with outcomes serving to to calibrate the hydrogeological mannequin of the basin. This mannequin will assist additional outline the brine extraction and reinjection wellfield design and the sustainable manufacturing charge from Laguna Verde. Montgomery & Associates have been engaged to handle the drill programme, JORC useful resource and reserves reporting and design of the extraction and reinjection wellfields.

Laguna Verde is the Firm’s most superior undertaking and has a complete JORC useful resource of 1.8 million tonnes LCE, of which 1.1 million is within the Measured and Indicated class. Laguna Verde’s Scoping Examine, introduced in January 2023, highlighted sturdy economics, with an NPV8 of US$1.8bn, an IRR of 45.1%, internet cashflows of US$6.3 billion and a low working prices of US$3,875/t for 30 years of manufacturing at 20,000 tpa LCE.

Drilling programmes at Laguna Verde since 2022

DLE Pilot Plant Commissioning and Manufacturing

The Firm´s one-tonne per 30 days DLE pilot plant (provided by Sunresin) is positioned in Copiapó, Chile, roughly 250km from Laguna Verde, and completed commissioning in late March. On the R&D centre the place the pilot plant is positioned, brine from the Laguna Verde undertaking is saved in a big 243,000 litre vessel exterior the pilot plant after which fed into an indoor tank having handed by means of filtration to take away suspended solids. It’s then fed into the DLE columns proven within the picture under, that are stuffed with adsorbent designed to be selective for lithium molecules. Lithium, as lithium chloride, is adsorbed from the brine, earlier than desorption with water to create a purified lithium chloride eluate.

DLE Pilot Plant at R&D Centre in Copiapó, Chile (30 x approx. 3m columns to supply as much as 1 tonne per 30 days of LCE)

Testing of a variety of commercially accessible adsorbents recognized that the adsorbent provided by Lanshen carried out the very best on the Laguna Verde brine ensuing within the choice of this adsorbent. The DLE Pilot Plant commenced operation in Q2 2024, producing top quality concentrated eluate. In Might, the Firm reported the important thing DLE efficiency metrics for the primary batch of 24m3 of concentrated eluate produced on the pilot plant. The restoration of lithium from the brine was 94% within the adsorption stage and 88% into the eluate. The lithium grade within the feed brine of 197mg/L was concentrated to 710mg/L within the eluate, or a 3.6X focus issue. These outcomes exceeded the Firm’s expectations. The eluate was additional concentrated by reverse osmosis to 2,194mg/l.

For the primary stage of manufacturing, a complete quantity of 1,196m3 of brine from the Laguna Verde Undertaking was processed on the DLE pilot plant with a complete of 14 cycles accomplished. Every cycle represents a quantity of brine being fed first by means of filtration to take away suspended solids, then into DLE columns that are stuffed with adsorbent designed to be selective for lithium molecules. Lithium, as lithium chloride, is adsorbed from the brine, earlier than desorption with water to create a purified lithium eluate.

Averaged throughout the 14 cycles, the restoration charge achieved by adsorption of lithium from the brine was 95% and the restoration charge of desorption from the adsorbent was 93%. The overall restoration charge into eluate averaged 88% and was extremely constant as proven within the determine under. The temperature of the brine and desorption water, utilizing the typical ambient temperature in Copiapó through the March to June interval of operation, was within the vary of 20oC to 25oC indicating that good efficiency was achieved with out the necessity to warmth options in both adsorption or desorption.

Pilot Plant Complete Restoration Charge

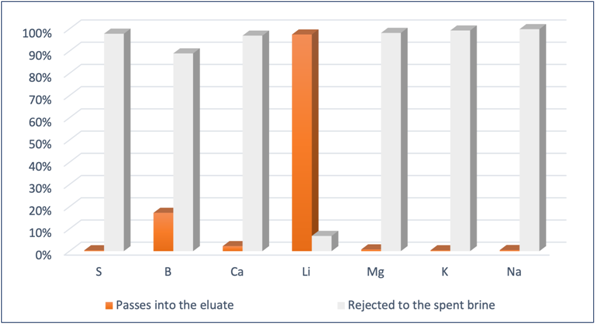

The eluate manufacturing charge was comparatively steady after the preliminary ramp up interval reaching a median of two.8 kg LCE per hour demonstrating that the design capability of the pilot plant of 1 tonne LCE per 30 days was comfortably achieved. Selectivity of the adsorbent is one other key efficiency parameter for a DLE operation. DLE primarily acts as a purification stage, recovering lithium chloride from the brine while rejecting different impurities. For all the main ions within the brine, other than boron, the rejection charge was very excessive, exceeding 99%.

DLE Efficiency – Rejection of Main Impurities

The downstream conversion of lithium chloride answer to battery grade lithium carbonate is effectively established within the lithium business. Reasonably than spending capital on establishing a lithium carbonate conversion plant, the Firm determined to companion with Conductive Vitality, an Alberta, Canada firm to undertake this conversion at its present facility in Chicago.

An preliminary 200L batch of concentrated eluate, was shipped to Conductive Vitality in Might. This batch was used as a trial earlier than establishing the conversion course of that may be used for processing bigger volumes of eluate produced by our DLE pilot plant into battery grade lithium carbonate. Conductive Vitality accomplished the set-up test-work producing lithium carbonate of 99.75% purity which is battery grade. This course of includes focus of the concentrated eluate to 18,000mg/l Li by ahead osmosis adopted by ion change to take away the hint impurities of calcium, magnesium and boron after which carbonation with sodium carbonate to supply battery grade lithium carbonate.

On completion of this trial, the Firm subsequently shipped batches of concentrated eluate from the pilot plant, with a complete of 88m3 shipped by late July, which is equal to roughly one tonne of lithium carbonate.

