A reader asks:

I’ve seen some pundits (*cough* Chamath *cough*) now shifting their stance to “short-term ache for long-term acquire” from all the political upheaval we’re seeing. Mainly the thought is a recession will really be helpful as a result of house costs, inventory costs and rates of interest will go down. I believe that is nuts however wished to listen to your take — are there any positives from a recession?

In only a few quick months we’ve gone from worries about an financial system that could possibly be liable to overheating to worries concerning the financial system slowing dramatically. GDP estimates for Q1 have gone from almost +4% a month in the past to -2.8% in a rush:

These estimates will not be set in stone, however financial exercise is slowing.

One factor we’ve discovered these previous few years is that nobody is sweet at predicting the timing of recessions, however that doesn’t cease individuals from speculating concerning the potential ramifications of an financial contraction when it lastly arrives.

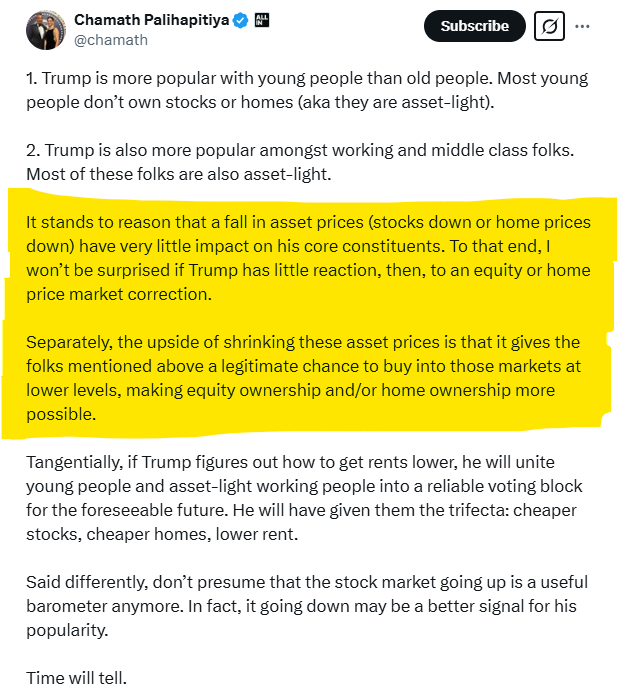

Right here’s what Chamath needed to say on Twitter concerning the prospect of Trump’s no insurance policies doubtlessly throwing the nation right into a recession:

It’s a protracted one so permit me to summarize: A major proportion of the nation doesn’t personal a lot in the way in which of monetary property like shares or a home. If we’ve a recession that ought to convey inventory costs and housing costs down which might make them extra accessible to extra individuals.

He’s in search of a silver lining. I get that. I’m a glass-is-half-full man too.

This sounds nice in idea.

Loads of younger individuals would love extra inexpensive house costs and a greater entry level into the inventory market. A recession would additionally probably imply decrease borrowing prices so mortgage charges can be decrease.

What’s to not like?

Since 1950, there have been 9 bear markets. The common drawdown in these bear markets was a lack of 35.5%, lasting 406 days from peak to trough. The power to purchase shares on sale must be a welcomed improvement for younger individuals or anybody who can be a internet saver within the years forward.

The issue is you don’t get to expertise recessions in a vacuum.

Individuals lose their jobs. Companies in the reduction of or go stomach up. Individuals spend much less cash. It’s more durable to seek out new employment or get a promotion. Wages fall. Massive raises go away.

Throughout the 2008 monetary disaster and its aftermath there was a continuing drumbeat of:

You’re fortunate to actually have a job.

You desire a elevate. On this financial system?!

That lasted for years after the technical recession had ended.

A whole lot of finance individuals take a look at recessions by way of the lens of spreadsheets and charts. I’m responsible of this too. However the human toll from a recession can’t be overstated. Ronald Reagan as soon as stated, “A recession is when your neighbor loses their job. A despair is if you lose yours.”

Watch out what you would like for.

JP Morgan as soon as stated, “In bear markets, shares return to their rightful homeowners.”

Some interpret that as a behavioral lesson the place solely these buyers with sufficient intestinal fortitude to lean into the ache will purchase when shares are on sale. There may be some fact to that.

Nevertheless, these “asset-light” people will battle to pay their payments or maintain their jobs throughout a recession as a result of they haven’t any assist from monetary property. Who do you assume goes to lean into the ache and purchase? The individuals who purchase would be the ones who have already got the cash.

The highest 10% of households by wealth personal almost 90% of the shares in the US. They’re those who can maintain shopping for in a downturn. Proper or improper, these are the rightful homeowners JP Morgan was referring to.

I additionally hate to be the bearer of unhealthy information to potential homebuyers however there isn’t a assure that housing costs will fall, even when we go right into a recession. That is housing value efficiency throughout each recession going again to 1960:

There was a short decline within the 1990 recession and naturally the Nice Monetary Disaster noticed housing costs get walloped. Aside from that, housing costs have been among the many greatest hedges in opposition to a recession.

If the financial system contracts, we might even see some aid in mortgage charges. Nevertheless, that doesn’t essentially imply housing costs will drop. The truth is, decrease charges might really drive extra demand for houses, particularly since exercise has been sluggish with 7% mortgage charges. Whereas elevated market exercise can be a optimistic improvement, it wouldn’t mechanically result in decrease costs. It will be factor to see extra exercise within the housing market however that may really result in larger costs.

Personally, I might somewhat we don’t have a recession. Job loss is painful. It could set individuals again years of their lives.

Nevertheless, you even have to acknowledge that you don’t have any management over the rationale for a recession–whether or not or not it’s a monetary disaster, pandemic, authorities coverage, inflation or one thing else.

No matter your station is in life you need to be ready for a nationwide or private recession sooner or later:

- Guarantee your emergency fund is properly stocked.

- Have another monetary backstops in place.

- Create a considerate monetary plan.

- Maintain your self employable.

- Maintain saving cash.

- Construct a margin of security into your funds.

Recessions is usually a good factor for sure people and companies. There have been a handful of nice companies based during times of financial ache — Airbnb, Uber, FedEx, Microsoft and LinkedIn to call a number of.

However I’m not going to sit down right here and let you know to hope for a recession. Recessions are unhealthy and we should always keep away from them if doable.

The drawbacks far outweigh the advantages.

We lined this query on this week’s Ask the Compound:

My tax man Invoice Candy joined us on the present to debate questions on Roth 401ks, coping with uncertainty in a monetary plan, shopping for a golf membership to a premium membership and conventional vs. Roth property in retirement.

Additional Studying:

Market Timing a Recession