The 1098-E type is what you obtain for tax season for those who paid greater than $600 in scholar mortgage curiosity final yr.

Receiving a 1098-E type might will let you deduct scholar mortgage curiosity in your federal tax return. This deduction can scale back your taxable revenue by as much as $2,500, providing some monetary aid for these managing scholar mortgage debt.

At present, we break down what the 1098-E is, and the way it impacts your taxes so that you could doubtlessly declare the scholar mortgage curiosity deduction.

Who Qualifies To Take The Pupil Mortgage Curiosity Deduction?

To take the scholar mortgage curiosity deduction, you need to pay at the least $600 in scholar mortgage curiosity. You’ll be able to solely deduct as much as a most of $2,500 in curiosity paid.

The coed mortgage curiosity deduction is an adjustment of your gross revenue. So for those who paid $2,500 in scholar mortgage curiosity, and also you earned $60,000, you’ll solely pay taxes on $57,500.

For the needs of the deduction, it doesn’t matter whether or not your loans are federal loans or personal scholar loans. Each qualify for the deduction.

The coed mortgage curiosity deduction goes to the one who is legally required to pay the scholar loans. Meaning, in case your mother and father took out loans for you, they get the deduction. That is even true for those who make the funds for the loans.

Married debtors should decide to file taxes as married submitting collectively in the event that they need to qualify for the deduction.

The coed mortgage curiosity deduction can be affected by your revenue. It’s a deduction with a “part out interval” which suggests as your revenue grows, you might have a decrease deduction.

The desk beneath reveals how your revenue impacts your capacity to take a deduction for 2024 (while you file in 2025):

|

Deduction Relative to Earnings |

|

|---|---|

|

Lower than $80,000- Full Deduction $80,000-$95,000- Partial Deduction Greater than $95,000- No deduction |

|

|

Incomes lower than $165,000- Full Deduction $165,000-$195,000- Partial Deduction Greater than $195,000- No deduction |

Because the deduction is predicated on a Modified Adjusted Gross Revenue (MAGI) it is advisable to do a little bit of math to find out your revenue. All of the main tax software program packages will appropriately calculate your scholar mortgage curiosity deduction.

How Do I Know If I Qualify For The Pupil Mortgage Curiosity Deduction?

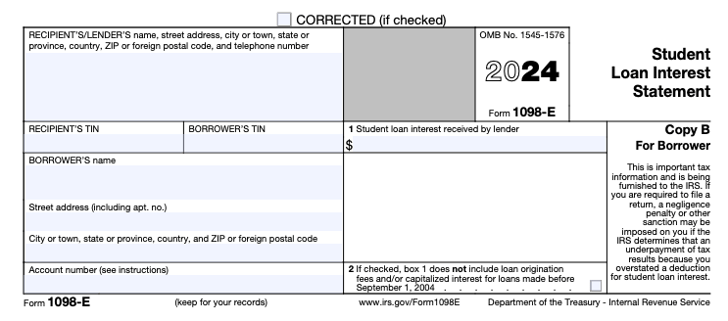

For those who meet or exceed the $600 curiosity requirement, your scholar mortgage servicer ought to mail you a replica of a 1098-E type. Field-1 of the 1098-E type comprises the full curiosity you paid in your loans within the earlier yr.

Folks with a number of scholar mortgage servicers might not mechanically obtain their 1098-E varieties in the event that they paid lower than $600 in curiosity per servicer. In these instances, name your mortgage supplier for extra info and to ask them to situation you the shape. Whilst you don’t want the shape to finish your taxes, it’s loads simpler than attempting to determine the quantity of curiosity you paid by yourself.

Affect Of The Pupil Mortgage Pause

Whereas the scholar mortgage pause formally led to 2023, many debtors didn’t must make funds by way of 2024 on account of ongoing lawsuits and forbearance. The results of that is that many debtors may not have PAID $600 in curiosity in 2024.

It is necessary to notice that you’ll be able to deduct ANY scholar mortgage curiosity paid, even for those who did not obtain a 1098-E. For instance, for those who solely paid $100 in curiosity, you will not get a tax type. Nonetheless, you’ll be able to deduct that in your taxes.

Be sure you hold your scholar mortgage statements as proof.

How To Use The 1098-E Kind?

The 1098-E type is a really primary type that comprises your private info and the quantity of curiosity you paid to the lender. For those who obtain a number of 1098-E varieties, you will have so as to add the quantities in Field-1 of the varieties to find out your complete quantity of curiosity paid.

Keep in mind, you’ll be able to deduct as much as a most of $2500.

For those who’re utilizing a tax software program to do your taxes, the software program will mechanically calculate your deductions. Nonetheless, for those who’re hand submitting your taxes, you’ll have to enter your complete curiosity paid in your type 1040.

Because the scholar mortgage curiosity deduction is an above the road deduction, you don’t want to fret about a complete itemization schedule.

Have you ever ever claimed the scholar mortgage rate of interest deduction?