The downstream plant is being commissioned with lithium carbonate manufacturing anticipated in October 2024. This can present the Firm with the capability to produce important portions of battery-grade lithium carbonate samples to potential strategic companions and offtakers to start product qualification.

Pilot Plant Inauguration

In Might, the DLE pilot plant was formally inaugurated in Copiapó with a ceremony attended by varied regional authorities, indigenous neighborhood leaders, teachers, and enterprise representatives. Attendees on the ceremony included the Presidential Delegate of the Atacama Area, Luis Pino, Regional Councillor Javier Castillo; CORFO Director Rosa Roman, CORPROA President Andres Rubilar; miners’ union president Joel Carrizo; indigenous neighborhood representatives Christian Milla and Ercillia Araya.

DLE Pilot Plant Inauguration Might 2024

DLE inauguration occasion Might 2024 with Steve Kesler, Government Chairman and Interim CEO and Ercilia Araya, President of the Colla-Ote neighborhood

Pre-Feasibility Examine at Laguna Verde

The PFS will outline the optimum configuration for the Laguna Verde undertaking, paving the best way for a DFS and discussions with strategic companions. Information from the DLE pilot plant and the drilling and area programmes are being included into the PFS which is being led by Worley, a world engineering companies firm, from their Santiago workplace.

As a part of that course of, in July, Worley accomplished a plant location research, and CTL has engaged varied consultants to conduct research on port entry, water provide, energy entry and lithium market dynamics. The plant location research recognized the best configuration for a manufacturing facility able to producing 20,000 tonnes of battery-grade lithium carbonate every year. This offered a trade-off evaluation between finding your entire plant at Laguna Verde versus splitting plant amenities between Laguna Verde and the close by mining centre of Copiapó. The choice of finding the DLE plant and eluate focus levels on the Laguna Verde web site, and the carbonation plant at Copiapó was extremely beneficial, ensuing within the choice to proceed with this feature. A concentrated eluate with 6% lithium, the utmost focus earlier than lithium salts start to precipitate, shall be transported to Copiapó for impurity removing and carbonation levels. This configuration ends in a minor improve in volumes transported whereas benefiting from Copiapó’s well-developed infrastructure and higher entry to a talented workforce. Based on the plant design, roughly 70% of the operational workforce shall be employed on the carbonation plant, subsequently finding it in Copiapó offers main benefits in hiring a neighborhood work drive together with variety outcomes akin to better feminine participation, whereas contributing to the native financial system. The footprint on the undertaking web site, which is at 4,300m above sea degree, shall be vastly diminished, from energy provide, storage, camp and plant amenities, development part impacts, and environmental impacts.

The carbonation plant in Copiapó would finally be expanded to additionally deal with concentrated eluate from the Viento Andino undertaking.

Company Developments

Particular Lithium Working Contracts (CEOLs)

Following the declaration of the Nationwide Lithium Technique in April 2023, the Authorities clarified that it could search majority management of strategic lithium belongings within the Salar de Atacama and Salar de Maricunga however that non-strategic salars might be developed by personal sector pursuits with out the necessity for state firm participation. In consequence, the Chilean Authorities requested that the Firm withdraw its preliminary software for CEOLs for Laguna Verde and Viento Andino (previously Francisco Basin) and apply by means of the brand new formal course of. CTL´s undertaking areas have been outlined as non-strategic and the Firm entered the method in June 2024 on a 100% possession foundation for Laguna Verde and Viento Andino. Functions for RFIs has additionally been made for 3 different lithium prospects in joint ventures with different events that are at the moment topic to confidentiality.

The Authorities offered an extra replace to the CEOL software course of on the finish of September, prioritising six salt flats for lithium improvement together with Laguna Verde, the Firm’s flagship undertaking, as having probably the most beneficial circumstances to advance lithium exploration and extraction. The Authorities is anticipated to announce an extra replace later this yr on extra salt flats for lithium improvement. The Ministry of Mining will award one CEOL per salt flat with firms solely thought-about in the event that they meet sure standards. CTL´s Expressions of Curiosity (“RFI“) software immediately addressed every of those key standards and because the Firm has a dominant licence place within the Laguna Verde basin it’s the solely Firm that meets the mining concession space requirement. The standards set out by the Authorities recognises the standing of the Firm´s progress on the Laguna Verde undertaking and places in place a transparent path to award a CEOL and the undertaking’s improvement into manufacturing, which is focused for 2027.

The Chilean Authorities will now start indigenous neighborhood consultations associated to those six salars. Extra to different standards, CTL has developed a powerful relationship with indigenous communities positioned within the environment areas, based mostly on early engagement together with a collaborative alliance signed in December 2023 to co-design the undertaking´s EIA. The Firm can also be working with the regional College to advertise native alternatives for future initiatives. The subsequent stage of the CEOL course of is for firms to submit CEOL functions by December thirty first 2024.

Acquisition of Laguna Verde LicencesIn April 2024, the Firm accomplished the acquisition of 23 Laguna Verde licences, beforehand topic to an possibility settlement. This now provides the Firm full possession and management over all 108 mining licences inside Laguna Verde. The Board believes this acquisition enhances potential returns to shareholders and de-risks the undertaking because it advances. Full possession of those licences has additionally facilitated the deliberate ASX itemizing.

