Are you able to begin investing in school? Perhaps you labored all summer time and now you will have some further money available, perhaps $1,000 or extra. If that’s the case, good job! Now, do you are taking that $1,000 and spent it on beer all 12 months? Or do you are taking that cash and put money into school?

Effectively, in case you spent it on beer, you’ll drink wonderful all 12 months. However in case you make investments it, by the point you retire, assuming you do nothing with that preliminary funding, it may very well be value round $13,000. So, was the beer value $13,000?

Investing is an effective way to avoid wasting for the longer term, so long as you’re accountable and disciplined. It would not require an enormous up-front funding, and it would not require a whole lot of time or effort. All it requires is a small tolerance for danger, a devoted time horizon, and an up-front time funding of an hour.

When you’re not in school, try our different guides on this sequence:

Why Begin Investing In School?

Let’s first speak about why it is best to begin investing in school. The massive motive is TIME.

Time available in the market beats timing the market.

What this implies is that one of the simplest ways to develop your cash is solely time. The sooner you begin investing, the extra time your cash has to develop.

Sadly, too many school college students are impatient – and it isn’t horny to see your $1,000 investing develop to only $1,080 by the top of the 12 months. Whereas seeing your cash develop $80 is nice – it isn’t life altering, and that may be discouraging.

However the place you actually see the positive factors is sooner or later. By beginning to make investments at 18 versus 30, you will have a 12 12 months lead over that very same particular person. Examine this out: how a lot that you must make investments per 12 months to make it to $1,000,000 by 62 years previous.

As you possibly can see, in case you get began investing at 18 years previous, you solely want to take a position about $2,100 per 12 months to be a millionaire by age 62. That quantity begins to go up loads the older you get. When you wait till 30, that quantity turns into $6,900 per 12 months that you must make investments – over 3x the quantity per 12 months. All due to time.

I am additionally a agency believer that the majority school college students can provide you with $175 monthly, via facet hustling in school or working whereas at school.

Associated: The Rule Of 72 For Investing

The place To Open An Account

Over the past decade, know-how has made investing out there to everybody for a low value – even free. Gone are the times whenever you needed to sit down with an “funding advisor” and plan out your investments (for a excessive price).

Right now, there are a whole lot of locations which you could make investments and purchase shares totally free. There are additionally cell apps that help you make investments totally free.

We have now a number of suggestions about the place to open an account based mostly on the way you wish to make investments.

Charles Schwab

Schwab is among the finest recognized funding brokerage corporations on the market. What makes them nice is that they’ve stable commission-free investing, a fantastic cell app, and banking merchandise as properly. Every little thing that you must open and develop with them. Take a look at Schwab right here.

Robinhood

Robinhood is nice if you wish to put money into particular person shares or commerce choices. This is not really helpful for traders beginning out, however their platform is free – and that is superior. The downside of Robinhood versus M1 is that Robinhood would not enable fractional share investing, which may make it exhausting for newbie traders with not some huge cash to get began. Take a look at Robinhood right here.

Constancy

Constancy is one in every of our favourite brokers as a result of they’re a full service agency that may develop with you as you make investments and acquire extra belongings. Constancy does supply some free investing choices – together with no minimal IRAs and fee free ETFs. Take a look at Constancy right here.

In order for you different choices, try this nice comparability chart of the perfect brokers for you.

What Sort Of Account To Open

If you’re new to investing, the very first thing that you simply want is a brokerage account. Investing can’t be accomplished at a financial institution, however should be accomplished at a separate entity (though some banks do have brokerages inside them). We advocate Schwab or Constancy to get began.

