How did the EV market carry out in 2024?

International EV gross sales hit 13.3 million models within the first 10 months of 2024, in keeping with EV market analysis agency Rho Movement, up 24 p.c year-on-year. Nevertheless, this rise did not play out equally throughout the three main regional markets.

China continues to guide world EV gross sales

As soon as once more China led the best way, amassing practically two-thirds of whole world gross sales in the course of the interval.

Purchases of EVs on this area have been up 38 p.c within the first 10 months of the yr to eight.4 million models. That is in comparison with 9 p.c development within the US and Canada, and a 3 p.c decline in Europe.

China’s dominance within the world EV market is starting to bleed into different markets.

Earlier this yr, China’s BYD (OTC Pink:BYDDF,HKEX:1211), the world’s largest EV producer, launched an reasonably priced EV mannequin priced under US$10,000. With North American and European EV producers already struggling to realize market share in their very own home spheres, these cheaper Chinese language EV fashions pose a big downside.

In response to this risk, the Biden administration elevated tariffs on Chinese language EVs to 100% in 2024, and disqualified imported EVs from a US$7,500 federal tax credit score. The European Union additionally imposed its personal tariffs on Chinese language EVs, starting from 17.4 p.c for BYD to 38.1 p.c for SAIC Motor Firm (SHA:600104).

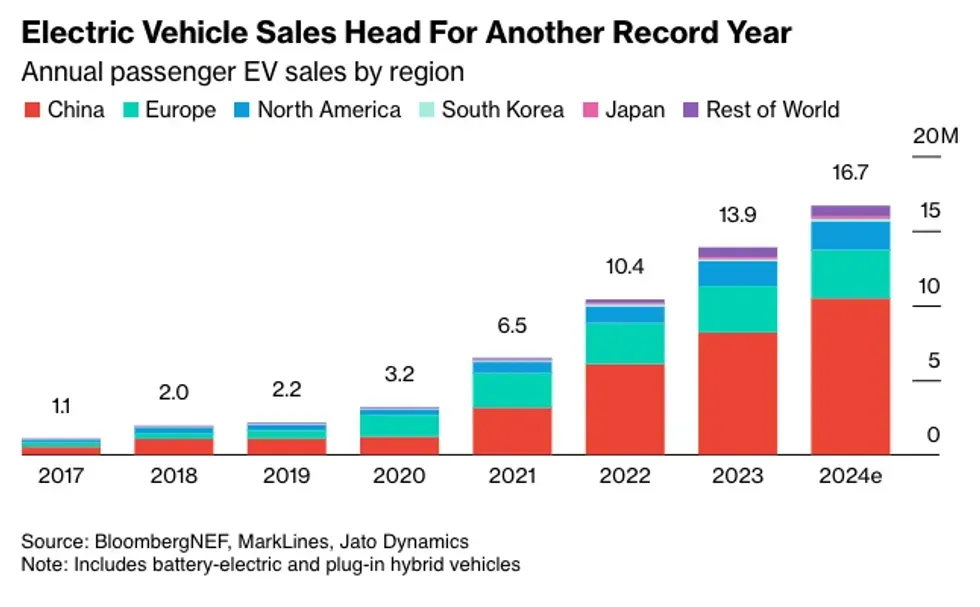

International EV gross sales, 2017 to 2024.

Chart through BloombergNEF, MarkLines and Jato Dynamics.

US EV business going through challenges

As the highest vendor of EVs within the US, Tesla’s (NASDAQ:TSLA) efficiency has an outsized impression on the area’s EV business. Lagging gross sales of Tesla fashions in 2024 have dragged down the general efficiency of the North American EV market.

In keeping with knowledge launched by the Electrical Automobile Council in early December, the Elon Musk-led firm’s whole gross sales for 2024 are down by 20.88 p.c in comparison with the earlier yr.

One other crimson flag for the US EV business is Ford’s (NYSE:F) determination in June to droop the discharge of latest battery electrical automobile (BEV) fashions — the corporate mentioned on the time that there wasn’t a robust sufficient enterprise case for such an funding. The information got here even though the auto big was the second best-selling EV model within the nation within the first half of 2024, earlier than it was overtaken by rival Basic Motors (NYSE:GM). In November, Ford introduced it might pause manufacturing of its F-150 Lighting truck for the rest of the yr.

In the meantime, Basic Motors has reduce its deliberate 2024 EV manufacturing vary to 200,000 to 250,000 models, a lower of fifty,000 models. The US auto producer can also be delaying the launch of the primary Buick EV mannequin.

Regardless of these challenges, the US EV market panorama has a number of brilliant spots.

Third quarter EV gross sales grew by 11 p.c year-on-year, in keeping with Cox Automotive. Even Tesla’s gross sales returned to development, rising 6.6 p.c, whereas Basic Motors posted a 60 p.c gross sales acquire for a similar interval.