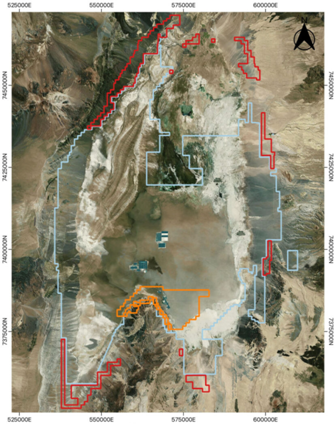

Renaming of Francisco Basin and Salar de Atacama

In June the Firm introduced it had renamed the Francisco Basin undertaking as Viento Andino. This was to make clear the undertaking is positioned exterior a close-by nationwide park of the same identify. Throughout the interval, the Firm additionally introduced the Salar de Atacama licences have been renamed the ‘Arenas Blancas’ undertaking to recognise that these fall exterior of the Salar de Atacama space thought-about by Authorities as ´strategic´ to be managed by the State entity Codelco. These Enviornment Blanca licences are proven right here.

Map of licence areas in Arenas Blancas

ESG and Group Engagement:

In January, the Firm hosted a world seminar on the Universidad de Atacama titled “Lithium: World Challenges. Native Points, Decarbonization, Sustainability and Participation” introduced collectively famend worldwide teachers and business leaders to discover the essential position lithium performs in world decarbonization and the transition to a inexperienced financial system.

The Firm has additionally partnered with the College of Atacama, which has seen the set up of the Firm’s laboratory DLE carousel on the campus. This initiative permits college students to conduct their very own testing and analysis, supporting the event of a workforce for the long run and regional financial improvement.

Submit-period finish, CTL participated within the Centre for Copper and Mining Research (“CESCO”) seminar in Santiago, a distinguished annual seminar for the mining sector in Chile and acquired public assist from the native indigenous neighborhood for its Laguna Verde undertaking. Native and nationwide media lined the endorsement made by the President of Colla-Ote Communities, Ercilia Araya, as seen within the press chopping under. On the seminar the Firm said if the Authorities need to see three to 4 new lithium initiatives in development by 2026, Laguna Verde could be certainly one of these initiatives. To realize this, the Firm continues it engagement with the Chilean Authorities as a part of the CEOLs functions and in a well timed method for the EIA allowing course of.

President of the Colla-Ote Group publicly endorses CleanTech Lithium‘s Laguna Verde undertaking at CESCO Seminar, August 2024

The Firm remained a signatory of the UN World Compact aligning with the ten guiding rules. The annual ‘Communication of Progress’ report was submitted in Might 2024.

ASX dual-listing:

On 20 September the Firm introduced an extension to the Australian Securities Alternate (“ASX”) IPO timetable to permit it to deal with sure procedural issues raised by ASX. Though it’s anticipated the ASX IPO will full previous to the year-end, there could be no certainty over the timing. Consequently, as part of regular apply, the Board continues to think about different accessible funding choices to offer the required ongoing working capital and to take care of progress on the Firm’s varied capital programmes as described above.

The ASX is a pure match as a dual-listing for CTL given the excessive proportion of its shareholder base designated as Australian domiciled; that base contains Regal Funds as a big sharesholder which holds roughly 15% of the Firm’s shares in situation.

It’s clear that an Australian itemizing will broaden the shareholder base, improve the Firm’s profile in Australia and expose the Firm to a deep pool of capital from buyers with an excellent data of investing in useful resource, and lithium, firms.

The Firm will proceed to maintain the market knowledgeable of progress as applicable.

Board Modifications:

Along with my duties as Government Chairman, I assumed the position of Interim CEO in April following Aldo Boitano’s resignation. The seek for a brand new CEO is ongoing, and we sit up for saying the chosen candidate in the end.

Lithium Market:

Whereas the worldwide lithium market stays subdued with present oversupply and low costs, there’s clear expectation that market circumstances can have improved considerably by the point the Firm comes into first manufacturing in 2027. Some present high-cost manufacturing is suspending manufacturing, new initiatives are being deferred while demand for lithium to be used in batteries, for Electrical Automobiles and ESS continues to develop. The expectation is that lithium costs will begin to recalibrate to a medium and longer-term worth that enables new initiatives to be financed. Cannacord Genuity forecasts that pricing to be in extra of US$22,500/t lithium carbonate from 2028 onwards. The scoping research for Laguna Verde and Viento Andino point out that these initiatives shall be within the lowest quartile of prices and financial even at immediately´s low costs and extremely engaging at forecast long-term costs.

The Firm has particular benefits in working in Chile which has a free commerce settlement (“FTA”) with the USA and preferential commerce preparations with the EU for important minerals akin to lithium. The power to produce battery grade lithium carbonate immediately into these markets with out intermediate processing in China shall be necessary for the Firm in these markets. In the meantime Chinese language firms are investing in battery provide chain manufacturing in FTA nations to take care of entry to the US market and can more and more search lithium carbonate from FTA compliant nations for these initiatives. The Firm is effectively positioned to benefit from this dynamic.

Financials:

The Firm’s money place on the interval finish, together with proceeds acquired from Mortgage Notes shortly after interval finish, was £2.1 million.

Within the six months to 30 June 2024, CleanTech continued to prioritise expenditure on its capital programmes with the next progress famous:

-

Laguna Verde: Drilling: 5 effectively programme; PFS: engineering and feasibility research by Worley, Montgomery have been progressed; Hydrogeological modelling: additional evolution of each the modelling and as has the planning for pump-test and reinjection programmes; EIA: analysis of and improvement of the baseline research stays continues and stays a key aspect of CleanTech’s programmes in Chile

-

DLE: pilot plant development, testing and commissioning and preliminary operation prices

-

Group Relations: programme and different ESG initiatives.

As well as, the acquisition of 100% of the authorized and helpful curiosity within the licences in Laguna Verde licences beforehand held underneath an possibility settlement was introduced in April 2024. Refer Notice 12 to the monetary statements for additional particulars.