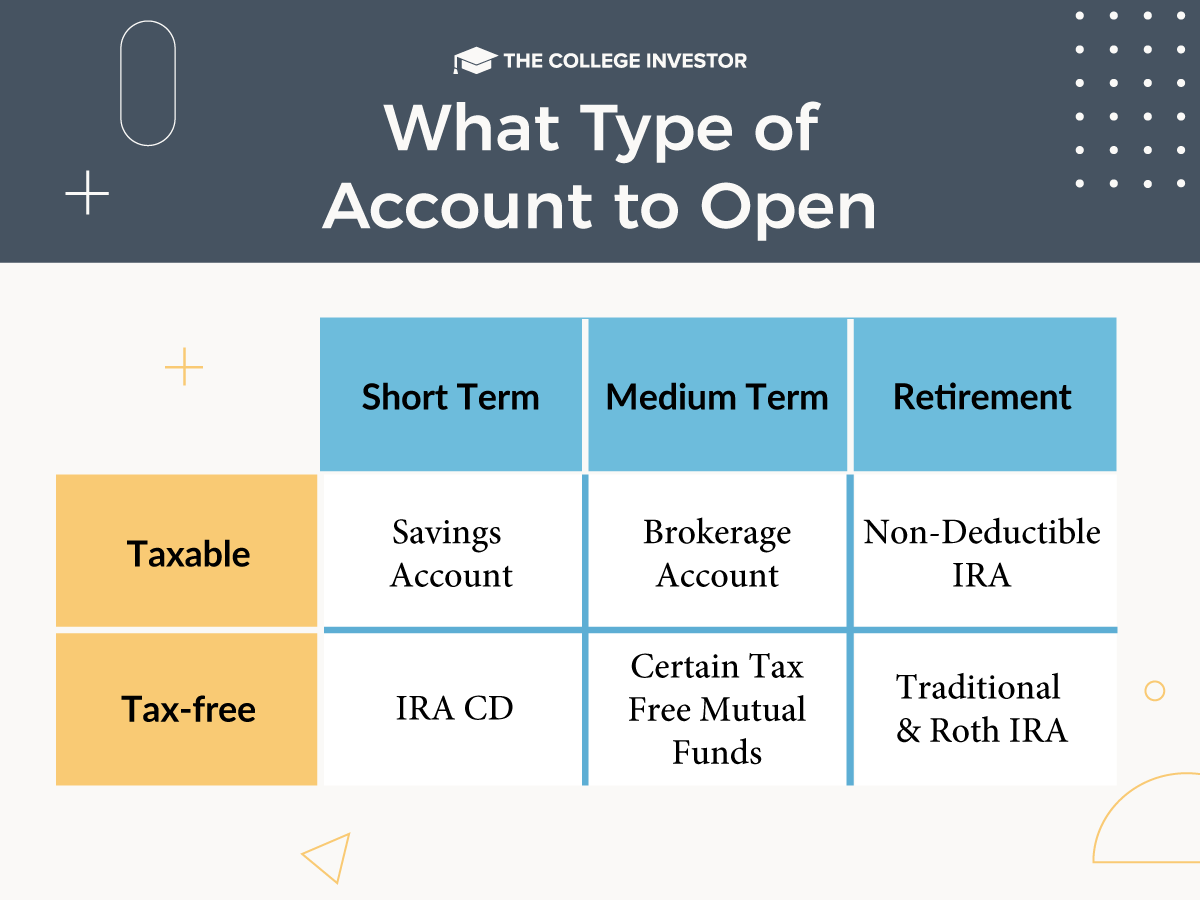

Whenever you join on the platform you need, you will have a number of choices:

Money Account: That is essentially the most primary account. It permits you to buy any sort of safety you need together with your money available. This selection is appropriate for many traders, particularly ones beginning out, and ones who don’t need their cash locked up till retirement.

Margin Account: A margin account is much like the money account, besides which you could borrow cash to take a position. This account permits some includes a money account would not, comparable to shorting investments, and promoting uncovered choices.

Conventional IRA: That is the normal retirement account automobile. It’s much like the money account in which you could buy securities with the money you will have out there. Nonetheless, this account locations a limitation that you simply can not withdraw that cash inside it till you’re no less than 59 1/2. Nonetheless, you get a tax profit for all cash invested as much as the restrict (which is $7,000, or $8,000 if over 50). You’ll have to pay taxes on any cash you withdrawal when you do retire.

Roth IRA: That is much like the Conventional IRA, besides that you don’t obtain a tax profit within the 12 months you make investments, however, at retirement, your entire withdrawals are tax-free.

So, what’s the best choice? If you wish to save for retirement now, and also you earned your earnings (that means it got here from work and never Mother and Dad), a Roth IRA is the best way to go. The reason being the tax you pay in your earnings now could be so low, that you simply get enormous financial savings in taxes whenever you retire. Nonetheless, in case you do not wish to tie up your cash for 40 years, a money account is an effective way to begin. In order for you a extra detailed information, try What Sort of Funding Account Do I Open?

So I Opened My Account, Now What?

Upon getting opened you account, the cash is simply sitting there not doing something for you. That is the place a bit of time is concerned to coach your self, and a bit of self-discipline about your time horizon comes into play.