“The expansion is being fueled partly by incentives and reductions; however as extra reasonably priced EVs enter the market and infrastructure improves, we will count on even better adoption within the coming years,” mentioned Stephanie Valdez Streaty, director of business insights at Cox Automotive.

European EV market sluggish

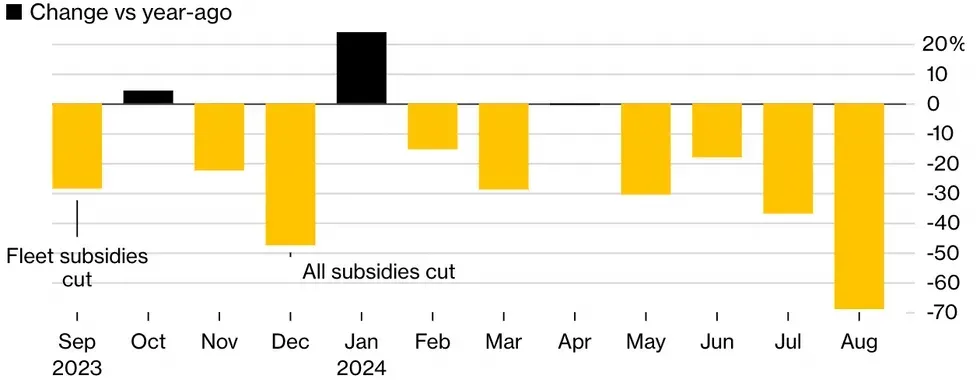

The European market additionally struggled in 2024, particularly in Germany, the biggest producer of EVs on this area. The German authorities reduce subsidies for EVs on the finish of 2023, which has disincentivized patrons in 2024.

The German EV business is the second largest on the earth after China. A important drop in demand in Germany has understandably had a dramatic impression on European EV manufacturing.

In October, Volkswagen (OTC Pink:VLKAF,FWB:VOW), the area’s largest automaker, introduced its intention to shut three German vegetation to chop prices because it tries to stave off competitors from cheaper Chinese language EVs.

Battery automobile registrations declined after incentives have been eliminated final yr.

Chart through Bloomberg and the European Car Producers’ Affiliation.

Europe’s auto makers are going through rising challenges forward of the approaching 2035 ban on the manufacturing of any new inner combustion engine automobiles. New EV registrations fell within the second half of the yr, together with in France and Italy, whereas the UK has seen some constructive features, as per Bloomberg.

What’s slowing down EV demand?

One of many greatest challenges at present going through the EV business is the issue of interesting to mainstream customers, lots of whom are coping with excessive rates of interest amid a cost-of-living disaster.

Relying on the geographic location and the automobile sort, BEVs are 10 p.c to 75 p.c costlier than standard inner combustion engine automobiles. That is making for less-than-appealing pitches on the gross sales flooring.

Throw within the increased price for tires, one-off repairs and the potential of having to exchange an exorbitantly priced battery, and it turns into clear why the hesitancy is palpable. Vary nervousness, particularly in colder climates, lengthy charging occasions and a scarcity of dependable charging infrastructure are additionally important obstacles to EV adoption. However nothing trumps price.

PwC lately polled over 17,000 customers throughout 27 international locations, and located that even in locations just like the Netherlands, which has superior charging infrastructure, excessive prices are nonetheless deterring would-be patrons from going electrical.

Total, PwC discovered that 75 p.c of respondents in Europe, the Center East and Africa cited the price of EV possession as the most important issue swaying their determination to buy. On prime of that, one-third of EV homeowners surveyed mentioned they might take into account going again to gas-powered automobiles to keep away from excessive upkeep prices and restricted vary.

Subsidies and tax breaks have helped to ease the worth burden, however pullbacks on these rebates have hit the market onerous in some European international locations the place excessive rates of interest and prices proceed to place EV purchases out of attain.

One other issue stunting gross sales within the European Union, reported Euronews, has been increased tariffs imposed on low-cost Chinese language EVs to restrict their capacity to displace home automakers from the market.

Regardless of the slowdown in adoption, 2024 continues to be anticipated to be one other file yr for the worldwide EV business.

That was the principle takeaway from a presentation on the BloombergNEF Summit in November. Aleksandra O’Donovan, the analysis group’s head of EVs, mentioned the agency is forecasting that EV gross sales worldwide will attain 16.7 million models in 2024, up from 13.9 million the earlier yr, representing 20 p.c of whole world automobile gross sales this yr.

Hybrid EVs gaining market share

One in every of 2024’s necessary EV market traits that’s more likely to keep on into 2025 is the recognition of hybrid fashions over wholly electrical automobiles. This pattern may be very a lot in keeping with the affordability and vary nervousness elements influencing gross sales.

To fulfill prospects the place they’re at proper now, auto makers are switching gears to deliver extra hybrid fashions to market, together with plug-in hybrid electrical automobiles (PHEVs).