Administration money prices of roughly £1.9 million have been incurred through the interval (1H 2023: £2.0m million). These money prices, largely replicate £0.5 million for employees prices (1H 2023: £0.5 million), £0.4 million for promotion public and investor relations and journey (1H 2023: £0.7 million), £0.8 million for authorized {and professional} assist together with itemizing and compliance and insurance coverage prices (1H 2023: £0.7 million), the stability of £0.2 million includes quite a lot of different and normal administrative prices (1H 2023: £0.1 million).

On 30 June 2024, the Firm executed a GBP mortgage observe instrument and an AUD mortgage observe instrument pursuant to which it issued mortgage notes (“Mortgage Notes”) to subscribers to boost A$3.995 million, roughly £2.1 million, to finance working capital and prices related to ASX admission. Refer Notice 11 to the monetary statements for additional particulars. Previous to getting into into the mortgage observe devices the Firm additionally terminated an settlement to situation a convertible mortgage observe to a excessive internet value who didn’t pay the subscription monies to the Firm regardless of on-going assurances on the contrary.

To assist CleanTech’s plans which goal preliminary manufacturing from Laguna Verde in 2027 the Board has developed a monetary technique to boost the capital wanted. The Firm routinely receives approaches from third events and continues to think about as a component its general funding technique. An necessary tenant of that technique is the participation and assist of strategic partnerships. Though strategic partnership discussions are at the moment taking tempo underneath non-disclosure agreements, they’re anticipated to progress additional as soon as the Laguna Verde PFS is accomplished and as soon as the preliminary portions of battery grade lithium from the DLE pilot plant and downstream processes can be found for assessment.

Outlook:

The Firm stays effectively positioned to show the efficacy of DLE to supply battery grade lithium carbonate from Laguna Verde brine and to ship the PFS later this yr. This can be a important step for securing strategic partnerships and future undertaking funding. The intention to ship battery-grade lithium carbonate by means of sustainable, low environmental influence manufacturing, utilising the DLE course of and renewable power, aligns the Firm with the Chilean Authorities’s Nationwide Lithium Technique and standards outlined within the CEOL functions. We’re effectively positioned to be prioritised amongst the personal sector potential initiatives.

Submit the interval finish, the Firm filed functions for its admission to the ASX. Alongside the dual-listing, CleanTech Lithium is in search of to boost funds to assist the subsequent stage of its improvement, together with the supply of a strategic companion, because it progresses in the direction of manufacturing.

The Board is happy concerning the alternatives forward and stay dedicated to delivering worth for our shareholders, companions, and the communities through which we function.

Steve Kesler, Government Chairman and Interim CEO

CleanTech Lithium plc

Condensed Consolidated Assertion of Complete Earnings

|

Notice |

Unaudited |

Unaudited |

|||

|

£ |

£ |

||||

|

Earnings |

– |

– |

|||

|

Administrative prices |

3 |

(2,861,194) |

(3,263,200) |

||

|

Working loss |

(2,861,194) |

(3,263,200) |

|||

|

Finance prices |

– |

(9,806) |

|||

|

Loss earlier than tax |

(2,861,194) |

(3,273,006) |

|||

|

Earnings tax |

5 |

– |

– |

||

|

Loss for the interval after tax |

(2,861,194) |

(3,273,006) |

|||

|

Different complete earnings/(loss): |

|||||

|

Alternate variations arising on translation of useful currencies |

(906,194) |

9,128 |

|||

|

Complete complete loss for the interval |

(3,767,388) |

(3,263,878) |

|||

|

Loss per share fundamental |

6 |

(0.020) |

(0.031) |

||

The accompanying notes are an integral a part of these unaudited condensed consolidated interim monetary statements.

Condensed Consolidated Assertion of Monetary Place

|

Unaudited 30-Jun-24 |

Audited 31-Dec-23 |

||

|

Notice |

£ |

£ |

|

|

Exploration and analysis belongings |

7 |

32,558,090 |

13,710,413 |

|

Non-current belongings |

32,558,090 |

13,710,413 |

|

|

Proceeds from Mortgage Notes issued |

11 |

2,109,986 |

– |

|

Money and money equivalents |

35,976 |

6,202,028 |

|

|

Commerce and different receivables |

8 |

179,989 |

610,898 |

|

Present belongings |

2,325,951 |

6,812,926 |

|

|

Commerce and different payables |

10 |

(906,550) |

(351,637) |

|

Provisions and accruals |

10 |

(587,646) |

(378,713) |

|

Loans notes |

11 |

(2,109,986) |

– |

|

Deferred consideration |

12 |

(984,408) |

– |

|

Present liabilities |

(4,588,590) |

(730,350) |

|

|

Deferred consideration |

12 |

(13,565,301) |

– |

|

Non-current liabilities |

(13,565,301) |

– |

|

|

Internet belongings |

16,730,150 |

19,792,990 |

|

|

Share capital |

26,310,625 |

26,310,625 |

|

|

Capital reserve |

(77,237) |

(77,237) |

|

|

Share based mostly cost reserve |

9 |

6,417,807 |

5,713,259 |

|

Overseas change reserve |

(1,611,569) |

(705,375) |

|

|

Collected losses |

(14,309,476) |

(11,448,282) |

|

|

Fairness and reserves |

16,730,150 |

19,792,990 |

The accompanying notes are an integral a part of these interim unaudited condensed consolidated monetary statements.