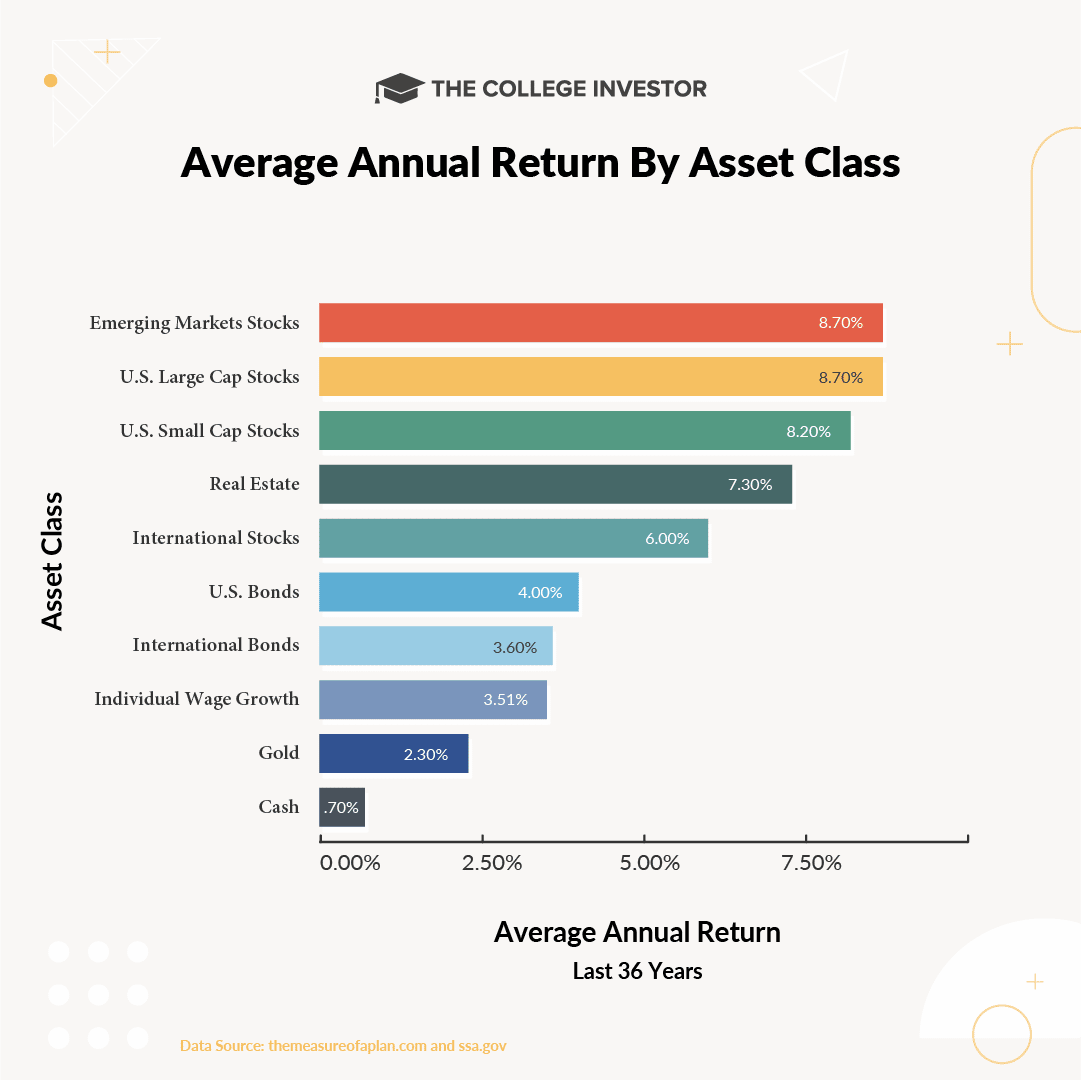

I wish to begin by saying you possibly can, and will for brief durations of time, lose cash. For instance, the S&P 500 (the biggest 500 firms in the USA) returned a pleasant 27.11% in 2009. That’s superior. Nonetheless, it misplaced an enormous 37.22% in 2008. There are enormous swings available in the market. Nonetheless, the explanation folks make investments is as a result of the return on the S&P 500 annualized for the previous 20 years has been 8.12%. There have been up years and down years, however in case you simply did nothing, you’ll have gained 8.12% yearly. This beats the usual for a financial savings account, which grew by solely 2.81% yearly.

So, taking that into consideration, it’s extremely really helpful that if you’re investing for the long run, you have a look at index funds. Index funds come as both mutual funds or ETFs, and so they observe an index, such because the S&P500 or Dow Jones Industrial Common. The most typical and extremely really helpful Mutual Funds and ETFs on the market are right here:

- iShares S&P500 Index (IVV)

- Schwab S&P500 Index (SWPPX)

- Vanguard 500 Index (VFINX)

- Vanguard Whole Inventory ETF (VTI)

- Vanguard Whole Inventory Market (VTSMX)

Additionally, you’ll more than likely be requested if you wish to reinvest your dividends or take them as money. Most massive firms within the U.S. pay dividends to their shareholders. As a small proprietor in every firm within the fund you bought, you get your dividends too. The fund will normally pay these out quarterly or yearly.

If you’re investing for the long run, I like to recommend reinvesting your dividends, as it is going to enhance you come.

If all of this sounds a bit a lot, try this information: The Rookies Information To Investing In The Inventory Market.

I Did It! Now What?

So, now you will have invested your $1,000 in an excellent index fund. Congratulations. Now, simply wait it out and add more cash each month or 12 months. Setup an automatic deposit and investing choice as a way to continue to grow your portfolio.

The inventory market will go up and down. The worst potential factor you are able to do is panic if the market drops, and promote your investments. The market will get better, and if you’re invested for the long run, you’ll reap the positive factors.

All the time bear in mind, it is vital to begin investing early. If you can begin investing in school, you may have an enormous leg up on everybody you already know!

Does anybody else have any ideas or recommendation on getting began? Any nice fund concepts for learners?