“Firms are turning to hybrid fashions to enchantment to a extra sensible and frugal shopper, as rich early EV adopters who fueled years of development have lately fled the market,” notes Enterprise Insider.

On this surroundings, hybrid-focused auto makers akin to Toyota (NYSE:TM,TSE:7203) and Ford are anticipated to outperform. Basic Motors can also be planning to launch extra hybrid EV fashions in 2027.

Even in China, the world’s prime EV market, plug-in hybrids are driving a big a part of EV gross sales development. BloombergNEF states that whereas BEV gross sales in China have been up 18 p.c within the first 10 months of the yr, plug-in gross sales have been up 37 p.c.

Mexico rising as an EV manufacturing hub

Outdoors of China, the US and Europe, EV gross sales are rising in rising markets.

JD Energy’s Autovista Group reported that in 2024, “Volumes grew by greater than 100% in markets together with Australia, Thailand, Brazil, Turkey, Malaysia, and Mexico in 2023 and greater than 50% in India and Japan”.

Mexico, for instance, is on its option to changing into a significant EV manufacturing hub.

“We’re already seeing EV manufacturing take off in Mexico over the previous 12 to 18 months,” mentioned Rho Movement analysis analyst George Whitcomb throughout a Benchmark-hosted webinar that INN attended in late November.

The expansion in Mexico’s EV business might be attributed to numerous elements, defined Whitcomb.

These embody its established transport manufacturing chains, geographic location, robust place within the conventional world auto business and commerce agreements. “However from an EV standpoint specifically, the US Inflation Discount Act (IRA) has been central to stimulating EV manufacturing in Mexico,” he added.

What’s the EV market outlook for 2025?

EV Volumes is forecasting that the overall EV share of light-vehicle gross sales worldwide will attain 22.6 p.c in 2025. Additional out, the agency sees the market share for EVs surging to 44.6 p.c in 2030 and 69.5 p.c in 2035.

Trying on the broader market (which incorporates buses, vans and heavy vehicles), tech analysis agency Gartner predicts that by the tip of 2025, 85 million EVs will probably be on the street, a year-on-year improve of 33 p.c.

China to proceed dominating the EV market

“The expansion in 2025 will probably be pushed primarily by increased EV gross sales in China (58%) and Europe (24%), which collectively are projected to signify 82% of whole EVs in use worldwide,” states Jonathan Davenport, senior director analyst at Gartner.

In 2025, the agency estimates that 49 million EVs will probably be on Chinese language roadways, in comparison with 20.6 million in Europe and 10.4 million in North America.

Gartner sees China persevering with its domination of the worldwide EV panorama for a minimum of one other decade. For its half, EV Volumes expects BEVs to “acquire floor within the BEV-PHEV combine from 2025 onwards” in China as the federal government provides additional monetary helps to inspire customers.

Europe’s EV market will cool earlier than heating again up

Europe’s light-vehicle EV market will see a development fee of twenty-two.8 p.c in 2025, in keeping with EV Volumes, adopted by an additional 20.1 p.c improve in 2026 and a 21.1 p.c rise in 2027.

By 2030, the agency sees EVs accounting for 61 p.c of the general light-vehicle market within the area.

Authorities subsidies will proceed to be a key issue shaping Europe’s EV business for 2025, says Rho Movement. For instance, the company notes that France is about to comply with Germany’s lead and make a 50 p.c reduce to its EV subsidies for 2025 as the federal government works to deal with fiscal challenges. Spain can also be contemplating lowering subsidies.

Nevertheless, Forbes reported that skilled companies agency Accenture has known as the slower development in Europe’s EV market “a brief blip” as a latest shopper survey exhibits that “each different shopper in Europe plans to purchase an EV within the subsequent 10 years and each fifth shopper within the subsequent 5 years.”

US EV market within the Trump period

EVs are projected to hit 13.5 p.c market share for total US light-vehicle gross sales in 2025, as per EV Volumes, up from an estimated 10.3 p.c in 2024. That determine is predicted to rise to 39.7 p.c by 2030 and 71.8 p.c in 2035.

Throughout the EV market itself, BEVs are nonetheless dominating over hybrid fashions and are anticipated to account for 82.4 p.c of whole US EV gross sales for 2025, up from 78.6 p.c in 2024.

The IRA, introduced ahead by the Biden administration in mid-2022, launched important tax credit for EV patrons, serving to to take the sting off the fee burden of shopping for into the clear know-how. Whereas the IRA is slated to run via 2032, there are considerations that President-elect Donald Trump could reverse these advantages as soon as he takes workplace in 2025.

“The US market stays buoyant partly due to IRA funding for customers switching to electrical which can be in danger with the beginning of the Trump presidency,” mentioned Rho Movement Knowledge Supervisor Charles Lester.

Don’t overlook to comply with us @INN_Technology for real-time information updates!

Securities Disclosure: I, Melissa Pistilli, maintain no direct funding curiosity in any firm talked about on this article.