Condensed Consolidated Assertion of Modifications in Fairness

|

Share capital |

Capital reserve |

Share based mostly cost reserve |

Overseas change reserve |

Collected losses |

Complete |

|

|

£ |

£ |

£ |

£ |

£ |

£ |

|

|

At 1 January 2023 |

21,076,155 |

(77,237) |

1,578,340 |

315,695 |

(5,562,683) |

17,330,270 |

|

Loss for the interval |

– |

– |

– |

– |

(3,273,006) |

(3,273,006) |

|

Different complete earnings |

– |

– |

– |

9,128 |

– |

9,128 |

|

Complete complete loss |

9,128 |

(3,273,006) |

(3,263,878) |

|||

|

Share choices and warrants |

– |

– |

778,935 |

– |

– |

778,935 |

|

Shares issued |

396,000 |

396,000 |

||||

|

30 June 2023 |

21,472,155 |

(77,237) |

2,357,275 |

324,823 |

(8,835,689) |

15,241,327 |

|

At 1 January 2024 |

26,310,625 |

(77,237) |

5,713,259 |

(705,375) |

(11,448,283) |

19,792,990 |

|

Loss for the interval |

(2,861,194) |

(2,861,194) |

||||

|

Different complete earnings |

(906,194) |

– |

(906,194) |

|||

|

26,310,625 |

(77,237) |

5,713,259 |

(1,611,569) |

(14,309,476) |

16,025,602 |

|

|

Share choices and warrants |

– |

– |

704,548 |

– |

– |

704,548 |

|

30 June 2024 |

26,310,625 |

(77,237) |

6,417,807 |

(1,611,569) |

(14,309,476) |

16,730,150 |

The accompanying notes are an integral a part of these interim unaudited condensed consolidated monetary statements.

Condensed Consolidated Assertion of Consolidated Money Flows

|

Unaudited |

Unaudited |

||

|

Notice |

£ |

£ |

|

|

Loss after tax for the interval |

(2,861,194) |

(3,273,006) |

|

|

Non-cash objects: |

|||

|

Honest worth of Mortgage Notice warrants |

592,633 |

||

|

Honest worth recognition of share choices and warrants |

556,896 |

||

|

Fairness settled transactions or companies |

– |

||

|

Motion in commerce and different receivables |

397,320 |

159,605 |

|

|

Motion in payables, provisions and accruals |

835,849 |

22,964 |

|

|

Finance prices |

(9,806) |

||

|

Internet money utilized in working actions |

(1,035,392) |

(2,543,347) |

|

|

Expenditure on exploration and analysis belongings |

(4,800,040) |

(5,481,243) |

|

|

Internet money utilized in investing actions |

(4,800,040) |

(5,481,243) |

|

|

Proceeds from situation of extraordinary shares |

– |

396,000 |

|

|

Finance prices |

– |

(9,806) |

|

|

Internet money generated from financing actions |

– |

386,194 |

|

|

Internet money movement |

(3,725,446) |

(7,638,396) |

|

|

Money and money equivalents introduced ahead |

6,202,028 |

12,368,265 |

|

|

Internet money movement |

(3,725,446) |

(7,638,396) |

|

|

Impact of change charge adjustments |

(330,620) |

(91,120) |

|

|

Money and money equivalents carried ahead |

35,976 |

4,638,749 |

The accompanying notes are an integral a part of these interim unaudited condensed consolidated monetary statements.

Notes to the Monetary Statements

1. GENERAL INFORMATION

CleanTech Lithium Plc (“CTL Plc”, or the “Firm”)

The condensed consolidated interim monetary statements of CleanTech Lithium Plc for the primary six months ended 30 June 2024 have been authorised for situation in accordance with a decision of the Board on 29 September 2024.

CleanTech Lithium Plc was included and registered as a personal firm, initially with the identify CleanTech Lithium (Jersey) Ltd, in Jersey on 1 December 2021 with registered quantity 139640. It was subsequently reregistered as a public restricted firm on 20 January 2022 and on 2 February 2022 it modified its identify to CleanTech Lithium Plc.

On 14 February 2022, a share-for-share change between the shareholders of CleanTech Lithium Ltd (CTL Ltd, or the U.Ok. entity) and CTL Plc accomplished, leading to CTL Plc buying and turning into the guardian firm of CTL Ltd and its wholly owned subsidiaries, collectively “CleanTech Lithium Group” or the “Group”.

Throughout the six months to 30 June 2024, there have been no adjustments to the construction of the CleanTech Lithium Group.

2. BASIS OF PREPARATION

The condensed consolidated interim monetary statements for the Group have been ready in accordance IAS 34 ‘Interim Monetary Reporting’ per the U.Ok.-adopted worldwide accounting requirements. They’re unaudited and don’t embrace all the data required for the preparation of the annual consolidated monetary statements and must be learn along side the audited consolidated monetary statements for the yr ended 31 December 2023 of CleanTech Lithium Plc, that may be discovered on the web site: https://www.ctlithium.com. The auditor’s report on these accounts was unmodified nevertheless it did make reference to materials uncertainties associated to going concern.

The quantities on this doc are offered in British Kilos (GBP), until famous in any other case. Attributable to rounding, numbers offered all through these condensed consolidated Interim monetary statements might not add up exactly to the totals offered and percentages might not exactly replicate absolutely the figures

A abstract of the numerous accounting insurance policies could be discovered within the Firm’s consolidated monetary statements for the yr ended 31 December 2023, on pages 50 to 53. The accounting insurance policies used to organize these condensed consolidated interim monetary statements are per these. Moreover, there are not any new requirements or interpretations relevant from 1 January 2024 which have a big influence on these condensed consolidated interim monetary statements.

Important accounting judgments, estimates and assumptions

In making ready this interim monetary report, it has been essential to make judgments, estimates and assumptions to type the idea of presentation, recognition and measurement of the Group’s belongings, liabilities, objects of earnings statements, accompanying disclosures and the disclosure of contingent liabilities. Uncertainty about these assumptions and estimates might lead to outcomes that require a cloth adjustment to the carrying quantity of belongings or liabilities affected in future durations.

The numerous judgments, estimates and assumptions made when making use of the Group’s accounting insurance policies are the identical as these utilized to the consolidated monetary statements for the yr ended 31 December 2023. The numerous judgment in assessing the exploration and analysis belongings for the existence of indicators of impairment on the reporting date, that are set out in observe 7.

Going Concern

The Group is in a pre-revenue part of improvement and till its transition to income era and profitability the Group shall be required to depend on externally sourced funding to proceed as a going concern, the Board recognises this situation might point out the existence of fabric uncertainties, which can solid important doubt relating to the Group’s capability to proceed as a going concern. However, the Administrators have a demonstrated report of efficiently elevating capital elevating for initiatives and ventures of this nature and are assured in having the ability to safe the funding wanted for the Group to ship on its commitments and proceed as a going concern.

3. ADMINISTRATION EXPENES

Administration bills within the six months to 30 June 2024 totaled £2.8 million, of which roughly £0.9 million displays non-cash objects (2023: £1.2 million). Extra particularly, roughly £0.6 million displays a provision made in opposition to VAT in Chile which should be recoverable as soon as manufacturing begins (Notice 8 offers additional element) (2023: £0.6 million). Along with the non-cash VAT provision, roughly £0.6 million has been recorded as a share-based cost for choices traditionally issued and for warrants issued as part of the Mortgage Notes issued within the interval (additional element is ready out in Notice 9) (2023: nil), these two objects have been off-set by the unrealised acquire on translation of the deferred consideration of 0.3 million (2023: nil).

Of the £1.9 million in money prices, roughly £0.5 million pertains to employees prices (2023: £0.5 million), £0.4 million pertains to promotion, public and investor relations and journey (2023: £0.7 million), £0.8 million pertains to authorized {and professional} (2023: £0.7million ) assist together with itemizing and compliance and insurance coverage prices, the stability of £0.2 million includes quite a lot of different and normal administrative prices (2023: £0.1 million).

4. SEGMENTAL INFORMATION

The Group operates in a single enterprise section, being the exploration and analysis of mineral properties, actions that are undertaken in Chile the place all of the Group’s non-current belongings are held.

5. INCOME TAX

The accrued earnings tax expense continues to be £nil because the Group stays in a loss-making place. No deferred tax asset is recognised on these losses because of the uncertainty over the timing of future income and good points.

6. LOSS PER SHARE

The calculation of fundamental loss per extraordinary share relies on the loss after tax and on the weighted common variety of extraordinary shares in situation through the interval.

A diluted loss per share assumes conversion of all doubtlessly dilutive Peculiar Shares arising from the share schemes. Potential extraordinary shares ensuing from the train of warrants and choices have an anti-dilutive impact because of the Group being in a loss place. In consequence, diluted loss per share is disclosed as the identical worth as fundamental loss per share.

|

Unaudited ix months to 30-Jun-2024 |

Reviewed six months to 30-Jun-2023 |

||

|

Primary and diluted loss per share |

£ |

£ |

|

|

Loss after taxation |

(2,861,194) |

(3,273,006) |

|

|

Primary weighted common variety of extraordinary shares (thousands and thousands) |

145.16 |

105.66 |

|

|

Primary loss per share (GBP £) |

(0.020) |

(0.031) |

7. EXPLORATION AND EVALUATION ASSETS

Bills incurred up to now by the Chilean entities on feasibility research, mineral exploration and delineation have been capitalised as “exploration and analysis belongings” inside “non-current belongings” in accordance with the Group’s accounting coverage.

|

Exploration and analysis belongings |

Unaudited six months ended 30-Jun-2024 |

Audited 12 months ended 31-Dec-23 |

|

£ |

£ |

|

|

Opening stability |

13,710,413 |

5,317,412 |

|

Additions |

19,795,670 |

9,383,902 |

|

Impact of international change translations |

(947,994) |

(990,901) |

|

Closing stability |

32,558,090 |

13,710,413 |

Of the £19.8 million in additions, roughly £15.9 million pertains to the honest worth of deferred consideration for licences acquired underneath the LV Buy Settlement (refer Notice 12), of which roughly £1.0 million was paid through the interval. An additional £0.1 million displays non-cash share-based funds made to employees and contractors, about which additional element is ready out in Notice 9. Different additions replicate the additions related to the capital programmes being undertaken through the interval. These additions have been off-set by unrealised international change good points of £0.9 million.

Impairment assessments

The Administrators assess for impairment when information and circumstances recommend that the carrying quantity of an exploration & analysis asset (E&E) might exceed its recoverable quantity. In making this evaluation, the Administrators have regard to the information and circumstances famous in IFRS 6 paragraph 20. In performing their evaluation of every of those elements, at 30 June 2024, the Administrators have:

-

reviewed the time interval that the Group has the correct to discover the realm and famous no cases of expiration, or licences which can be anticipated to run out within the close to future and never be renewed;

-

decided that additional E&E expenditure is both budgeted or deliberate for all licences;

-

not determined to discontinue exploration exercise resulting from there being an absence of quantifiable mineral useful resource; and

-

not recognized any cases the place adequate knowledge exists to point that there are licences the place the E&E spend is unlikely to be recovered from profitable improvement or sale.

Primarily based on the above evaluation, the Administrators will not be conscious of any information or circumstances that may recommend the carrying quantity of the E&E asset might exceed its recoverable quantity.

8. TRADE AND OTHER RECEIVABLES

|

Unaudited as at 30-Jun-24 |

Audited as at 31-Dec-23 |

|

|

£ |

£ |

|

|

Prepayments and deposits |

144,586 |

570,936 |

|

VAT |

17,651 |

13,385 |

|

Different receivables |

17,752 |

26,557 |

|

Complete |

179,989 |

610,898 |

Prepayments and deposits largely replicate pay as you go insurance coverage and different industrial subscriptions which renew variously and yearly in addition to workplace rental deposit quantities paid.

Though VAT reveals a stability of roughly £18k at 30 June 2024, at that date roughly £2.4 million in Chilean VAT recoverable shouldn’t be proven within the desk above. Though the Chilean VAT is anticipated to be eligible for refund in future, because of the uncertainty over the timing of future manufacturing and revenues, which might set off the Group’s eligibility to get well that VAT, the Administrators have made full provision in opposition to this identical quantity. Accordingly, roughly £0.6 million provision has been mirrored within the earnings assertion for the interval ended 30 June 2024 (refer Notice 3).

Different receivables comprise a number of smaller working capital balances in Chile.

9. SHARE BASED PAYMENTS

On 30 June 2024, a complete of 4,380,181 warrants attaching to Mortgage Notes issued (refer Notice 11) have been granted. No different warrants or choices have been granted, exercised, forfeited or allowed to lapse through the six months to 30 June 2024.

|

Unaudited Six months ended |

Audited 12 months ended |

|

|

30-Jun-24 |

31-Dec-23 |

|

|

# |

# |

|

|

Excellent at begin of interval |

34,362,750 |

10,984,745 |

|

Share choices granted |

– |

3,283,000 |

|

Warrant shares granted |

4,380,181 |

21,876,005 |

|

Share choices exercised |

– |

(1,100,000) |

|

Share choices revoked or forfeited |

– |

(681,000) |

|

Excellent at finish of interval |

38,742,931 |

34,362,750 |

All choices and warrants are granted in Firm’s identify. Share choices granted have a weighted common train worth of 47 pence and warrant shares granted have a weighted common train worth of 34 pence.

The honest worth of every possibility granted within the interval was estimated on the grant date utilizing the Black Scholes possibility pricing mannequin. The next assumptions have been used:

|

Honest worth of name possibility per share |

£0.12 – 0.38 |

|

Share worth at grant dates |

£0.39 – 0.55 |

|

Train worth |

£0.01 – 0.57 |

|

Anticipated volatility |

98% |

|

Vesting interval |

4.7-5.0 years from vesting |

|

Threat-free rate of interest (based mostly on authorities bonds) |

4.16% |

The overall share possibility honest worth cost through the six months to 30 June 2024 is £198k (2023 £779k), of which roughly £86k has been recorded within the earnings assertion as a non-cash worker expense; the stability has been recorded inside E&E. The overall warrant shares honest worth cost through the six months to 30 June 2024 was roughly £506k (2023: £27k).

As famous, these honest worth estimates derived thorough Black-Scholes modelling and Monte Carlo simulations are non-cash accounting entries.

10. PAYABLES, PROVISIONS AND ACCRUALS

|

Unaudited at |

Audited at |

|

|

at 30-Jun-2024 |

At 31-Dec-23 |

|

|

£ |

£ |

|

|

Commerce and different payables |

(863,526) |

(291,369) |

|

Different taxes and social safety |

(43,024) |

(60,268) |

|

Provisions |

(99,067) |

(106,451) |

|

Accruals |

(488,579) |

(272,262) |

|

Complete |

(1,494,196) |

(730,350) |

Commerce and different payables embrace routine commerce collectors.

Different taxes and social safety balances largely relate to people-related prices and taxes balances on the interval finish. Accruals embrace routine accruals for skilled companies rendered not invoiced at interval finish.

11. LOAN NOTES

Shortly after the interval finish, CleanTech acquired the money generated from issuing Mortgage Notes previous to 30 June 2024.

On 30 June 2024 the Firm executed a GBP mortgage observe instrument and an AUD mortgage observe instrument pursuant to which it issued mortgage notes to subscribers to boost A$3.995 million, roughly £2.1 million, to finance working capital and prices related to ASX admission. As well as, the Mortgage Notice holders have been granted with a complete of 4,380,181 warrants valued at roughly GBP £506,000 on the date of grant. As there are not any vesting circumstances connected to the warrants, the whole worth has been expensed as a non-cash honest worth accounting adjustment (refer Notice 9)

Though the Mortgage Notes have a maturity date of 30 June 2025, the Firm shall redeem the Mortgage Notes at par along with the relevant premium on the sooner of the Maturity Date or 10 days following completion of any fairness fundraising by the Firm of not less than AUD $5.0 million. The premium payable on redemption relies on when redemption happens as follows: the Mortgage Notes carry a premium of 15% if the Mortgage Notes are repaid inside three calendar months; or a premium of 25% if the Mortgage Notes are redeemed between 4 and 6 calendar months; or a premium of 40% if the Mortgage Notes are redeemed between seven and 9 calendar months; or a premium of fifty% if the Mortgage Notes are redeemed between ten and twelve calendar months. The Mortgage Notes are unsecured, nevertheless if they aren’t redeemed on or prior to a few months from their date of situation, the Firm has agreed to make use of greatest endeavours to grant or procure to grant the observe holders a primary rating cost over each all of the belongings and undertakings of the Firm and your entire issued share capital of CTL UK.

12. DEFERRED CONSIDERATION

Laguna Verde Possibility buy-out

On 19 April 2024, CleanTech Laguna Verde SpA, a completely owned Chilean subsidiary of CleanTech Lithium Plc, entered right into a sale and buy settlement (LV Buy Settlement) to accumulate 100% authorized and helpful curiosity within the mining licences traditionally held by CleanTech underneath possibility underneath the phrases of the LV Possibility Settlement. The LV Buy Settlement had the impact of terminating the LV Possibility Settlement.

Pursuant to the LV Buy Settlement the consideration payable includes fastened funds totaling US$10.5 million, that are scheduled to happen a varied annual and semi-annual millstone durations over a interval of as much as 5 years from the date of the LV Buy Settlement, and two deferred funds, totaling US$24.5 million, scheduled to happen upon offered manufacturing reaching 10k tonnes of LCE and 35k tonnes of LCE respectively or on the tenth anniversary of the date of the LV Buy Settlement, whichever is the sooner.

The carrying worth for the LV licences acquired pursuant to the LV Buy Settlement, has been designated as an asset acquisition in accordance with the Group accounting coverage and assigned a good worth in accordance with the rules of the UK IASs. Equally, the Group has assigned a good worth to the deferred consideration related to the acquisition which is allotted between present and non-current liabilities.

In assessing the suitable foundation on which to find out the honest worth of the non-current part of the deferred consideration, the Administrators have used a reduction charge of 8% which they consider is reflective of the elements that market individuals would think about within the pricing of such a legal responsibility in addition to the foreign money through which the cashflows are denominated. That is per the necessities of IFRS 13 – Honest Worth Measurement.

As described above, the 2 ultimate funds of the deferred consideration, totaling USD$24.5m, are required to be made upon reaching sure manufacturing milestones, however in any occasion, are required to be made inside 10 years of execution of the LV Buy Settlement. Because of the uncertainties surrounding the timing of reaching the manufacturing milestones, the Administrators have assumed that the remaining two funds shall be made on the tenth anniversary of signing the LV Buy Settlement.

|

Unaudited at 30-Jun-24 |

|

|

£ |

|

|

Deferred consideration, present |

988,784 |

|

Impact of international change variations on present deferred consideration |

(4,376) |

|

Deferred consideration, present |

984,408 |

|

Deferred consideration, non-current |

13,894,931 |

|

Impact of international change variations on non-current deferred consideration |

(329,630) |

|

Deferred consideration, present |

13,565,301 |

|

Complete |

14,549,709 |

13. SUBSEQUENT EVENTS

Issues regarding occasions occurring since Interval finish are reported on within the part entitled Chairman and Chief Government Officer’s Assertion.

**ENDS**

|

For additional info contact: |

|

|

Steve Kesler/Gordon Stein/Nick Baxter |

Jersey workplace: +44 (0) 1534 668 321 Chile workplace: +562-32239222 |

|

Or by way of Celicourt |

|

|

Celicourt Communications |

+44 (0) 20 7770 6424 |

|

Beaumont Cornish Restricted (Nominated Adviser) |

+44 (0) 20 7628 3396 |

|

Canaccord Genuity (Joint Dealer) |

+44 (0) 20 7523 4680 |

|

Fox-Davies Capital Restricted (Joint Dealer) |

+44 (0) 20 3884 8450 |

|

Daniel Fox-Davies |

Notes

About CleanTech Lithium

CleanTech Lithium (AIM:CTL, Frankfurt:T2N, OTCQX:CTLHF) is an exploration and improvement firm advancing lithium initiatives in Chile for the clear power transition. Dedicated to net-zero, CleanTech Lithium‘s mission is to turn out to be a brand new provider of battery grade lithium utilizing Direct Lithium Extraction know-how powered by renewable power.

CleanTech Lithium has two key lithium initiatives in Chile, Laguna Verde and Viento Andino, and exploration stage initiatives in Llamara and Arenas Blancas (Salar de Atacama), positioned within the lithium triangle, a number one centre for battery grade lithium manufacturing. The 2 most superior initiatives: Laguna Verde and Viento Andino are located inside basins managed by the Firm, which affords important potential improvement and operational benefits. All 4 initiatives have good entry to present infrastructure.

CleanTech Lithium is dedicated to utilising Direct Lithium Extraction with reinjection of spent brine leading to no aquifer depletion. Direct Lithium Extraction is a transformative know-how which removes lithium from brine with increased recoveries, quick improvement lead instances and no intensive evaporation pond development. www.ctlithium.com

Glossary

|

CLS Pty |

Chilean Lithium Salars Pty Restricted (Australian overhead firm now wound-up and deregistered) |

|

CLSH |

Chilean Lithium Salars Holdings Restricted (Australian holding firm now wound-up and deregistered) |

|

CTL Ltd |

CleanTech Lithium Ltd; U.Ok. registered and tax domiciled firm |

|

CTL Plc |

CleanTech Lithium Plc; Jersey registered and tax domiciled firm |

|

DLE |

Direct lithium extraction |

|

EIA |

Environmental Impression Evaluation |

|

ESG |

Environmental, Social and Governance |

|

Group |

CleanTech Lithium statutory group |

|

IPO |

Preliminary public providing |

|

JORC |

The JORC Code offers a compulsory system for the classification of minerals Exploration Outcomes, Mineral Sources and Ore Reserves in response to the degrees of confidence in geological data and technical and financial issues in public experiences |

|

LCE |

Lithium carbonate equal, business customary terminology used to check totally different types of lithium compounds |

|

LSE |

London Inventory Alternate |

|

MoU |

Memorandum of Understanding |

|

mg/L |

micrograms per litre |

|

Professional forma Group |

Non-statutory professional forma group as outlined within the notes to the monetary assertion |

This info is offered by RNS, the information service of the London Inventory Alternate. RNS is permitted by the Monetary Conduct Authority to behave as a Main Info Supplier in the UK. Phrases and circumstances regarding the use and distribution of this info might apply. For additional info, please contact rns@lseg.com or go to www.rns.com.

SOURCE: CleanTech Lithium plc

View the unique press launch on accesswire.com